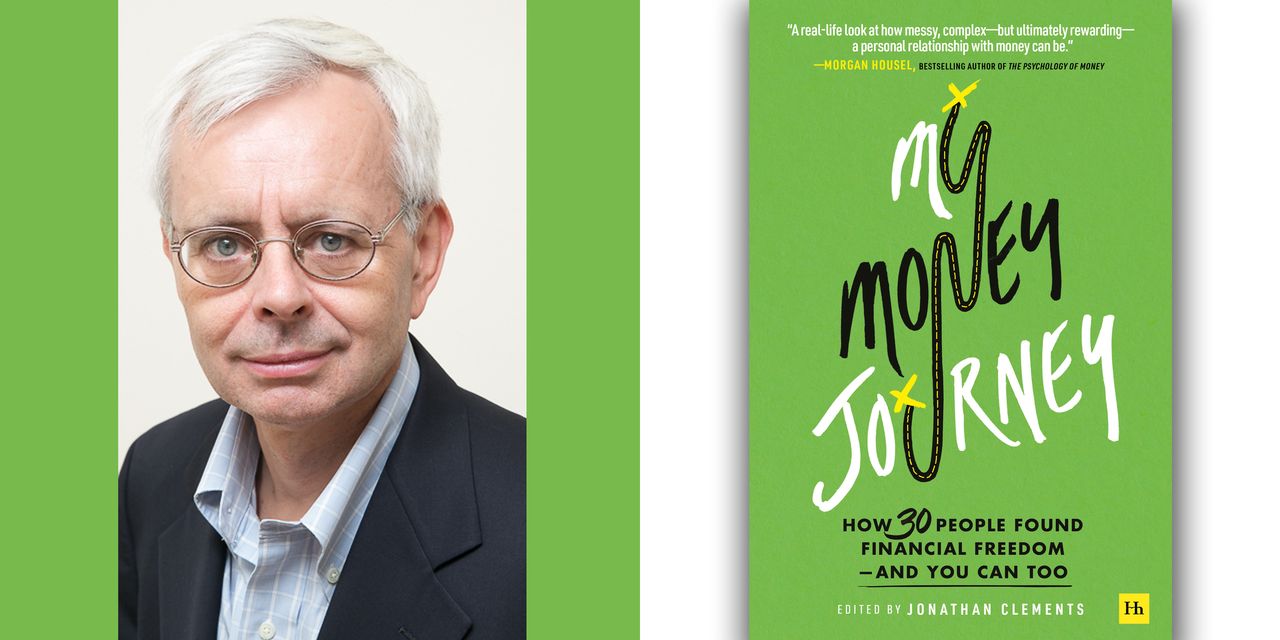

About the author: Jonathan Clements is the founder of the personal finance website HumbleDollar. He spent almost 20 years at The Wall Street Journal, where he was the newspaper’s personal-finance columnist, and six years at Citigroup, where he was director of financial education for the bank’s U.S. wealth management arm. Read a section adapted with permission by Harriman House from My Money Journey: How 30 People Found Financial Freedom—And You Can Too.

It was year-end 2007. I was about to turn age 45. I was in an unhappy relationship I didn’t have the courage to end. I was coming up on my 1,000th Wall Street Journal column. I wondered how much longer I could keep it up before my articles descended into repetitive blather. My amateur running career—a source of pride for a once-wimpy English schoolboy—was spluttering, my Achilles tendon aggravated by a bone spur.

After years of saving, I owned a house that was mortgage-free and a portfolio worth $976,000. But my two children were my only great joy. Hannah was then in college, Henry in high school.

I mention this not to argue that money often fails to buy happiness, though I believe that’s true. Rather, I mention year-end 2007 to draw a line across my life’s calendar. The years that followed brought events—good and bad—that upset my life’s predictable rhythm. But it was the humdrum early years that put me on the path to financial independence. Along the way, I learned 10 key financial lessons. I can’t claim to be naturally thrifty. I spent my college years and my first year in the workforce accumulating credit-card debt and occasionally overdrawing my checking account.

In August 1986, after working in London for a year, I moved to the New York area and settled down with my PhD-student fiancée. She had a modest stipend, so I was the main breadwinner, initially earning a pitiful $20,000 a year at Forbes magazine. I had to grow up financially, and I needed to do it fast.

We called these “the lean years.” Takeout pizza on Friday night was an extravagance. A car repair was a crisis. Our apartments in Brooklyn left me with a dread of cockroaches and mice. The occasional restaurant meal had me toting up the bill as the food was ordered—not exactly conducive to digestion.

Things slowly improved. My salary rose, and my wife got an academic job. In 1992, we moved from Brooklyn to the house we bought in the New Jersey suburbs. The house cost $165,000, had three bedrooms and a single bathroom, and felt barely affordable. I would live there for two decades.

Financially, the only big hit during those two decades was our 1998 separation and subsequent divorce. It wasn’t that much of a hit because we didn’t have much to divide. A silver lining I only later came to appreciate: Post-divorce, I got to call the shots on every dollar I earned.

Journalism wasn’t exactly a high-paying profession then, and it’s even worse now. Still, I had a knack for taking the somewhat tedious topic of personal finance and making it understandable. By 1994, at age 31, I became the Journal’s personal-finance columnist.

I hustled to supplement my salary. I wrote a second column each week for The Wall Street Journal Sunday, for which I was paid extra. I penned three books over the course of a decade, each of which garnered a low six-figure advance.

