Thesis

Centrus Energy (NYSE:LEU) is one of the most distinct companies in the uranium industry. They are the only producer of low-enriched uranium in the USA. Their balance sheet is alarming at first glance because it has negative equity. On the positive side, Centrus has negative net debt and meaningful uranium inventory. The company represents a geopolitical wager betting on deepening the uranium deficit and US nuclear revival at a great price.

Uranium Looming Deficit

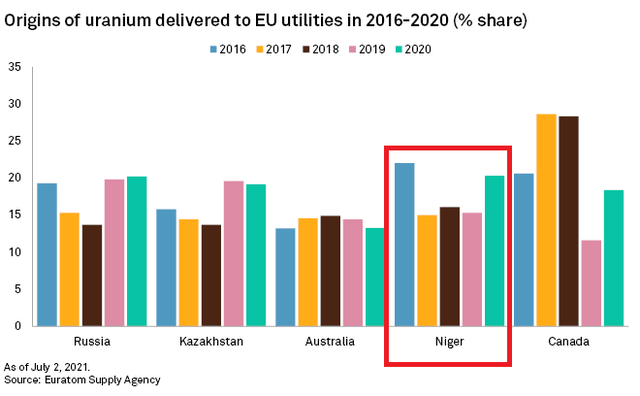

Uranium offers an exceptional asymmetric investment opportunity. Its growing deficit caused by stagnating supply and increasing demand heralds the new bull market. Unlike commodities such as copper and oil, uranium is not dependent on the economic cycle. Geopolitics drives its price more and applies with even greater force today. The coup in Niger, the country that supplies 7% of the world’s annual production, affirms that fact. Europe relies heavily on Nigerian uranium; 20% is imported from Niger.

Euroatom Supply Agency

I’ll summarize in a few points why we’re at the beginning of an epic bull market in uranium. Lack of investment in discoveries and new mines, combined with political-economic fragmentation, significantly impacts supply. Even without direct sanctions, many countries have begun to supply uranium from other sources, but Russia.

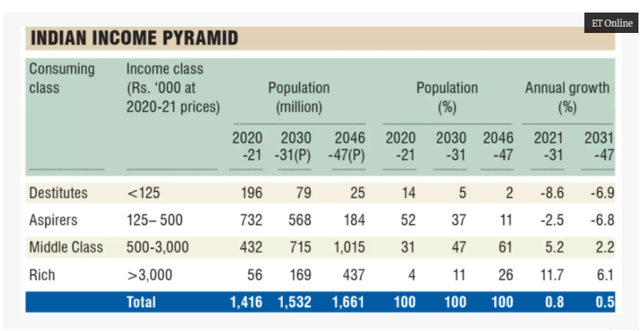

On the other hand, we observe rising demand due to nuclear power revival. The latter has become widely accepted as an alternative to fossil fuels, making it an essential element of the transition to zero carbon emissions. And it is not only that, the population of India and much of Africa is growing exponentially. Increasing capacity is the only way to meet the rising people’s energy needs. In addition, India is climbing up the S curve of GDP, in which fewer people live in desperate poverty, and more are entering the middle class. It is projected that the Indian middle class will grow by 65 % by 2030. The chart below illustrates the Indian income pyramid.

Economic Times

That means they will demand more stuff, and its production needs ever-increasing energy. The answer to the rising demand is nuclear power. Another crucial point is energy independence. World fragmentation is the driver behind it. An increasing number of countries plan to grow their nuclear capacity for all the reasons listed – the Green Deal, demographics, and energy independence.

A potential accelerator – sanctions against Russian uranium. The imbalance between supply and demand is a fact. It will slowly and steadily impact uranium prices. If sanctions are imposed on Russian uranium, the process described above will accelerate multifold, and the uranium shortage will reach epic proportions.

That is not healthy for any market. The commodity CAPEX cycle creates imbalances between demand and supply, which are cured by the market dynamics. Epic deficits caused by exogenous shocks negatively impact the industry long-term, even if we, as investors, can cash significant returns. We can profit handsomely in a normal CAPEX cycle without systematic shocks, and the uranium market is such an opportunity.

