Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

An initial coin offering, or ICO, is a popular way for crypto projects to generate publicity and raise capital. Much like crowdfunding, ICOs allow the community to have a tangible impact on a project’s growth – while also providing scope for investors to realize substantial returns in the future.

ICOs have the potential to generate these substantial returns. Ethereum (ETH) is currently demonstrating a 6,300x multiplier since its Initial Coin Offering (ICO) in 2014. Cardano (ADA), meanwhile, is presenting a 125x multiplier since its ICO in September 2017.

More recently, OpenCampus (EDI) is trading at 1,400% of its initial ICO price while SUI (SUI) trades at 660% of its initial ICO price. This shows that returns can be significant depending on which ICO is chosen – the other side of the coin is that multiple ICOs have turned out to be no more than scams.

As brand new projects, ICO cryptos often have no established market to fall back on while their utility is unproven, even if the potential of the solution they offer is high. It is important for investors to understand that even the best ICOs are not guaranteed to deliver immediate returns or success for the investor.

This article discusses the best crypto ICOs available, covering what they are and why they are so highly regarded, before exploring the key factors to bear in mind when making an ICO investment decision.

The Best Crypto ICOs to Invest in Right Now

Listed below are some of the best ICO cryptos available to investors, derived through in-depth research and analysis. We’ll discuss each of these ICOs in the following section, providing the information needed to make an informed investment decision.

- Wall Street Memes (WSM) – At its ICO stage, the token holds substantial promise for future growth. The project is channeling the spirit of communities, intertwining this with its already strong NFT following – has now raised more than $26 million in just 12 weeks.

- Sonik Coin (SONIK) – Brand new ERC20 meme crypto ICO with high ambitions to reach a $100 million market capitalization. Offers powerful APY rewards and priced at just $0.000014 per token, ICO is expected to sell out quickly.

- Launchpad XYZ (LPX) – Access All Web3 Services Under one Portal with this newly launched cryptocurrency. With the LPX token, members can access a decentralized exchange, a P2E hub, and access trading terminals. $1.25 million was raised during its ICO.

- yPredict (YPRED) – Next-gen trading and research platform that lets traders access data-driven insights on the cryptocurrency markets. With the $YPRED token, earn passive income and get access to P2E platforms. $3.3 million raised in its ICO.

- Chimpzee (CHMPZ) – Token which helps users benefit from helping the planet by providing them with a passive income for holding. $1.1 million raised in its ICO.

- Scorpion Casino (SCORP) – Social-powered online gambling platform and casino that allows users to earn up to $10,000 in staking yield. Has now raised more than $660k in its presale.

- eTukTuk (TUK) – Upcoming cryptocurrency ICO, aiming to set up EV charging stations for TukTuk drivers in developing countries. $TUK priced at $0.024 on presale.

- ScapesMania (MANIA) – A new presale which has already fully sold out its whitelist. Powered by a Binance Grant winning team, the project gives crypto enthusiasts access to the revenue streams from a $100+ Billion Gaming Market.

- Pikamoon (PIKA) – New P2E gaming project where players collect and battle wild Pikamoons and explore the wider Pikaverse – $3.8 million raised in its ICO, which is in its final stage.

- MindAI (TMC) – New AI-powered crypto exchange that offers trading pairs with leading cryptos and lower fees than some of its rivals. $50k raised since ICO launch.

- CryptoCitizen (CCASH) – Another crypto gaming project, CryptoCitizen features MMORPG elements and several components, including shooting, racing and PVP.

- Heroes of Mavia (MAVIA) – Base building crypto game where players create their own armies and conquer enemy bases.

- Kryptview (KVT) – New research-to-earn which is dedicated to in-depth analysis of crypto projects to provide a clear overview, rather than just price potential.

- OutDID – End to end private ID verification system using ZK proofs to streamline compliance procedures for online businesses.

The Best New ICO Crypto Projects Reviewed

Investing in an ICO can be risky, given that the project in question will still be in its infancy and is not yet established. However, those with a higher risk tolerance level can benefit from improved ROI potential. The two often go hand in hand.

With that in mind, let’s take a closer look at the best crypto ICOs listed above, exploring why they are so sought-after:

1. Wall Street Memes (WSM) – ICO Token With Upside Potential and a Strong Community Backing

Wall Street Memes (WSM) launched its new crypto token, $WSM, on May 26. This token was birthed from the Wall St Bulls NFT project, known for selling out in just 32 minutes.

$WSM is on presale and has already raised a stunning $26 million in just 12 weeks at the time of writing, with the closing date set for the end of September.

Participating in an ICO usually provides the best entry point, as several price rounds often rise over time, offering a discount to the initial risk-takers. This combined with solid community backing, like $WSM’s, hints at high upside potential.

$WSM has a considerable digital influence and a strong bond with its community, as demonstrated by notable figures like Elon Musk interacting with its Twitter platform. The widespread reach and popularity hint at potential future listings on top-tier exchanges, including Binance.

Although presales have inherent risks, they also harbor a high potential for rewards, especially when a strong community backs the project. $WSM’s backing and success with the NFT market position it as a promising new crypto.

$WSM’s launch, coinciding with the meme coin season, underscores the brand’s dynamic nature and expansion, keeping pace with emerging trends such as Bitcoin Ordinals NFTs.

To celebrate the initiation of the $WSM presale, a $50k airdrop event is planned, where holders can engage via Discord and fulfill simple tasks to participate.

The structuring of the $WSM token distribution, with a cap of 2 billion tokens, is community-centric. Half of these tokens are earmarked for the presale, while the remaining is equally split between rewards for the community and providing liquidity for exchanges.

Bear in mind that promotion and endorsement can sometimes be a double-edged sword. It might result in an overvaluation of the token or the community might expect returns that cannot be delivered upon. Even the most well executed projects might encounter difficulties, so be sure to adjust your investment allocation for volatility.

Still, with meme coins like Pepe being one of the best-performing assets of 2023, WSM might be attractively priced, if it can emulate such a performance. You can enter the Wall Street Memes Telegram group to keep up with the latest updates and for additional information.

| Presale Started | 26 May 2023 |

| Purchase Methods | ETH, USDT, Credit Card |

| Chain | Ethereum |

| Min Investment | 100 $WSM |

| Max Investment | None |

2. Sonik – Viral Meme Crypto ICO With 4,224% APY and Tiny Entry Price of Just $0.000014

Sonik ($SONIK) is a newly launched ICO that offers significant passive income returns as well as a tiny entry price of just $0.000014. This entertainment based token takes its cue from the Sonic the Hedgehog franchise, but has no official affiliation with Sonic or Sega. Currently, the project is offering a large 4,224% yield which will be reduced as more people hear about the project and take part in the staking rewards.

There are 3 stages to the Sonik roadmap. The first stage concerns the concept art, token deployment, and presale. The second stage concerns the Uniswap DEX launch and staking. The third stage concerns community building and working to reach a target market capitalization of $100 million, a highly ambitious goal.

The Sonik project has an irreverent and carefree attitude, typical of degenerate meme tokens which focus on stylish marketing that attracts specific customers. While there is significant variance in terms of how these tokens perform, some (such as Pepe, Turbo, and Doge) can do enormously well if a movement gets behind them.

