I’m always on the lookout for the best possible investments, and I have a strong preference for stocks with rapidly growing dividends. As a largely buy and hold investor, it gives me considerable satisfaction to possess investments that outperform the market and generate powerful dividend growth.

A well worn shibboleth states that past performance does not guarantee future results. I largely agree with that statement. Nonetheless, there is plentiful evidence that stocks that consistently outperform the S&P 500 over long time frames, when taken as a group, continue to outpace the indexes.

Add to that research showing dividend growers beat the market, and you have a recipe that often unearths solid investments.

Both of these stocks have more than doubled the returns of the S&P 500 over five and ten year periods, and these companies boast 5-year dividend growth rates in the mid to high teens or better.

Both firms reported Q2 2023 earnings early this month, and the results are well worth perusing.

And despite an economic backdrop that many believe works against these two companies’, both performed very well this year. In part, that can be attributed to the somewhat unique business models employed by the two firms.

Federal Agricultural Mortgage Corporation (AGM)

AGM provided Q2 results during the first week of this month. The company notched blockbuster results with non-GAAP EPS of $3.86 trouncing analysts’ estimates by $0.63. Revenue of $84.55 million was up by 8.3% year over year, beating consensus by $5.27 million.

Some highlights for the quarter included: $0.6 billion of new business volume in the form of servicing rights on a pool of loans serviced for others acquired during the quarter.

Net interest income up 23% year-over-year to $78.7 million, net effective spread also increased 34% from the prior-year period to a record $81.8 million, and net income of $40.4 million, up by $5.3 million from the same period last year.

Federal Agricultural Mortgage Corporation, also known as Farmer Mac, is a federally chartered corporation that provides a secondary market for loans made to borrowers in rural America.

When evaluating Farmer Mac as a prospective investment, it is essential to understand that the firm’s federal charter provides AGM with access to capital at substantially lower interest rates. Additionally losses by farmers, which are AGM’s primary clients, are mitigated by the federal government.

