Investment briefing

Abcam plc (NASDAQ:NASDAQ:ABCM) has caught a tremendous bid these past 2 months after announcing a “strategic review,” and acquisition interest from Danaher (DHR) now looking more and more likely.

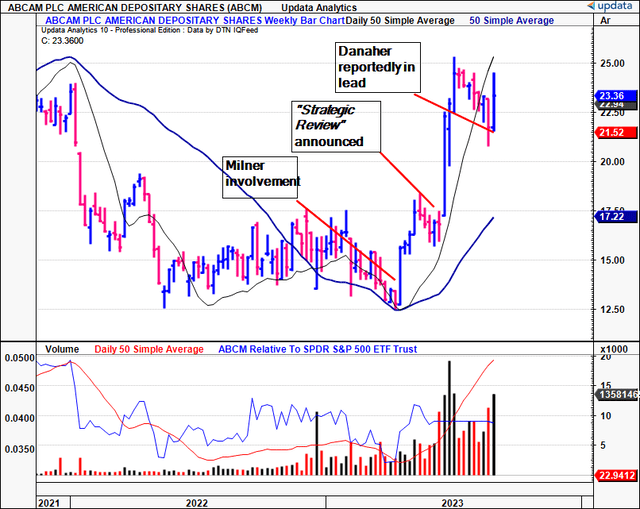

ABCM popped with authority in June after the British company confirmed it will consider a sale to the right target after a proxy battle with its founder, Jonathan Miller, and activist hedge fund Starboard Value opened a position in the company in June. Miller pulled out of his proxy solicitation in June as well. One can observe the impact of these “events” in Figure 1, that appear to have changed expectations for the company going forward.

Here I’ll cover all the moving parts of the prospective sale to DHR as to what is known, keeping in mind that a deal could be confirmed as early as the week starting 28th August 2023, as reported by the company. Net-net, without the deal particulars known in its entirety, it’s difficult to advocate a buy on ABCM, especially as there’s been no confirmation. Avid readers will know I’ve been flat on ABCM since February, noting the many value compressors and inability to catch a bid off its all-time lows since listing on the NASDAQ in 2020. In that vein, I continue to rate ABCM a hold, pending 1) a buyout actually being confirmed in the first place, and 2) the full details of any potential acquisition.

Figure 1. Multiple inflection points driving ABCM ADR’s off lows

Data: Updata

Figure 2. ABCM sells at all-time highs after series of investment updates

Data: Updata

Recent developments

1. Takeover interest from DHR

ABCM is now firmly in the deal spotlight and DHR is emerging as the front-runner for acquiring the company. Reports surfaced yesterday after those familiar with the matter told newswires, DHR had outsized competing bidder Agilent Technologies (A) in the race to snap up ABCM’s operations.