There are a total of 299,792,458,000 $SONIK tokens available, with 50% up for grabs in the ICO, 40% set aside for staking, and 10% allocated for DEX liquidity on Uniswap. The hard cap for this ICO is $2,098,547 and there are no stages or price increases – the token price remains the same throughout.

To take advantage of this initiative, users will need a Metamask or Wallet Connect account, as well as either USDT or ETH to make the transaction. More information can be found through Twitter, Telegram, or the Sonik whitepaper.

Remember to complete your due diligence, as the project founders have clearly stated they are not responsible for any losses. The prices could reach the moon as fast as the speed of light, or it could go to zero. All investments come with risks.

| Presale Started | August 2023 |

| Purchase Methods | ETH, USDT |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

3. Launchpad XYZ – Web3 Ecosystem to Help Users Navigate Crypto and Access Info

Launchpad XYZ offers a single platform through which members can access all of the best Web3 use cases. At the center of the ecosystem is $LPX, the native cryptocurrency recently launched on presale.

Through the Launchpad XYZ portal, users can access a range of Web3 services, including a Web3 wallet that allows one to swap hundreds of tokens and access limited perpetual contracts. Users can stake $LPX tokens to earn discounts on trader exchange fees.

One can access trading insights through Launchpad XYZ’s trading terminal by staking the token. While this cryptocurrency has no historical price movements that can help us analyze its future price, it offers multiple use cases. $LPX is a utility token, as it will also be used to purchase fractionalized assets such as cars, houses, and more.

Those staking a minimum monthly average of 10,000 $LPX can benefit from discounts on fees and get guaranteed access to presales and to whitelists of new NFT mints. Launchpad XYZ offers data on hundreds of tokens and identifies which exchanges offer the best liquidity for those interested in discovering more about new tokens.

Launchpad XYZ hosts many crypto presales on its ecosystem, allowing users to directly claim new tokens through their wallets. By offering all these experiences in one ecosystem, Launchpad XYZ aims to onboard the next 10 million users in the Web3 space.

From a maximum supply of 1 billion tokens, 250 million $LPX have been allocated for the ongoing presale. The presale will consist of 10 rounds, each offering 25 million tokens.

Currently, $LPX is priced at $0.0445 during the second round, the price will jump to $0.0565 by the tenth and final round, an increase of 27%.

More than $1.25 million has now been invested in the LPX presale. Read the Launchpad XYZ whitepaper and join the Telegram channel to learn more about this cryptocurrency project.

| Presale Started | 27 April 2023 |

| Purchase Methods | ETH, USDT, Credit Card |

| Chain | Ethereum |

| Min Investment | 100 LPX |

| Max Investment | None |

4. yPredict – New Trading and Analytics Platform that Utilizes AI and Machine Learning

yPredict uses artificial intelligence and machine learning to offer financial prediction methods and data-driven insights on the cryptocurrency markets.

The platform, built by doxxed and experienced professional traders, quants and software engineers, will allow users to maximize their profit-making potential by providing a range of tools and AI-generated data and analytics.

While yPredict is a new cryptocurrency, it uses an important element of blockchain technology – artificial intelligence. By using tools such as Natural Language Processing, the platform analyzes the sentiment of various tokens. Furthermore, the ecosystem uses over 25 chart pattern recognition tools, allowing the AI to determine the bullishness of a particular coin.

Users can access predictive analytics and models, which have been verified by the yPredict DAO (Decentralized Autonomous Organization). By holding this utility token, users can also generate a potentially high APY (Annual Percentage Yield).

Existing $YPRED holders are awarded 10% of all the new subscription revenue generated. Furthermore, 15% of swap fees are also shared amongst token holders through a staking pool. By staking $YPRED, one gets free access to the data analytics platform as well.

yPredict lets members study about cryptocurrencies and take quizzes on its Learn2Earn ecosystem. After taking each test, users are awarded with a certain amount of $YPRED. Through a play-to-earn ecosystem, members can bet on the crypto markets’ future outlook to earn more tokens.

The tokens have further utility as they are used to purchase memberships on the platform, with three tiers available (free, active, pro) that allow access to different levels of features and analytical data.

Currently, $YPRED can be purchased for only $0.1 during the ongoing cryptocurrency presale but by the final round, the price will jump to $0.12 per token – an increase of 20%.

Since the presale went live, yPredict has managed to raise over $3.3 million, with the token to be listed on exchanges after the presale concludes.

Read the yPredict whitepaper and join the telegram channel to learn more about this cryptocurrency.

| Presale Started | Q1 2023 |

| Purchase Methods | MATIC, ETH, USDT, BNB, Credit Card |

| Chain | Polygon |

| Min Investment | 200 YPRED |

| Max Investment | None |

5. Chimpzee – Token Which Helps You Benefit From Helping the Planet

In the realm of cryptocurrency projects, while many are focused on developing innovative financial solutions, there remains a notable absence of initiatives addressing environmental and social issues. Fortunately, a new trend is emerging, and a select few pioneering projects are taking the lead.

One such project is Chimpzee, which places its emphasis on preserving the planet and its wildlife. Chimpzee offers a range of features that enable users to earn passive income while making a positive contribution to environmental causes.

These features, including Play-to-Earn, Shop-to-Earn, and Trade-to-Earn, are accessible through the Chimpzee shop, the NFT marketplace, and the Zero Tolerance Game. The project’s team has dedicated 10% of the token supply and a portion of the profits to support organizations working towards these important causes.

Among the avenues for earning passive income, holding a Chimpzee passport proves to be the most lucrative for users. It grants them the ability to earn additional CHMPZ tokens by engaging with various elements of the ecosystem.

The Chimpzee project will unveil a mobile app that utilizes AI technology to create personalized chimpzee avatars for its users. These avatars can be utilized to create a unique Chimpzee NFT passport, which will share many of the same benefits of a Diamond NFT Passport.

To participate in the Chimpzee presale and secure one of these exclusive passports, a total of 40 billion CHMPZ tokens will be made available across four rounds. In the current round, the price per 1 CHMPZ is currently at $0.00085 – the presale will end when we reach the listing price of 0.00095.

Obtaining the Chimpzee Diamond NFT passport during the presale offers users the most advantageous rewards, but the supply is limited. Those who miss out on the presale will need to purchase the passports at a higher price and wait until after the whitelist NFT passport prelaunch, which is exclusively reserved for presale investors.

Only participants in Stage 1 of the presale will have access to buy and mint the Diamond NFT passport in the exclusive pre-launch event. Chimpzee holds great potential to make a notable impact in the field of environmental projects and is certainly worth monitoring.

Seizing the opportunity to join the presale early on presents irresistible advantages, with $975k raised in the ICO already.

| Token Symbol | CHMPZ |

| Total Supply | 200 Billion |

| Presale Supply | 40 Billion |

| Network | Ethereum (ERC-20) |

| Purchase Method | ETH, USDT, Credit Card |

6. Scorpion Casino (SCORP) – New Social Casino with Attractive Staking Yield & $660K Raised Throughout Presale

Scorpion Casino is a newly launched online gambling platform and casino that is community driven and allows users to earn a daily yield based on its overall success.

The platform allows users to earn up to $10,000 in daily passive staking yield for holding $SCORP tokens – which has seen $660k of investment in its presale.

Scorpion Casino allows its players 30,000 betting opportunities every month, with more than 200 classic casino games, 160 live games and a sportsbook.

