Investment Rundown

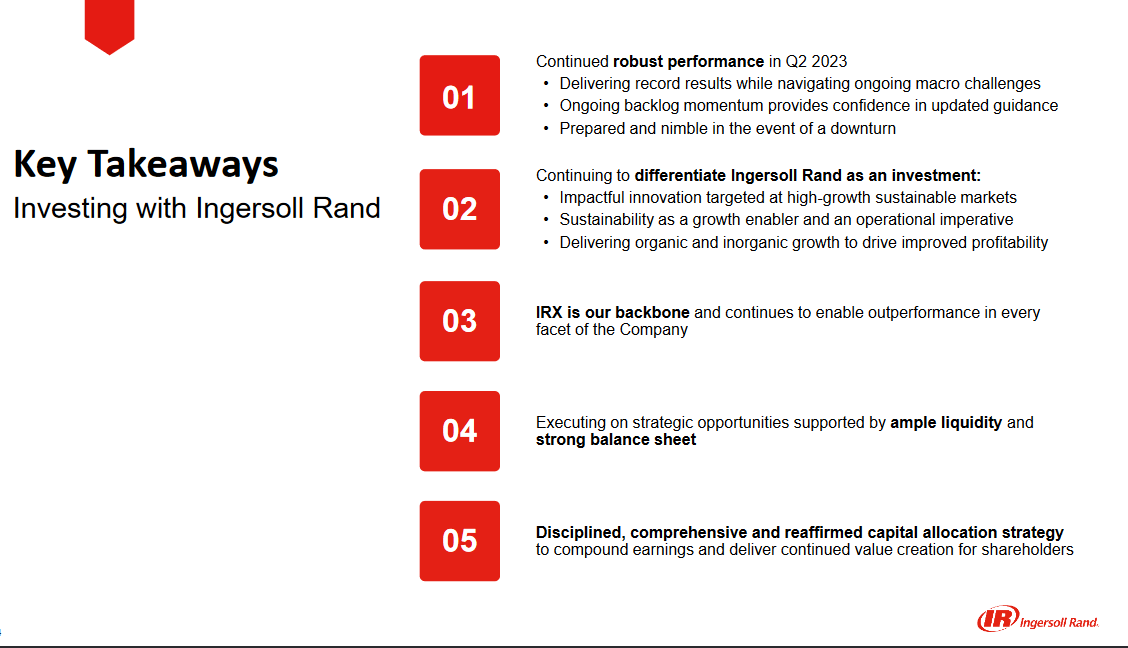

Stability and consistent growth are two of the qualities that I associate with Ingersoll Rand Inc. (NYSE:IR). The latest quarterly report from the company showcased a robust top-line growth of 9% and 5% organically. Guidance was raised for the year and EPS is projected to deliver a 14 – 19% YoY growth, which is making the current p/e of nearly 24 seem quite fair to pay. A premium is often attached to companies consistently showcasing the growth and an ability to maintain margins as well.

For investors who seek a diversified industrial play, I think IR right now has a lot to offer. The dividend may not be something to cheer or get too excited about, but with a recent history of buying back shares, I think investors are still getting some decent value here over the long term. As FCF builds up even stronger as well, the company seems to increase these practices in my opinion. The raised guidance and impact that several megatrends have on the company I think will ultimately conclude with a solid ROI for investors, rating IR a buy for now.

Company Segments

IR stands as a global supplier and deliverer of a varied range of diverse solutions across multiple sectors. With a strong international presence spanning the United States, Europe, the Middle East, India, Africa, and the Asia Pacific, the company plays a vital role in shaping industries and driving innovation.

Results (Earnings Presentation)

