One of the great things about buying cheap stocks that are exhibiting attractive growth is that, even after they rise significantly, they can still look rather attractive from a fundamental perspective. One really good example of this that I could point to is automotive retailer Group 1 Automotive (NYSE:GPI). Ever since I bought stock in the company early last year, it has been one of my favorite prospects and one of the best performers in my portfolio. Although I have trimmed my stake in the company recently, I do still believe that the company offers further upside from here. This is even in light of recent mixed financial results.

Great results up to this point

When I first began buying stock of Group 1 Automotive in March of last year, shares were going for just under $190 apiece. Since then, the company has seen significant upside, with shares current trading at $259.96. Naturally, this upside did not come all at once. It occurred over the span that exceeded a year. And all along the way, I remained optimistic about the enterprise. In my most recent article published about it in May of this year, for instance, I still ended up rating the business a ‘strong buy’, citing the cheap share price and continued growth as reasons for investors to be optimistic. And even since that article, the stock has continued to appreciate, getting a 17.3% return at a time when the S&P 500 has gone up only 6.7%.

Author – SEC EDGAR Data

Part of what makes Group 1 Automotive a truly remarkable opportunity is the fact that management continues to capture growth, largely by means of acquisition. Consider how the firm performed during the second quarter of its 2023 fiscal year. That’s the most recent quarter for which data has been made available. Sales for that time came in at $4.56 billion. That’s about 10% higher than the $4.15 billion the company reported one year earlier. The largest chunk of this sales increase came from the new vehicle retail sales category that management reports. Revenue shot up 21.2% year over year, soaring from $1.85 billion to $2.24 billion. A 5.9% increase in the price per unit sold under the new vehicle retail category was partially responsible for this improvement. But even more significant was the 15.2% jump in the number of units sold year over year.

On the growth side of things, it is worth mentioning that even same store data was promising. New vehicle retail sales on this basis grew 15.9%, driven by a 12.3% jump in retail new vehicle units sold and aided to some extent by a 3.9% rise in the average price per unit sold. Something that did prove to be a boon for the business with its own online digital platform. During the most recent quarter alone, management reported 12,200 vehicle sales through this channel. That’s a 78.2% increase year over year and it is more than enough evidence to see that the platform, known as AcceleRide, is a tremendous success for the company and its investors. This doesn’t mean that everything was great. Overall used vehicle retail sales, for instance, dropped 3.6% year over year. This was driven by a 4.4% plunge in retail used vehicles sold.

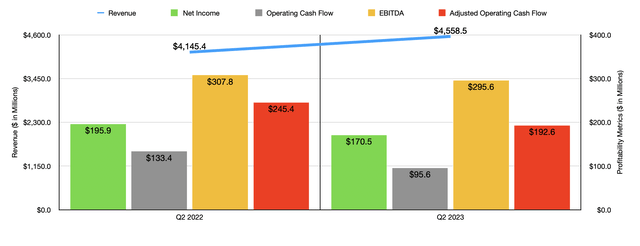

While the top line has been fantastic, the bottom line has seen some pain. Net income in the most recent quarter totaled $170.5 million. That is down 13% from the $195.9 million reported one year earlier. Other profitability metrics followed a similar trajectory, with operating cash flow dropping from $133.4 million to $95.6 million. If we adjust for changes in working capital, we would get a drop from $245.4 million to $192.6 million. Meanwhile, EBITDA for the company declined from $307.8 million to $295.6 million. This decline, even at a time when sales increased, was driven by a plunge in the gross profit margin for the company. This dropped 16.9% year over year in the second quarter for new vehicle retail sales, and it declined by 7.9% when it came to used vehicle retail sales. Lower vehicle margins that have been driven by an increase in production of new vehicles seem to be largely responsible for this.

Author – SEC EDGAR Data

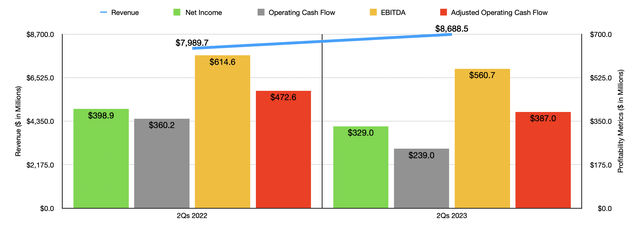

As you can see in the chart above, financial performance for the first half of 2023 looked very similar to what it did in the first half of 2022 as a whole. This shows that the recent trend of downward pressure did not begin in the second quarter alone. But the big question is whether or not there exists additional opportunities for shareholders from this point. Normally, a weakening on the bottom line should cause investors to take a more cautious approach. But as you will see, the stock still looks cheap even if recent financial performance is indicative of future performance.

Author – SEC EDGAR Data

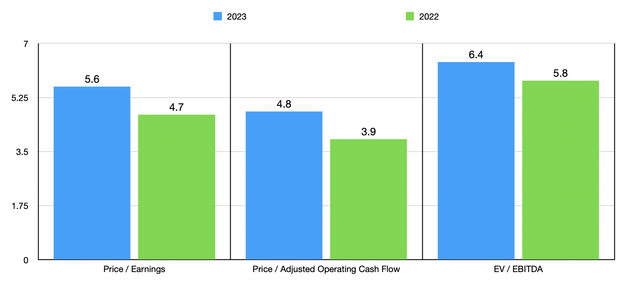

Unfortunately, management did not provide guidance when it came to the rest of the fiscal year. But if we annualize financial results achieved so far, we would expect net income for 2023 of $619.8 million. Adjusted operating cash flow would be $733.9 million, while EBITDA should be somewhere around $1.08 billion. In the chart above, you can see how shares of the company are priced on a forward basis utilizing these figures. You can also see how the stock looks through the lens of the 2022 fiscal year data. In both cases, the stock looks cheap on an absolute basis. But it also helps if shares are attractively priced compared to similar enterprises.

In the table below, you can see that I compared the company to five similar firms. Using both the price to earnings approach and the EV to EBITDA approach to valuing the company, I found that only one of the five firms was cheaper than it. And when it comes to the price to operating cash flow approach, our target was the cheapest of the group. It is likely because of how cheap shares are and because the company continues to generate attractive cash flow that management is so intent on buying back additional shares. On August 2nd of this year, for instance, the company announced that it was increasing its share buyback program. The plan has been increased by $153.7 million, taking it back to $250 million in all. Even though I am generally not a huge fan of share buybacks, when the stock is this low, it would be almost a breach of fiduciary responsibility for a business that’s generating attractive cash flows to not buy back stock.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Group 1 Automotive | 5.6 | 4.8 | 6.4 |

| Sonic Automotive (SAH) | 76.6 | 24.2 | 15.0 |

| Asbury Automotive Group (ABG) | 5.2 | 11.5 | 5.3 |

| AutoNation (AN) | 6.7 | 6.2 | 6.7 |

| Lithia Motors (LAD) | 7.6 | 24.4 | 8.5 |

| Penske Automotive Group (PAG) | 9.5 | 9.7 | 8.1 |

Takeaway

Recently, I sold off around 58% of my stake in Group 1 Automotive. However, this is not because I believe that shares are no longer attractive. Even though I acknowledge that the easy money has been made, I would argue that the stock does deserve further upside from this point. The reason for my sale was because I found some short-term opportunities that I believe could offer some nice returns. But assuming everything goes according to plan, I will eventually put some or most of the capital back into Group 1 Automotive.

Read the full article here