The platform is licensed and regulated in Curacao, while games are provably fair, with the sportsbook allowing wagers on major sports such as the NBA and NFL, Premier League, UFC, boxing and others.

Despite being new in the space, Scorpion Casino has also partnered with long-running platforms such as BetRadar and CoinsPaid, while a listing on a tier-1 exchange has also been secured after the presale ends.

One token currently costs $0.016 but $SCORP will be listed for $0.05.

The presale is offering 40% of the supply with no vesting period, with the token used as a payment method on the site, as well as for staking and its affiliate reward system.

Presale buyers can get an extra 20% of $SCORP for a limited time by using the bonus code Scorpion20 when they make a purchase.

| Presale Started | Q2 2023 |

| Purchase Methods | BNB, ETH, USDT |

| Chain | Binance Smart Chain |

| Min Investment | $10 |

| Max Investment | None |

7. eTukTuk (TUK) – Earn Staking Rewards with this Crypto Aiming to Reduce Air Pollution

The next cryptocurrency on our list is $TUK, the native token of eTukTuk. This is the first-ever automotive project based on the Binance Smart Chain.

eTukTuk wants to help TukTuk drivers start adopting electric vehicles (EVs) and will build charging stations and set up electric vehicle supply equipment (EVSE).

According to the World Health Organization (WHO), 99% of the population breathe polluted air. There are 270 million TukTuks that operate on Internal Combustion Engines (ICEs), which run on non-renewable sources such as fossil fuels. These contribute to more pollution than cars.

As ICEs are slowly becoming obsolete, TukTuk drivers struggle to make a minimum wage to support their families. Therefore, eTukTuk will set up EV charging stations in urban and suburban areas of developing countries.

The EVSEs and charging stations will be set up in different ‘territories.’ Each territory will be operated and set up with the help of local manufacturers, known as territory partners. This helps limit the cost of production. The platform will let drivers make payments at the charging stations with $TUK tokens.

Since the cryptocurrency is based on the Binance Smart Chain, there are low fees and high scalability. According to the eTukTuk whitepaper, drivers will take home 400% more in revenue by using this platform.

Territory partners will be rewarded, as they get a commission for each transaction on the charging stations. Token holders can stake $TUK to earn passive income. eTukTuk is priced at $0.024 on presale.

Join the eTukTuk Telegram channel for more information.

8. ScapesMania – Join this Exciting Gaming Ecosystem and Implement Decisions by Joining a DAO

In 2023, the DeFi tokens market cap is valued at $3 billion, an 88% decrease compared to the 2022 valuation of $27 billion. This is mainly due to the failure of play-to-earn (P2E) gaming platforms to focus on proper gaming opportunities and incorporate successful earning opportunities.

ScapesMania ($MANIA) is a gaming ecosystem that will incorporate in-game quests and focus on offering a massive casual gaming opportunity to bring in Web2 users to the Web3 space. At the same time, ScapesMania will decentralize its ecosystem and allow token holders to join the platform DAO.

With $MANIA, investors can join the DAO and play a role in implementing future decisions through voting opportunities. Users can purchase in-game boosters, decorative items, and energy boosts within the games. Along with this, ScapesMania will also offer in-game NFTs.

The $MANIA token has a low supply of 4 billion and will also be bought back with the profits generated from the ecosystem. During the initial stages of the project, up to 50% of the profits will be used to buy back tokens and complete burning events. This token has finished its whitelist event and is priced at $0.00213 during the presale stage.

Presale investors can buy the token for a 400% discount, as the price is set to increase to $0.01 when the exchange listing takes place. With 1.2 billion allocated for the presale, investors have ample opportunity to buy $MANIA.

10% of the token supply will also be allocated for staking rewards, allowing you to generate passive income on the ecosystem.

The token has the potential to offer huge returns, with exchange listings to be confirmed on top-tier exchanges such as Gate.io, BitMart, and PancakeSwap.

| Presale Started | Q2 2023 |

| Purchase Methods | BNB, BUSD, USDT, USDC |

| Chain | Binance Smart Chain |

| Min Investment | $10 |

| Max Investment | None |

9. Pikamoon – New P2E Gaming Cryptocurrency ICO to Invest in 2023

Pikamoon has recently launched the ICO of its native token $PIKA. With this cryptocurrency, token holders can purchase NFT avatars, battle against other players, and earn rewards on a play-to-earn ecosystem known as the Pikaverse.

The $PIKA ICO will consist of three rounds – each offering 5 billion tokens. In total, $PIKA has a total supply of 50 billion tokens and is already in the final stage with tokens selling for $0.0006.

On the Pikamoon marketplace, investors can leverage $PIKA to buy their Pikamoon NFT avatars. There is a total of 18,012 NFTs, each belonging to four regions – The Flame Empire, Earth Regions, Thunder Collective, and Water Kingdom.

The game is set in the world of Dreva – where you can explore the territories, purchase virtual land, and battle against other Pikamoon.

According to the Pikamoon whitepaper, the platform will develop an online mode that allows players to engage in Player v Player fights and compete in online quests.

However, the platform will also cater to gamers through the offline mode, which can be accessed without holding any $PIKA tokens. This platform has been KYC verified by Coinsult and audited by CoinSniper.

5% of all tokens spent on the marketplace will be burnt, and a 2.5% tax will be levied on all sell orders and transfers. The tax will be distributed towards P2E prize pools, marketing purposes, and ecosystem development.

More than $3.8 million has been raised in the Pikamoon ICO at the time of writing.

| Presale Started | 16 April 2023 |

| Purchase Methods | ETH, USDT |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

10. MindAI – Upcoming Crypto Exchange with New Presale Token Launch

MindAI is a start-up that aims to revolutionize the crypto space by offering various blockchain products and services.

The main offering of this platform is an AI-powered cryptocurrency exchange known as TMCX. The exchange will be powered by TMC (The MindAI Coin), recently launched on presale.

Once the exchange is listed, TMC will be used to settle all transactions and to complete payments for goods and services. Token holders can also secure fee discounts by trading with TMC. Along with this native token, MindAI will offer Bitcoin (BTC) and Ethereum (ETH) as trading pairs.

The platform will charge a fixed trading fee of 0.25% per transaction but has no plans to increase this number. AI will be used to detect fraud, offer users online assistance, and monitor cryptocurrency transactions.

Methods such as deep learning will be applied to offer advanced image generation via speech and text prompts. Since MindAI has registered itself as a startup in the Business Register in Italy, 15% of the available cash flow will be put towards research and development.

The MindAI presale is currently in phase one, where the $TMC token is priced at just $0.15. There will be eight rounds in total, with the eventual price rising to $0.20 before the exchange listing. 50% of the total 300 million TMC supply will be allocated across the eight rounds.

5% of the tokens have been reserved for exchange listings, while 30% will be given to the team’s foundation. Read the MindAI whitepaper to learn more about this project.

| Presale Started | 13 April 2023 |

| Purchase Methods | ETH, USDT |

| Chain | Ethereum |

| Min Investment | $50 |

| Max Investment | None |

11. CryptoCitizen (CCASH) – Top Initial Coin Offering in the Blockchain Gaming Sector

Another of the best ICO cryptos to keep an eye on is CryptoCitizen, the latest addition to the ever-growing blockchain gaming sector, offering a free P2E metaverse complete with an overarching storyline.

