Introduction

As reported by Bloomberg the other day, Boeing (BA) discovered that its largest supplier drilled holes in a component that helps maintain cabin pressure of the 737 MAX jet.

Bloomberg

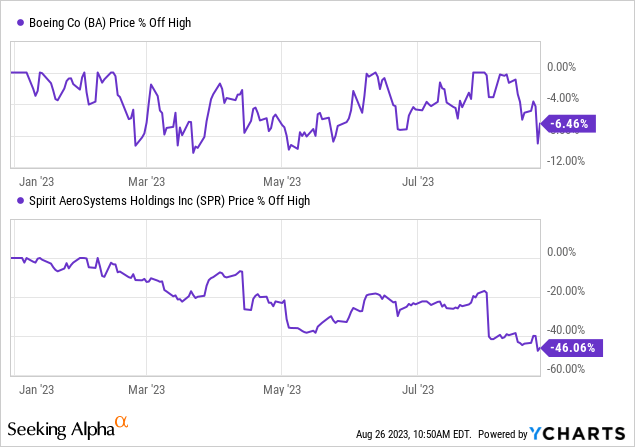

This derailed both the stock prices of Boeing and the supplier this is about, which is Spirit AeroSystems (SPR) – although calling a 6.5% drawdown for Boeing a derailment may be a bit much.

What I’m getting at here is that I prefer to buy top-tier suppliers with pricing power over the manufacturers of airplanes – at least in the commercial sector.

For example, engine suppliers sell to all major aerospace producers, avoiding a lot of competition between their customers. They also tend to benefit from tremendous aftermarket sales potential, pricing power, and being able to focus on a few key products.

This brings me to General Electric (NYSE:GE). Next year, the company will be a pure-play aerospace company, selling advanced engines to both commercial and defense customers.

It recently announced new leadership for the renewable/energy spin-off.

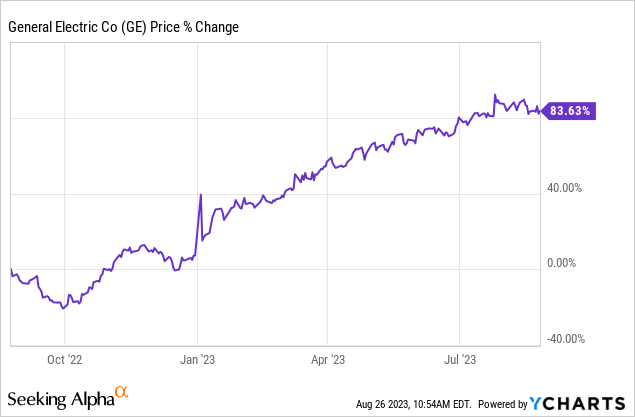

Over the past 12 months, GE shares have added 84%, outperforming every major peer in its segment – by a mile.

Since my last article titled General Electric Has Become An All-Star Industrial Powerhouse Again, the stock has added another 5%.

The best thing is that I would make the case that General Electric isn’t even close to being overvalued, which is what I’ll discuss in this article.

Not only is the company firing on all cylinders when it comes to demand and production of its engines, but it is also in a great spot to significantly boost free cash flow in the years ahead, lowering net debt and improving shareholder returns.

If I didn’t already have close to 20% industry exposure, I would consider adding this stock to my portfolio.

So, let me walk you through my thoughts, as there’s a lot to discuss!

Firing On All Cylinders

If there’s one major thing that has changed since my last article, it’s the overwhelming demand changes in commercial aviation, with the Paris Air Show being the biggest event showing the return of strength.

Bloomberg

As reported by Bloomberg (emphasis added):

With deliveries still hampered by strained supply chains, many customers want to lock in orders now to avoid being relegated to the end of the line. Airbus SE has said it’s sold out almost until the end of the decade for narrowbody jets, and Boeing Co. also has few near-term delivery slots. It’s not just the smaller aircraft that are becoming harder to find, but also increasingly widebodies, flown on global routes that are more popular than ever after most countries dropped travel restrictions.

Three years after we got bad news from Wuhan, we’re finally in a situation where even long-range, widebody demand is coming back, which is great news for General Electric, which is a leader in this segment.