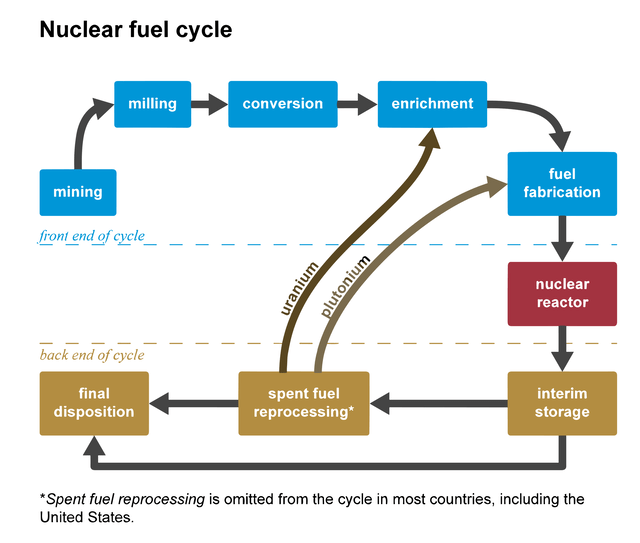

Centrus business is, at least to say, obscure. To make my thesis more comprehensive, I will briefly present the fuel nuclear cycle.

Nuclear Fuel Cycle 101

In nature, uranium occurs in the form of 6 isotopes. The two primary ones are U235 and U238. In nuclear energy and for defense purposes, U235 is of leading importance. U238 produces plutonium for nuclear triad (intercontinental ballistic missiles, strategic bombers, and nuclear submarines).

Uranium 238 (U238) makes up over 99% of the uranium found in nature. The remaining less than one percent includes all other isotopes. Among these is Uranium 235 (U235), which has the most comprehensive application in energy. The path of uranium from the mine to nuclear reactors and warheads is long and complex.

I will give a glossary of terms that you will encounter later in the report:

- Yellow cake – this is the final product of the uranium mine output. It is a yellow powder of the chemical compound Tri Uranium Heptoxide U3O8.

- Conversion – the first step of nuclear fuel production. The input feedstock is U3O8; the output is uranium hexafluoride UF6.

- Enrichment – step two in producing nuclear fuel. The input feedstock is UF6, and the output feedstock is enriched uranium (LEU, HEU, or HALEU).

- SWU – separative work units – the energy required to produce a unit of enriched uranium. One SWU is equivalent to the work (separative work) needed to enrich one kilogram of U235 or U238.

- LEU – low enriched uranium – uranium with an isotope concentration of U235 between 3-5 %. This is the most common type of enriched uranium used for fuel in nuclear reactors.

- HALEU – high assay enriched uranium – uranium with an isotope concentration of U235 between 5-20 %. HALEU is mainly used in test reactors not intended to produce electricity. A new generation of reactors operating with HALEU will stream in the coming years.

- HEU – highly enriched uranium with an isotope concentration of U235 above 20%. HEU is referred to as weapons-grade nuclear material. As the name implies, it is mainly used to produce nuclear weapons.

This is what the nuclear fuel cycle looks like from the mine through the nuclear reactor to the radioactive waste dump.

US Energy Information Administration

We, as investors, can get involved mainly in the first two steps of the chart. At the following stages of production, only a few public companies are involved, and Centrus Energy is one of those companies.