The game also features MMORPG elements, ensuring it appeals to a broad audience. The CryptoCitizen ecosystem comprises several components: a shooting game, a racing game, and a PvP fighting arena.

Players can earn CCASH through skilled gameplay, which they can use to increase their ‘Citizen Ranking’ and access NFT drops.

Alpha testing is still ongoing for the CryptoCitizen team, although the project has generated tremendous buzz already.

More than 165,000 people currently follow CryptoCitizen’s official Twitter account – and given the team was present at Gamescom 2022, the hype is likely to continue building around this new project.

12. Heroes of Mavia (MAVIA) – Battle-Builder Game with P2E Features

Heroes of Mavia could be one of the best crypto ICOs in the blockchain gaming niche due to its appealing ‘base building’ features.

Within the Heroes of Mavia ecosystem, players can create their own armies and conquer enemy bases – allowing them to earn Ruby tokens in the process.

Ruby tokens can then be used to upgrade a user’s base, strengthen their army, and solidify defenses.

However, aside from the battle mechanics, Heroes of Mavia also has a built-in NFT marketplace, live battle streaming features, and even a ‘Base Partnership Manager’ for users to collaborate and generate passive income.

Like many of the best ICO cryptos, Heroes of Mavia has already attracted massive attention from prospective investors on social media.

The game is backed by leading entities like Binance Labs and Animoca Brands – meaning all eyes will be on Heroes of Mavia ahead of its Beta phase launch in Q4 2022.

13. Kryptview (KVT) – New ‘Research-to-Earn’ Ecosystem with Unique Use Case

As stated by CoinMarketCap, Kryptview is a data platform dedicated to community research on tokens and cryptos.

This unique platform rewards users for in-depth analysis of crypto projects, providing a clear incentive to participate in the Kryptview ecosystem.

Aiming to be the first ‘research-to-earn’ platform to hit the mainstream, the Kryptview project has already received backing from major players such as The Blox and Matters.

Interestingly, the platform’s users can add ‘research bounties’ to specific assets, enticing researchers to provide information and generate income.

The Kryptview token (KVT) is used for rewards distribution and additional perks, making it a crucial part of the ecosystem.

The KVT ICO is set to go live on October 13th and will see 12.5% of the total supply being offered to early investors – allowing them to benefit from price increases if the token becomes listed on major exchanges in the future.

14. OutDID – Fraud resistant, Scalable, Cost Effective, Zero Knowledge Compliance for Online Business Owners

OutDID is a decentralized solution for user verification, aimed primarily at online businesses that need to verify customers. One solid selling point of OutDID is that the verification is private. Once the verification has been achieved, the information is not given to any third party, including the OutDID algorithm. It stays on the user’s device.

This is relevant because of the sheer volume of user identity thefts and data compromises with major providers – Experian, Target, eBay, Facebook, First American, etc. Keeping sensitive information local to a device is one of the most accurate ways to retain this data. And the more that information travels, the more likely it is to be intercepted.

Because it uses zero knowledge (ZK) proofs, it can handle billions of verifications. It takes only 15 seconds to verify user identity. After the first verification is complete, users can move to other sites without needing additional verification, in a one step system.

This solution eliminates many kinds of problems faced by business owners. The first is data processing. Even if cybercriminals hack a business database, no customer information will be kept on record, as related to compliance. Because it is fast and easy, users are far less likely to abandon the sign up process. Compliance procedures are often quite difficult, costly, and burdensome for business owners to comply with. Moreover, the rules often change.

Social media platforms, for example, can use OutDID to verify their users. A centralized social platform might need to ensure that all users are older than 18, and OutDID can verify this quickly and easily, without compromising user data to third parties.

The private verification system of OutDID also claims to be 10x cheaper than other providers, and also claims to have a 100% foolproof document fraud detection system in place. Information for this upcoming OutDID ICO has yet to be finalized, but it will likely be an ERC20 token.

What is a Crypto ICO?

A crypto ICO is a type of blockchain-enabled crowdfunding that allows a crypto project to raise funds by selling tokens. The tokens that are offered tend to have a use case within the project itself, meaning early investors can become a part of the community before the project has even launched.

Most of the time, crypto ICOs will allow investors to purchase tokens at a discounted price relative to their eventual listing price. This is done to entice investors to participate in the ICO, kick-start development and generate publicity, which is crucial to a project’s growth.

The concept of crypto ICOs is not new, having been around since the early 2010s and similar to a stock exchange IPO.

Ethereum is one of the most notable projects to begin its life as an ICO, as early investors were able to acquire ETH for just $0.31 per token back in 2014. Given that ETH tokens are now valued at around $1,800 – and has been as high as $4,800 – it’s clear why ICOs are so popular with risk-seeking investors.

However, it’s also essential to bear in mind that crypto ICOs are generally unregulated, meaning they are not supervised or policed by leading institutions. As such, investors looking to participate in crypto ICOs must do their due diligence and be aware of the heightened risks before deciding to purchase tokens, as well as understand that success is not always guaranteed, despite the potential of a project.

A History of ICOs

ICOs emerged as a method for crypto developers to secure funds for cryptocurrency projects. It involves creating blockchain based tokens and selling them directly to investors at a discounted rate. While IPOs (Initial Public Offerings) involve the sale of stock to raise capital for mature companies, ICOs do the same thing in a Web3 context.

ICOs serve as a funding mechanism for early-stage projects, often in the tech startup realm. ICO investors purchase tokens without obtaining any ownership stake in the company. The premise is that investors believe in the project’s value and anticipate potential profits by purchasing tokens at a lower price early on and selling them for a profit once the project achieves success.

As previously mentioned, the first major success story in the world of ICOs was Ethereum. Back in 2014, it managed to raise an impressive sum of $16 million (this amount is small by current standards, EOS having raised $4 billion). Today, Ethereum not only stands as one of the most valuable cryptocurrencies but also serves as the foundation for an entire ecosystem of decentralized applications (dApps) that have flourished with its technology. It’s also the home of decentralized finance (DeFi), an incredibly large field estimated at $44 billion by total value locked (TVL).

In 2017, however, the ICO success stories rapidly diminished – 80% of ICOs in this time period were estimated to have been scams. A number of fraudulent projects scammed investors out of their earnings. Only about 8% of such ICOs reached a centralized exchange (CEX) for serious liquidity and long term growth.

This resulted in a regulatory crackdown, mainly from the Securities and Exchange Commission (SEC) in the USA. An ongoing case of Ripple vs SEC is still deliberating as to whether such projects constituted a securities offering or not. If so, the offerings would be in violation of SEC guidelines, potentially resulting in criminal liability for the founders.

Due to the regulatory crackdown and the risky nature of ICOs, Web3 fundraising mechanisms have evolved into various formats – Securities Token Offerings (STOs), Initial Exchange Offerings (IEOs), and Initial Dex Offering (IDOs). The ecosystem had to evolve to become safer but also more flexible, as the sophistication of the Web3 ecosystem developed further.

How do Initial Coin Offerings Work?

Initial coin offerings are scheduled events that last for a specific amount of time which is decided on by the project’s team. The team will set a date for the ICO and determine their fundraising goal.