As expected, widebody aircraft have more powerful engines, currently topped by the Boeing 777 and the Airbus A350 of those in service. Meanwhile, the GE9X, which is purpose-built for the forthcoming Boeing 777X, holds the Guinness World Record title for thrust, officially known as ‘the most powerful commercial aircraft jet engine (test performance). – Simple Flying

This is what the company said with regard to the Paris Air Show in its 2Q23 earnings call:

As many of you saw at the Paris Air Show, GE Aerospace showcased industry leading solutions for both commercial and defense across propulsion, systems and services. Our teams are delivering for customers both in services and by growing our large young fleet of 41,000 commercial engines and 26,000, rotorcraft and combat engines. Today we’re partnering with airframers, airlines and lessors to drive stability and predictability as they ramp.

Speaking of the second quarter, commercial engine revenue surged by 35%, driven by LEAP deliveries and a growing spare engine deliveries ratio.

Commercial services revenue also grew over 30%, with increased shop visits and external spare parts demand.

In other words, General Electric is now seeing the benefit from both rising demand for new engines and the many benefits that come with an ever-increasing installed base.

On a side note, I still believe that aftermarket demand is one of the most underappreciated benefits of investing in (the right) aerospace players.

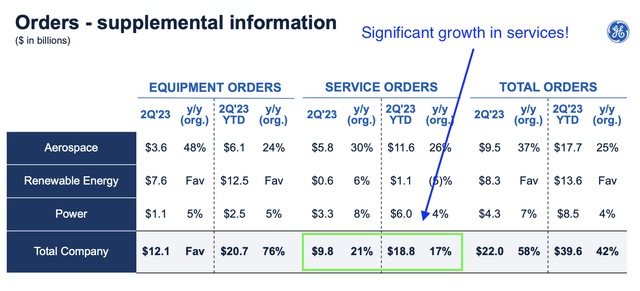

General Electric (Author Annotations)

But wait, it’s not just commercial demand!

In the defense sector, orders more than doubled, while engine output increased by over 70%.

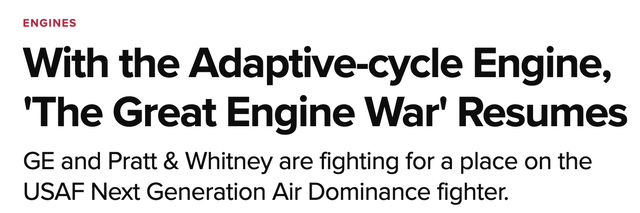

Furthermore, the XA100 engine received recognition and funding. This engine is used to compete for the Air Force’s Next Generation Air Dominance fighter. As a shareholder of the company’s largest competitor in this space (RTX Corp. (RTX), which owns Pratt & Whitney), I’m not too happy about that. Needless to say, it’s great news for GE, as it’s looking to expand its footprint in this segment.

AIN Online

This engine is the most cost effective option to meet the needs of the U.S. warfighter for decades to come. We’re pleased the house has recognized the importance of this program by including funding in the National Defense Authorization Act, and in the House Appropriations Committee defense bill. We’ll be closely watching the Senate as it considers legislation this week. – GE 2Q23 Earnings Call

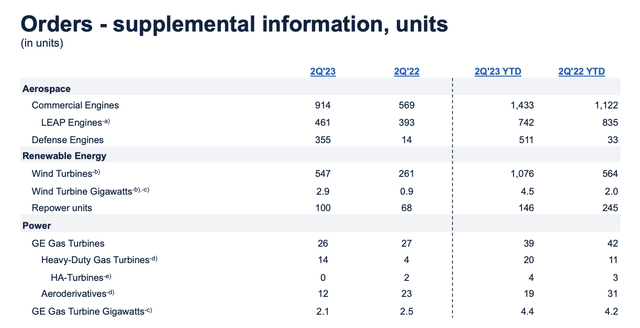

Excluding pricing, we see that the company got orders for 1,433 commercial engines on a year-to-date basis. That’s up from 1,122 in the prior-year period.

Defense engine orders exploded from 33 to 511.

Strength in this segment includes new major deals with the Indian Air Force and strength in domestic demand.

General Electric

On top of that, the non-aerospace segment also did well.

In its earnings call, GE made clear that it saw growth tailwinds driven by sustainable energy needs and energy security in the GE Vernova segment.

- According to the company, renewables demonstrated improvement, marked by record orders, particularly in Grid.

