Investment Thesis

Stride Inc. (NYSE:LRN) has been performing very well recently so, I decided to look into the company’s financials and look into its outlook going forward and whether it is a good time to invest. It seems like the company is serving the niche very well and the management is doing a very good job at operating the company, therefore, I assign a buy rating to Stride.

Briefly on the Company

Stride is an online for-profit education company that is designed to provide an alternative to traditional brick-and-mortar education for students from kindergarten through 12th grade. It also offers further education in the form of career learning programs for adults and middle and high school students.

Outlook

The company is serving a very niche market that is getting more popular every year, especially with the evolution of technology in the last 3 years since the pandemic showed us that a lot of our work can be done with a stable internet connection and a laptop.

Education technology is poised to grow at a whopping 20% throughout 2019 to 2026, which tells us that the demand for alternatives to the standard brick-and-mortar education programs is increasing. I still believe that companies like Stride will continue to serve just a minor population of the country because ever since the pandemic, children and young adults are craving that real-life connection that traditional schools offer, however, if Stride can grow its numbers over time, I still think it is possible to make it in this segment of education.

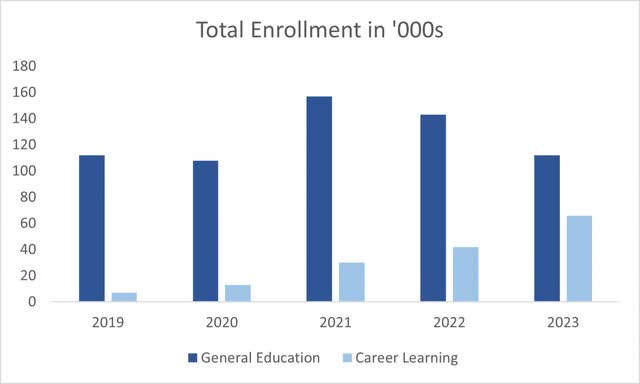

Looking at the enrollment numbers, the Career Learning segment has seen very strong growth y-o-y increasing 57% to around 66,000 students while revenues were up more than 70%. That is exceptional growth, which I believe will continue for years to come.

A little bad and good on the General Education front is that the total enrollment has seen a massive 22% decline y-o-y, which led to an 11% decrease in revenues, however, revenue per enrollment was up 14.4% from last year. Tuition seems to have gotten more expensive, which partially offset the 22% decline in total enrollment for the year.

Enrollment (Author)

Unfortunately, the company doesn’t guide up until the next report, which will be in October ’23. I will be dialing in to hear how the Gen Ed segment develops and whether the company anticipates better enrollment numbers in the future.

The company is also starting to embrace AI capabilities and believes that AI will bring a positive impact for students and teachers alike. Looking at Chegg (CHGG), although not in quite the same category, acknowledged ChatGPT and how it affected its operations negatively, the shares plummeted around 50%. In contrast, Stride’s mentioning of AI was in a more positive light, which didn’t affect the share price that much. I do believe AI will help the company to become even more efficient and profitable, even if enrollment numbers stay where they are.

Risks

I would be very cautious if enrollment numbers started to dwindle further in both segments. The company is very profitable, but that profitability may turn to losses if there isn’t enough revenue coming in and expenses spiral out.

There are many competitors in the industry and if the company cannot retain the numbers, it will lose a lot of revenue if it cannot offer a superior product.

Since everything is done online, according to the annual reports, the company is using AWS (AMZN) and Microsoft’s (MSFT) Azure for all their data and server needs, any cybersecurity risks like cyberattacks will have a substantial impact on the company’s operations, which may lead to privacy breaches, fines, and damage to its reputation, and subsequently leading to a fall in share price.

Financials

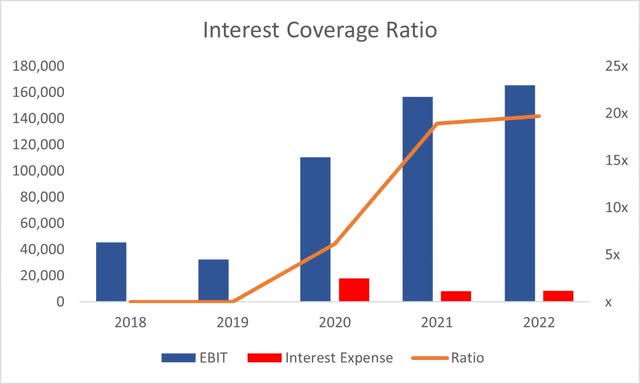

As of FY23, the company had around $410m in cash and equivalents, against $413m in long-term debt. I wouldn’t say that’s a bad position to be in. The company’s interest coverage ratio is extremely high, sitting at around 19x. This means that the company’s EBIT can cover interest expenses 19 times over. For reference, 2x is considered healthy. Safe to say, the company is not at any risk of insolvency.