Each cryptocurrency ICO will usually have a soft cap and a hard cap, which state the minimum and maximum number of tokens to be sold. Once the ICO has gone live, the purchasing process tends to look something like this:

- Investors will go to the project’s official website to participate in the ICO

- The website will display the token’s price and the currency used for the exchange – example ‘bridge’ currencies include ETH and BNB

- A wallet address will be provided by the project’s team, to which investors must send funds to acquire tokens

- The investor will then send their investment amount to the wallet address before providing their own wallet address to receive their ICO tokens post-purchase

As the process above highlights, all that’s required to participate in an ICO is a crypto wallet and some digital currency holdings to make the exchange. However, this does mean prospective investors must own some crypto ahead of the ICO.

ICO, STO, IEO, IDO – What’s the Difference?

While traditional methods like bank loans and venture capital investments have long been the go-to choices, the rise of cryptocurrencies has introduced a new alternative in the form of token sales. Increasingly, companies are turning to token sales as a means to raise funds by creating cryptocurrencies and offering them to the public in exchange for major crypto or fiat currencies.

All token offerings are an investment in some form of digital currency, typically based on the Ethereum network. These are known as ERC-20 tokens. But the initial type of token fundraising, the ICO has now evolved into many subcategories and variants.The 4 main types include:

- ICOs – Comparable to an IPO but with digital tokens.

- IEOs – Similar to the ICO but taking place on a centralized exchange for added liquidity and legitimacy.

- STOs – A regulated variant of the ICO that is in full compliance with existing legal frameworks

- IDOs – A decentralized and unregulated token offering mechanism with fewer safeguards and more risk.

Each framework has its advantages and disadvantages, depending on what the classes of investors are looking for.

However, remember that the lines have blurred somewhat and the terms can be used in different contexts. Binance, for example, is a centralized exchange that offers a decentralized launchpad (BSCpad) for investment. This is an IDO on the Binance Smart Chain (BSC). It’s also common to hear that an ICO is launching on Binance, though this would technically be an IEO.

ICOs

As touched upon earlier, the ICO represents the basic framework for cryptocurrency fundraising. ICOs started to take place in 2014, after Bitcoin had a noticeable upsurge in price around 2013. The price of BTC was up 5,400% by the end of 2013, prompting increased interest in tokens (Bitcoin itself had no ICO). Partially due to this, early stage cryptos like Monero, Litecoin, and Ethereum started to engage in ICOs around 2014.

By 2017, unfortunately, the model was to be taken advantage of with a number of scam projects taking place, resulting in a regulatory crackdown. To this day, legal uncertainty still exists about the legal definition of a cryptocurrency, and how they should be taxed and regulated. Investors still have to learn how to stay safe when engaging in ICOs.

To mitigate ICO risks, it is essential for potential ICO participants to conduct thorough due diligence. This includes researching the project team, reviewing the whitepaper, assessing the project’s roadmap and milestones, and evaluating the market demand for the proposed product or service. Investors should also consider the reputation of the project’s advisors, the transparency of communication, and the compliance of the project with relevant regulations.

Be aware of how scam artists use psychological tactics to entice investors – “get in before it’s too late” or “price could rise to 10x” claims are to be treated with extreme skepticism. Ensure that you know who the founders are and check their history and social profiles.

Scam operations always leave telltale signs, usually on the official website and the whitepaper. People overlook these signs due to FOMO – “Fear of Missing Out”. They are too eager to make significant returns as opposed to completing their due diligence.

One study on 503 ICOs across 60 countries found that an increased number of advisors and insider retention correlated with positive returns – so making sure that the founders intend to stay with the project is essential to long term success. The friendliness of the legal system in the country also contributes to how much funds are raised in an ICO.

With a traditional ICO, there is typically no third party that is offering any form of KYC audit or checks. The founders act as the marketers, auditors, and promoters – a recipe that leads to disaster, because there are few safeguards for investors and few penalties for fraudsters.

IEOs

IEOs, or Initial Exchange Offerings, involve a centralized cryptocurrency exchange facilitating token sales for new projects. In contrast to ICOs, IEOs are conducted through exchanges, allowing projects to leverage the exchange’s customer base and quickly enable trading for their tokens. Advantages of IEOs include enhanced trust due to the exchange’s due diligence on listings and immediate token liquidity.

A project that launches on a centralized exchange like Binance is typically safer than a decentralized exchange like Pancakeswap. Binance has to deal with increased regulatory pressure from centralized authorities and likes to list higher-quality projects that adhere to KYC requirements. Otherwise, it would face criticism for listing low-quality tokens.

With the IEO, the project pays a listing fee to a centralized exchange. In return, the exchange will take on the responsibility of marketing and promoting the upcoming listing. So it makes sense to list on Binance, the world’s largest exchange by trade volume, which tends to have the most power, features, and influence. New tokens on Binance can appreciate by 41% shortly after listing – a feature known as the “Binance Effect”. Projects that recently launched through Binance IEOs include Open Campus, Space ID, and Hooked Protocol, all with a 1000%+ increase at the time of this writing.

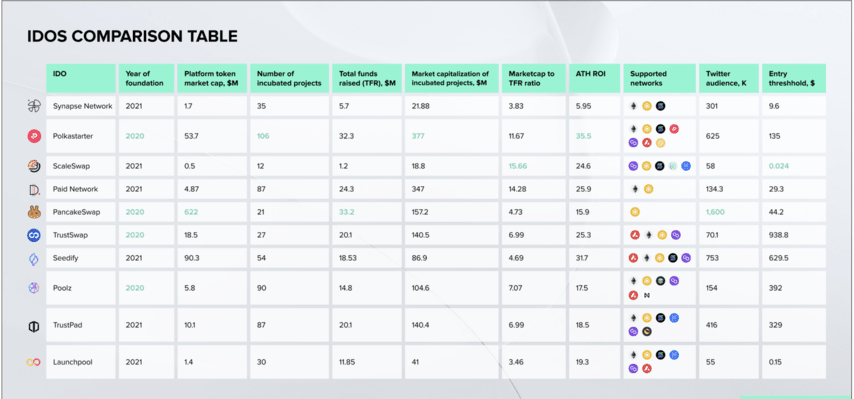

However, there are many decentralized platforms that do engage in KYC procedures. Synapse Network has a 2% acceptance rate for projects, with $15 million raised with 37 participating projects. PolkaStarter, meanwhile, allows anti-spam verification and KYC integration, with $49 million raised for over 111 initiatives. Top projects listed on Polkastarter include Galaxy Fight Club, OkLetsPlay, Humans, Wonderman Nation, and Nitro.

STOs

STOs, or Security Token Offerings, have emerged as a regulated alternative to ICOs. While ICOs lack regulation and have faced crackdowns due to scams and manipulation, STOs seek to comply with anti-money laundering (AML) requirements and securities laws. Security tokens issued through STOs represent tradable financial assets with the potential for profit. They offer benefits such as intrinsic value for tokens, reduced investor concerns about fraud due to regulatory oversight, and improved liquidity through the tokenization of various assets.

Securitize is an exceptional platform for Security Token Offerings (STOs), offering a comprehensive solution for individuals and companies seeking to create security tokens. The platform provides a highly flexible and efficient backend that assists users throughout the securities issuance process.

A notable feature of Securitize is its capability to integrate third-party applications operating on the Ethereum network. Furthermore, the Digital Securities (DS) Protocol developed by Securitize offers a seamless and compliant integration solution for issuers, investors, and exchanges, covering the entire lifecycle of digital securities, including issuance, trading, distribution, and governance.

