Investment Rundown

Chemed Corporation (NYSE:CHE) is a quite niche comapny focusing on providing hospice and palliative care services to patients with the help of a network of physicians. Operations are in the US and despite the Covid-19 pandemic hitting the sector hard, CHE seems to be one of the few that is still growing from those levels. It wasn’t a one and revenues are set to reach $2.26 billion in 2023.

As higher interest rates and labor inflation are taking a toll on the margins the EPS from the last report did show a YoY decrease unfortunately but in the long-term remains very strong and I think it will be a winner. The valuation of the company is slightly above the rest of the sector at a p/e of 25 or a premium of around 25%. I think that this isn’t sufficiently appealing to make it a buy right now. For investors that are already in the company, I think a hold makes sense and a buy could be established if the share price drops to lower levels. However, that seems most likely to only happen if CHE showcases signs of slowing growth.

Chemed Comapny News

Quite recently CHE declared another quarterly dividend, this time reaching $0.4, and marks another set of dividend increases for the company. For the last 14 years, the dividend has been growing and the payout ratio sits at 7.73% right now. This leaves ample amounts of increases in the future without harming the prospects of expanding through capital deployments in my opinion.

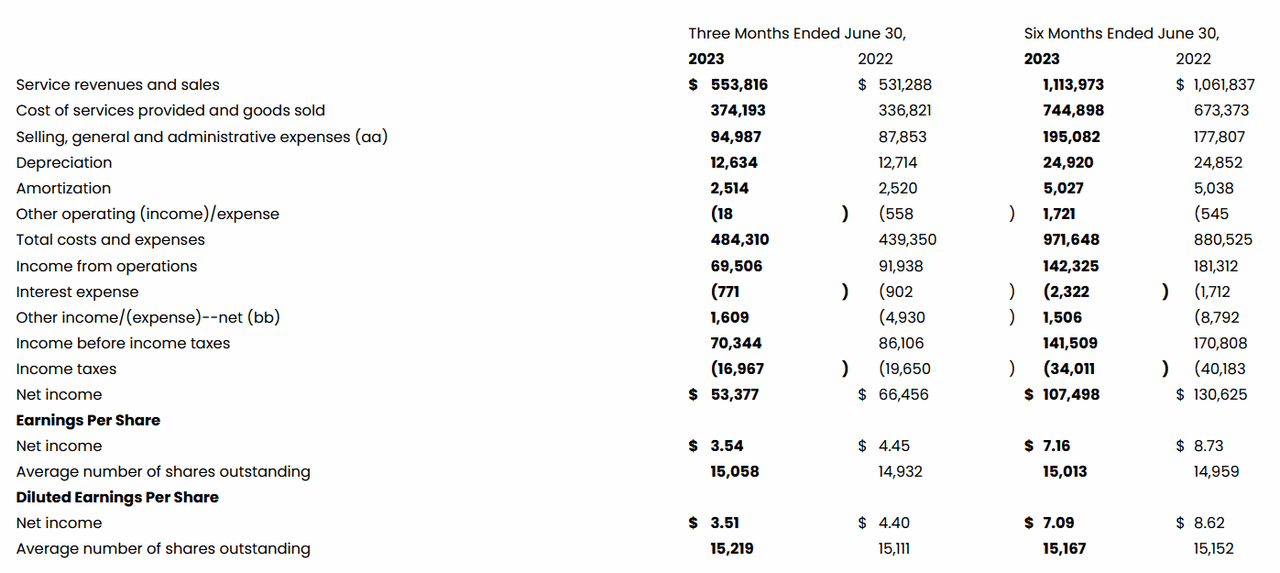

Besides the dividend, we also got the Q2 FY2023 report from CHE on July 26. The results showed strength in the top line, but the bottom line was less impressive. The revenues came in at $544 million and are setting CHE up very well to achieve the 2023 predictions of $2.26 billion. Moving over to the EPS it dropped by 2.7% YoY and came in at $4.71.

Income Statement (Earnings Report)

CHE is a company that operates in the healthcare services industry where it focuses on providing hospice and palliative care services to patients. The company operates through a large network of physicians and registered nurses. CHE has divided the options into two various segments, VITAS and Roto-Rooter. The first one is the best performing from the last quarter as revenues rose by 7.8% and the ADC by 6.2%. These are solid results and underscore why even though the price of CHE might be high for a buy, a hold rating will benefit from the appreciating share price as long as they continue posting results like this.

