Vivid Seats Inc. (NASDAQ:SEAT) delivered quarterly market place orders growth, and offered a guidance increase. I think that further optimization of the performance of marketing campaigns, M&A, and organic growth from discounts strategy could accelerate FCF growth. Besides, further offerings like the Taylor Swift Eras tour could enhance the size of each order, and may enhance future net sales growth. Yes, I found some risks from relationships with vendors or failed M&A efforts, however the company appears quite undervalued.

Vivid Seats

Vivid Seats is a company with its own technological platform, where production companies sell tickets to their clients. The company’s function is to put sellers and buyers in contact for tickets to massive live events.

Source: Company’s Website

Vivid Seats’s income is driven through a percentage of the transactions carried out within its platform as well as the sales of its associated distributors. Income is generated from the purchase and collection of services from clients, in addition to offering services such as insurance for events, by contracting third-party companies.

The core of this business is Skybox, the platform that Vivid Seats offers to the ticket sellers in order to publish events, and also allows a series of digital tools for the organization and management of sales, segmentation, and advertising options to reach potential buyers. Along with this platform that makes up the company’s historical business, a real money application with sports video games was added in 2021 with the acquisition of Betcha Sports Inc. It was renamed as Vivid Picks in 2022. I would say that Vivid Seats has expertise in the M&A markets.

Vivid’s operations are divided into two segments: the Marketplace Call and the Resales segment. The first of these is made up of the bulk of the business, which includes Skybox and the new sports game application acquired in 2021. The benefit of the contact platform between sellers and ticket buyers is the great diversification that exists within the offer of events within the page. The categories in this sense are sports, theater, and music. Within the sports category, we find the basketball and ice hockey leagues, some of the most popular sports in the United States.

Within the theaters we find everything from Broadway proposals to small family shows, the same for musical events, expanding the arrival of sales for massive and niche events. On the other hand, the resales segment works with the purchase of tickets directly from the vendors and the sale of these on the platforms of the company or their own platforms.

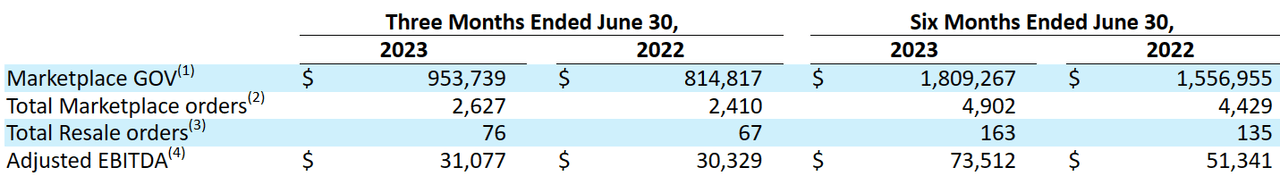

I am quite optimistic about Vivid Seats mainly because management continues to offer beneficial figures. In the last quarter, total market place order increased along with the total resale orders and Adjusted EBITDA.