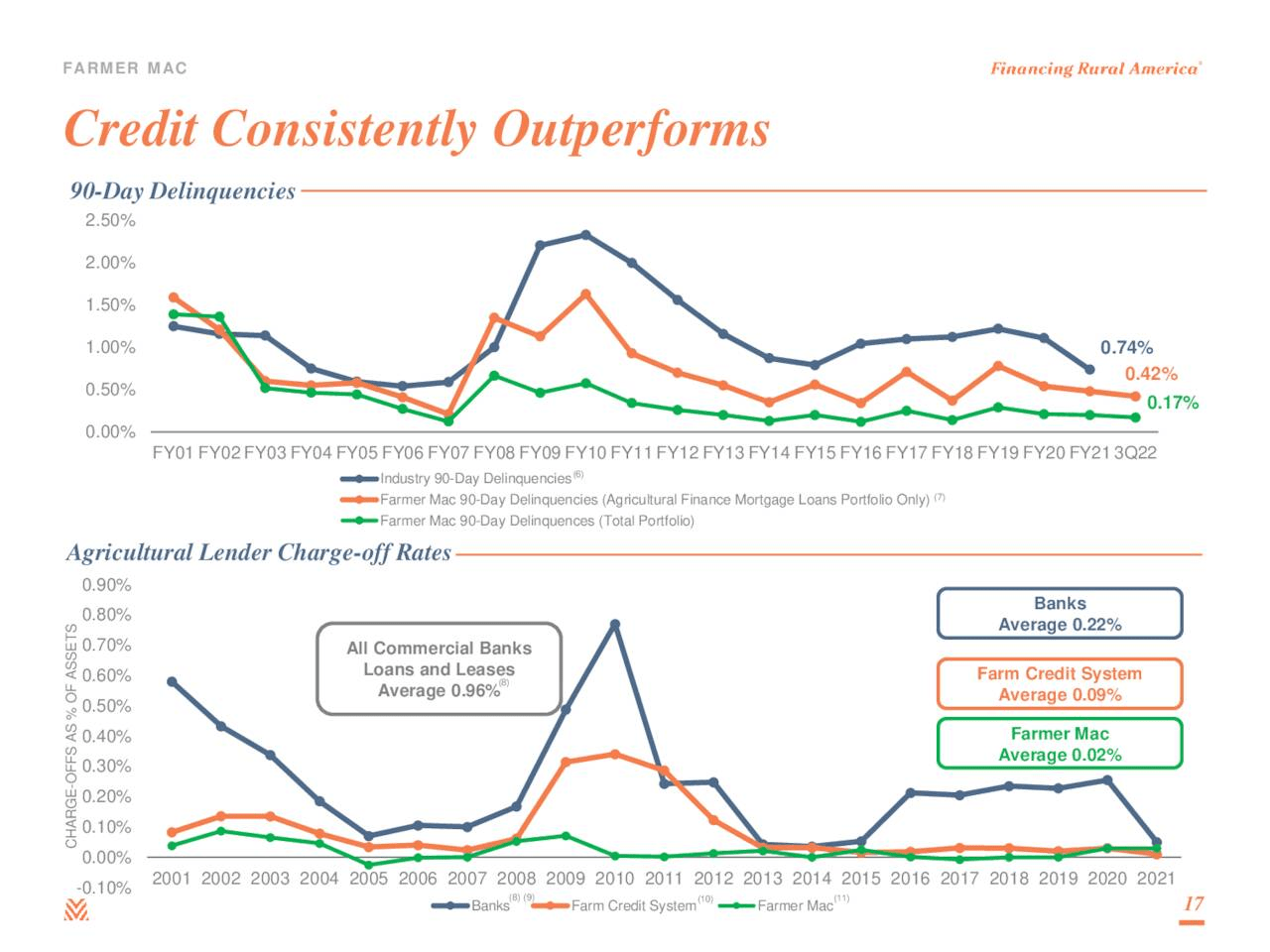

This largely explains why the company’s current 90-Day delinquency rate across all lines of business is only 0.17%. In fact, throughout Farmer Mac’s history, the company’s Agricultural Finance Mortgage Loans lifetime losses are only 0.11%, and during the most recent quarter, Farmer Mac reported zero charge offs.

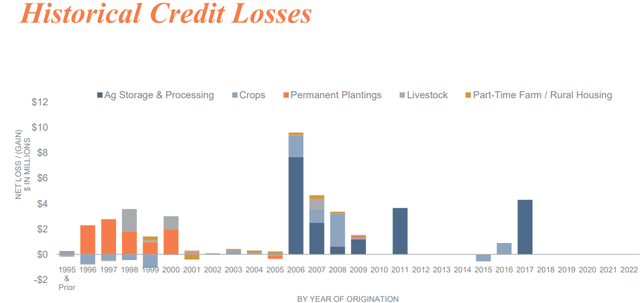

The following chart provides an overview of AGM’s credit losses over the years.

AGM Earnings Presentation

These low loss rates translate into much better charge-off rates than those recorded by banks.

Because Farmer Mac exercises very tight lending standards, the firm has never suffered delinquency or credit loss from its AgVantage securities, USDA Guaranteed Loan Programs, or its Rural Utilities program.

AGM Earnings Presentation

From 2000 through the end of 2022, AGM’s business volume increased at a CAGR of 10%. With nearly $300 million in revenue in the first two quarters of this year, Farmer Mac has already exceeded the record $275.4 revenue recorded in 2022.

From FY 2020 through last quarter, the company’s net effective spread has increased from 0.93% to 1.17%, core ROE has grown from 16% to 19%, and the stock’s book value per share is up from $60.41 to $82.71.

With a total loan portfolio of $26.7 billion, 68% is dedicated to farm and ranch, 25% to rural utilities, 6% to corporate finance, and 1% to renewable energy.