Company Overview

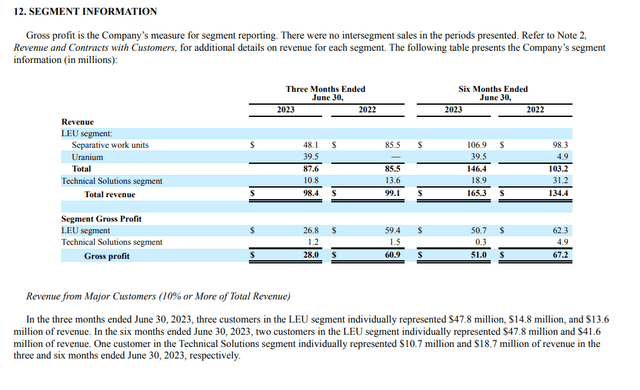

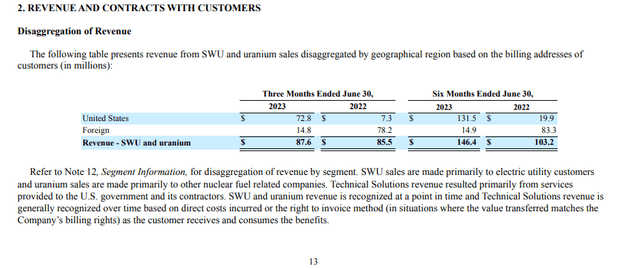

Centrus Energy is well-positioned to benefit from the new uranium bull market. The company’s business has two segments. The image below from Centrus Q2 2022 financial report illustrates revenues by segment:

Centrus Q2 2023 statement

88 % of the revenue comes from SWU and uranium sales. That segment supplies various components for producing nuclear fuel. 12 % of the revenue comes from the technical solutions segment responsible for designing, constructing, and manufacturing uranium enrichment and nuclear fuel fabrication systems.

Geographically, the company`s customers are utility companies in the US. The chart below illustrates the revenue by country:

Centrus Q2 2023 statement

The primary market is the USA, with 91 % revenues.

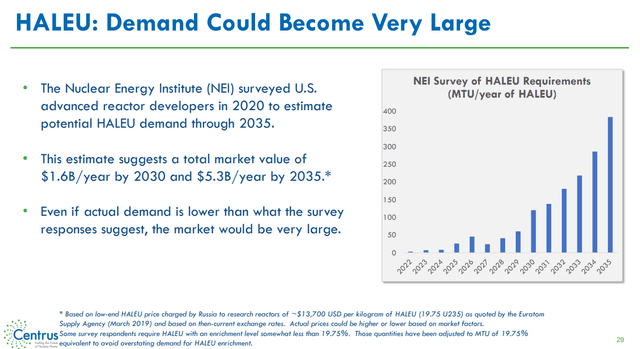

Carbon-neutral energy requires a transition to a new generation of energy sources. Nuclear power is among them. In recent years, new reactors have been developed to cement nuclear power’s place as the best solution. These reactors will operate with HALEU instead of those working with LEU.

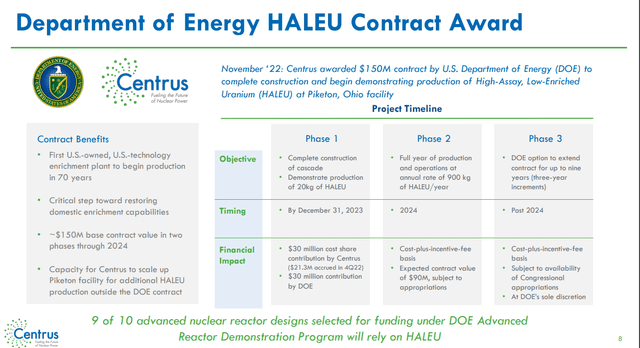

The higher concentration of U235 will enhance the reactors` performance. The goal is to achieve all three: simplified design, easier servicing, and increased safety. However, the limitation to their widespread adoption is the availability of a HALEU production facility. Centrus has a unique position recognized by the Department of Energy and the Gates Foundation. On 17 July, the company signed a memorandum of understanding with Terra Power company for developing small modular reactors backed by the Gates Foundation. On 22 November 2022, DoE awarded Centrus a 150-million-dollar contract to complete the construction and production of HALEU in the Piketon, Ohio, facility. More detail about the grant from DoD is shown in the image below.