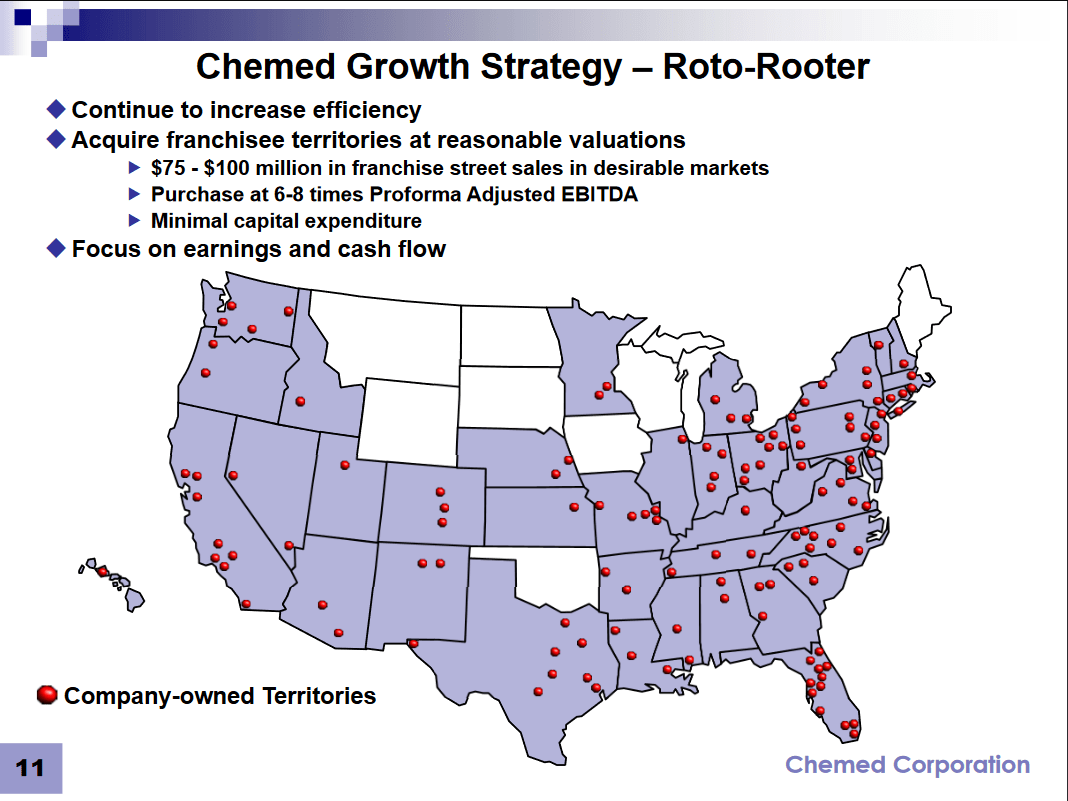

Market Overview (Investor Presentation)

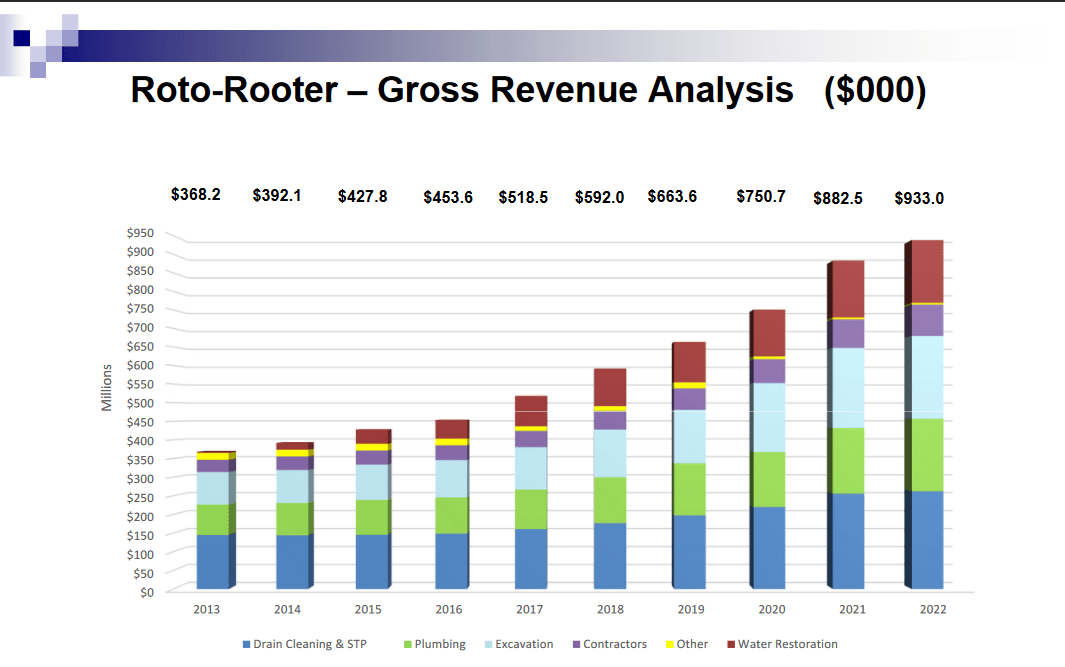

It seems that CHE is becoming more and more of an FCF-focused company as the management sees a lot of potential in the Roto-Rooter segment. They are continuing to acquire the franchise and expand their market position across almost all states in America. The segment requires a minimal amount of capital expenditures and can generate substantial FCF instead. This will fuel expansion in other segments and also support a growing dividend yield.

