Why does a market mispricing currently exist?

Aside from some small revenue streams, the majority of Liquidia’s (NASDAQ:LQDA) assumed market value rests in the future commercialization of their FDA approved drug for pulmonary hypertension (PH), Yutrepia. LQDA has been in a legal battle with United Therapeutics (UTHR) since 2020. The onset of this battle put a regulatory halt on their commercialization efforts. In July of 2023, LQDA seemed to be on the precipice of getting over the regulatory hurdle, possessing two paths to commercialization: they could either have a District Court ruling overturned by the Federal Circuit or have a PTAB ruling confirmed by the Federal Circuit. Either occurrence would result in LQDA’s ability to finally commercialize Yutrepia.

On July 27 of this year, path number one became impossible. The Federal Circuit did not overturn the District Court’s ruling against LQDA. LQDA’s stock price went from a high of $9.90 on June 28 when oral arguments were trending in LQDA’s favor to a low of $6.83 shortly after the unfavorable verdict.

However, investors have overestimated the negative impact of the Federal Circuit’s recent confirmation of the District Court’s ruling and have underestimated the speed, likelihood, and effect of the Federal Circuit’s confirmation of the Patent Trial and Appeal Board (PTAB) ruling, creating an opportunity for investors to enter LQDA at an attractive price with short- and long-term price catalysts ahead.

Why does the Federal Circuit’s confirmation of the District Court’s ruling not merit a 31% drop in stock price?

Four reasons indicate that the recent drop in LQDA’s stock price is a market overreaction.

- Winning the District Court appeal was always a more unlikely path to commercialization

- The District Court appeal loss will be temporary in its efficacy to halt LQDA’s commercialization of Yutrepia

- The likelihood of the PTAB’s ruling being confirmed by the Federal Circuit and making the invalidation of patent 793 binding on the District Court is very high

- A Federal Circuit verdict on the PTAB ruling will come soon

Let’s dive further into these reasons one at a time.

Reason #1: Winning the District Court appeal was always a more unlikely path to commercialization

The arguments considered by the District Court and the PTAB were very different. In essence, the District Court considered whether LQDA would violate patent 793 by commercializing Yutrepia, a patent that protects the method of taking Treprostinil, the main drug in Yutrepia, via a dry inhaler. In contradistinction, the PTAB did not consider whether LQDA’s commercialization of Yutrepia would violate patent 793. Instead, the PTAB considered whether patent 793 should have ever been granted in the first place.

LQDA’s argument in District Court to demonstrate their non-violation of patent 793 was weak. They contended that because Yutrepia would technically not be administered by a LQDA representative but rather self-administered by their customers, LQDA couldn’t be held responsible for violating the patent. The judge disagreed and ruled that even though LQDA wouldn’t technically be administering Yutrepia to their customers, by commercializing Yutrepia, they would induce their customers to violate patent 793. The Federal Circuit subsequently confirmed the District Court ruling.

If LQDA’s non-violation case was weak all along, why did LQDA bother appealing the decision to the Federal Circuit? This question brings us to our next reason.

Reason #2: The District Court appeal loss will likely be temporary in its efficacy to halt LQDA’s commercialization of Yutrepia

In July of 2022, the PTAB determined that patent 793 should have never been granted in the first place. Being invalidated, any violations of patent 793 were potentially non-enforceable. However, for the PTAB ruling to be binding on the District Court decision, the PTAB ruling would have to be confirmed in an appeal to the Federal Circuit.

In other words, there was significant upside and limited downside to LQDA for appealing the District Court case. If LQDA won their appeal and the Federal Circuit found that commercializing Yutrepia would not result in violating patent 793 then LQDA could commercialize Yutrepia immediately. However, even if the Federal Circuit confirmed the District Court ruling, as long as the PTAB ruling was subsequently confirmed by the Federal Circuit, the previous rulings on LQDA’s violation of patent 793 would be rendered ineffective because LQDA couldn’t violate what should’ve never been in place to begin with!

In addition, LQDA originally thought that in hearing their appeal, the Federal Circuit would consider the PTAB ruling which invalidated patent 793. However, the Federal Circuit declined to consider the PTAB ruling because it had not been confirmed by the Federal Circuit in appeal which brings us to reason number three.

Reason #3: The likelihood of the PTAB’s ruling being confirmed by the Federal Circuit and making the invalidation of patent 793 binding on the District Court is very high

On average, the Federal Circuit affirms a PTAB ruling 75% of the time. Statistically, the odds are in LQDA’s favor, but the odds of LQDA’s success are even greater when we look at why the PTAB originally invalidated patent 793.

