Intro

Five Below, Inc. (NASDAQ:FIVE) is a specialized value retailer in the US, known for its diverse product range. They offer an array of accessories such as socks, sunglasses, jewelry, and cosmetics, along with personalized living space products like lamps, frames, and blankets. Their inventory includes both everyday essentials and seasonal items for celebrations. By combining a broad selection of products with competitive pricing, FIVE has carved out a niche as a go-to destination for budget-savvy shoppers seeking a wide range of trendy and practical items.

In this assessment, we will comprehensively examine FIVE’s financial performance and its potential for future expansion. Our evaluation will specifically delve into the company’s earnings, profitability, and capacity to generate cash flow. By attaining a more insight into these critical factors, investors can formulate a well-informed assessment of FIVE’s attractiveness as a potential investment opportunity.

Growth and Profitability

When you’re thinking about where to invest your capital, looking back at how a company has performed in the past is essential. By reviewing important aspects like how their revenue and free cash flow have grown over time, you can get a sense of how well they can handle changes in the market. This kind of analysis also helps you see how good the company’s leaders are at building smart strategies and dealing with challenges. In the end, understanding how a company has done before gives you the knowledge you need to make smart investment choices. And when it comes to FIVE, the company has built up a solid track record of financial performance over the years.

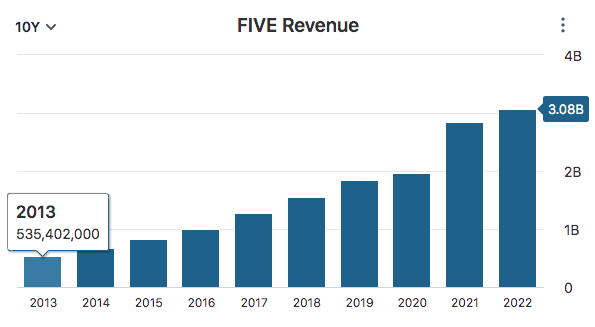

Over the past decade, FIVE has experienced impressive growth in its financial performance. The company’s revenue has soared from $535 million in 2013 to $3.1 billion in 2022, marking a remarkable total growth of 474.52%. This translates to a compounded annual growth rate (CAGR) of 19.11%.

Data by Stock Analysis

Furthermore, FIVE’s free cash flow has shown a substantial increase, with values ranging from $5.26 million in 2013 to $62.97 million in 2022. This represents a substantial total growth of 1097.15%, indicating a CAGR of 28.18%. This robust growth in both revenue and free cash flow underscores FIVE’s consistent expansion and financial strength over the past decade.

These fantastic revenue and free cash flow growth results can be attributed to FIVE’s resolute commitment to delivering extreme value. The lion’s share of its merchandise portfolio falls within the budget-friendly bracket of $1 to $5, occasionally extending to $10 for select items. This strategic pricing architecture positions Five Below as an alluring haven for astute consumers with a keen eye for value, an appeal particularly resonant with the younger shoppers.

Additionally, FIVE’s product landscape is constantly adapting to encapsulate the latest trends. The store boasts an extensive array encompassing toys, electronics, games, domicile essentials, and apparel, all competitively priced to be accessible. This distinctive positioning establishes FIVE as a treasure trove for finding distinctive and fashionable gifts that are popular with the youthful demographic, encompassing tweens and teenagers.

This strategy has proven to be quite profitable over the last ten years. On average, the company has boasted a return on equity (ROE) of 25.40%, which is quite impressive. Comparatively, the typical ROE for companies in their sector is 10.84%, therefore FIVE is standing out by generating more profits compared to its industry rivals. This shows that the company is effectively managing their resources wisely contributing to their strong business performance.

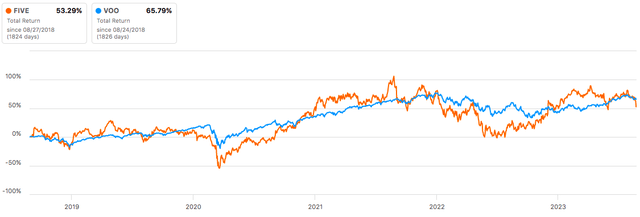

However, what investors care most about is the company’s total return. Over the past half-decade, FIVE has generated a solid total return of 53%. While this performance is noteworthy, it’s essential to consider the broader context. During the same period, the S&P 500 has surged with a 65% total return. This indicates that while Five Below has demonstrated commendable growth, it has trailed slightly behind the broader market’s remarkable ascent over the past five years.

Data by Seeking Alpha

Looking Ahead

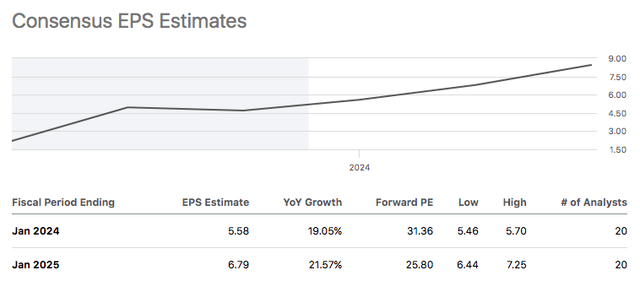

Looking ahead to the remainder of 2023, FIVE is poised for continued robust performance. The company’s earnings per share (EPS) estimate for the fiscal period ending in January 2024 stands at $5.58, reflecting a healthy year-over-year growth of 19.05%.