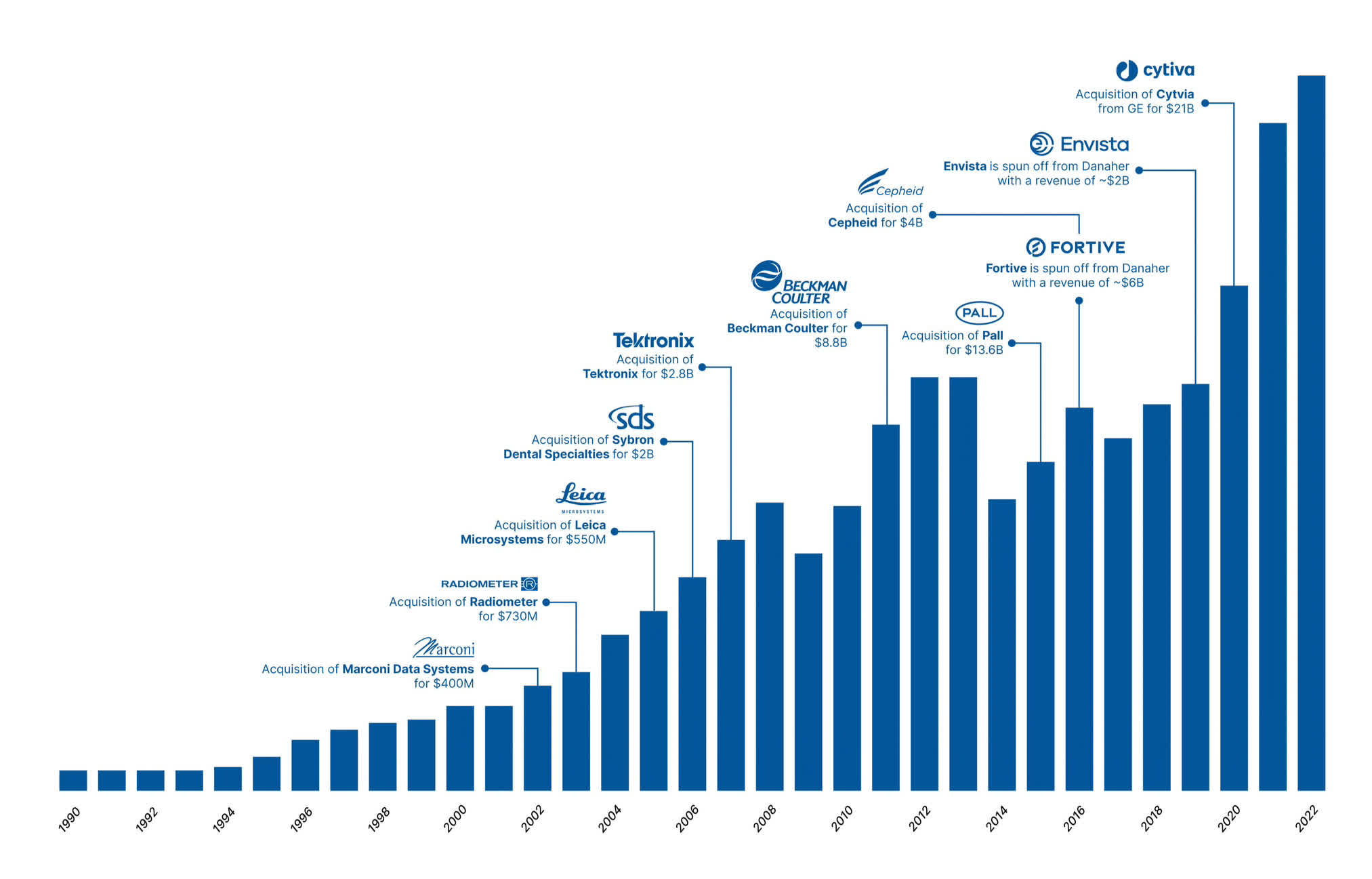

As a bit of background, DHR has been expanding its biomedical footprint for some time now. A serial acquirer, it is no slouch when it comes to spending big on strategic transactions to expand its own portfolio. It acquired Cytiva in 2020 for $21Bn, and has a long-list of multi-billion buyouts over the past decade. Figure 3 outlines this history in greater detail.

Figure 3.

Source: “Quatr” analysis on X.

Wind-back a few months, and ABCM’s board of directors unanimously decided to explore “strategic alternatives” for the company’s future. Among those options, a potential sale of the company was immediately thrown into the foray.

The move surfaced amid ABCM’s engagement in a proxy battle featuring Jonathan Milner, the company’s founder and a former director, who also owns a 6.3% stake in the biotech player. At the time, Milner aimed to seek a board position as executive chairman of the company he founded. ABCM said it was “disappointed that despite the Board’s clear and consistent efforts to engage constructively with [Milner], he…pursued aggressive tactics as he [sought] to force the company to agree to his demands”. Interestingly enough, the company looks to have wielded in part, given Milner withdrew the proxy solicitation in late June, noting he wanted to “allow the board to focus on pursuing its strategic review”.

Whilst this is potentially positive news for the company, critically, it’s essential to note that:

- Neither ABCM, nor DHR have confirmed the deal yet—reports are from sources “familiar with the matter”.

- If it were confirmed, precise details of any proposed price remain undisclosed.

The suggestion is that the offer could mimic ABCM’s current market cap, around $5.2Bn at the time of writing. This estimation is influenced by the fact that the company’s stock has already hit a 20% rally since mid-July after the company’s disclosure it was considering takeover interests.