The platform has established itself as a leading global security token issuance platform, with support from more than 10 investors, including reputable names like Morgan Stanley, Blockchain Capital, and Tezos. Other notable STO launchpads include TokenSoft and Securrency. All allow for fully compliant securities token offerings.

IDO

IDO, or Initial DEX Offering, represents a newer financing model that combines aspects of ICOs and IEOs. IDOs issue tokens through decentralized exchanges, with pricing occurring after the tokens have been circulated. One benefit of IDOs is that pre-mines are avoided. This is a means through which the founders benefited at the expense of the wider community. But IDOs do not always enforce KYC requirements and few safeguards are in place for investors.

Ethereums DaoMaker is a prime example of an IDO launchpad. It was one of the very first platforms to allow access to IDO offerings and pioneer new types of token sale formats – such as the Dynamic Coin Offering (DYCO) and the Strong Holder Offering (SHO). This changed the way that investors gained access to tokens. It has held SHOs for many successful tokens – My Neighbour Alice, Lossless Protocol, Orion Money, etc.

BSCpad is Binance’s decentralized launchpad for Binance Smart Chain. Many are unaware that while the Binance exchange is centralized, the Binance Smart Chain/BNB Chain is decentralized. Notable launches on BSCpad include Revomon, Medabots, GameZone, and AstroSwap.

PancakeSwap (CAKE) is an IDO platform and DEX that does not enforce special registration or KYC procedures. This is a huge IDO platform with over 1.6 million users. Famous IDOs that launched here include FC Porto, KALM, YieldWatch, and Horizon Protocol.

If you want to look into Web3 trading pairs on decentralized exchanges, then DEXTools.io is a terrific resource. You can analyze trading pairs cross chain and pairs are ranked with a unique score. It also lists live new pairs including token price and liquidity – you can keep tabs on your favorite pairs over time, to spot market insights.

How to Find the Best New ICO Cryptos

Finding the best crypto ICOs can be challenging – especially given how saturated the crypto market is. Websites such as CoinMarketCap, Twitter, Reddit/CryptoCurrency, CoinList and CoinGecko are great for helping you find new projects – but it is vitally important you conduct thorough and detailed research in all projects before deciding to invest in them.

Strong indicators you are in good hands include a doxxed and public development team (although meme projects often have anonymous developers), a clear roadmap and whitepaper, and strong social media following – although check post engagement and beware of bots and spam accounts boosting numbers.

The strategies below can help separate the high-potential ICOs from those that are likely to fall by the wayside:

Review the Project’s Whitepaper and Roadmap

One of the most important things to do when considering an ICO investment is to review the project’s whitepaper and roadmap. These elements help inform whether the project will have longevity or not, which is a crucial factor in an ICO’s success. It’s also wise to ensure the whitepaper is grammatically correct and has no obvious spelling errors, which tend to be a hallmark of a hastily formulated project.

The best ICOs tend to have detailed whitepapers that clearly explain what the project looks to accomplish and how it plans to do so. The best projects set out to utilize blockchain technology to offer a solution to a real-world issue, although some – especially meme coins – deliver returns simply by capturing the current zeitgeist and gaining momentum.

The white paper should contain a detailed tokenomics section. This is a section detailing how tokens are to be distributed and at what price. It will clearly outline where the funds are going, how much is allocated to the founders, early stage investors, the public, etc.

This is very useful information because if one group has too many tokens, it could exert undue influence. You can also review any data in relation to staking, if applicable. Staking allows investors to reinvest their returns and can go up to 15% (in the case of Polkadot). This can be likened to dividend reinvesting in classical finance, which is a great way to build long term wealth.

Use Social Media

Another helpful tactic to find the best crypto ICOs is to use social media. Social media platforms such as Twitter and Reddit have become valuable resources for crypto investors since they can offer real-time insight into a project’s progress. With marketing playing a massive role in an ICO’s success, most development teams will emphasize social media to foster strong community backing.

Reddit is a particularly useful resource when it comes to ICO investment. There is a subreddit called /r/CryptocurrencyICO/ that is just dedicated to ICOs. These Reddits can provide additional context for your investment, offering views and perspectives that may not be available directly from the official website or whitepaper. Reddit is particularly useful for meme tokens like Doge (2.4 Million subscribers) and Shiba Inu (400,000 subscribers), and massive movements can grow on Reddit to support cryptocurrency projects.

For ICO updates, you will want to join Discord. Discord is often where giveaways and new info takes place, alongside Telegram. Popular Discord groups for ICO investment include Jacob Crypto Bury (best overall), Crypto Hub (good for beginners), and Satoshi’s Insights (great for analytical insights). Large communities are built on these messaging platforms with regular updates, promotions, and announcements. This is especially true for ICOs and new projects that are just getting started.

Twitter is useful for breaking news. Influential figures like Justin Sun (Tron) Changpeng Zhao (Binance), and Sam Bankman Fried (formerly of FTX) will often make tweets about events that have just happened. In many instances, you can get breaking news on Twitter, right from the hands of the company founder. While new projects will often have a Twitter account, it becomes more prevalent as Web3 projects grow in size.

Youtube is another excellent resource. JacobCryptoBury delves deeply into ICO listings and gives additional insights and perspectives. It’s useful to gain these additional insights from a group or from a seasoned professional, and this can shorten the learning curve in many ways.

Other useful Youtube resources include Ivan on Tech (250k subscribers) and BitBoy Crypto (1.45m subscribers). Each channel covers a different angle. Ivan on Tech is useful because he brings on different professionals in the industry for additional perspectives. BitBoy crypto focuses on making money quickly, and it covers the latest news and updates in the industry.

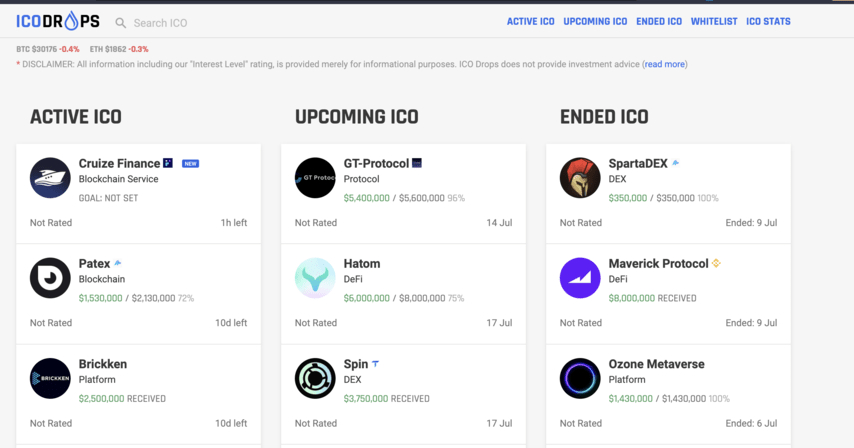

Make Use of an ICO Calendar

ICO Calendars are a great way to find upcoming ICOs. Typically, you can first view the industry, start and finish date, blockchain, and how much the ICO is expected to raise in their campaign. You can then drill into the ICO for further information.

Popular sites for upcoming and newly launched ICOs include ICO Drops and CoinCodex’s ICO Calendar. As you can see from the calendar below, three upcoming events including ecoterra, yPredict, and Deelance are three presale listings on Coincodex, followed by oZone Chaing and Wall Street Memes. You can see the current stage and the start/end dates.