Centrus company presentation

The projected demand for HALEU will increase due to the introduction and adoption of SMRs. The chart below from Centrus last presentation illustrates that:

Centrus company presentaion

Being among the few producers of HALEU gives Centrus an exceptional moat. On top of that, it could not be duplicated due to business peculiarities and its importance for national security. Running Centrus business requires highly skilled professionals in particular areas – from legal consultants and lobbyists to mathematicians and nuclear engineers. Obtaining permits and following the regulations to operate nuclear-related enterprises is another unbearable endeavor.

Company Financials

To begin with, Centrus Energy has negative equity due to accumulated losses of $214 million in past years. At the same time, their long-term debt is $182 million, and cash is $212 million, so the company has access to liquidity. Centrus has uranium inventories valued at $288 million too. Despite accumulated losses and negative equity, the company is liquid.

|

EBITDA/Interest expenses |

40 |

|

EBIT-CPX/Interest expenses |

47.5 |

|

Quick ratio |

1.4 |

|

Current ratio |

0.5 |

|

Net debt/EBIT |

(0.1) |

|

Net debt/EBIT-CPX |

(0.1) |

|

Long-term debt/Equity |

229 % |

|

Total debt/Equity |

203 % |

|

Total liabilities/Total assets |

104 % |

Data source: Seeking Alpha Centrus company profile

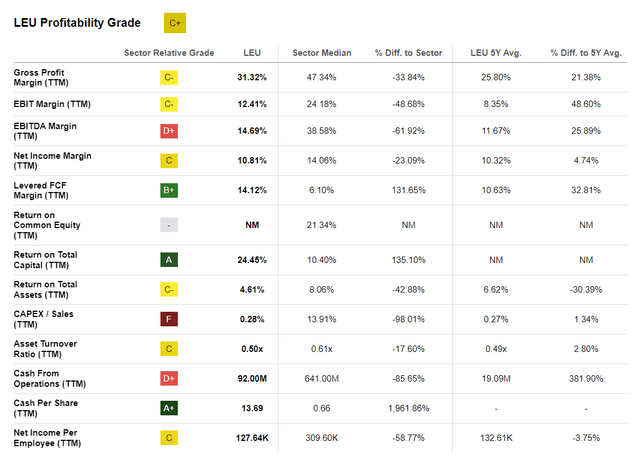

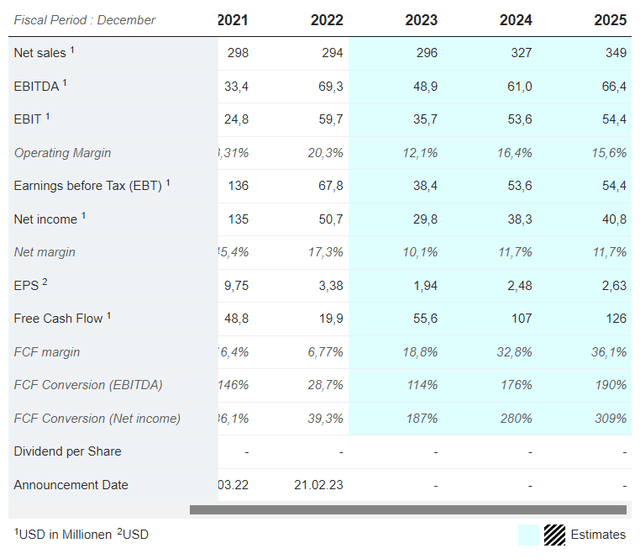

Centrus has proven its ability to generate free cash flow during difficult times. The below chart from the company`s profile illustrates that:

Seeking Alpha Centrus profile

The company has a significantly higher 5Y average FCF margin than the energy sector median and the company`s 5Y average. Another positive sign is strong Gross and Net Income margins higher than the company`s 5Y average. Higher uranium prices will expand the margins and positively affect Centrus’s bottom line.

