Research Brief

Hidden amongst the majestic pine forests of the Pacific Northwest, an area I have visited several times, is a dividend quick pick I discovered this week among the regional banking sector.

The parent firm behind regional banking brand Umpqua Bank, Columbia Banking System (NASDAQ:COLB), had its Q2 results on July 19th which we will dive into as a reference for today’s analysis.

Here are a few relevant points about the merger between Columbia and Umpqua, whose completion was announced in March: combined company has $50B+ in assets, $37B in loans, $45B in deposits. Bank branches continue to operate under the Umpqua brand, based in the Portland Oregon area. The combined ticker trades on Nasdaq. The new firm will be a top-30 US bank.

Rating Methodology

My simplified method rates 5 individual categories with equal weighting: dividends, valuation, share price, earnings growth, capital strength.

To get a “holistic” buy rating, the stock must pass 4 of the 5 categories. 3 out of 5 is a hold or neutral rating, and below that is a sell rating.

A company may appear like a buy or sell in one of the categories but the overall final rating may be different.

Dividends

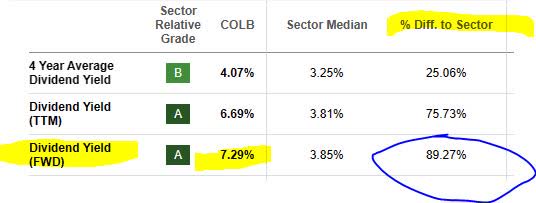

The first rating category to consider, but not the only one, is that of dividends. In particular, what grabbed my attention was the 7.29% dividend yield this equity offers, according to official data as of Aug. 26th.

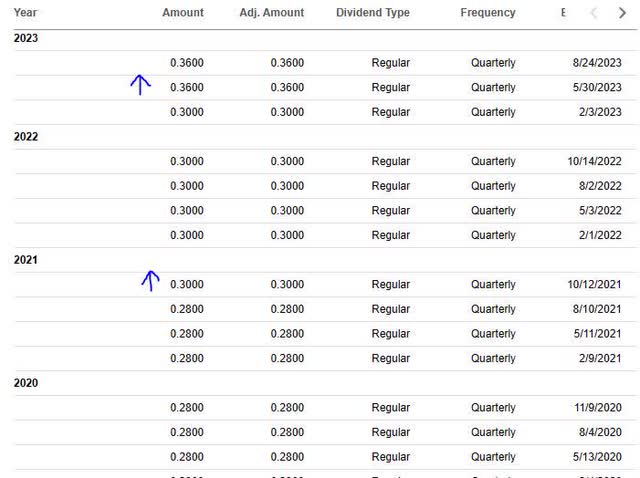

Currently it offers a payout of $0.36 per share on a quarterly basis.

Columbia Banking – dividend yield (Seeking Alpha)

When comparing to its sector average, the forward dividend yield is an attractive 89% above the sector average, which hovers around 3.8%. Impressively, this earned a grade of “A” from Seeking Alpha, and understandably why.

Columbia banking – dividend yield vs sector average (Seeking Alpha)

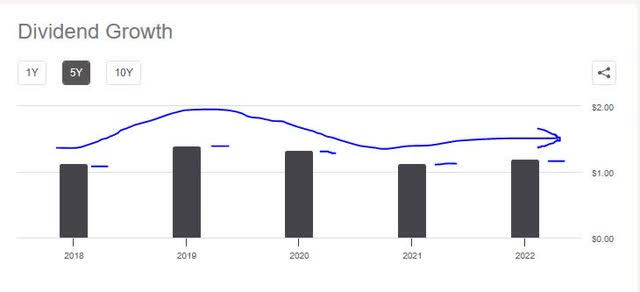

Less convincing is the 5-year dividend growth, as the data below shows. I am looking for a steady upward trend over 5 years, however this stock has struggled to grow its dividend significantly in that time, despite an improvement between 2021 and 2022:

Columbia banking – 5 year dividend growth (Seeking Alpha)

To offset that negative, one plus to mention is that the dividend payouts have been steady each quarter since 2021, without interruptions. More good news for a dividend portfolio relying on the steady quarterly income.

Columbia Banking – dividend history (Seeking Alpha)

Based on the data above, I would recommend this stock in the category of dividends.

Later, in the section on share price I will show how the dividend income helps my investment idea for this stock, which I will show through a trade simulation.