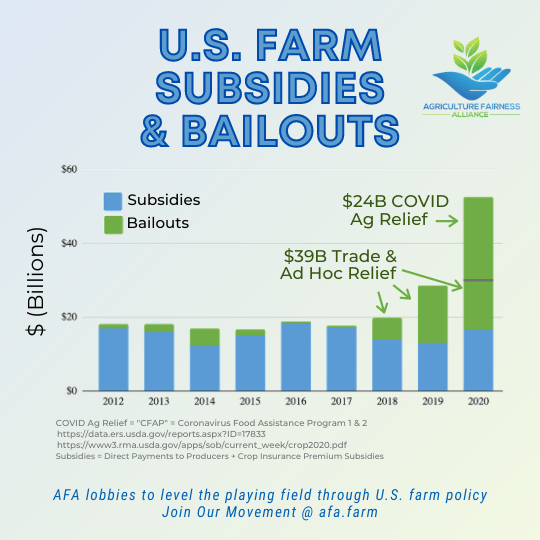

Once again, it is important to understand that the company’s risk profile is buttressed by the federal government’s support of farmers. This serves to reduce the risk related to Farmer Mac’s loan portfolio.

Source: Agriculture Fairness Alliance

It is reasonable to assume that AGM can continue to grow at a marked pace. The U.S. agriculture mortgage market stands at $349 billion, and Ag productivity must double to meet the forecast for global demand

Furthermore, Farmer Mac is targeting the markets for rural infrastructure and renewable energy as previously untapped sources of growth. Renewable electricity capacity alone is expected to grow at a 48% rate over the next half decade.

AGM is also increasing the firm’s presence in the timber industry.

As an investor that focuses on dividends, there is a good reason that Farmer Mac earned a position in my portfolio. With a current yield of 2.62%, the stock sports a 5-year dividend growth rate of nearly 17% and has a payout ratio that is a hair above 30%.

UFP Industries, Inc. (UFPI)

UFPI provided Q2 earnings early this month. The company reported a double miss with GAAP EPS of $2.36 missing by $0.03 and revenue of $2.04 billion, down nearly 30% year over year, falling short of consensus by $250 million.

However, the rather large miss in revenue can be attributed to falling lumber prices. Those lower costs were passed along to customers, so the total effect was minimal. The company did record an 8% decrease in organic sales.

Adjusted EBITDA margin improved by 50 basis points to 11.5%. UFPI also reported cash flow from operations of $321 million, a $231 million improvement over last year.

The company now has a net cash surplus of $425 million this year, compared to net debt of $191 million last year.

UFPI is a major producer of wood and wood-alternative products for the construction, industrial, retail, and international markets

The firm operates in three segments: In 2022, Retail Solutions generated $3.7 billion in sales, Construction $3.1 billion, and Packaging $2.4 billion in revenue.

Generating about 40% of revenues, the Retail Solutions segment serves the repair and remodel markets.

In Q2 of 23, the segment’s net sales of $920 million dropped 18% compared to the comparable quarter of 2022. This was due to an 18% decline in prices in the lumber market. Gross profit of $121 million increased 65% compared to the second quarter of 2022 and the gross profit margin jumped to 13.2% from 6.5%.

This segment offers pressure-treated and fire-retardant lumber products and wood plastic composites that include decking, railing systems, balusters, fencing, lattice, picnic tables and landscaping products.

Major product lines include outdoor living brands, ProWood pressure treated lumber, and Deckorators decking and railing.

The UFP Construction segment is the leading supplier to factory-built housing and single and multi-family builders. UFPI estimates it produces 45% of the roof trusses used in factory-built housing in the United States.

The segment also produces floor systems along with engineered wood and non-wood components, cut and shaped lumbers, wall panels, I-joists, plywood, and oriented strand boards.

This is in addition to the distribution of electrical, and plumbing products. The Construction segment also provides concrete forming services and commercial business units for the infrastructure and non-residential construction markets.

Construction reported Q2 net sales of $550 million, down 44% from the comparable quarter. The drop in sales was attributed to a 26% decrease in selling prices along with an 18% percent decrease in organic unit sales.

