With a market capitalization of $17.48 billion, PulteGroup (NYSE:PHM) is a massive player in the homebuilding space in the US. In recent years, the firm has grown significantly, with the number of homes delivered and the average price per home sold shooting up. This year has proven to be a rather interesting period of time. Earlier in the year, following on a trend that began in 2022, backlog for the business started showing significant declines. However, even in light of continued inflation and high interest rates, the picture for the company is improving. Add on top of these improvements just how cheap shares are on an absolute basis, and I would argue that the company makes for a solid ‘buy’ candidate at this time.

A turnaround at last

Before I get into the fun fundamental data, it might be a good idea to discuss, in a bit of depth, what PulteGroup is and how it operates. Founded in 1956, the firm operates as one of the largest home builders in the country. In fact, as of the end of its 2022 fiscal year, it ran over 800 active communities spread across 42 markets in 24 states. The properties that it builds fall under a variety of brand names, such as Pulte Homes, DiVosta Homes, Centex, and more. And according to management, the company also considers itself to be a provider of solutions for buyers across the spectrum, including first time buyers, move up buyers, and what management calls ‘active adults’. One thing that the company does prioritize is the construction of single-family homes. About 86% of its Closings in 2022 fell under this category. The remainder involved all sorts of homes, including condominiums, townhomes, and duplexes.

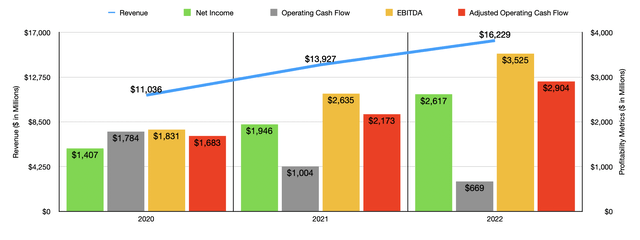

Author – SEC EDGAR Data

Over the past few years, the financial trajectory achieved by PulteGroup has been impressive. Revenue shot up from $11.04 billion in 2020 to $16.23 billion in 2022. This surge in revenue brought with it higher profits and cash flows as well. Net income, for instance, rose from $1.41 billion to $2.62 billion over this window of time. It is worth noting that operating cash flow was cut by nearly two-thirds during this time. But if we adjust for changes in working capital, we would see that it increased from $1.68 billion in 2020 to $2.90 billion last year. Following the same trend was EBITDA. It jumped from $1.83 billion to $3.52 billion over the same window of time.

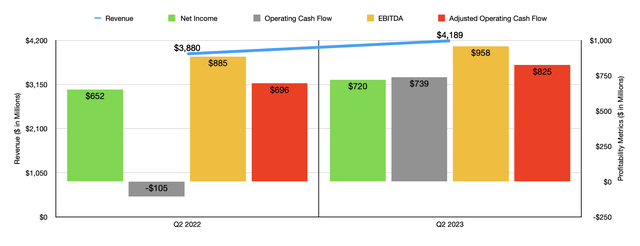

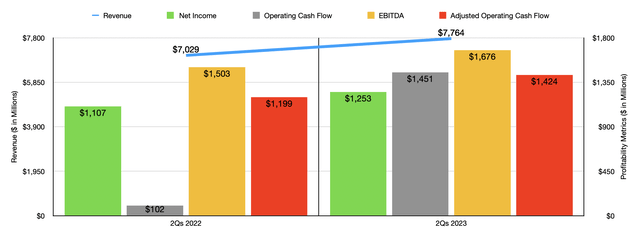

Author – SEC EDGAR Data Author – SEC EDGAR Data

As you can see in the two charts above, financial performance continued to be positive this year. Revenue, both for the most recent quarter and for the first half of the year as a whole, came in higher than it was during the same windows of time last year. Profits and cash flows, without exception, also increased year over year. At first glance, all of this looks fantastic. But in order to truly understand what is going on, we need to dig deeper. And this is because we are experiencing uncertain times. You see, there has existed, for many years, a housing shortage. According to Freddie Mac, the US market is short on supply for homes by about 3.8 million units. But restrictive zoning policies, high inflation, and now rising interest rates, have all proven to be prohibitive to the construction of new properties.

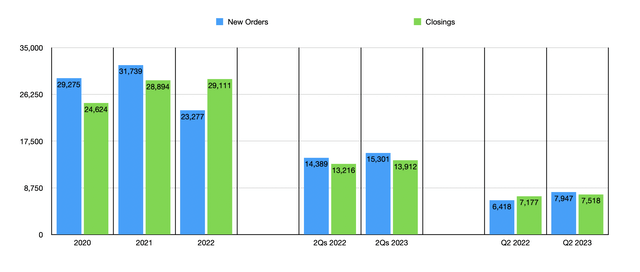

Author – SEC EDGAR Data

Even with these issues, PulteGroup was able to grow the number of properties that it sold each year. Overall closings jumped from 24,624 in 2020 to 29,111 in 2022. And even in the current fiscal year, closings continue to rise, with the number reported for the first half of the year totaling 13,912. That’s up nicely from the 13,216 reported in the first half of the 2022 fiscal year. While the company was benefiting from increased closings, it also benefited from higher average selling prices. Back in 2020, the average home that it sold had a price tag of $430,000. That number jumped to $542,000 in 2022. In the most recent quarter of this year, the company reported an average selling price of $540,000. Although this is lower than what the company saw in 2022 as a whole, it is lower than the $524,000 reported for the second quarter of 2022.