- Onshore Wind showed strength, with North American equipment orders growing significantly.

- Profit improvements were achieved through price adjustments and productivity enhancements.

Overall, GE Vernova’s revenue forecast was raised to mid-single-digit growth, with an improved profit outlook, which brings me to the outlook.

GE Has Room To Run

Thanks to highly favorable developments, investors witnessed a shift in full-year expectations from high single-digit to low double-digit revenue growth for the year.

General Electric

Adjusted EPS projections were lifted from $1.70-$2.00 to $2.10-$2.30, based on an operating profit within the range of $4.7 billion to $5.1 billion.

Notably, free cash flow guidance also saw an upward revision, from $3.6 billion to $4.2 billion to a new range of $4.1 billion to $4.6 billion.

In other words, the company achieved something most aerospace companies were unable to do: hike free cash flow guidance – in this case, by a lot!

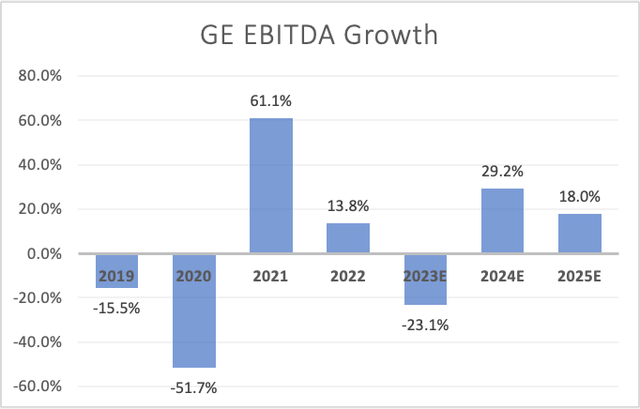

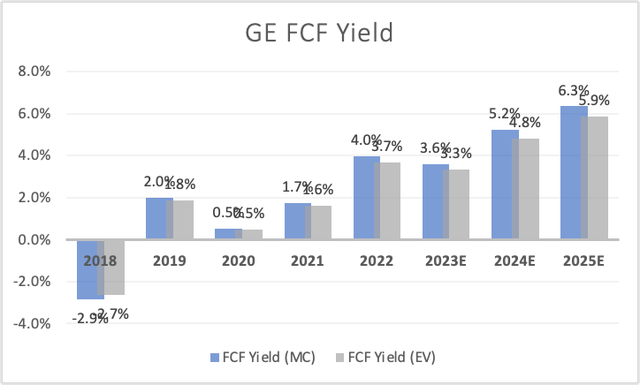

Having said that, looking at the chart below, we see that growth is expected to continue.

In 2024, EBITDA is expected to grow by 29%, followed by another 18% increase in 2024. Please note that the 2023 decline includes the GE HealthCare (GEHC) spin-off.

Leo Nelissen (Based on analyst estimates)

Even better, after 2023, the company’s free cash flow is expected to gradually increase to roughly 6% of its enterprise value. It will likely be higher, as I didn’t use an expected net debt decline of roughly 40% between 2025 and 2024. So, there’s a bit of a higher margin of safety there.

Leo Nelissen (Based on analyst estimates)

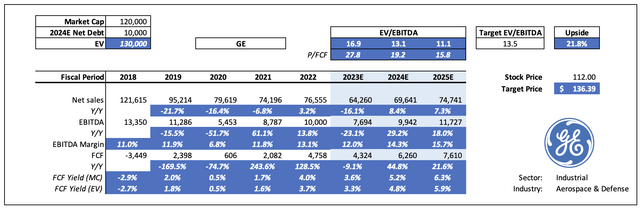

By 2025, the company is expected to have a leverage ratio of less than 0.5x EBITDA, which would give it the lowest leverage ratio among major aerospace companies in the United States.

When putting these puzzle pieces together, I would argue that GE shares are still at least 20% undervalued.

In this case, I’m using a 13.5x EV/EBITDA multiple, which isn’t high for a company expected to grow its EBITDA by double digits on a prolonged basis.

Leo Nelissen (EBITDA, Revenue, FCF numbers are based on analyst estimates)

The current consensus price target is $125, which makes me above-average bullish.

Currently, the most bullish rating on my radar comes from Jefferies, which hiked its rating from $120 to $130.