Gross profit was also down 40% to $137.2 million. This was caused by normalizing market pricing along with a decrease in volume associated with a decline in housing starts and industry production of manufactured homes.

The segment’s gross profit margin improved to 25% from 23% in 2022.

Via the Packaging segment, UFPI is the leader in industrial wood and packaging solutions. This segment provides pallets, strapping, foam, labels, corrugates, and films.

In Q2, net sales for Packaging of $488 million were down 28% year over year. This was the result of a 21% decrease in selling prices and a 9% decline in organic unit sales.

Sales from acquisitions were up 2%. Gross profit of $118.2 million dropped by 27%, due to normalizing market pricing and a decline in volume in line with market conditions.

Since 2019, value added products have constituted about two-thirds of UFPI’s total revenue.

Because lumber is a key component for many of the firm’s product lines, fluctuations in lumber prices affect UFPI’s value-added and fixed-price product lines work in opposing ways. This results in an internal hedge. Management touts how this provides UFPI a means to limit price swings in the buy and sell sides of the business.

I am attracted by UFPI’s nearly unique company culture. The company no longer requires an undergraduate degree for promotion into management positions. As of 2016, the firm has operated its own business school. Fully funded by UFPI, the UFP Business School is two years long and consists of 30 business courses.

Furthermore, every manager is required to own stock in UFPI, and every plant is a profit center. Employees receive bonuses based on the return on invested capital, which aligns employee interests with company interests.

UFPI also employs a disciplined acquisition program. The firm has a history of acquiring numerous, small, bolt-on acquisitions. In turn, this serves to drive growth and expand the company’s product portfolio and footprint.

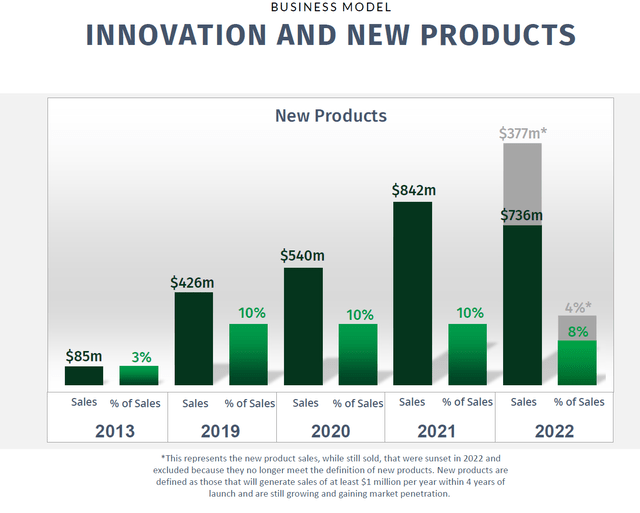

UFPI Investor Relations

UFPI just increased the quarterly dividend to $0.30 a share, a 20% increase in the quarterly rate. The board approved a new share buyback program authorizing the repurchase of up to $200 million worth of shares until the end of July 2024. This is equivalent to about 3.2% of the current market cap.

UFPI’s dividend yields 1.19%, the payout ratio is about 11%, and the 5-year dividend growth rate is 25.59%.

AGM And UFPI: Buy, Sell, Or Hold?

I consider both companies to be very solid long term investments.

If AGM was a bank, its loan losses would be considered phenomenal. In part, this is because the company benefits from federal programs that serve to mitigate losses by farmers. Furthermore, AGM’s federal charter provides access to capital at substantially lower interest rates.

Folks gotta eat, and population growth means there is an ever increasing demand for Ag products. This provides a rather transparent long term growth runway for AGM.

I view UFPI as having an exceptional leadership team. While construction activity could wane over the short term, a lack of housing, combined with aging housing stock and rising rents, should provide long term demand for the company’s products.

I rate AGM as a solid Hold. A low double digit drop in the share valuation would likely lead me to add shares.

I rate UFPI on the weaker end of a Buy.

I have a position in both companies that I initiated over the last few weeks.

Read the full article here