Without getting into the legal quagmire too much, 35 U.S.C. §102 states that an inventor is entitled to a patent unless, “the claimed invention was patented, described in a printed publication, or in public use, on sale, or otherwise available to the public before the effective filing date of the claimed invention.” Ironically, Robert Voswinckel, the inventor on patent 793, disqualified his own patent application according to the PTAB ruling. Before patent 793 was filed in 2005, he had published the discoveries he later patented in two academic journals in 2004, Circulation: Journal of the American Heart and European Heart Journal: Journal of the European Society of Cardiology. Thus, the information patented was not novel but in fact “described in a printed publication” of his own writing a year earlier and therefore did not merit a patent. I’m simplifying the legal complexities of this argument tremendously, but its rather straightforward and as much of a slam dunk as it appears to be. It was such a slam dunk that the PTAB re-affirmed their conclusions in February of 2023 and rejected UTHR’s request for a re-hearing.

A Quick Summary

To summarize, the recent 31% drop in LQDA’s stock price from June 28th to present was precipitated by the negative Federal Circuit confirmation of the District Court’s earlier ruling that LQDA would violate patent 793 by commercializing Yutrepia. However, this ruling will likely be rendered ineffective when the Federal Circuit confirms the PTAB’s ruling that patent 793 should have never been granted in the first place, and then the coast will be clear for LQDA to commercialize Yutrepia. When will the Federal Circuit rule on the PTAB’s decision?

Reason #4: The Federal Circuit’s verdict on the PTAB ruling will come soon

The legal dance has already begun. It started when UTHR filed a 179-page opening brief on August 4, 2023. Beginning August 4th, LQDA has around 40 days to file their responsive brief. UTHR will then have around fifteen days thereafter to file their reply brief. Then, oral arguments will commence on the next available court date, likely mid-October. LQDA will probably have a ruling on their PTAB appeal from the Federal Circuit between late-2023 and mid-2024.

Short Term Price Target

Upon Federal Circuit confirmation of the PTAB ruling, the stock price should at least return to $9.90 (the price it hit on June 28, 2023 when it seemed most likely LQDA would win the District Court appeal and begin commercialization of Yutrepia). However, more near term catalysts exist which should create positive price inflections. These catalysts include:

- Mid-September when LQDA’s responsive brief is filed wherein we believe they will point out that UTHR has offered nothing new or substantial in their opening brief which should materially change the PTAB’s original ruling and refusal for a re-hearing. This responsive brief will give the market more confidence on LQDA’s near term prospect for commercializing Yutrepia.

- Mid-October when oral arguments will publicly commence which we believe will give the market more confidence that the Federal Circuit will confirm the PTAB ruling and LQDA will be able to commercialize Yutrepia.

- Early November when UTHR will announce their Q3 earnings which we believe will show to the market that the inhalation Treprostinil drug market for pulmonary hypertension is larger than one billion dollars annually with gross margins close to 90th percentile.

Long Term Price Target

If the short-term price target is $9.90, what are LQDA’s long term prospects?

When LQDA is finally able to commercialize Yutrepia, we believe they will take market share at a desirable from UTHR for three reasons:

- LQDA has a better product than UTHR.

- LQDA has the perfect CEO to commercialize Yutrepia

- LQDA has the right industry connections for sales through their promotional partnership with Sandoz

Reason #1: LQDA has a better product than UTHR

To understand why LQDA’s Yutrepia is a better product than UTHR’s Tyvaso and Tyvaso DPI, we must understand the dynamics of PH and the current drug treatments on the market. PH is a progressive disease. To adequately treat the symptoms, the dosage of Treprostinil must be increased over time as the condition worsens and the body becomes more resistant to Treprostinil. Traditionally, oral consumption of Treprostinil in pill form is the earliest treatment and has the weakest dosage capacity. Oral Treprostinil comes with some nasty side effects such as nausea and other related GI problems. When the oral Treprostinil dosage becomes too weak, the patient graduates to inhaled Treprostinil which has a higher dosage capacity than orally administered Treprostinil. Finally, subcutaneous or intravenous injection is the final phase of Treprostinil administration, carrying the greatest dosage capacity. Injection has wicked side effects along with concomitant dangers such as sepsis. It also wreaks the most havoc on a patient’s schedule and personal autonomy.

Clinical studies have shown that Yutrepia is preferred over Tyvaso in part because Yutrepia is capable of delivering a much larger dosage of Treprostinil than Tyvaso. This greater dosage capacity means that patients who use Yutrepia can stay in the inhalation phase of their treatment for longer while patients who use Tyvaso have to graduate to injected Treprostinil sooner, a much less preferred method of Treprostinil administration. Studies have also shown that the administration of Yutrepia requires fewer breaths and cartridges as Tyvaso.

Reason #2: LQDA has the perfect CEO to successfully commercialize Yutrepia

In addition to having a better product, LQDA has the perfect CEO to successfully commercialize Yutrepia. Dr. Roger Jeffs, CEO of LQDA, already successfully commercialized plenty of PH drugs in his 16-year tenure at UTHR which ended in 2016. Who would know better how to capture market share from UTHR than the man who ran them successfully for almost two decades?

Reason #3: LQDA has the right industry connections to ramp sales quickly through their partnership with Sandoz

Sandoz is a company that owns and markets an injection drug for PH. LQDA already has a revenue sharing agreement with them and recently extended the partnership into developing a new, subcutaneous pump to inject Treprostinil. Through their partnership, LQDA will be able to leverage Sandoz’ existing pipeline to ramp sales of Treprostinil up quickly.