Author – SEC EDGAR Data

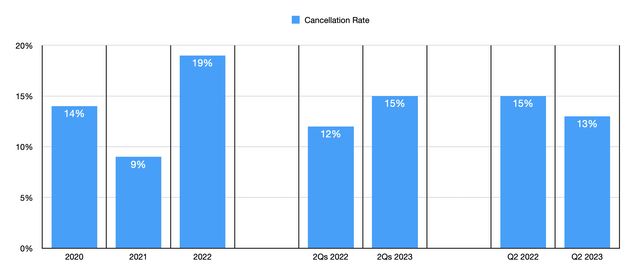

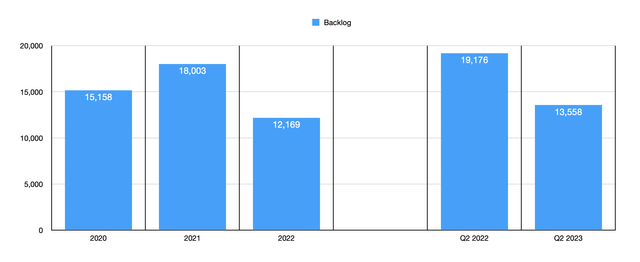

But even while all of this was occurring, some signs of weakness began developing. I even wrote about this idea regarding the homebuilding space in an article that I published earlier this year. Without exception, the firms had experienced significant year-over-year declines in both orders and backlog. Cancellation rates went through the roof as well. A lot of this pain actually began showing up in 2022. For that year, new orders for the company came in at 23,277 units. That was down from the 31,739 reported for 2021. This, combined with a more than doubling in cancellation rate from 9% to 19% resulted in the company’s backlog shrinking from 18,003 properties to 12,169.

Author – SEC EDGAR Data

When it comes to the current fiscal year, backlog continues to be depressed. As of the end of the most recent quarter, it totaled 13,558 properties. That is a steep drop compared to the 19,176 reported the same quarter last year. But if you look at these data points and compare them to the ones that I mentioned in the prior paragraph, you will notice that the number of properties in the company’s backlog is actually higher than what it was at the end of 2022. And this is where the turnaround starts to become clear.

During the second half of 2023, PulteGroup recorded 15,301 new orders. That’s an increase of 6.3% over the 14,389 new orders reported for the first half of 2022. When you look at only the most recent quarter on its own, you see an acceleration of new orders. In that quarter, the company reported 7,947 new orders. That’s 23.8% above the 7,177 new orders reported for the second quarter of last year. The cancellation rate in the first half of this year was 15%. That was up from the 12% reported one year earlier. However, for the second quarter alone, the direction shifted, with a cancellation rate of 13% coming in below the 15% reported the same time last year. In its most recent investor call, the management team at the firm mentioned that consumer demand is strong and that favorable housing conditions, namely a 1 million unit decrease in existing home sales, has done wonders for the business.

Author – SEC EDGAR Data

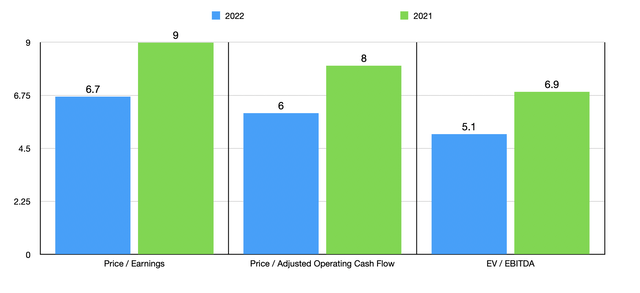

When it comes to the 2023 fiscal year in its entirety, management has not provided any significant guidance. It is looking as though the year will be better than 2022 was. But to be conservative, especially during these uncertain times, I’ve decided to value the company based on historical results from both 2021 and 2022. In the chart above, you can see exactly how cheap shares are. On an absolute basis, they are definitely in value territory. Relative to similar firms, I would argue that the stock is either fairly valued or slightly on the cheap side but. In the table below, for instance, you can see how shares are priced against five similar firms. On a price to earnings basis, two of the five companies ended up being cheaper than PulteGroup. This number increases to three of the five on a price to operating cash flow basis. However, it drops to only one if we rely on the EV to EBITDA basis.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| PulteGroup | 6.7 | 6.0 | 5.1 |

| Meritage Homes (MTH) | 5.9 | 5.2 | 4.6 |

| Beazer Homes USA (BZH) | 4.7 | 2.6 | 6.9 |

| Century Communities (CCS) | 7.5 | 4.2 | 7.6 |

| Legacy Housing Corp (LEGH) | 8.0 | 44.3 | 6.2 |

| Dream Finders Homes (DFH) | 10.6 | 11.3 | 8.2 |

Takeaway

When I wrote my bearish article on the housing market earlier this year, I fully expected market conditions to worsen for quite a few quarters. I would have been shocked if you told me at that time that some of the players in the space would see some improvements while interest rates were even higher than they were when I wrote that article. However, it is clear that the strength of the consumer, combined with the power of the housing shortage, has more than offset the negatives brought about by high inflation and high interest rates. Given these market conditions and seeing how cheap shares of PulteGroup are, I do believe that enough upside potential exists to rate the business a ‘buy’.

Read the full article here