The AMD Investment Thesis Remains Robust, But Only For The Patient

We previously covered Advanced Micro Devices, Inc. (NASDAQ:AMD) in May 2023, rating the stock as a Buy, with the robust demand for generative AI likely triggering the next semiconductor super-cycle.

We also believed that the strategic leadership of CEO Lisa Su and Victor Peng (previously from Xilinx) might eventually allow AMD to close the gap to Nvidia (NVDA), consequently translating to the expansion of the former’s top and bottom lines.

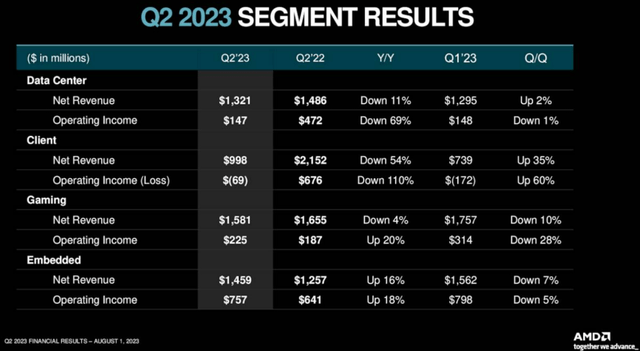

AMD’s FQ2’23 Performance

Seeking Alpha

For now, at the back of NVDA’s stellar FQ2’24 performance, with data center sales of $10.32B (+141.1% QoQ/ +171.5% YoY), comprising 76.3% of its overall top-line (+16.8 points QoQ/ +19.6 YoY), it is apparent that AMD investors have been left momentarily wanting.

AMD reported underwhelming data center revenues of $1.32B (+2.3% QoQ/ -10.8% YoY) in the same quarter, suggesting that NVDA has eaten everyone’s lunch as similarly observed by multiple market analysts.

Most importantly, the AMD data center segment’s operating margin of 11.1% (-0.3 points QoQ/ -20.6 YoY) has also fallen drastically, with its overall inventories of $4.56B (+7.8% QoQ/ +72.7% YoY) remaining bloated in FQ2’23.

Consumer demand for AMD’s latest EPYC Bergamo CPU appears to be less than impressive as well, with the company drastically slashing MSRPs by up to -20%, despite the cloud optimized processor’s supposed market leading performance.

This is a drastic contrast to NVDA’s expanding gross margins of 70.9% (+6.3 points QoQ/ +25.6 YoY) and operating margins of 51.4% (+21.6 points QoQ/ +41.3 YoY) in the latest quarter, implying robust consumer demand despite the premium pricing.

AMD’s FQ3’23 revenue guidance of $5.7B (+6.5% QoQ/ +2.5% YoY) does not instill confidence either, attributed to the slower MI300 sampling in Q3’23 and production ramp only by Q4’23.

It remains to be seen if AMD’s MI300 Chip Accelerator is able to meaningfully gain some of NVDA’s current market share, especially due to the latter’s outsized FQ3’23 revenue guidance of $16B (+18.4% QoQ/ +169.8% YoY).

Assuming a similar cadence from FQ2’23, we may extrapolate a heavier data center weighting of $12.2B in FQ3’23 (+18.2% QoQ/ +218.5% YoY), suggesting another massive GPU win for Jensen Huang and to a smaller extent, Intel (INTC), since the DGX H100 utilizes Sapphire Rapids CPU.

NVDA’s impressive growth is naturally attributed to “accelerating demand from cloud service providers and large consumer Internet companies for HGX platform, the engine of generative AI and large language models, based on our Hopper and Ampere architecture Tensor Core GPUs.”

The uncertain compatibility issues may also affect whether these providers/ consumers eventually diversify their AI platforms with MI300. This may also be worsened by NVDA’s aggressive launch of the next-gen GH200 Grace-Hopper superchip as a direct competitor to AMD’s MI300, slated for delivery by Q2’24.

Therefore, while Lisa Su may have reported growing “AI cluster engagements by more than seven times sequentially,” it remains to be seen how much of these sampling may be successfully converted to orders and sales.