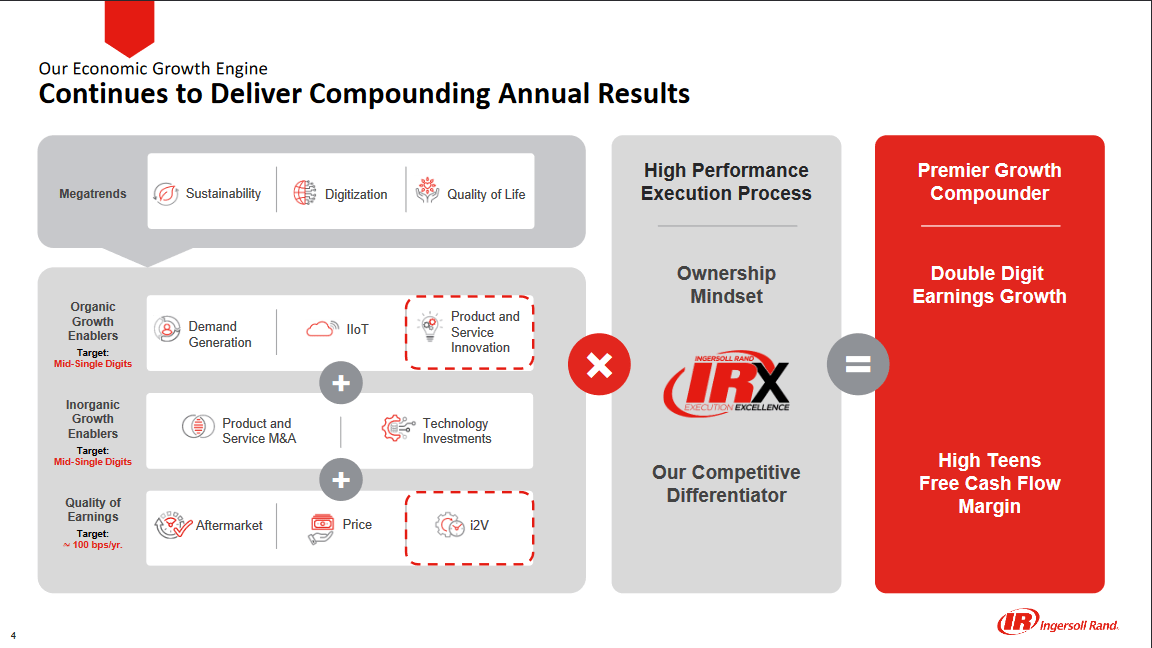

The operations of the business involve the Industrial Technologies and Services segment. This division is focused on manufacturing and servicing a comprehensive lineup of air and gas compression technologies. These technologies play an important role in a wide array of applications, ranging from industrial processes to energy systems, underlining the company’s commitment to delivering essential solutions that power various sectors of the global economy. In recent years, major megatrends are emerging which is pushing revenues forward for IR. Some of these are the increasing demand for digitalization and more sustainable business practices, areas which IR can help supply.

In addition to its Industrial Technologies and Services segment, Ingersoll Rand’s influence extends to the Precision and Science Technologies sector. This segment is responsible for the design, manufacturing, and marketing of an impressive array of pumps, encompassing diaphragm, piston, water-powered, peristaltic, gear, vane, progressive cavity, and syringe pumps.

Highlights (Investor Presentation)