Source: 10-Q

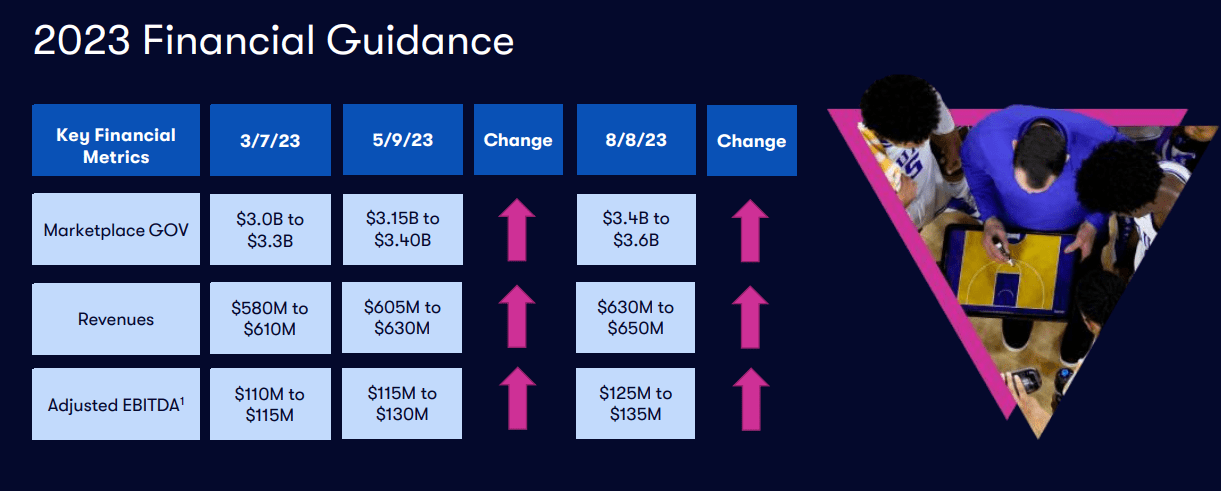

I could not find a very detailed forecast made by Vivid Seats, however what I found is quite beneficial. Management recently increased its revenue expectations to about $630-$650 million and adjusted EBITDA to about $125-$135 million. I believe that these figures would most likely interest most investors.

IR

Solid Balance Sheet With A Small Amount Of Debt

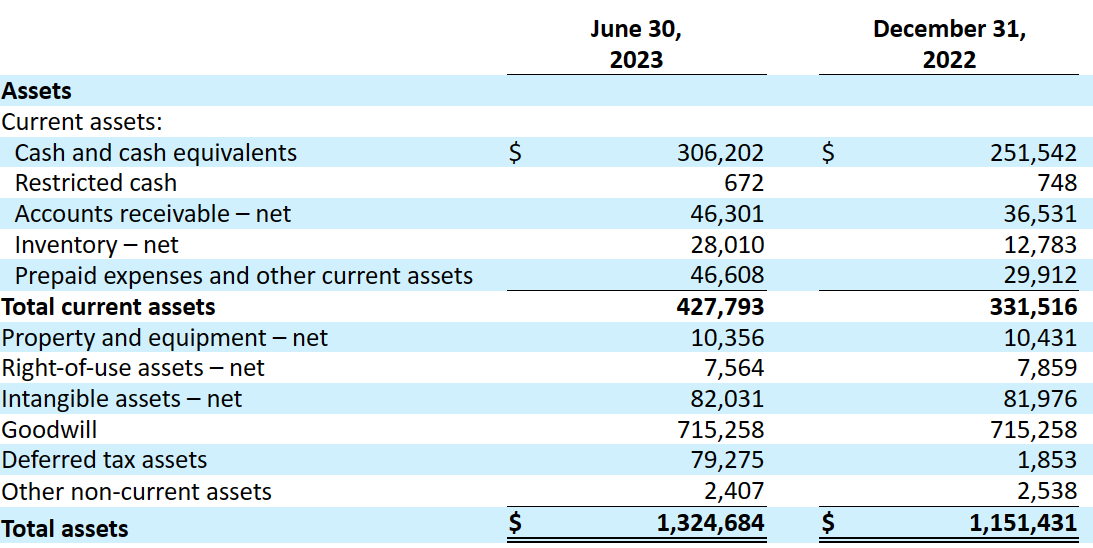

As of June 30, 2023, the company reported cash and cash equivalents worth $306 million, with accounts receivable close to $46 million, inventory worth $28 million, and prepaid expenses and other current assets of $46 million. Total current assets are worth $427 million, below the current amount of liabilities, however the difference is not large. I would not be afraid of liquidity issues.

Long term assets included property and equipment worth $10 million, right-of-use assets of $7 million, intangible assets worth $82 million, and goodwill of about $715 million. Finally, total assets stood at $1.324 billion. Hence, the asset/liability ratio stands at about 3x-4x.