Where did I stash this money? Much of it went into stock index funds. That brings me to one of the first financial lessons I learned: If you want to outpace most other investors, simply aim to match the market averages. Among colleagues and readers I became known—perhaps notorious—for favoring stock-heavy portfolios built using broad market index funds. I’ve been wrong many times, but that was one thing I got right.

While I viewed my stock index funds as my growth money, I saw extra mortgage payments as a bond substitute. That brings me to a second early lesson. Why buy actual bonds at 4% or 5% when I could effectively earn more than 7%—my mortgage rate at the time—by paying off my home loan? By 2005, I was mortgage-free. It was the best bond investment I’ve ever made.

The third key lesson from these early years: the importance of low fixed living costs, which—when coupled with my rising income—allowed me to save hefty sums each month. My modest home was the biggest factor. But in truth, I was reluctant to spend on almost anything. I didn’t eat out much. I drove the same used car for years. I took the kids on fun vacations, but always kept a close eye on cost. This was a great strategy for amassing wealth. I’m not sure it’s a great strategy for enjoying life.

I wasn’t counting pennies—I’ve never been one to budget—but I kept myself on a short financial leash. I never much liked the house I lived in for those 20 years. An occasional indulgence, coupled with less self-inflicted work stress, would have taken some of the grind out of my march toward seven figures.

While the two decades through 2007 were a long slog filled with predictable days, the years since my 45th birthday have seen all kinds of upheaval. I left The Wall Street Journal in 2008, then spent six years at

Citigroup.

Eventually, I focused my efforts on HumbleDollar, the website I launched at year-end 2016.

Over the past 15 years, I’ve written eight books, moved house four times, got married again and—alas—divorced again.

There’s a fourth lesson here, one I learned from the happiness research: Our satisfaction through life is U-shaped, with many of us hitting bottom in our late 40s. Want to escape midlife misery? Saving early in life can give us the financial flexibility to change our life’s trajectory.

For me, the past 15 years have seen the sort of experimentation and turmoil you’d expect from someone in his 20s—a life phase I never had because I was thrust so quickly into the role of family breadwinner. Indeed, I’ve taken to referring to this period as my second childhood.

How have I fared financially through this stretch? It has been a mixed bag.

When I joined Citigroup in 2008 and became director of financial education for the bank’s U.S. wealth management group, my financial house was already well in order. But my income doubled even as I continued to live like a newspaper reporter.

Working for a Wall Street firm was an education: I got to see the advice business from the inside. But toward the end of my Citi career, I realized that—for the only time in my life—I was working solely for a paycheck. My dollar income might have been impressive, but the psychic income wasn’t. In early 2014, I quit.

Meanwhile, I’ve sold three homes over the past dozen years. One was a rip-roaring success—the apartment I bought in New York City in 2011 during the depth of the housing crisis and sold three years later. But one was an unmitigated disaster that probably left me more than $100,000 poorer. What went wrong? Among other things, the apartment had higher fees than nearby properties, and that made it difficult to sell.

Therein lies a fifth lesson: Almost all of us suffer one or two big financial hits during our life, and it helps to be financially prepared, including having plenty of cash. This particular storm was bruising, but it didn’t threaten my financial future. What about my portfolio? Like everybody else who owned stocks, my investments were crushed by the 2007-09 and 2020 stock market drubbings. But despite relentlessly arguing that financial markets are efficient and can’t be beaten, I saw both market declines for what they were—moments of overwhelming investor fear that caused share prices to become unhinged from intrinsic value—and I bought like crazy. I went into late 2008 with 70% of my portfolio in stocks. By the time the market bottomed in March 2009, I was at 95%.

This is the sixth key lesson I’ve learned over my investing career: Every so often, we see temporary investor insanity, and that’s a moment when we might stray from our usual asset allocation.

Through the 2010s, my portfolio was entirely in index funds and mostly in stocks. But I had hefty holdings of index funds focused on value stocks, small-company shares, developed foreign markets and emerging markets, all of which badly lagged behind during the 2009-2020 U.S. bull market. Lesson No. 7: If you diversify broadly, you’ll own the stock market’s big winners, but you’re also guaranteed to own the duds.

Yes, I would have fared far better if I’d held a lopsided portfolio focused solely on large-cap U.S. stocks. But I’m not about to change strategy. I have no clue which parts of the global market will shine in the decade ahead, so I’ll continue to own a little of everything.

Amid the financial triumphs and disasters of the past 15 years, perhaps the biggest change is this: Even as I continue to spend my days writing and thinking about money, I spend very little time thinking about my own finances. In a world where so many folks worry about how to cover day-to-day expenses, I’ve come to see not thinking about money as a great luxury. Lesson No. 8: Often, the best way to buy happiness isn’t to buy anything at all—and instead simply sit on a pile of savings and enjoy the resulting peace of mind.

I’ve also become more carefree in my spending. I enjoy helping my two kids financially and funding my grandson’s 529, and I’ve belatedly become more focused on charitable giving. That brings me to my ninth lesson: There is, I’ve found, greater happiness in spending on others than spending on myself.

Not all is right in my world. Like a force in motion that stays in motion, I’ve found that decades of working hard have created a momentum of their own, one I struggle to resist. In part, I chalk this up to the delusion that what I do is important, which perhaps it is, but not nearly as important as I imagine. Therein lies a 10th and final lesson: managing time is more important than managing money—because time is the ultimate limited resource. I should lead a more balanced life. I know that intellectually. But I’m still trying to convince myself.

Write to [email protected]

Read the full article here