People

CEO is Daniel Poneman. He has been in this role since 2015. His appointment coincides with the brutal bear market that lasted until 2021 when it bottomed out. Poneman has proven to be a strong leader by successfully surviving this crisis. He has skin in the game, too. He owns $3.5 million worth of stock, 0.62% of the company. Chairman Mikel H. Williams was newly appointed to the position this year. It has $2.4 million in shares.

The CEO successfully navigated the tough post-Fukushima bear market. In recent years, he negotiated contracts with TENEX and Orano to buy SWU at prices well below today’s. Skin in the game is also present.

Unlike Cameco, where the usual suspects have invested – funds with exposure to energy and mining, the situation is different at Centrus. Global X and Vanguard are still in play. However, two names stand out. One is a director on the company’s board.

Neil Subin has been an independent director since 2017. He is a partner and manager of Broadbill Investment Partners, a boutique fund investing in deep-value and distressed businesses. The most significant exposure in their portfolio is Centrus – about 60%. These stocks represent 3.32% of Centers. The other name that owns 12.1% of the stock is Morris Bawabeh. There is no information about him. It is only indicated that he is related to Kulayba LLC.

Valuation

I value companies in the resource extraction sector by net asset value, but Centrus is a company in its own game. Companies producing nuclear fuel exist, but they are not public. This makes comparing where Centrus its peers an impossible task. In that case, I chose the 2 Stage Discounted Free Cash Flow Model for the evaluation.

Assumptions and inputs from Professor Damodarran’s database:

- Risk-free rate is equal to the 5Y average of US long-term Government bond Rate – 2.2%

- Perpetual growth rate, g, is equal to the 5Y average of US long-term Government bond Rate – 2.2 %

- US market equity premium – 5.0 %

- Coal and related energy unlevered Beta 1.25

- Coal and related energy Debt/Equity ratio 21.71 %

- Centrus effective tax rate 22.5 %

- Centrus FCF forecast 2024 107,000,000,000 $

The above parameters are inputs in the following steps:

1. Calculate Levered Beta with the formula below:

Levered Beta = Unlevered Beta * (1+D*(1-T)/E)

2. Calculate the discount rate (discount rate as the cost of equity) using the resulting value for leveraged beta. The formula I use is:

Cost of Equity = Risk Free Rate + (Levered Beta * Equity Risk Premium)

3. Stage 1: I calculate the present value of discounted free cash flows for ten years using 2024 FCF estimates from Market Screener. I assume the FCF will grow at a stable rate of 2.2 %.

Market Screener Centrus profile

4. Stage 2: I calculate the Terminal Value of the free cash flows over ten years at stable growth into perpetuity, g, and the resulting discount rate. Then, calculate the present value of the Terminal Value:

Terminal Value = FCF2033 × (1 + g) ÷ (Discount Rate – g)

Present Value of Terminal Value = Terminal Value ÷ (1 + r)10

5. Sum the final results of stage 1 and stage 2. Their sum is called the Total Equity Value (TEV);

Total Equity Value = Present value of next ten years cash flows + Terminal Value

6. Divide the TEV by the total number of company-issued shares. The result is the intrinsic value of the acacia, which I compare against the current market price.

Cost of Equity 9.47 %

Total Equity Value = $1,416,00,000,000

Fully diluted shares = 15,500,000

Intrinsic value per share = $91.3

Current market price = $44.94 (24/08/2023)

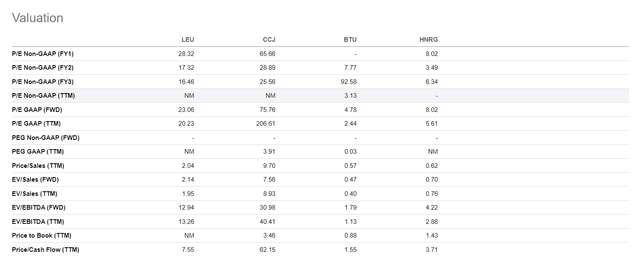

Centrus operates in the coal and consumables fuel industry; as I mentioned, there are no direct peers to compare. Only one company shares some similarities with Centrus. Cameco Corporation (CCJ) is a fully integrated uranium miner engaged in all stages of nuclear fuel production.