Source: 10-Q

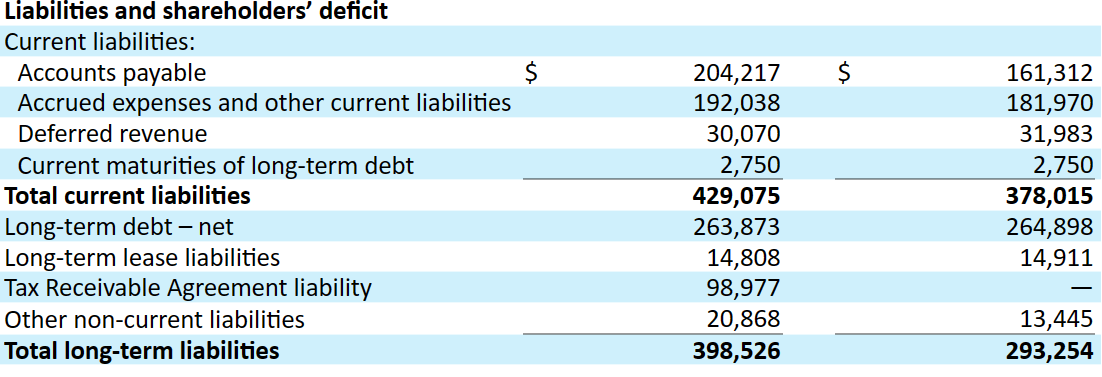

The liabilities include accounts payable worth $204 million, accrued expenses and other current liabilities of $192 million, deferred revenue of $30 million, and total current liabilities of $429 million.

Besides, long-term debt stands at $263 million, with long-term lease liabilities of $14 million, tax receivable agreement liability worth $98 million, other non-current liabilities of $20 million, and total long-term liabilities of $398 million.

Source: 10-Q

Beneficial Market Expectations

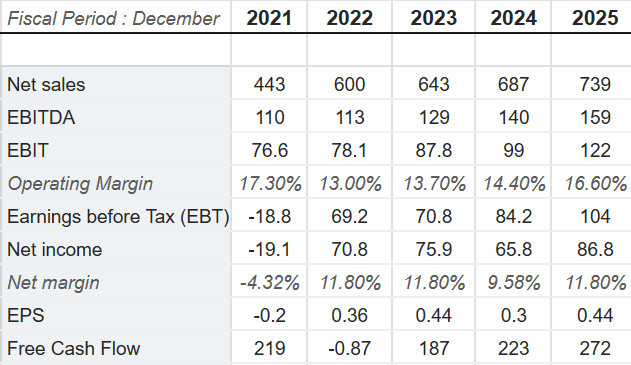

Most analysts are expecting net sales growth, net income growth, and FCF growth. With this in mind, I believe that investors may want to have a look at their figures before they see my figures.

Analysts expect 2025 net sales of about $739 million, with EBITDA worth $159 million, 2025 EBIT close to $122 million, EBT worth $104 million, and net income close to $86 million. Finally, net margin would be close to 11.8%, with 2025 FCF close to $272 million.

Source: Market Screener

First FCF Catalyst: Inorganic Growth, Better Marketing And Advertising Campaigns, And Digital Improvements

One of my first assumptions about Vivid Seats is with regards to recent initiatives announced. The company is currently pursuing a growth strategy, through the organic scale of the business and possible future acquisitions. In this strategy, the search for new clients stands out through the optimization of the performance of marketing and advertising campaigns. The user data of the sports games application plays a role in this regard, since it expands the company’s database. Vivid owns its own digital tools. If these initiatives are successful, I would expect FCF growth.

Further Brand Recognition And Customer Affinity Driven By Promotions And Discounts Could Bring Net Sales Growth

Within this growth project through the customer base, we find other points of support such as the growth of brand recognition, customer affinity, and retention of existing customers. For this, the company launches different promotions, discounts, and benefit programs for frequent customers. Another factor at play within this strategy is increasing the engagement of the customers. Under my DCF model, I assumed that further increase in the customer base will most likely lead to net sales growth.