Quickly mentioning the guidance set out for 2023 by the management the revenues are expected to grow by 8.5 – 9.5% in the VITA’s segment and by 1 – 2% in the Roto-Rooter segment. In terms of the full-year EPS, guidance of $19.9 – $20.1 has been set. Meaning on the higher end, CHE is trading at a p/e of 25.5.

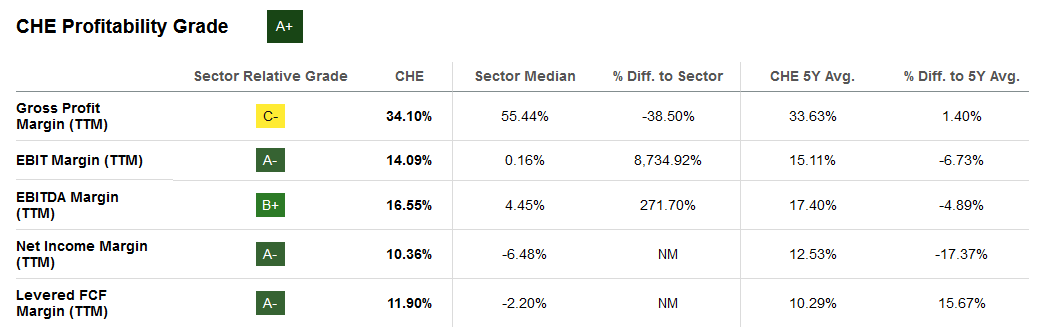

Profitability Of The Business

Profitability (Seeking Alpha)

Taking a look at the margins I think CHE has come a long way and it makes more sense if it gets the valuation it does right now. The net margins are at 10.3% which is slightly below the 5-year average of the company, but still substantial enough to support the current dividend. Looking at the causes for the lower net margin, I think the main culprit is higher interest rates and also wage inflation increasing the operational expenses of the business. Worth highlighting also is the fact that CHE has done a very good job of reinvesting into themselves and the ROC is at 18.9%. With such a high return it seems that the market is very optimistic towards the future of CHE and a higher valuation is set in place. However, the valuation seems supported only by these facts, meaning that a failure to uphold them will likely result in a significant decline in the share price. This introduces risk as we lack a margin of safety if we were to invest right now.

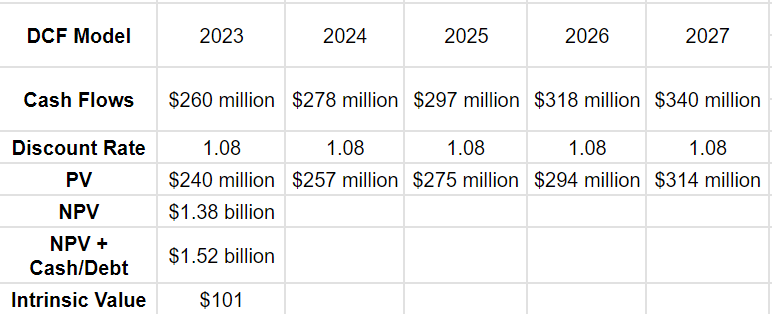

Valuation Model

DCF Model (My Own)

Taking a look at the chart above here it further highlights why I think CHE makes more sense as a hold rather than a buy. The lack of growth in the FCF going forward ensures that the intrinsic value is far below the current share price. The premium you have to pay to the intrinsic value is not worth it. I am anticipating a 7% annual growth of FCF which is fair in my opinion as investment in the Roto-Rooter segment is likely to result in this assessment. Cash remains high and the debt position is low for the company at just $16.3 million.

Risks

There is the potential for an escalation in operating expenses, which could impact CHE’s overall profit margins. As the demand for the services provided by CHE continues to rise, the company might face the necessity of allocating greater resources to meet the growing expectations of its customers. This, in turn, could lead to elevated operational costs as CHE strives to maintain its service quality and customer satisfaction.

Roto-Rooter (Investor Presentation)

It’s worth noting, however, that while the possibility of increased operating expenses is a valid consideration, it might not be substantial enough to create a bearish outlook for the company. CHE management has demonstrated competence in navigating the intricacies of their industry, suggesting their ability to effectively manage and mitigate the impact of rising operational costs.

Final Words

CHE has been very good at maintaining the momentum from the COVID pandemic and capitalizing on the pressure and demand it placed on the sector. Revenues are set to continue going higher and a lot of the anticipation from investors seems to be that CHE will eventually turn into an even stronger FCF machine, able to pass and distribute substantial amounts to shareholders.

However, I don’t like the premium necessary to start a position and will instead be rating the company as a hold until more favorable price targets are met and a better margin of safety is established.

Read the full article here