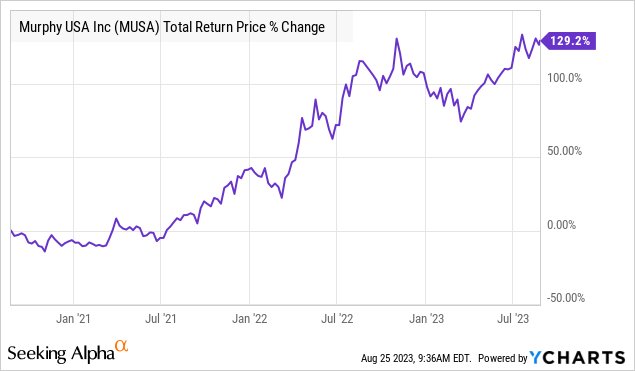

Murphy USA Inc (NYSE:MUSA) is a fuel retailer with a network of 1,725 gas stations and convenience stores between the “Murphy” and “QuickChek” brands. Following a record 2022 defined by elevated gasoline prices, the story this softer fuel demand amid a shift in the macro environment.

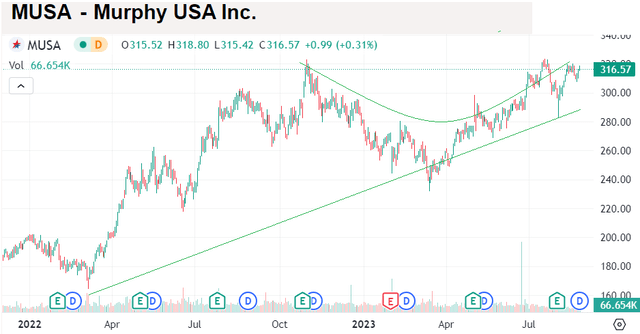

At the same time, Murphy has managed to outperform with shares currently trading near an all-time high supported by impressive operating and financial execution. The company’s Q2 earnings report was highlighted by solid margins, particularly through merchandise sales benefiting from a continued expansion effort with new store locations.

While MUSA offers a modest 0.5% dividend yield, the quarterly rate has climbed by 22% over the past year and we see room for further hikes supported by underlying cash flows. We are bullish on the stock and expect more upside going forward.

MUSA Q2 Earnings Recap

Murphy USA reported Q2 EPS of $6.02, coming in $0.04 ahead of estimates, but also down from $7.53 in Q2 2022. There are several moving parts here, and we’ll try to unpack the key metrics.

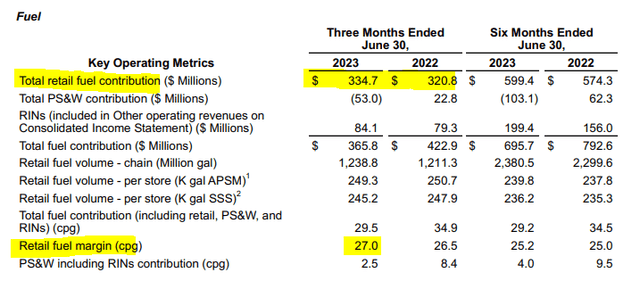

Even with the large drop in gasoline prices compared to the record in the period last year, total retail gallons sold climbed by 2.3%, reflecting the addition of 30 new stores opened over the period. This helped balance a -1.8% decline in same-store-sales (SSS).

More favorably, the retail fuel margin at 27 cents per gallon, climbed from 26.5 in Q2 2022. The effort was good enough for the total retail fuel income contribution to increase by 4% to $334.7 million.

So to reconcile the fuel numbers, the biggest difference compared to last year is that the smaller pipeline, supply, and wholesale ((PS&W)) segment represented a cost center this quarter compared to the exceptional positive contribution in Q2 2022. This side of the

source: company IR

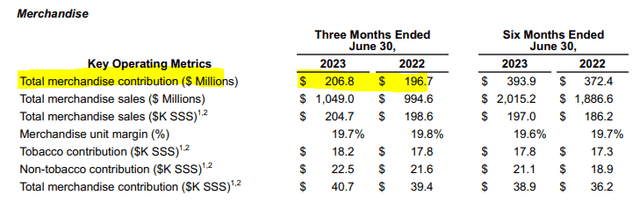

That momentum is carried over into the merchandise segment based on sales of convenience items and tobacco products at the stores. The total merchandise contribution of $206.8 million was up 5.1% y/y including a 2.7% increase in same-store sales.

source: company IR

What’s Next For MUSA?