Data by Seeking Alpha

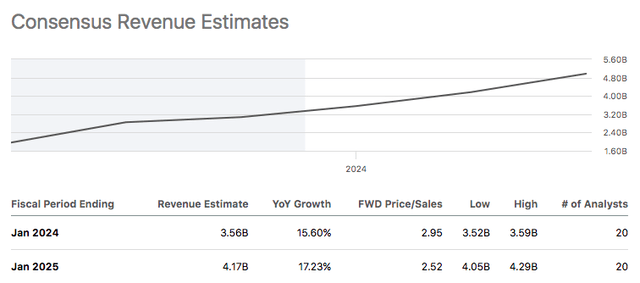

In tandem with this promising earnings outlook, FIVE’s revenue projections for the same period exhibit a positive trajectory. Anticipated revenue is pegged at approximately $3.56 billion, marking a noteworthy year-over-year growth of 15.60%. These projections underscore FIVE’s strategic positioning and potential to sustain its upward trajectory, suggesting a prosperous outlook for the company’s performance throughout the latter part of 2023.

Data by Seeking Alpha

Looking forward to 2024, FIVE is expected to continue its strong growth trajectory. The company’s earnings per share EPS is projected to reach $6.79 in fiscal year 2024, representing a 21.57% year-over-year increase. Revenue is also expected to grow significantly, reaching $4.17 billion, up 17.23% from the previous year. These projections are based on the company’s strategic direction.

Five Below’s growth strategy is centered on store expansion. The company plans to increase its store count from 1,340 locations as of January 2023 to over 3,500 locations in the future. This expansion will be focused on both existing and new markets, and it will leverage the company’s existing brand recognition and operational efficiencies.

Recent years have witnessed FIVE’s steady expansion, marked by the opening of a net total of 170 new stores in fiscal 2021 and 150 in fiscal 2022. Looking forward to fiscal 2023, the company aims to launch an additional 200 new stores. These upcoming locations will follow a model averaging around 9,500 square feet and will primarily find placement in-line within power, community, and lifestyle shopping centers spanning various market categories.

There are some concerns however, with investing in FIVE. Investors considering FIVE should be mindful of certain risks associated with the company’s niche market focus on tweens and teens. This demographic is characterized by its ever changing preferences, therefore FIVE needs an agile approach to product offerings in order to remain relevant. FIVE’s ability to effectively navigate these shifts will be pivotal for sustaining its appeal.

Additionally, FIVE’s pricing model, grounded in the “everything under $5” strategy, has been a cornerstone of its success. However, any potential deviation from this strategy, such as price increases, could carry the risk of customer attrition.

In the past year, we’ve witnessed a notable surge in inflation, inevitably casting its shadow over FIVE’s business. This environment has improved recently but in the event FIVE faces high inflation again, the company faces a challenging crossroads: the company can opt to raise its prices, resulting in potential repercussions for customer engagement; absorb the impact on its margins; or explore cost-effective product alternatives. Unfortunately, none of these choices are appealing for FIVE, and none of these avenues offer solutions that align with the company’s overarching objectives.

To combat these risks, FIVE will focus on further sales growth through increased brand awareness. Employing a prudent marketing strategy, the company prioritizes digital channels, streaming video, television, community involvement, and philanthropic efforts. The company plans to utilize it’s expanding email database and active social media presence to drive brand engagement and in-store traffic. It’s our view that this digital thrust not only extends the brand’s footprint but also bolsters online sales and broadens the customer base.

Valuation

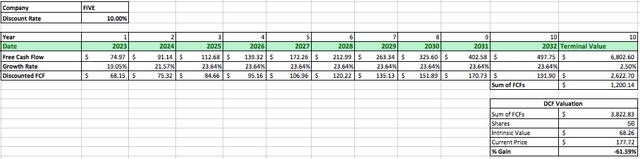

To assess FIVE’s intrinsic value, we’ll conduct a discounted cash flow (DCF) analysis, starting with the initial free cash flow of $62.97 million achieved in 2022. Initially, we consider a growth rate of 19.05% for 2023 and 21.57% for 2024, consistent with the anticipated robust earnings growth based on analysts’ projections mentioned in the section above.

For the subsequent phase, we integrate the average compounded annual growth rate CAGR of revenue and free cash flow over the last decade, which stands at 23%. This growth rate is applied to years 3 through 10.

Factoring in a discount rate of 10%, representative of the market’s average return with dividends reinvested, and a perpetual growth rate of 2.5%, FIVE’s intrinsic value is projected to be $68.26. This analysis suggests a potentially overvalued market price for FIVE. The implied total return from this valuation is estimated to be around -61.59%.

Author’s Work

Takeaway

FIVE presents a compelling investment opportunity characterized by its solid financial performance, growth trajectory, and strategic positioning in the value retail sector. The company has demonstrated impressive revenue and free cash flow growth over the past decade, underpinned by a commitment to offering extreme value to its customers. FIVE’s ability to adapt to evolving consumer preferences and its strategic product assortment have contributed to its sustained profitability.

Looking ahead, FIVE’s strong earnings and revenue growth projections for the coming years reflect its robust potential for expansion. The company’s strategic focus on store densification and brand engagement through digital channels positions it well to capitalize on future opportunities in both existing and new markets.

However, investors should remain mindful of certain risks associated with FIVE’s niche market targeting tweens and teens, whose preferences can be fickle and challenging to predict accurately. Additionally, any deviation from the company’s successful pricing strategy of “everything under $5” carries the potential risk of customer attrition.

Given these factors, the current valuation of FIVE appears to be on the higher side, implying a potential overvaluation. The projected total return from this valuation analysis is notably negative, indicating a possible discrepancy between the current market price and the estimated intrinsic value. In light of these considerations, we will give FIVE a “hold” rating.

Read the full article here