2. Potential acquisition forensics

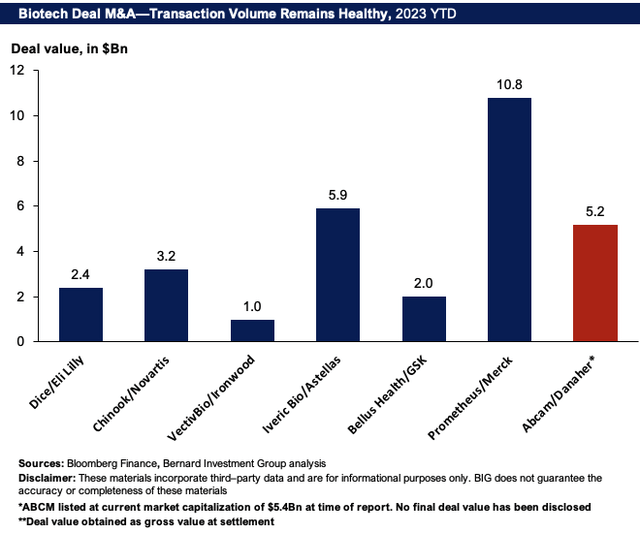

Several points are worth noting about a potential acquisition. As one scenario, I’ll presume the transaction price is to settle at $5.2Bn, the company’s market cap as I write. As to the comparable biotech M&A deals to date, this sits at the higher end of the scale. Figure 4 outlines it would sit in line with Astellas Pharma (OTCPK:ALPMF)’s purchase of Iveric Bio (ISEE) for $5.9Bn (see my August ALMPF publication covering this here). Merck (MRK)’s buyout of Prometheus Biosciences for $10.8Bn leads the transaction value in this comps analysis.

Figure 4.

BIG Insights

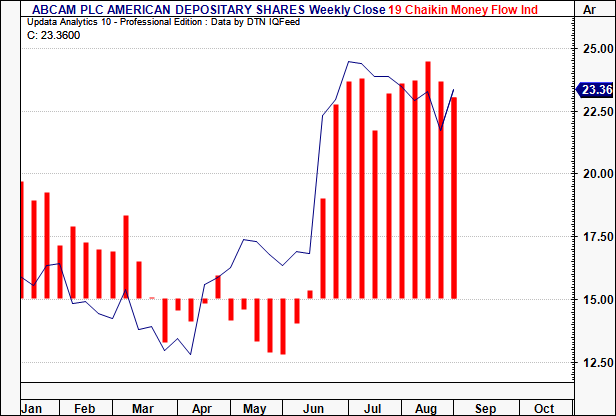

The market certainly agrees with the prospect of ABCM being acquired strategically. Figure 5 illustrates the money flows into/out of ABCM’s U.S. listed equity over 2023. The statements since June have clearly spurred a spree of demand into the stock. Investors are net long in positioning (short interest is 0.43%) and inflows are the highest they’ve been in June—August since the start of FY’23. Presuming the market is an accurate judge of value and expectations, this chart is telling of both for ABCM.

Figure 5.

Data: Updata

The next question I’d ask myself is “why is DHR interested in ABCM in the first place?”. Its equity performance has been flat, and, as discussed in the last publication, so too has the profits produced on capital invested into the business.

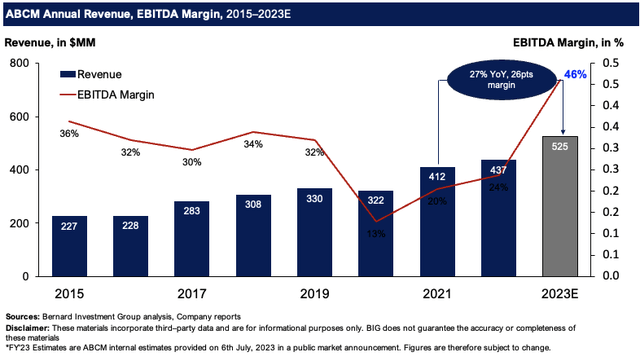

But we don’t get paid for what’s already happened. It is the expectations—or even as I saw it put once, “the expectations of the expectations”—that drive market returns in the mid-term. By the same token, ABCM’s forward expectations are something of value in my opinion. The firm reported in July that it expects $525mm in sales for FY’23 on adj. EBITDA margins of 46% (all figures are converted in USD at the exchange of $1 = GBP 0.79).