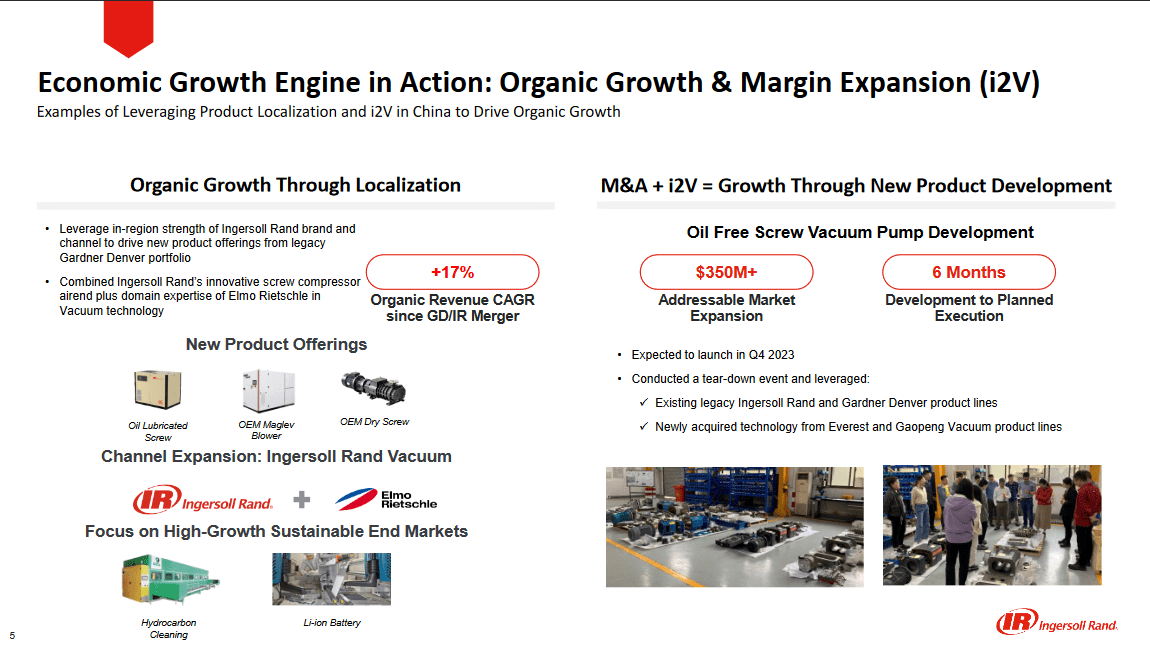

Organic growth has been impressive for the company and the recent quarter showcased just that, displaying a 5% YoY organic growth rate for the business. Thanks to new product developments, for example, the company has managed to expose itself to a $350 million TAM opportunity. Expansions like these are what will be driving the growth forward in the coming years and why IR can trade at the premium it does, right now around 37% based on earnings in comparison to the sector.

Growth Targets (Investor Presentation)

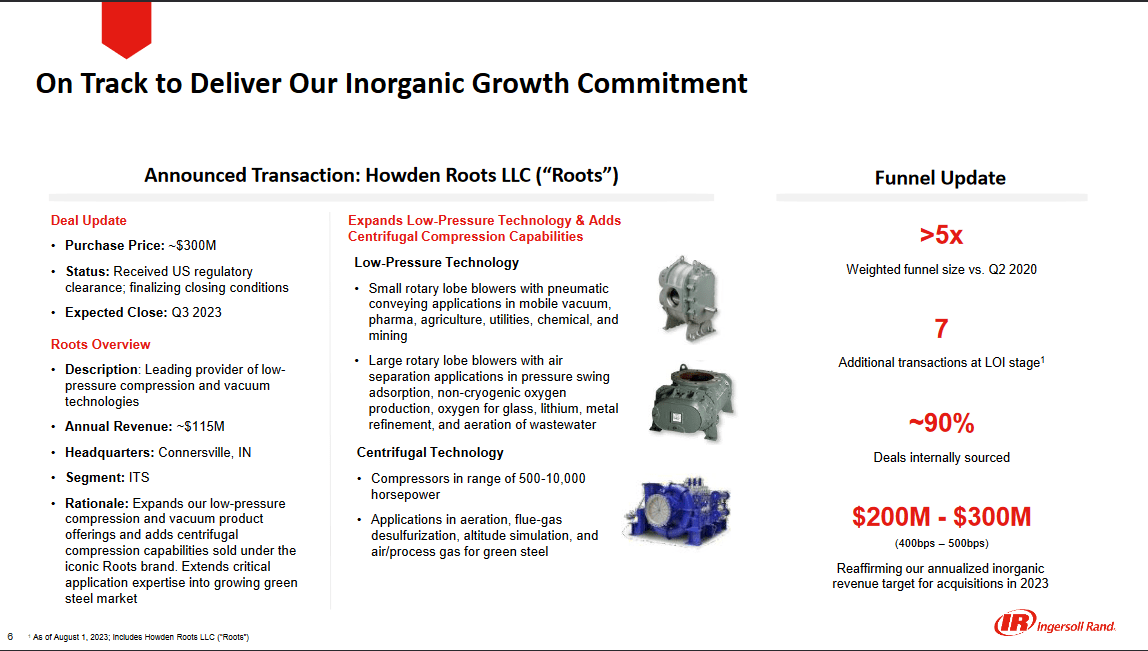

Despite the company growing at a decent rate organically, the management of IR still sees a lot of potential in acquiring smaller businesses adding them to their portfolio, and fueling growth that way. With levered FCF margins of 12.99% and a cash position of nearly $1.2 billion, the company is well within the ability to do such moves, I think. The latest commitment by the company involves the announced transaction of Howden Roots LLC for $300 million. The annual revenues for the company are $115 million, giving the company a sales multiple of just under 3, which is perhaps not that cheap, nor very expensive either. Based on the sector average for industrials, it’s a near 100% premium, but this is a common case when making transactions like these.