Improvements In The Quality Of Concert And Theater Categories Could Also Accelerate Orders

As Vivid Seats becomes a large platform, I believe that the shows and concerts offered may increase their standards. As a result, I believe that we may see larger orders, net sales growth, and FCF growth. A clear example of this improvement was the record demand for the Taylor Swift Eras tour. In this regard, management provided an explanation in the last quarterly report.

The increase resulted from an increase in new orders processed and an increase in average order size, driven by increased revenues in our concert and theater categories. Record demand for the Taylor Swift “Eras” tour also contributed to the increase for both periods. Source: 10-Q

New Partners Like ESPN And New Development Of Tools For Ticket Sellers Could Also Push The FCF Margins And Net Sales Growth

In the structural sense to continue with this strategy, the development of tools and services for ticket sellers within the platform is one of the company’s proposals, offering better quality in service provision. Along with this proposal, there is the proposal to expand the relationship with its partners that are an important part of the Vivid Seats ecosystem. Within this group, we find partners from the entertainment industry such as ESPN, companies that offer merchandising or services within the events with the purchase of tickets, and those companies that have advertising spaces within the Skybox platform.

My Cash Flow Expectations

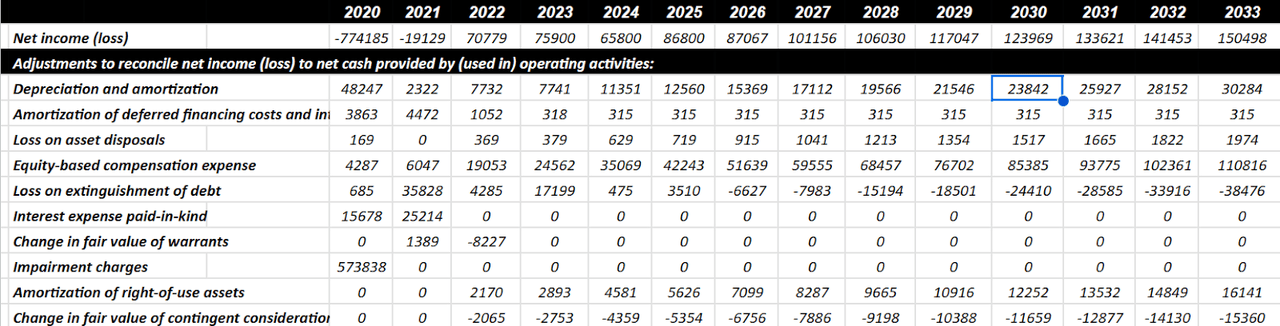

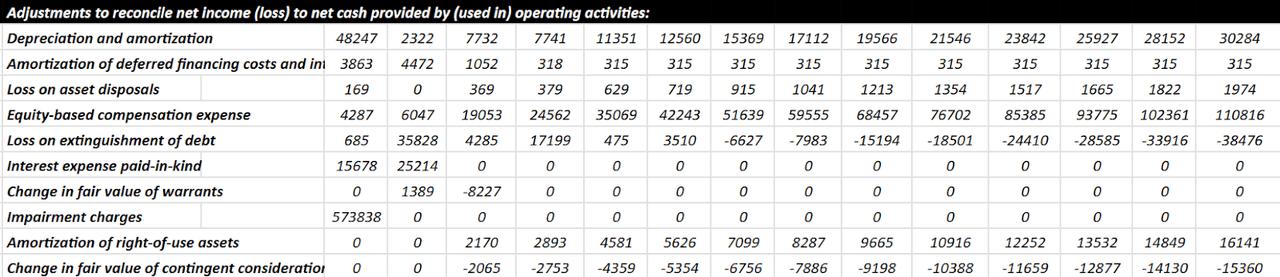