Coverage ratio (Author)

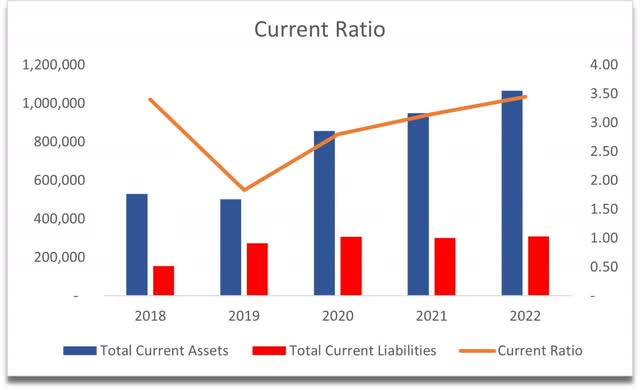

The company’s current ratio is very healthy, which stood at around 3.5 at the end of FY23. This means that the company can pay off its short-term obligations 3.5 times over. However, in my opinion, this ratio is a bit too high, and I would like to see it coming down to around the 1.5-2.0 range. This high ratio tells me that the company may not be utilizing its assets very efficiently right now, or at least its cash position, which could be used to further growth or reward shareholders.

Current Ratio (Author)

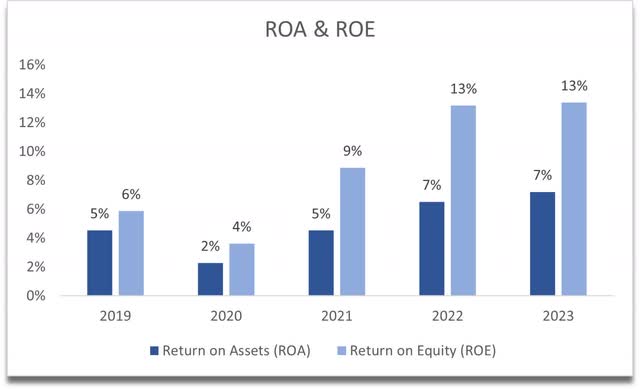

Looking at the company’s efficiency and profitability metrics, ROA and ROE are alright, just above my minimums of 5% for ROA and 10% for ROE, which tells me that the management is doing a decent job at utilizing the company’s asset and shareholder capital. ROA could be slightly higher if the current ratio comes down in the future. Nevertheless, the metrics are in an uptrend, which is a positive sign.

ROA and ROE (Author)

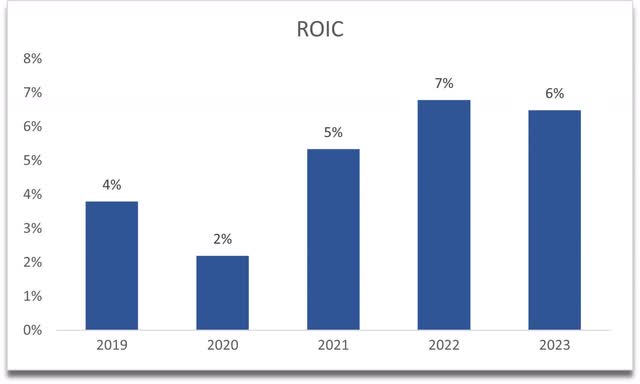

Stride’s return on invested capital is not the greatest and is slightly below my minimum of 10%, however, it seems to be about the mid-point if compared to similar companies. This tells me that the company still has a decent moat and a competitive advantage. If this improves over the next couple of years, then the company will be even more attractive as an investment.

ROIC (Author)

Overall, pretty decent numbers. The company is in a good financial position and should be able to weather any further economic headwinds.

Valuation

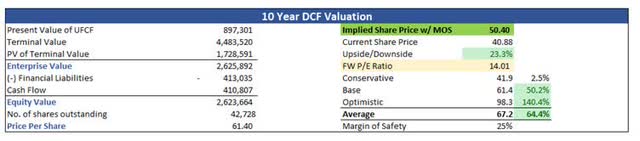

Over the last decade, the company managed to grow at around 9% on average. For my base case, I decided to stick to this average for simplicity. For the optimistic case, I went with 13% CAGR, while for the conservative case, I went with 7% CAGR to give me a range of possible outcomes.

In terms of margins, I decided to improve gross margins by around 300 bps or 3% over the next decade, which I think is on the conservative side. I also improved operating margins by 200bps over the next 10 years. This will lead to net margins improving from 7% at the end of FY23 to around 10% by FY33, which seems very achievable.

On top of these estimates, I will add a 25% margin of safety to be even more conservative. With that said, Stride’s intrinsic value is $50.40 a share, implying the company is currently trading at a 23% discount to fair value.

Intrinsic Value (Author)

Closing Comments

I think the company is a buy at these price levels. The company is doing a good job in this niche market and is very profitable. I believe in the long run, the company will reward its shareholders. I also believe that EdTech is going to grow for many years to come, and Stride will be one of the top companies that will innovate in this segment in the future.

The risk/reward here is very attractive, however, if the company is not able to retain good enrolment levels to offset revenue declines, especially in the Gen Ed segment, the thesis will have to be adjusted accordingly. I see a lot of potential for the Career Learning revenue segment to perform well in the future, and it could become the main revenue generator for the company. This was a quick overview of the company; please do your own due diligence to see if this is a company you would like to own.

Read the full article here