Figure 6 depicts ABCM’s annual revenue growth and EBITDA margin from 2015 to the estimates for 2023. Say it does come in with its forecasted numbers this year, you’re looking at a 27% growth in top-line revenues, and 26 percentage point growth in EBITDA margin (leading to EBITDA of $241.5mm). Perhaps this is one reasoning behind the deal.

The capital put at risk in the business—around $1.01Bn deployed at the time of writing—could be considered quite valuable on these numbers. Presume a growth to $1.1Bn in capital deployed (with WC considerations), you’re looking at the $1.1Bn producing $188.5mm in pre-tax earnings, otherwise 18.8% pre-tax return on investment In per-share terms, you’re looking at $4.80/share of capital producing $0.82/share in earnings pre-tax. Compared to ABCM’s history, this is quite the step up.

Figure 6.

BIG Insights

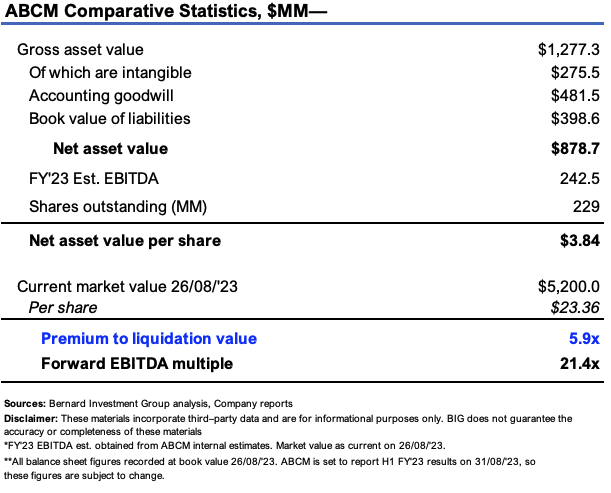

Is the deal worth it at an estimated $5.2Bn transaction value? Figure 7 runs through some basic assumptions given the firm’s latest book values to see how “worthwhile” it would be for DHR on valuation terms. Again—I’d stress here, that this is under the assumption of a $5.2Bn offer, and that a deal is taking place in the first place. I’ve also included the intangible asset value as part of ABCM’s ‘adjusted’ liquidation value as these are of value. They include patents, trade names, licence fees and so forth. ABCM’s net asset value comes to $3.84/share on its last reported book values, net of ~$400mm in liabilities. At the $5.2Bn market cap, you’re looking at a 6.1x premium to the adj. liquidation value, and ~21.5x FY’23 EBITDA estimates. ABCM currently sells at 36.7x forward EBITDA as I write, so this would be quite the discount to current market value.

Figure 7.

BIG Insights

Discussion

Biotech M&A hasn’t slowed its cadence in 2023 despite a higher cost of capital and tighter money within funding circles. Run with the scenario that DHR has in fact decided to move on ABCM for a second, and that it could potentially pay around about current market value. DHR’s extensive acquisition history is to be noted. But it hasn’t exactly outperformed equity benchmarks these past two years either, having slipped off all-time highs of ~$330 in August 2021. It now trades at ~$255 as I write. Strip the pandemic era out of it—DHR was one almighty compounder. From 2013—2019, it rated 285% to the upside from $41–$158 in a matter of 6 years, all driven by its strategy to acquire growth. If history does in fact rhyme, as Mark Twain opined, then you’d expect DHR to catch another bid over the coming decade.

ABCM on the other hand would be a major benefactor to an acquisition. Its equity struggled since listing on the NASDAQ in 2020, and after it delisted from the LSE. Critically, the acquisition would expand DHR’s footprint in the biomedical arena whilst providing much needed capital resources and potential synergies to ABCM. The question is what it means for shareholders. Not a great deal, in my view. Given ABCM’s rally off June lows, it remains to be seen what level it can sell at from here. DHR, in my view, would be unlikely to offer a substantial premium over these current levels either, for the same reason. Alas, it is difficult to coil around ABCM’s equity at this point in time, hoping to strike with the investment fangs on a premium offer. In that vein, I continue to rate ABCM a hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here