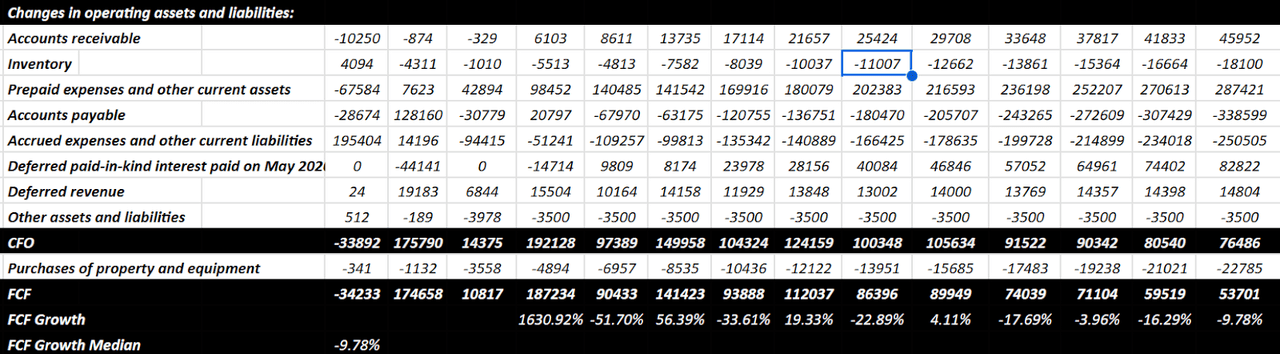

My figures include 2033 net income close to $150 million, with adjustments to reconcile net income to net cash provided by operating activities including depreciation and amortization worth $30 million, equity-based compensation expense of about $110 million, and loss on extinguishment of debt of about -$39 million.

Besides, assuming no interest expense paid-in-kind, no change in fair value of warrants, and no impairment charges, amortization of right-of-use assets stood at $16 million, with change in fair value of contingent consideration close to -$16 million.

Source: FCF Expectations

With regards to changes in operating assets and liabilities, I also included changes in accounts receivable worth $45 million, inventory of about -$19 million, and prepaid expenses and other current assets of about $287 million.

Source: FCF Expectations

If we also take into account accounts payable of -$339 million, accrued expenses and other current liabilities worth -$251 million, and changes in deferred revenue worth $14 million, 2033 CFO would be close to $76 million. Finally, considering purchases of property and equipment worth -$23 million, 2033 FCF would be $53 million.

Source: FCF Expectations

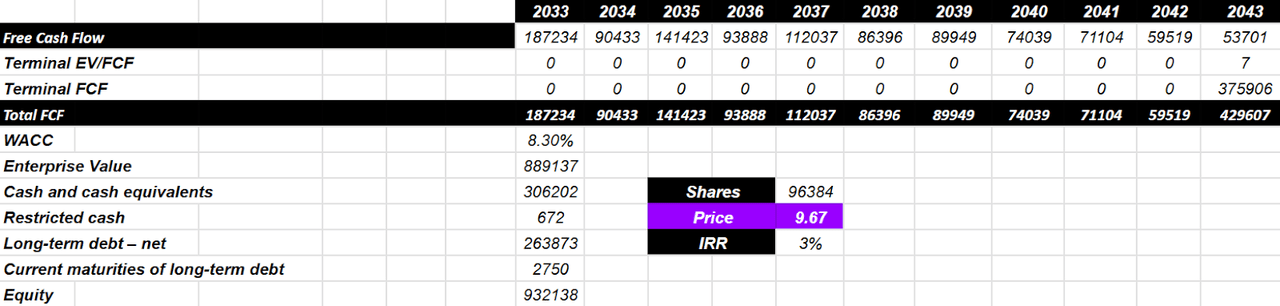

With an EV/FCF close to 7x and WACC of 8.3%, the enterprise value would be about $889 million. Also, including cash and cash equivalents of $306 million, long-term debt of $263 million, and current maturities of long-term debt of $2 million, the implied equity would be $932 million, and the fair price would be close to $9.67 per share.