The benefit of these calendars is that you can filter them to suit your preferences. You can filter for upcoming or ongoing presales or the type of blockchain (BTC, Ethereum, Solana, etc). This allows you to become more granular in your search. You might want to pre-register for projects so you get the very earliest stage, with the lowest price. Given the variance between start and end prices, this is an excellent advantage from an investors standpoint.

An ICO calendar easily streamlines your research. You can pick a number of upcoming or ongoing ICOs that match your search criteria, and invest amounts in them as they come up. If you schedule your investments you are less likely to engage in impulsive spending on the next hype-laden ICO.

Look At The Liquidity

Aside from completing due diligence, one of the most overlooked aspects of ICO investment for newcomers is understanding token liquidity. It‘s possible to purchase a token while remaining completely unaware that you might not be able to sell it for a lockup/vesting period. This means you will be stuck with your tokens if you want to sell after a defined period. These vesting periods are enforced to prevent speculation and ensure the long term growth of the ecosystem.

A vesting period is a time when tokens are locked, until specific conditions have been met (token generation events, centralized exchange listing, etc). A certain amount of tokens will be released at set intervals. This encourages price stability and serves as an incentive for investors. It further helps to maintain the integrity of the project.

A prime benefit is to align employees and early investors with the long-term success of the project. For example, a management team might receive 20% of tokens after the first year (the “cliff” period), with the remaining 80% released on a monthly basis over 4 years or so.

Even if you do have the token to sell, there might not be a market for it. Tokens that list on decentralized exchanges as opposed to centralized exchanges will often be far less liquid. So it’s important to investigate the vesting period for an upcoming ICO/IDO and to ensure that the token will be liquid enough for sale. Projects that launch through an exchange (IEO) will often have much-improved liquidity, especially if it’s a large exchange such as Binance.

Get Involved in Web3

The quickest way to understand ICO offerings is to take part in one of them. You can invest for as little as $20 in many instances. With $100, you could potentially invest in five ICOs and monitor the performance of each of them. This could be a much sounder investment decision rather than placing substantial amounts of capital into a new project that is going “to the moon” – at least according to the project founders.

Alternatively, you could take a full or part time position with a Web3 startup that is involved with token offerings. Smart contract developers are in demand – 117,000 Ethereum smart contracts were deployed in 2022, while there were only 205,000 deployed from 2015 to 2021. And smart contract development is not tied to crypto prices, meaning you may not run out of a job just because Bitcoin decided to take a nosedive.

Other roles include content creators, marketers, network engineers, SEO specialists, consultants, lawyers, and more. In this manner, you can see how a company goes about creating an ICO first hand, and this is the best way to gain direct knowledge of the process. Hopefully, you can see how a high quality ICO project works in practice – you might even get the chance to invest early.

Risks of ICO Investments

ICOs are inherently risky. The main reasons include a lack of regulatory oversight, unrealistic expectations on behalf of the investors, and volatility/market manipulation.

Lack of Regulatory Oversight

One of the primary risks associated with ICOs is the lack of regulatory oversight. Unlike traditional fundraising methods such as IPOs, ICOs do not typically adhere to the same stringent regulations and requirements. This lack of regulation leaves investors vulnerable to potential scams, fraud, and market manipulation.

Without proper oversight, there is a higher probability of encountering fraudulent projects or individuals who may misrepresent their intentions, inflate token values, or disappear with funds. This is often done through rug pulls or pump and dump schemes.

With a rug pull, the creators of a cryptocurrency will intentionally drain the liquidity or value of a token, leaving investors with worthless tokens. The project team can remove liquidity from exchanges or even code the tokens so they are unsellable.

Pump and Dump schemes involve the manipulation of a token (often upward) through promotional content or direct market manipulation. When the price appreciates, the fraudsters sell their tokens. Scam ICOs are more correctly described as rug pulls, where the core team intends to take off with investors’ funds.

The lack of regulatory oversight is primarily what attracted scam artists to the ICO in the first place. You have many investors eager to get in on Web3, where huge profits could be made. And you have a fundraising model that does not enforce any KYC compliance procedures.

This was made easier because the cryptocurrency markets were themselves not regulated – it was easy for traders to manipulate the price of a token, and get away with it. It is only recently that we have seen regulation enter cryptocurrency, and this still applies largely to centralized high volume exchanges as opposed to small-scale DEX exchanges.

A scam ICO can also hide its fundraising progress, preventing investors from observing how much has been raised and how much time is left. Often, this is conducted alongside claims to “get in quick” before the time runs out. Ultimately, if you detect any lack of transparency in the ICO, follow up to see if it’s legitimate.

Unrealistic Expectations (Leading to Severe Losses)

Another risk lies in the quality and viability of the projects themselves with claims that are misleading or not based on factual information. Many ICOs are launched based on whitepapers or concepts without a working product or proven track record.

Investors often contribute funds based on promises and speculation, without concrete evidence of the project’s feasibility or potential for success. People often forget that they are literally investing in a piece of paper, a theoretical blueprint – in many cases, that is exactly what they were doing. The product has not actually been launched with a live audience.

As a result, there is a significant risk of investing in projects that fail to deliver on their promises or never materialize at all, resulting in financial losses for participants. Moreover, there is a risk of poor token distribution and governance.

In some cases, ICO projects allocate a significant portion of tokens to the development team or founders, leading to a concentration of power and potential conflicts of interest. If not properly managed, this could result in decisions that do not align with the best interests of token holders, further diminishing the value of investments.

Many projects have emerged making unsubstantiated claims that are designed to hook investors. There have been multiple “Ethereum killers”, but Ethereum has not been killed, and probably won’t be. Just because a project has an interesting whitepaper and concept does not mean it’s going to be a success or hit any of its claims.

Volatility & Market Manipulation

Finally, the volatility of the cryptocurrency market poses an additional risk for ICO investors. The value of cryptocurrencies can experience significant price fluctuations, and this volatility extends to ICO tokens as well. Bitcoin is the most stable of all cryptocurrencies mainly due to its high trade volume. And it experienced large levels of volatility. So it stands to reason that lower volume ICO tokens are also going to experience even higher levels.

Large volume cryptocurrencies are more difficult to move because they take higher positions to manipulate the price. If the market capitalization of a token is $500 million, you would need very large sums to move the price. But if the market capitalization of a token is just $1 million, the amount required is relatively small, for some people and institutions.

Moreover, traditional financial markets have always been heavily regulated, with many safeguards in place against bad actors who seek to manipulate the price. Regulation within the crypto industry is not as strong, and it was almost non-existent in 2017, the days when the ICO was particularly popular.

How to Invest In An ICO

Investing in an ICO token is quite straightforward. By and large, tokens are a lot easier to invest in than other financial instruments. But you still need to get familiar with the process so you can keep your funds securely stored.

Step 1 – Choose Your ICO

We have already been over this step, but just to reiterate – you need to find a legitimate ICO that has a strong chance of success. Check an ICO calendar to see which ones match your preferences.

Once you have decided on a suitable ICO, you can visit the page to see which type of tokens you need to invest in the project. You will want to buy a crypto that is accepted/required by the ICO. USDT and ETH are commonly accepted. If it’s a Binance-supported ICO, you might need BUSD or BNB.