I should also mention that dividend yield is not everything, even when it goes past 7% or higher, as that could also be the result of a drastic drop in share price, making it possible to buy more shares with less capital invested. This is why it is only one of the 5 categories I go over, but still an important one as it can be an income source for some investors, though not all are dividend investors.

Valuation

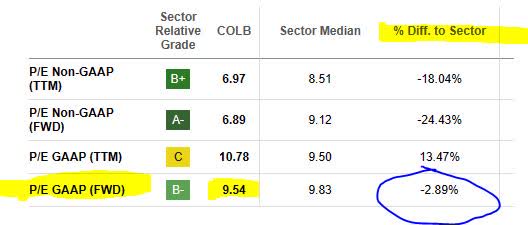

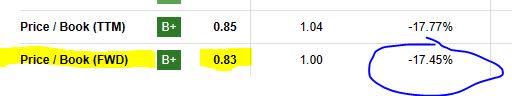

In this category, I will zero in on just two valuation categories that I think are relevant and are my standard approach in every article: the forward P/E ratio and forward P/B ratio. The data is from official Seeking Alpha valuation data as of Aug. 26th.

In the first metric below, this stock is currently 9.54x forward earnings, almost 3% below the sector average which is hovering closer to 9.8x earnings. I would be willing to accept up to 10x earnings in this case, so I think both the sector and the stock are reasonably valued in this space.

Columbia Banking – P/E ratio (Seeking Alpha)

In the second metric, I love the fact that this stock is at 0.83x forward book value, over 17% below its sector average which is at 1x book value. I am looking for stocks around not much higher than 1x book value, so I think this is a good point to be at, especially having gotten a “B+” grade from Seeking Alpha.

Columbia Banking – P/B ratio (Seeking Alpha)

I think the data proves that this stock can currently be recommended in the category of valuation. What I think would separate a value opportunity from a value trap is lack of good financial fundamentals, so that is why valuation is only one of my 5 categories I review and not the most important one.

Share Price

In this category, my goal is to determine if the current share price should be recommended as a buying opportunity, independent of how this stock did in the other 4 categories I covered, as this section studies the price chart itself.

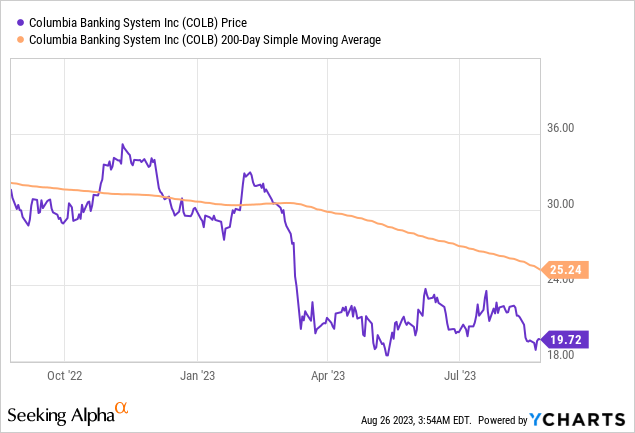

For simplicity, I am using YCharts to track the current share price of $19.72 (as of market close on Friday Aug. 25th) and compare to the 200-day simple moving average of $25.24, as the chart shows:

While the share price being well below the moving average may seem like it presents a buy opportunity, I think it is more important to first determine your profit goal for this stock but also your risk tolerance for capital loss as well. I view the moving average as a long-term trend indicator and good reference point.

I actually create two trading simulations where I buy 10 fictitious shares and hold them for 1 year, at which point I sell. My profit goal is a return on capital of +10% or better, and my risk tolerance is a negative return on capital of -10% or lower.

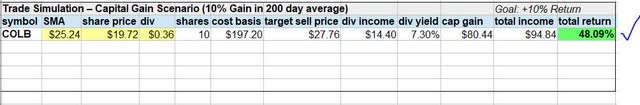

In the first simulation, we buy at the current share price and assume the current SMA will rise by 10% in a year, making that our target sell price. This scenario also generates dividend income, and a total return on capital of 48.09%, thereby far exceeding my profit goal. My “assumption” of SMA growth in a year may also be affected by many factors in the meantime.

Columbia banking – trade simulation 1 (author analysis)

In the second simulation, I test the SMA “dropping” by 10% in a year, making that our new sell price. In this scenario, we still make over 22% positive return.

Columbia banking – trade simulation 2 (author analysis)

Because both scenarios meet or exceed my profit goal as well as stay within my loss limits, I would recommend the current share price of $19.72 as a buying opportunity right now.