Valuation

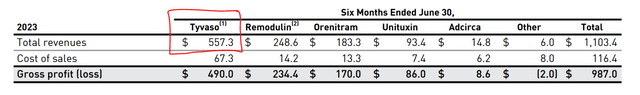

Even though the treatable market for PH in the US is small, approximately 40,000 diagnoses current in the US with around 1,000 new ones added every year, the profits have been huge for companies that have commercialized drug offerings. UTHR, the leader in treating WHO group 1 and group 3 PH via inhaled Treprostinil with their two drugs Tyvaso and Tyvaso DPI, is set to make over one billion in revenue domestically this year on these two PH drugs alone. At 88% gross margins, that is a lot of money!

United Therapeutics 2023 Q2 10-Q

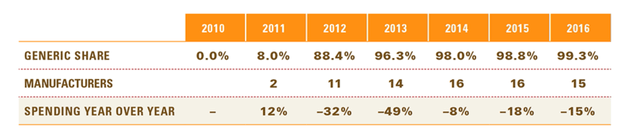

According to Blue Cross Blue Shield data, when only one generic drug is introduced into a market that has been dominated by a single player, the pricing of the generic comes in at around 75% of the incumbent drug. Currently, there are no generic drugs currently being developed to treat PH with inhaled Treprostinil other than Yutrepia. Given the above data and considering that it took over five years (2015 – 2020) for LQDA to develop Yutrepia and the development was aided greatly by their proprietary engineering PRINT® technology, it is safe to assume that Yutrepia will command around 70% of the price Tyvaso and Tyvaso DPI command for at least five years after commercialization.

According to the same data, generic adoption from the brand label typically happens slowly in the first year of release, especially when only one generic hits the market, but quickly ramps up in the subsequent years to exceed well over 50%.

J Bull

Generic share of the Lipitor market after patent expiration

If LQDA eventually takes 50% of market share from UTHR at a 30% discount on product price as a generic drug is wont to do, LQDA is looking at 300m. in annual revenue. If we maintain the proportion between UTHR’s current annual revenue of 1.9B and market cap of 11.04B and apply it to LQDA’s future valuation, LQDA’s 300m. in annual revenue yields a market cap of 1.7B, nearly a 4x from its current 451m. market cap. Thus, a 3.7x in stock price to $25.97 within the next 1-3 years (depending on how quick the legal battle is settled, how quick LQDA can commercialize Yutrepia, and how much the market assigns future PH drug market revenue to them) is reasonable.

In addition, these numbers assume there is no growth in the PH inhalation drug market which is unlikely for two reasons: global expansion and domestic price increases. UTHR’s Tyvaso has recently received approval to treat WHO group 1 PH in Japan, and they’re planning to begin commercial sales in the second half of 2023 there. Argentina and Israel are markets they’re currently making headway in as well. While the market of group 1 and group 3, the only two groups of PH listed by the FDA as treatable with drugs, in America may only be 40,000 patients annually, it is estimated that the global market is over 500,000 patients annually. In addition, over the past three years, UTHR has seen a 26% average increase in its revenue generation from Tyvaso and Tyvaso DPI. These increases are mostly due to pricing power which should continue in the duopolistic future when Yutrepia is commercialized.

What risks threaten LQDA?

The Federal Circuit may not confirm the PTAB’s appeal. If this occurs, LQDA would likely be halted from commercializing Yutrepia until patent 793 expires on May 4th, 2027. Currently, LQDA has around 98m. in cash on hand, and their cash burn runs at around 46m. annually. Thus, if Yutrepia’s commercialization is pushed back until 2027, LQDA would likely be forced to dilute equity to fund the company until Yutrepia started generating revenue.

UTHR may drum up further legal hindrances to delay LQDA’s commercialization of Yutrepia. Currently, UTHR generates approximately 2.7m. a day on their monopoly of the PH inhalation drug market. Thus, they’re highly incentivized and capitalized to delay LQDA’s commercialization of Yutrepia even a little.

Newer drugs may enter the PH inhalation drug market after LQDA. Competition will drive the prices LQDA can charge down and their margins will be squeezed more than we anticipate.

Finally, Yutrepia may struggle to take market share from Tyvaso and Tyvaso DPI once it is commercialized. The average lifespan of someone once they are diagnosed with PH is around six years. The quality of their life in the mean time is heavily predicated upon the efficacy of the drug they’re taking. A bias for the tried-and-true market leading drug may keep people from switching from Tyvaso or Tyvaso DPI to Yutrepia.

Conclusion

We believe these risks are unlikely to materialize, however, and that in the short run (1-6 months) LQDA’s stock price will rise to over $10 a share with several short term, positive price catalysts along the way. In the long run (1-3 years), we expect the market for PH inhalation drugs will grow and LQDA will enjoy taking up to half that market share if not more.We would like to thank Josiah Bull for this piece.

Read the full article here