California regulators voted on Thursday to allow Cruise (NYSE: GM) and Waymo (GOOG)(GOOGL) to start running a 24/7 paid taxi service in San Francisco. Anyone who’s been to the city of San Francisco recently, especially in the evening, has seen the cars driving around, eerily with no one in the driver seat. Many of these have been operating as taxis, leading to some unique outcomes.

As we’ll see throughout this article, self-driving is a new investment opportunity, however, we expect there to be substantial winners and losers in this risky new industry.

The Self Driving Problem

The self-driving problem is enormously complex. Because regardless of what some in the media might make you afraid of, general AI has yet to exist. Computers follow a set of rules. Modern statistics, combined with extraordinarily complex rules, leads to the AI that seems to look extraordinarily complex, like Chat GPT.

In fact the impacts on training data from the growing number of generative AI models has made current generative AI worse. Self-driving is a complex set of rules and when it hits an unexpected scenario it fails. As a result, we expect AI to continue the way Cruise and Waymo are building it up, city level robotaxis that earn income and gather data.

Market Opportunity

The market opportunity is huge.

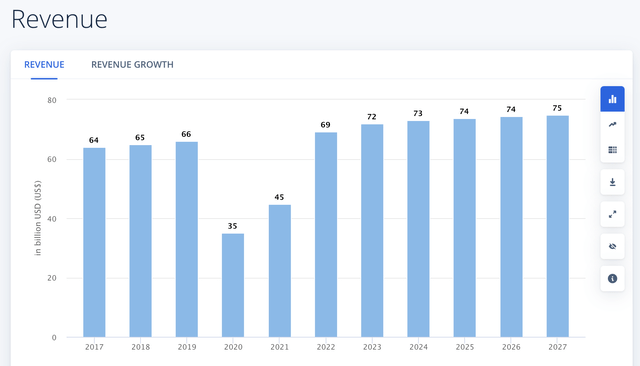

Taxi Revenue

The revenue earned from ride hailing and taxi services is clearly enormous. Despite a sizable dip during COVID-19, the earnings from the industry are set to surpass $70 billion this calendar year. The city model enables these companies to take advantage of major markets to start that are responsible for a substantial % of the market like NYC or SF.

With Waymo and Cruise already taking advantage of the market, earning cold hard cash as they improve, they’re already taking advantage of the market.

Take Advantage

So what’s the best way to take advantage of this. Cruise has 2x the fleet size of Waymo currently with Cruise having roughly 400 vehicles and Waymo having about half of that. However, Waymo is better at running 24/7 while Cruise primarily runs at night showing a potential fear around the intensity of daytime operations.

The answer is it depends.

General Motors (NYSE: GM) has a $46 billion market capitalization with its 80% ownership of Cruise. Waymo was once worth almost $200 billion but is now worth $30 billion. Cruise is estimated to be worth about $30 billion. That means it makes up just over half of General Motor’s valuation. Obviously, any success there would be very profitable for General Motors.

On the other hand, Google is enormous. It’s worth almost $1.7 trillion. That means even if Waymo becomes worth several hundred $ billion the upside for Google will be much smaller. Of course if Waymo never goes anywhere, Google’s core business and current value is much less important than that of Cruises.

The investment you take advantage of is based on your personal risk profile and the amount of exposure you want to that company’s self-driving results.

Tesla’s Downside

Let’s get to our thoughts on one of the most talked about companies in the self-driving world, Tesla (NASDAQ: TSLA).

Tesla’s approach, more and more, seems to focus on driver assistance rather than full self-driving. The company has numerous miles on its systems but it hasn’t started rolling out full self-driving without a driver like Cruise and Waymo. They might have statistics on human interventions required, but they don’t hit all the unique opportunities that happen when human drivers aren’t using the system as much, like short-distance complex city driving.

Cruise and Waymo have hit consistent interventions but each time they learn something from it. They’re already earning revenue from the business and gathering data. We think Tesla is behind Cruise and Waymo by a significant margin in terms of earning revenue from full self-driving. Right now Tesla hasn’t indicated any sort of path to hitting where Cruise and Waymo are, that’s more than a long-term goal.

There’s something else worth noting here that’s coming increasingly into view. Regulatory burden. Full 24/7 self-driving was allowed in San Francisco after years of testing and despite strong protests. Some would argue if it had been San Francisco’s decision and not California’s regulatory decision it wouldn’t have been approved at all. Each city is a pain staking process that requires years of effort and planning.

The path to self-driving revenue seems to be taxi-replacement in major cities that can be painstakingly investigated and mapped. They have the scale to make such an effort worth it. More importantly Waymo and Zoox are backed by companies that can spend $10s of billions to make it a reality. Cruise is already a leader and General Motors is strong. Tesla is behind and even as a car company isn’t profitable enough to continue these investments at a higher scale.

Given that self-driving is a key part of Tesla’s incredibly high valuation versus other car makers we expect it to underperform as it continues to fall behind in the race.

Our View

Humanity is great and solving problems and the amount of money being invested here along with the start of regulatory approval coming implies that they think there’s a path forward.

However, there’s winners and losers and risk levels. Google is the classic choice. Its tech seems to be leading, in on the road issues, versus Cruise. It has the financial backing to continue investing heavily, and even if the business ends up worthless it’s not in a particularly tough spot with its investment.

General Motors is a higher-risk higher-reward. Cruise is doing incredibly well with its expanding flow of robotaxis. The company makes up a sizable part of General Motor’s valuation, meaning the potential for much stronger shareholder rewards if it succeeds. However, General Motors core business still helps to provide some helpful isolation.

Then there’s Tesla. The company is dramatically overvalued and one way to meet that would be an incredibly successful self-driving business, but it’s not leading there. We expect Tesla to continue to struggle to justify its valuation and as it drops down it increases the chance that investors will see that, punishing it further.

Thesis Risk

The largest risk to the thesis in our view is an unexpected technological breakeven, a “golden nugget” that happens once in a while. Tesla could have one, some moment of technical genius, that changes the field. It’s happened before in AI with the creation of generative AI models and more. Tesla is actively investing and could see such a breakthrough that enables it to catch up to its competitors.

Read the full article here