Source: DCF Model

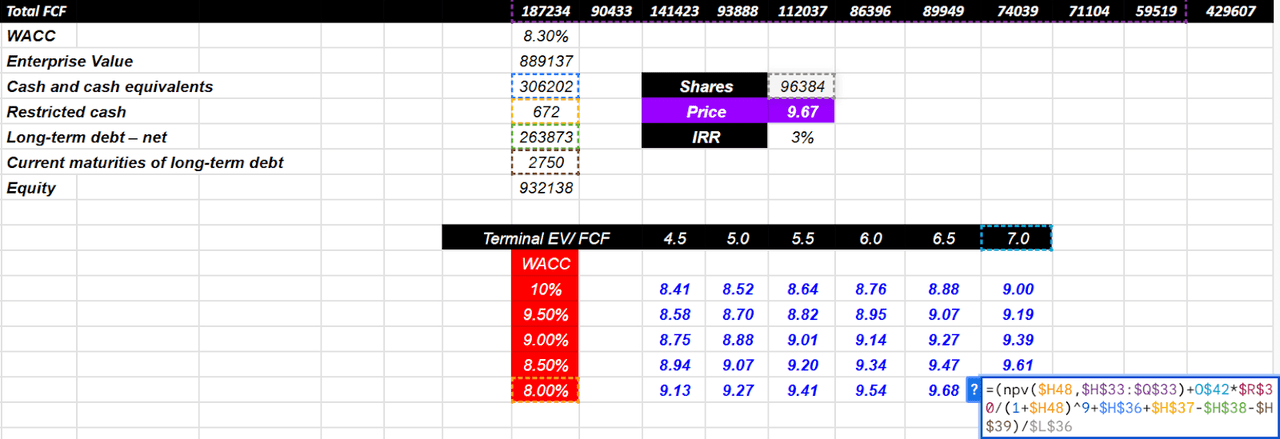

The Sensibility Analysis Indicates That My Model Was Not Subject To Significant Changes When We Change The WACC and The EV/FCF.

I took some time to assess how changes in the WACC and the terminal EV/FCF would affect the implied fair price. With a WACC ranging from 8% to 10% and EV/FCF close to 4.5x-7x, the fair price did not really change a lot. All my results indicated that Vivid appears undervalued.

Source: DCF Model

Competitors

The competitive environment is high, and exists in a multi-segment market. Direct sellers, ticket distributors, and second-hand sellers such as Vivid Seats make up this competitive environment. Similar companies that offer the same services within the United States are StubHub, Ticketmaster, SeatGeek, and TicketNetwork.

The competition is affected by a series of factors that have to do with availability, the offer of tickets, and the user experience. In this sense, developments in relation to promotions or loyalty programs are essential for customers to choose this platform over others that sometimes offer the same tickets at similar prices. Also, the facilities and tools that Vivid can offer to the sellers are factors directly related to the traffic within the platform.

The competition for the application of sports video games is given by the entertainment industry in general and real money applications in particular.

Risks

First of all, we must point out that the Vivid Seats business depends directly on the sports and entertainment industry, and a cessation of these activities or a reduction in supply would affect the company. Growing competition and the relationship with vendors are also risk factors. The inclusion of new tools or technologies as well as changes in the engineering of the platform’s algorithms can offer negative results if they are not incorporated by the vendors, or they show complications and rejection in the incorporation of their use.

In the context of growing inflation and with the seasonality of sales and income that the company experiences from four months, at this time it is difficult to make projections on short and long-term financial results. Along with this we can add the possible legal situations from the use of user data. Any restriction or change in this regard would also affect the data processing centers and the application of these on commercial strategies in general.

Although the integration of Betcha Sports in 2021 was currently successful, it does not ensure that future acquisitions will have the same result. Besides, it is good to understand that a large part of the operational risk of Vivid Seats is due to the success of the training industry and occasionally of the associated vendors within its platform.

My Takeaway

Vivid Seats continues to deliver quarterly market place orders growth driven by clients growth thanks to optimization of the performance of marketing and advertising campaigns. I continue to be optimistic about the future because management offered an adjusted EBITDA guidance increase, and Vivid is present in the M&A markets. Hence, we can expect organic growth from discounts strategy as well as inorganic growth. I did find several risks from growing competition and the relationship with vendors among other risks. With that, I believe that Vivid Seats appears undervalued.

Read the full article here