I will compare Centrus primary with Cameco. I added Peabody Energy Corporation (BTU) and Hallador Energy Company (HNRG) to understand how distinct Centrus Energy is as a business.

Seeking Alpha Centrus company profile

I use EV/Sales and Price/Cash Flow ratios primarily. Accounting shenanigans could easily distort the earnings. So, the revenue and cash flow give a better picture of the company’s ability to generate profits. Centrus is undoubtedly cheaper than Cameco and pricier than Peabody and Hallador.

Risks

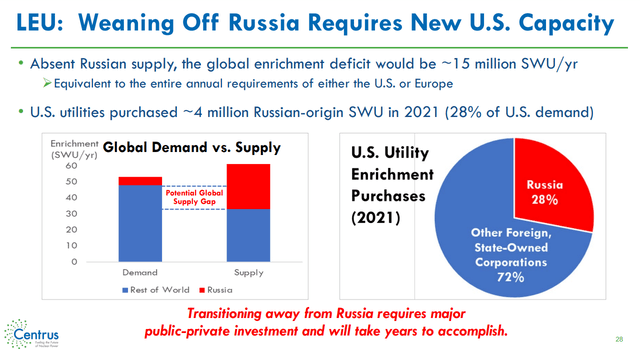

50 % of US-enriched uranium imports come from Russia and its allies Kazakhstan and Uzbekistan. Ban on Russian enriched uranium imports will cause an extreme deficit of LEU. The chart below from Centrus last presentation shows the degree of dependency on Russian uranium imports.

Centrul company presentation

For Centrus, the most significant risk is the contract with TENEX. This Russian state-owned corporation produces components for uranium enrichment and nuclear fuel production. 2015 Centrus signed a contract with them in force until 2028. If sanctions are imposed on Russian uranium, deliveries from TENEX will stop. Centrus would have to restart its LEU production facilities and rely on the accumulated uranium reserves.

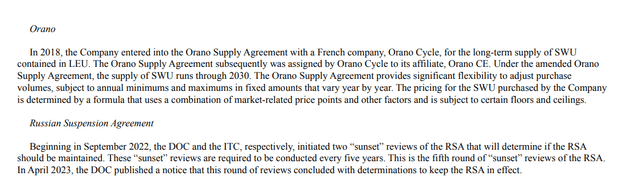

The below expose is from the company`s Q2 2023 report. It discusses the Orano Supply Agreement and the Russian Suspension Agreement (RSA). Risk-related, the latter matters the most.

Centrus Q2 2023 financial statement

The Department of Commerce (DOC), in April 2023, decided to keep RSA in effect till 01 January 2028.

On the other hand, in February of that year, a bill for a complete ban on Russian uranium imports was introduced. House committee approved the bill. An important detail is mentioned in the quote below from an article published in Nuclear Newswire:

The legislation would start banning Russian uranium 90 days after its enactment but would also allow the Department of Energy to issue waivers should the DOE determine (1) that there is no alternate source of low-enriched uranium available to keep a U.S. nuclear reactor in operation or (2) that importing Russian uranium is in the national interest.

That bill might pass the Senate, and the President will sign it. That will cause shockwaves in the uranium market and will adversely affect Centrus. On the other hand, as the quote above hints, there will be legal backdoors. Another factor diminishing the negative consequences is the DOC decision to extend the RSA till 2028.

Conclusion

Centrus is a geopolitical wager betting on deepening the uranium deficit and US nuclear revival at a great price. The critical role of the uranium enrichment process makes Centrus essential for national defense and energy independence. The memorandum between Terra Power and Centrus and the DoD-awarded contract notably increased my hypothesis’s credibility. The company’s primary risk is the Russian uranium supply ban. However, due to the DOC decision and the legislation backdoors, the negative effect will be short-lived. Centrus Energy is an extremely volatile long-term play with a horizon above 24 months.

Read the full article here