This is especially due to NVDA’s incremental HGX supply every quarter through 2024, as similarly corroborated by Taiwan Semiconductor Manufacturing Company Limited’s (TSM) expanded CoWoS advanced packaging capacity for AI chips, from the original monthly capacity of 8K wafers in H1’23, to 9K in H2’23 and around 25K in 2024.

With AMD only securing a monthly capacity of 6K wafers in Q4’23, it appears that the Lisa Su led company may potentially lag in the first leg of the AI race. As a result, investors must also temper their short-term expectations accordingly.

So, Is AMD Stock A Buy, Sell, or Hold?

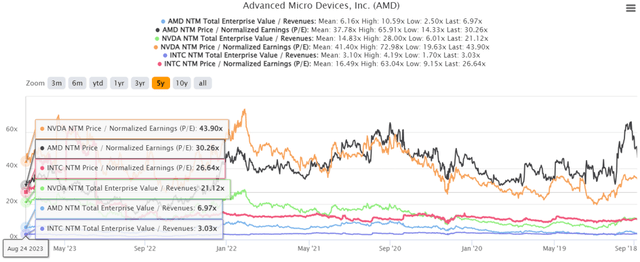

AMD 5Y EV/Revenue and P/E Valuations

S&P Capital IQ

For now, AMD trades at a NTM EV/ Revenue ratio of 6.97x and NTM P/E of 30.26x, higher when compared to its 1Y mean of 5.67x/ 26.71x, though its P/E is still moderated when compared to its pre-pandemic mean of 4.31x/ 36.99x, respectively.

Most importantly, while AMD has historically traded close to NVDA’s valuations, we have already observed a drastic split since May 2021, with the latter taking the lead with a NTM P/E of 43.90x. This is thanks to the latter’s diversified chip and SaaS offerings across data center, AI, IoT, gaming, and automotive end-markets.

However, investors should note that AMD still commands a notable premium compared to the semiconductor median P/E valuation of 19.32x, suggesting that it is not entirely excluded from Mr. Market’s euphoria surrounding generative AI.

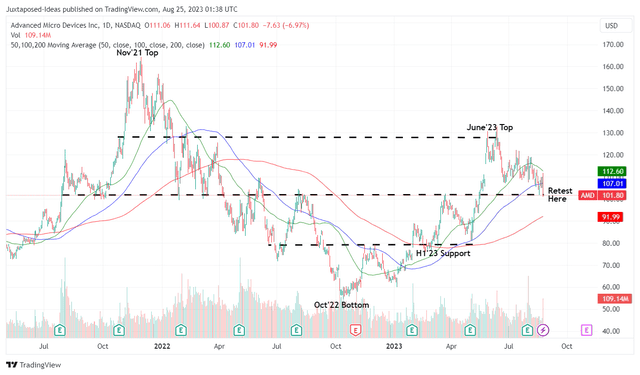

AMD 2Y Stock Price

Trading View

For now, the AMD stock has returned much of its June 2023 gains, currently retesting its August 2022/ March 2023 support levels of $100.

It is apparent that the exuberance surrounding generative AI has been overly fast and furious, with many other related stocks, such as Super Micro Computer, Inc. (SMCI) and C3.ai (AI), similarly retracing over the past few weeks.

However, here is where opportunistic investors may consider adding, since the correction has brought forth improved upside potential to our long-term price target of $160, based on the AMD stock’s NTM P/E of 30.26x and consensus FY2025 adj EPS of $5.29.

We maintain our belief that while NVDA may have won the first round of the AI race, AMD is likely to share the limelight in the long-term, depending on the timing of their product launches.

For example, Lisa Su already hinted at its next-gen MI400 offerings in the recent earnings call, with a similar pared down line up for Chinese markets to comply with the US trade policies, similar to NVDA’s H800 and A800 GPUs:

China is a very important market for us, certainly across our portfolio, as we think about certainly the accelerator market… We do believe there’s an opportunity to develop product for our customer set in China that is looking for AI solutions, and we’ll continue to work in that direction. (Seeking Alpha)

Combined with the promising reports of MI300 potentially outperforming NVDA’s H100, we believe the AI chips Total Addressable Market size of $150B by 2028 is large enough to accommodate two winners.

As a result of the attractive risk/ reward ratio, we continue to rate AMD stock as a Buy for patient investors.

Read the full article here