Risks

While inorganic growth has undoubtedly played a pivotal role in Ingersoll Rand’s historical and future growth strategies, the pursuit of aggressive expansion comes with its own set of considerations. While diversification through acquisitions can enhance the company’s market reach and capabilities, there’s a need to strike a balance between expansion and maintaining a laser focus on core operational efficiency.

The risk associated with overly aggressive expansion lies in the potential to dilute the company’s ability to execute its core strategies effectively. As the company diverts its attention and resources to new ventures, there’s a risk of losing the depth of expertise and operational excellence that has been the cornerstone of its success.

Company Highlights (Investor Presentation)

Within the industrial and engineering sectors, the landscape continues to exhibit fragmentation, primarily stemming from the inherent strength of specialized product fulfillment. This unique niche-focused approach has traditionally provided a competitive advantage, creating a protective moat around companies like Ingersoll Rand (IR). Yet, upholding and expanding this moat demands a continuous pursuit of innovation.

Financials

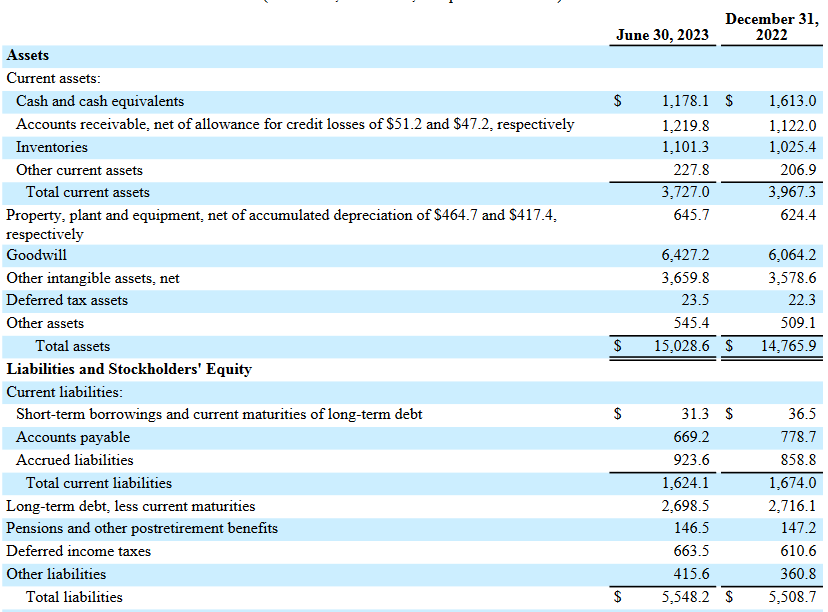

Maintaining a solid balance sheet is crucial if IR is aiming to make a lot of strategic acquisitions and build inorganic growth that way. It was mentioned earlier that IR has a cash position of nearly $1.2 billion right now, which might be down from over $2.1 billion in 2021, but still reflects a strong financial base for the company in my opinion.

Balance Sheet (Earnings Report)

Assets in comparison to liabilities showcase a clear positive discrepancy of about 3:1 which is great to see. The long-term debts for the business are just shy of $2.7 billion and even though the cash position can’t cover 50% of that, which is something I would highly value in most cases, accounting for FCF margins of nearly 13% and steadily growing ones too, IR is in no risk of defaulting on debt, I think.

Final Words

I think that right now, IR extrudes a sense of stability and eagerness to grow and deliver solid earnings growth that gets passed on to investors as well. The company has managed to grow FCF annually by over 13% over the last 10 years, and this has enabled them to make strategic acquisitions and drive inorganic growth. An ROA of 4.68% shows that IR is performing very well in making the most of its assets, and having the premium it does makes sense. Even with the p/e around 24, I think you are getting a decent deal right now. IR is a company that adding to when the share price unreasonably decreases makes a lot of sense. The balance sheet is sound and the growth going forward is reliable, which results in me rating IR a buy right now.

Read the full article here