In reality, I am well aware that the SMA can move beyond just a +/- 10% range, however this is a simplified framework one can use and may or may not fit everyone’s portfolio strategy.

Earnings Growth

In this category, I am looking for longer-term trends in earnings growth, with more emphasis on net income and less on the top line.

However, it is worth mentioning that on the revenue side this bank did very well, with net interest income seeing YoY growth, according to the income statement:

Columbia banking – net interest income (Seeking Alpha)

Further, the top line revenue number also grew on a YoY basis, another positive to mention. In fact, it seems to have grown each quarter since June 2022:

Columbia banking – revenues (Seeking Alpha)

I think the strong interest revenue could be correlated with the overall high interest rate environment in that same 1 year period, after a series of central bank rate hikes.

I think this tailwind will continue to favor this bank and others, considering that the consensus from rate traders has been that the next Fed meeting will lead to rates remaining steady while for the November meeting the sentiment points to a 46% likelihood of another rate hike, according to CME Fedwatch.

The bottom line for this company has also seen a very nice YoY growth, as has the earnings per share. I believe this is a sign of efficient cost management and a step in the right direction for this bank.

Columbia Banking – net income YoY (Seeking Alpha) Columbia banking – EPS (Seeking Alpha)

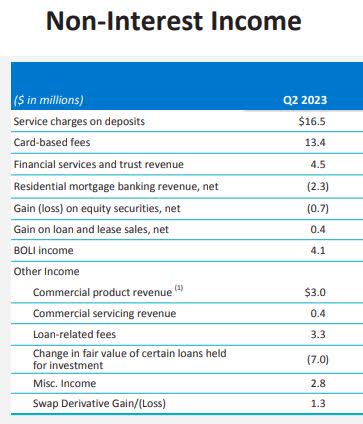

Although this is a regional bank, I am also looking for diversification of earnings across different business segments, not simply interest income. This bank has that as well. According to the table below, for example, two major sources of income for the quarter were service charges and card fees, to the tune of several million$ dollars.

Columbia banking – non interest income (company q2 presentation)

Hence, the data clearly shows that this stock should be recommended on the category of earnings growth, based on the data shown, which shows a firm that has revenue diversification as well as top line & bottom line YoY growth.

Capital Strength

In this category, I assess the financial fundamentals that point to a very solvent and financially strong company with potential to last. This is an important point, since the market already went through the March banking shock with a handful of regional bank failures, so I want to highlight that not all regionals are in the same boat as Silicon Valley Bank.

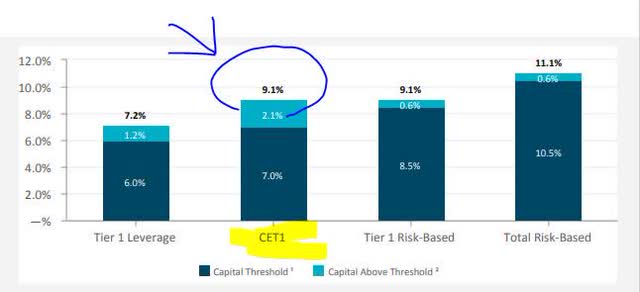

In the banking sector, the CET1 ratio is a key metric I follow, and this bank exceeds its target with a CET1 of 9.1%, but also exceeds its target in other capital ratios as well, a positive sign I think.

Columbia banking – CET1 ratio (company q2 presentation)

Positive sentiment was shared by the company in their Q2 presentation comments as well, pointing to what I think will be a positive few quarters coming up.

We expect to quickly approach and exceed our long-term total risk-based capital target of 12%, providing for enhanced flexibility to return excess capital to shareholders while continuing to support our expanding franchise. We are already above our long-term CET1 capital target of 9%.

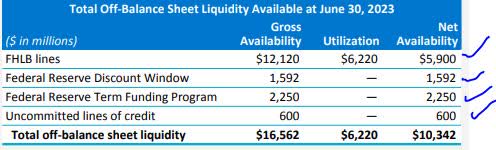

I want to also address any reader concerns about how exposure to uninsured deposits could impact this firm’s liquidity, in the event of a run by uninsured depositors.

According to the company’s commentary, such deposits are barely 1/3 of total deposits, and there is plenty of liquidity to cover them if needed:

Uninsured deposits were $13.5 billion at June 30, 2023, representing 33% of total deposits. Available liquidity of $18.1 billion was 134% of uninsured deposits at that time.