The official page should also tell you key information about the project (theme, industry, token price, vesting period, etc). This is key information needed to decide whether it’s worth the investment or not.

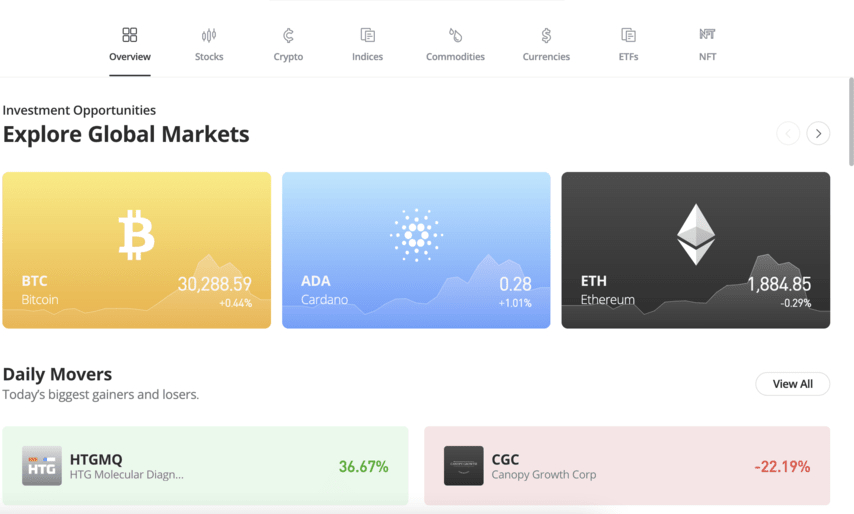

Step 2 – Buy Your Crypto on eToro

Investing in an ICO is relatively straightforward. First, you are going to need to acquire crypto funds, most likely either ETH or an acceptable stablecoin such as USDT, USDC, BUSD, etc. You can check what tokens the ICO accepts on its official presale page. Depending on the ICO, you might have to join an exchange to take part (this would technically be an IEO, but the terms are often used interchangeably).

We recommend eToro when it comes to buying your crypto. It comes with low fees (1% on all crypto transactions), world class copy trading features, and full KYC and regulatory compliance. You can easily purchase any of the major cryptos on this site – It has over 90 cryptos to choose from.

You can buy your crypto on eToro and store it there too – it’s a highly regulated international brokerage. The eToro money crypto wallet is easy to use and actually has an unlosable private key, a distinct advantage over Web3 wallets. It can be accessed using your eToro credentials.

But eToro does not connect to Web3 interfaces – you need a Web3 wallet for this to happen.

Step 3 – Send to a Web3 Wallet & Make Purchase

Once you have purchased your crypto on eToro, you will need to send it to a Web3 wallet – MetaMask and Wallet Connect are two of the most popular options. Both allow you to access the world of Web3 tokens. Simply go to the MetaMask download page and set up your accounting, remembering to store your private keys securely.

MetaMask, for example, functions as a browser extension that connects to Web3 sites. When you go to the presale/ICO page, your MetaMask wallet will connect to the site (or your Wallet Connect). You can purchase the ICO tokens using a coin in your MetaMask wallet. Simply go to the official ICO page, connect your MetaMask wallet, and make the purchase. It should take less than a minute to execute the transaction.

Ongoing presales like Wall Street Memes or Ecoterra are very easy to invest in, with clear instructions on each of their official listing pages. You can invest in these projects to better understand the world of ICOs, and to get started with crypto investment. While the results of any investment are never guaranteed, you also have to stake a certain amount to get real experience.

Note that the exact means of ICO investment might vary depending on your preferences and on the requirements of the ICO. There might also be differences between the project launchpads, fundraising type (IDOs, ICOs, IEO), minimum requirements, and a number of other criteria that you can only find out by looking at the official page and completing your own research.

Are ICOs a Good Investment?

Although ICOs are undoubtedly a widespread phenomenon within the crypto market, can they be considered a good investment? There are definite reasons why they can be a noteworthy investment:

- Become Part of a Growing Community – Taking part in an ICO allows investors to become part of a growing community at the very beginning of the project’s life cycle. This has the added benefit of enabling like-minded people to interact with each other and form relationships whilst also providing feedback to the project’s development team.

- Huge Returns Potential – Naturally, one of the main benefits of investing in an ICO is the vast returns potential that they can offer. Since most ICOs offer tokens at a reduced price point, early investors are in a great position to benefit if/when the token is listed on a major exchange. Projects offer discounted prices to kick-start development or generate publicity and attention – which then means more investment and a higher probability of success.

- Exclusive Perks – Many ICO cryptos will offer exclusive benefits to entice early investors. The specific benefits can vary wildly but may include premium NFTs or access to merchandise. There may even be private Discord servers that only ICO investors can join, providing an incentive to participate.

Again, it is essential to note that ICOs do not guarantee profits even if the fundamentals of the project are solid and the potential is high – ultimately the market will decide success or failure.

It is also important for investors to understand their own tolerance for risk as ICOs are substantially more risky and volatile than investing in established top cryptos such as Bitcoin or Ethereum.

Best Crypto ICOs – Conclusion

In summary, this article has taken an in-depth look at the best crypto ICOs to launch in 2023, covering what they offer and why they have generated such high momentum. Thanks to the innovative use cases displayed by these projects, investors remain eager to see how well they can perform in the weeks and months ahead.

Investors will do well to remember that risk should be given equal weight to the potential rewards. This can help to avoid many of the ICO projects that turn out to have no long term viability. Returns are not guaranteed, especially when it comes to the volatile cryptocurrency markets.

All things considered, the overall best crypto ICO, based on our research, would be Wall Street Memes. Drawing parallels from other successful meme coins alongside the community backing it has, Wall Street Memes holds the potential to be a significant player in the meme crypto space.

The Wall Street Memes presale allows early investors to buy $WSM tokens at a discounted price point. The ICO has now raised more than $26 million in just 12 weeks.

References

FAQs

How does an ICO in cryptocurrency work?

When an upcoming ICO is announced, early investors will have the opportunity to buy tokens using a ‘bridge’ cryptocurrency – such as ETH or BNB. The project’s team will provide a crypto wallet address to send funds to in return for tokens, with the token price being either fixed or variable, depending on demand.

Is investing in ICO crypto a good idea?

Investing in upcoming ICOs is inherently risky since projects are still in the early stages of their lifespan, so nobody knows for certain whether they will be successful. However, investors with a higher risk appetite can often generate considerable returns when an ICO crypto is listed on a major exchange since they will have been able to acquire tokens at a discounted price.

How do I buy crypto ICO?

Participating in an ICO is as simple as heading to the project’s official website and connecting a crypto wallet. Following this, investors will be able to buy tokens using a bridge currency (e.g. ETH, BNB), after which the project’s team will send the relevant number of tokens to the investor’s wallet.

Was Ethereum an ICO crypto?

Yes – Ethereum started as an ICO in 2014, raising over 7,000,000 ETH (around $2.2 million) in the first 12 hours of tokens going live. By the end of Ethereum’s presale, the development team had raised a remarkable $18.3 million for the project.

What are the best crypto ICOs to buy in 2023?

Out of all the projects we’ve reviewed, Wall Street Memes, yPredict and Launchpad XYZ offer the most intrinsic value and upside potential.

Read the full article here