For better or worse, I have, over the years, found myself drawn to companies that have very simple business models. In addition to being easier to understand, they do, from my experience, often have some of the best fundamental performance out there. And one fairly simple type of business involves the ownership of telecommunication assets. At top of mind when this topic comes up is none other than American Tower (NYSE:AMT) and its rival, Crown Castle (NYSE:CCI). For those who don’t mind paying a premium compared to what many value investments tend to cost and who want strong and steadily growing cash flows, these types of firms make for great prospects. But when you set the two companies side by side, you can only arrive at one conclusion. And that is that while American Tower is a solid business with excellent long-term potential, Crown Castle is superior to it in almost every way.

A brief description of our candidates

Odds are, if you are reading this article, you already know a bit about both of these companies. It might be helpful, however, to provide a little bit of info regarding what each one is and how it operates. They are both in the same industry and their primary business involves the ownership and operation of towers that make the transmission of data possible. Simply put, without them, the world would grind to a halt. In terms of sheer size, American Tower takes the cake. It boasts over 226,000 towers in its network, including those that it does not own but, instead, operates. By comparison, Crown Castle owns over 40,000 towers.

If this looks like a massive disparity, keep in mind that about 78,000 of the towers owned by American Tower are located in the Asia-Pacific region (mostly India) and are nowhere near as important for the company as some towers elsewhere. For instance, even though the Asia Pacific region towers account for 34.5% of the physical towers the company owns or operates, that region is only responsible for 10.1% of the company’s revenue. When we dig deeper into the fundamental data, you will find that the two companies are much closer in size than what they appear just when looking at tower count.

Of course, the firms have other assets as well. Both have significant investments in fiber. I could not find how many miles of fiber that American Tower owns. But Crown Castle has around 85,000 route miles of fiber in its network. And both companies also make other various investments, such as in small cell networks. At present, Crown Castle has around 120,000 small cells in its network that make efficient communication within incredibly dense areas possible. There are other points of differentiation as well. For instance, while Crown Castle has not placed an emphasis on owning data centers, American Tower made a massive investment in this space with its acquisition of CoreSite, a purchase that cost at $10.1 billion on an enterprise value basis. Since then, the company has grown CoreSite’s data center operations from 25 locations to 28.

Why you might want to buy American Tower

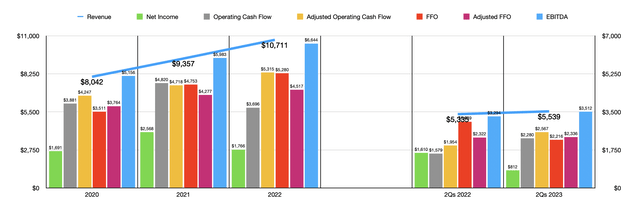

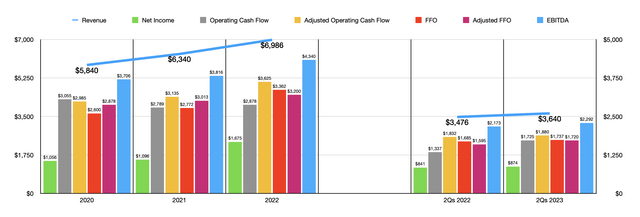

Truth be told, I could write an entire long article dedicated to these various assets and other investments that these two companies have made. But my goal is to see which prospect makes the most sense for investors to consider. As I stated already in the introduction to this article, my view is that Crown Castle is the superior play in most respects. But before I dive into why that is, it would be only fair to point out some ways in which American Tower is better. For starters, the company is larger. In 2022, American Tower generated revenue of $10.71 billion. That’s up from the $6.99 billion reported in revenue that same year for Crown Castle. Revenue growth has also been more impressive. Over the past three completed fiscal years, American Tower has grown its revenue by 33.2%. Over that same window of time, revenue growth for Crown Castle has been 19.6%.

American Tower (Author – SEC EDGAR Data)

There’s also the fact that American Tower boasts a truly global presence. I already mentioned the 78,000 towers that it owns in the Asia Pacific region. The business also has a presence in no fewer than seven African countries and in four European countries. Its presence in Latin America amounts to eight countries. Speaking of those India based towers, earlier this year, news began circulating that the enterprise is exploring a sale of those assets specifically, with the goal of getting around $4 billion for them. It is unclear, however, if that will ultimately come to fruition.

Crown Castle (Author – SEC EDGAR Data)

The special emphasis on data centers might also be a reason why American Tower might appeal more to some investors over others. This is a rather large market opportunity, amounting to $279.5 billion in 2022 alone. By 2032, aided by an annualized growth rate of 7.3%, it’s expected to climb to $565.5 billion. However, this is a very costly market to play in, as evidenced by the $10.1 billion purchase price of CoreSite stacked against the fact that, in the most recent quarter alone, data center operations accounted for only 7.5% of the revenue reported by American Tower.

But Crown Castle deserves the crown

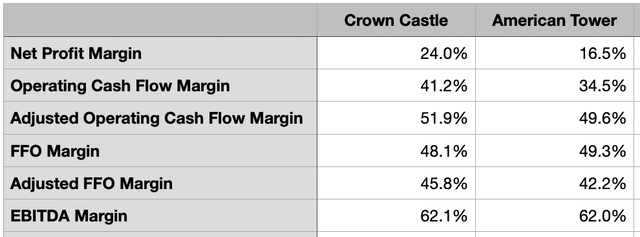

Outside of these areas, I see no reason to prefer American Tower over Crown Castle. For instance, when we talk about the issue of profitability, Crown Castle clearly leads the way. As you can see in the table below, the company’s net profit margin of 24% in 2022 comfortably exceeded the 16.5% reported by American Tower. But it’s not just the net profit margin. Almost every profitability metric was better year over year. The one exception was FFO, or funds from operations. The FFO margin reported by Crown Castle came in at 48.1%. That’s slightly lower than the 49.3% reported by American Tower. Although I take no pleasure in saying it, it is likely that profitability for Crown Castle will rise even further relative to what American Tower reports. I say that because, earlier this year, the management team at Crown Castle announced that they were cutting 15% of their workforce and, as part of that, incurring charges of only $120 million.

