Introduction

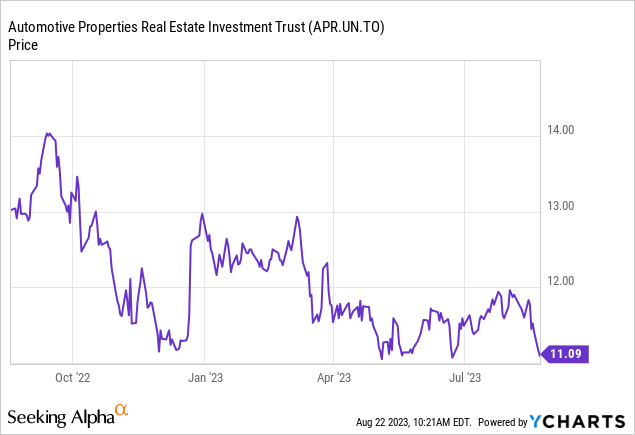

I started tracking Automotive Properties REIT (TSX:APR.UN:CA) in March of this year as I was charmed by the well-covered 6.2% dividend yield. Since that article was published, the share price of Automotive fell by 14% to the current level of C$11.15. This boosts the distribution yield to approximately 7.2%. As the Canadian real estate sector has been pretty volatile in the past few weeks, I wanted to update my view on the REIT to see if this would be a good moment to dip my toe in the water.

There are currently 49.05M units outstanding (including the 9.3M Class B LP Units), resulting in a market capitalization of approximately C$547M.

The FFO and AFFO results were decent

To get a better understanding of Automotive’s business model and exposure to its largest tenant (and main shareholder) I’d like to refer you to my previous article from March.

I was looking forward to seeing the REIT’s financial performance as it completed the acquisition of six properties in January of this year for a total acquisition cost of C$98.5M. The acquisitions are triple net leases with contractual rent increased based on the Quebec CPI but with a floor of 1.5%. The average weighted lease term was 16 years, so this acquisition provided additional excellent visibility to the REIT. While the cap rate was not disclosed, automotive properties were valued at roughly 6.75% at that point and I think that’s a fair assessment.

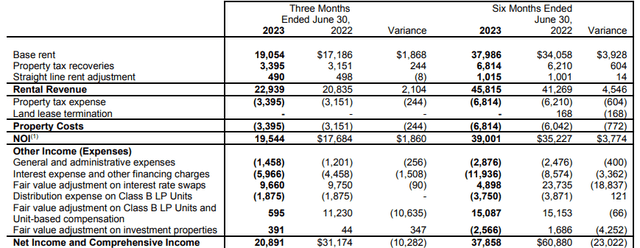

Looking at the results in the second quarter, the REIT reported a total NOI of C$19.5M which is an increase of in excess of 10% compared to the second quarter of last year. The total NOI in the first semester was C$39M, which means the annualized NOI is approximately C$78M. An important metric as the real estate is valued at C$1.18B on the balance sheet indicating a cap rate of 6.6% and the NOI will obviously continue to increase thanks to the inflation-related and contractual rent hikes.

APR Investor Relations

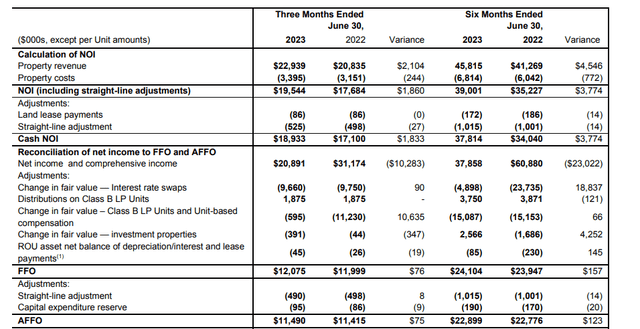

The NOI is obviously just one part of figuring out how attractive Automotive properties is. The FFO and AFFO results provide a better indication and unfortunately the higher interest expenses meant the total FFO and AFFO result remained pretty flat.

APR Investor Relations

As you can see above, the FFO came in at C$12.1M in the second quarter of this year, compared to C$12M in Q2 last year. And we see a similar increase in the AFFO which increased by C$75,000 to C$11.5M. This means the AFFO per share was approximately C$0.234. And based on the current distribution rate of 6.7 cents per month and thus C$0.201 per quarter (and C$0.804 per year), the payout ratio was 87.4% of the AFFO. This means there is wiggle room and the distribution is still well covered.

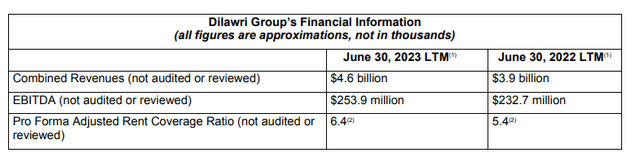

On an annualized basis, the stock is now trading at just under 12 times the annualized AFFO. That’s not unreasonable but of course the financial health of the main tenant, the Dilawri Group, remains very important as Dilawri accounts for in excess of 50% of the year-to-date rental income. Fortunately Automotive Properties provides a summarized overview of Dilawri’s results. As of the end of June, the LTM EBITDA was approximately C$254M, an increase from the C$233M at the end of the second quarter of last year. This also means the pro forma adjusted rent coverage ratio increased from 5.4 to 6.4.

APR Investor Relations

Of course a high EBITDA result does not necessarily mean Dilawri is in great financial shape but seeing the strong EBITDA results is encouraging. And Dilawri obviously needs the real estate assets to conduct its daily business.

As of the end of June, the REIT had about C$538M in gross debt at a weighted average interest rate of 4.18%. The debt to gross book value ratio was approximately 45%. That’s higher than the 40% as of the end of 2022 as the majority of the acquisition completed in the first semester was covered by the credit facility. Based on the current payout ratio, Automotive is able to retain about C$1.65M of its AFFO on a quarterly basis. That’s approximately C$6.5M per year which will help to keep the debt ratio at an acceptable level while it could also help the REIT to reduce its refinancing needs.

It goes without saying the cost of debt will undoubtedly increase over the next few years but I would expect Automotive Properties to increase the ratio of secured debt (mortgages) versus using credit facilities to keep the cost of debt under control.

A 200 bp increase in the average cost of debt (which would imply a 6.18% interest rate) would increase the annual cost by C$11M. Needless to say that would be tough considering that would reduce the AFFO/share by 22 cents per share to just over C$0.70.

But that’s why the rent escalators that are currently in place are so important. Assuming a 3% rent hike in 2024 followed by the minimum rent increase of 1.5% in 2025 would add back about 7 cents per share. And as Automotive could reduce its net debt by C$15M between now and the end of 2025 by keeping its dividend unchanged, it could reduce the impact by an additional 2 cents per share on the AFFO level.

Investment thesis

This means that even in a worst case scenario I don’t expect the REIT’s AFFO result to fall below 80 cents per share. In that case the distribution would still be fully covered although the coverage ratio would be too low to be comfortable.

This indicates Automotive Properties could be interesting from an income perspective but I wouldn’t expect too much in terms of capital gains in the next few years if the interest rates on the financial markets remain at the current level.

This year’s AFFO per share will likely come in around C$0.92-0.93 and I do expect some growth for next year as 91% of the interest exposure has been hedged but refinancings from 2025 on will likely weigh on the results – unless the market interest rates will have decreased by then.

I currently still have no position in Automotive Properties but the REIT offers exposure to an interesting niche while offering an attractive yield as well.

Read the full article here