Lastly to mention, but also relevant I think, is that this bank has multiple off-balance sheet liquidity sources it can tap into if needed. According to the following graphic, it still has over $10B in untapped available liquidity across multiple sources including the Federal Home Loan Bank and the Federal Reserve programs, among others.

Columbia banking – liquidity sources (company Q2 presentation)

Therefore, based on the evidence, I would highly recommend this stock in terms of its company capital strength.

Rating Score

Today, this stock won in all 5 of my 5 rating categories, earning a “Strong Buy” rating from me today. This is actually more bullish than both the quant system and the analyst consensus, according to the graphic below.

Columbia banking – ratings consensus (Seeking Alpha)

! However, I should still caution that even though I am rating it a strong buy it is up to individual investors to determine what level of risk tolerance to accept and for what timeframe.

In my trade simulation I showed earlier, I added just 10 shares of this stock to a long-term portfolio that also may consist of other banks including much larger ones & global players, which I think would diversify the risk exposure of having just regional banks alone in the portfolio. The point is, it is a strong buy but also should fit in with a larger portfolio and its strategy.

Risk to Outlook: Exposure to Office Loans

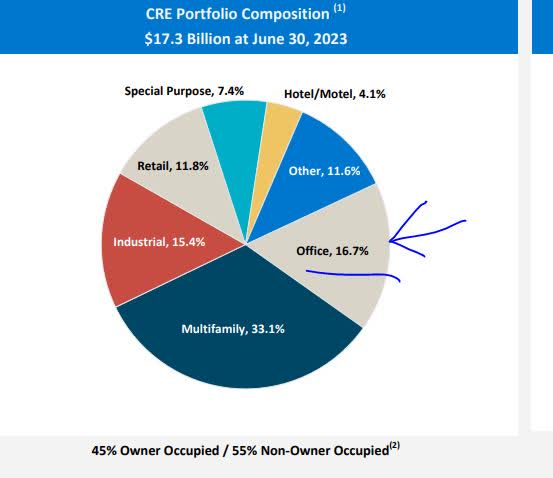

My heavily bullish outlook on this stock could be impacted by the risk of investors avoiding regional banks like this one due to perceived exposure to office loans, which has been a recurring topic lately.

This sentiment was highlighted by a July 14th article in global media giant Reuters, which mentioned that even JPMorgan Chase (JPM) and Wells Fargo (WFC) are preparing for losses on office loans:

Lenders’ exposure to commercial real estate has come under growing scrutiny this year, as the sector globally – particularly office buildings – has been pressured by high interest rates and workers continuing to stay at home.

However, according to Columbia Banking System’s own data, their exposure to office is just under 17% of their overall CRE portfolio, so not even 1/4th of the loan book. In fact, it seems the majority of their book is focused on multifamily residential and industrial properties.

Columbia banking – CRE portfolio (company q2 presentation)

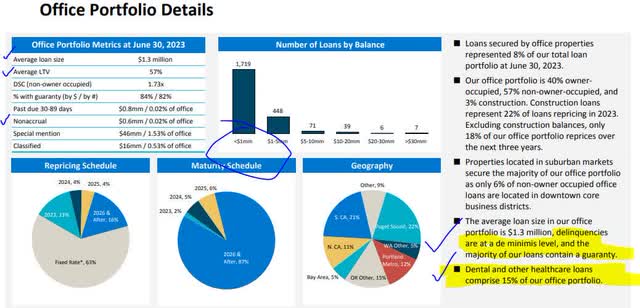

In researching further, I discovered that 15% of their office exposure is tied to medical type of offices, and we know these are not exposed to “remote work” risk since they require being in the office to work with patients. Delinquencies are also very minimal, and just 0.02% of the loans are in a non-accrual status, which sheds some positive light on this topic.

Columbia bank – office portfolio (company q2 presentation)

So, my bullish rating remains as I think that the positives of this stock I highlighted outweigh the risk above.

Analysis Summary

Here is a quick recap of what we discussed in today’s research analysis.

This stock, which is the first time I ever covered it, is getting a strong buy rating, as my analysis points to a much more bullish sentiment than the consensus from analysts and the quant system.

Positives: dividends, valuation, share price, earnings growth, capital strength.

Headwinds: none significant to mention

Risk of exposure to office loans has been determined to not be overly impactful to my bullish rating.

Concluding thoughts:

Regional banks are still in play, and you just have to find hidden gems like this one that are nestled among the timbers of the Pacific Northwest, but present strong financial fundamentals as well as a dividend-income opportunity, that could fit in as a smaller component of an overall financial-sector portfolio.

Read the full article here