While the company doesn’t have a high dividend yield (0.3%) and a history of disappointing investors, I believe that the new GE is one of the best aerospace companies money can buy.

As I already own five companies in the industry with roughly 20% exposure, I will refrain from buying – unless the stock were to offer a steep sell-off.

Having said that, if I were looking for an entry, I would likely wait for a slightly bigger correction. Shares are currently 5% below their 52-week high.

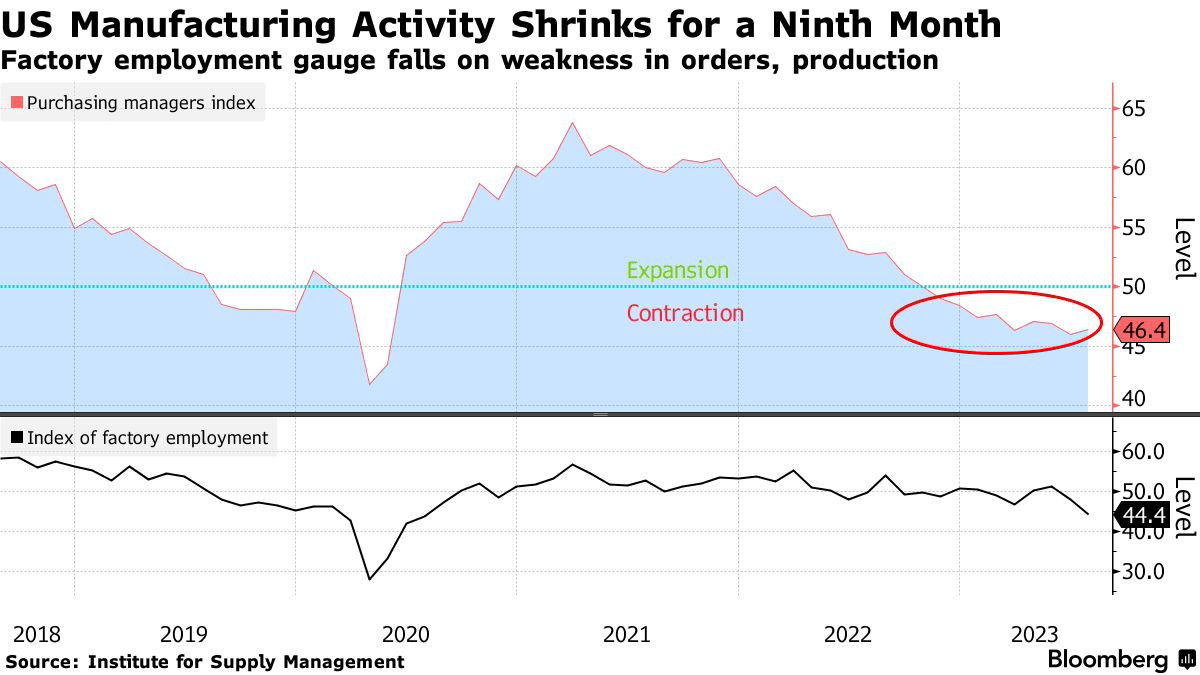

I could see 5-10% more weakness if economic conditions deteriorate even further. Right now, that seems to be the case.

Bloomberg

Even worse, inflation is turning out to be sticky (which was my thesis from the beginning). If the Fed has to keep rates elevated, I think we could get a great buying opportunity in GE shares.

Having said that, given my view on this company and its longer-term potential, I will maintain a Buy rating.

Takeaway

In a dynamic aerospace market, my preference leans towards robust suppliers with pricing power, like General Electric, over aircraft manufacturers.

With its strategic focus on advanced engines, GE stands out as a dominant player benefiting from accelerating aviation demand, which is emphasized at events like the Paris Air Show.

The company’s commercial engine and service revenue surged, and its defense sector orders more than doubled.

Moreover, GE’s improving performance in sustainable energy is also noteworthy, with Vernova displaying significant growth in renewables.

Backed by impressive guidance, GE has the potential for sustained double-digit EBITDA and free cash flow growth, positioning it as an undervalued contender in the aerospace industry.

While a cautious approach is advised given economic uncertainties, I maintain a Buy rating on GE and believe it’s one of the best players in its industry.

Read the full article here