Author – SEC EDGAR Data

In addition to being more profitable, Crown Castle also boasts a significantly more appealing yield. As of this writing, the yield on the stock is 6.29%. That is significantly higher than the 3.53% that American Tower brings to the table. There are two primary reasons why the yield is higher. First, the company has a higher payout ratio if we use the adjusted operating cash flow, which is operating cash flow without factoring in changes for working capital, as the numerator of the equation.

That payout ratio, using data from 2022, is 71.8%. By comparison, for American Tower, that ratio is 49.5%. This might also explain, to some extent, why American Tower is growing more rapidly. Last cash used on paying out a distribution leaves more cash to focus on growth. But even if the payout ratio for Crown Castle ended up being reduced to what American Tower pays, the yield would still be higher at 4.34%. This brings us to the second reason, which is that, over the past year, shares of both companies have fallen. But the decline seen by Crown Castle has been more significant. Shares of it are down 43.1% compared to the 33% drop that American Tower went through.

Author – SEC EDGAR Data

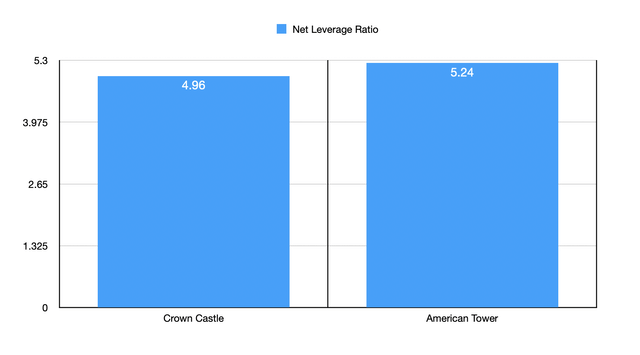

There are two additional reasons why I prefer Crown Castle over its counterpart. The first of these is that leverage is lower. If we use the balance sheet data for each company as of the second quarter of the 2023 fiscal year and assume that each firm matches the midpoint of guidance for the year when it comes to profitability, we end up with a net leverage ratio for American Tower of 5.24. That number is slightly lower at 4.96 for Crown Castle. I wouldn’t say that either company is overleveraged. But lower leverage, keeping all else the same, does translate to less risk.

Author – SEC EDGAR Data

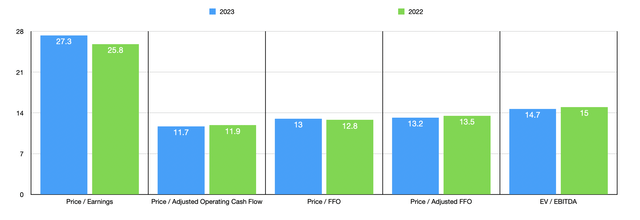

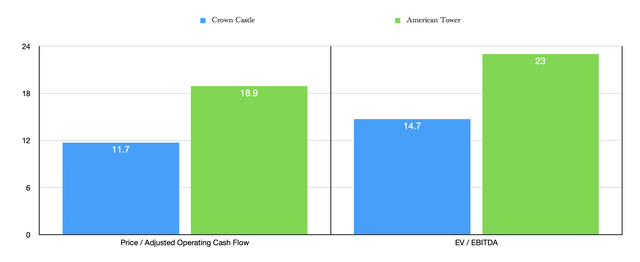

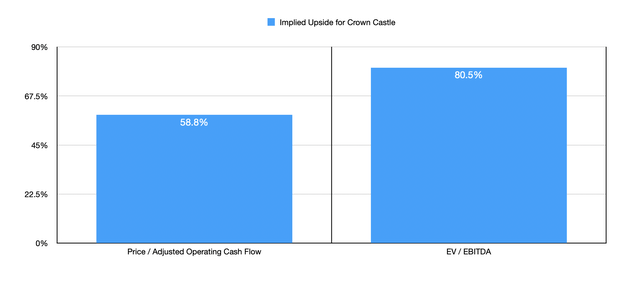

And finally, there is the issue of valuation. In the chart above, you can see how shares of Crown Castle are valued using both estimates for 2023 and actual results for 2022. I then took two of those metrics and, in the first chart below, compared them, on a forward basis, to the pricing I get for American Tower. In the event that Crown Castle were to trade at the price to adjusted operating cash flow multiple that American Tower currently trades at, upside for the company would be 58.8%. And when we do the same analysis using the EV to EBITDA approach, upside is 80.5%.

Author – SEC EDGAR Data

Author – SEC EDGAR Data

Takeaway

From all the data that’s in front of me, I must say that I find Crown Castle to be a rather compelling prospect. The stock is definitely not in value territory. But it is cheap enough, when you consider how high quality the company is, to warrant a significant amount of optimism. American Tower is also a great company, but shares are more expensive. In addition to that, there are other negatives working against it. If your goal is to capture international growth, and you prioritize revenue expansion, it might make the most sensible prospect of the two. But if you want a cash cow with an attractive yield and a more efficient operation, and you want all of that at a bargain price, Crown Castle is certainly the prospect to consider.

Read the full article here