Overall, the takeaway is that despite the lower headline earnings compared to an exceptional 2022, the results this quarter are seen as strong because Murphy USA continues to capture income growth from its core operations as a consumer-facing fuel retailer. The variability is more related to volatile commodity fuel prices outside the company’s control and doesn’t diminish the more structural tailwinds.

The strong point here is the relative stability of the broader operation with customers attracted to Murphy’s everyday low prices enhanced by the combination of high-quality service and even a loyalty program. This was a theme discussed by management during the earnings conference call:

As managers and owners of the business who are truly invested for the long term, while the exceptional 2022 results present a challenging comp, we are encouraged by the higher earnings power and cash flow generation of the business in a highly stable environment and the significant upside potential for outsized earnings and cash flow when volatility returns.

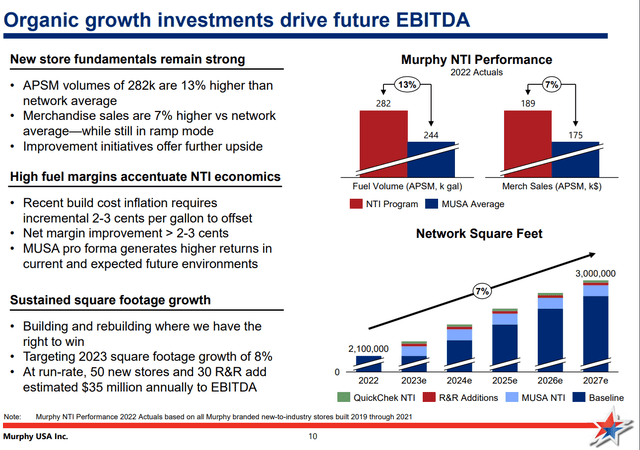

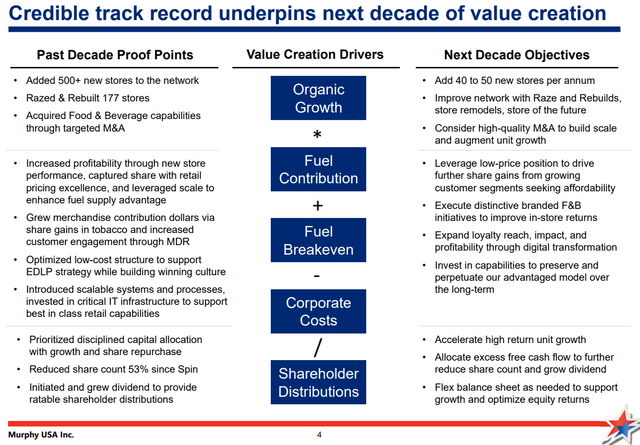

A theme for the company has been continued market share gains relative to the industry. Convenience stores and even gas stations nationally remain highly fragmented when a majority of single-store operators. The advantage to Murphy is its ability to keep investing in growth while benefiting from the wide scale.

Recent data suggests its new-to-industry (NIT) stores being the new locations opened tend to outperform its network average in terms of fuel and merchandise sales. With plans to grow total retail square footage by more than 40% through 2027, the runway here is for higher margins and EBITDA strength.

This follows current 2023 guidance to open up to 45 new stores this year, along with “raze and rebuild” up to 30 locations. A target for the full-year merchandise contribution between $795 and $815 million, if confirmed, would represent an increase of 5% compared to 2022.

source: company IR

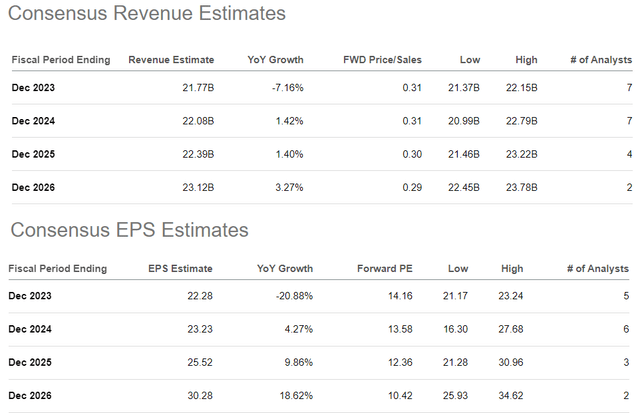

Looking ahead, the setup here considers 2023 as a transitional year within the long-term growth trajectory. According to consensus estimates, Murphy is expected to again generate top-line and earnings growth by 2024 through fiscal 2026.

Seeking Alpha

MUSA Dividend

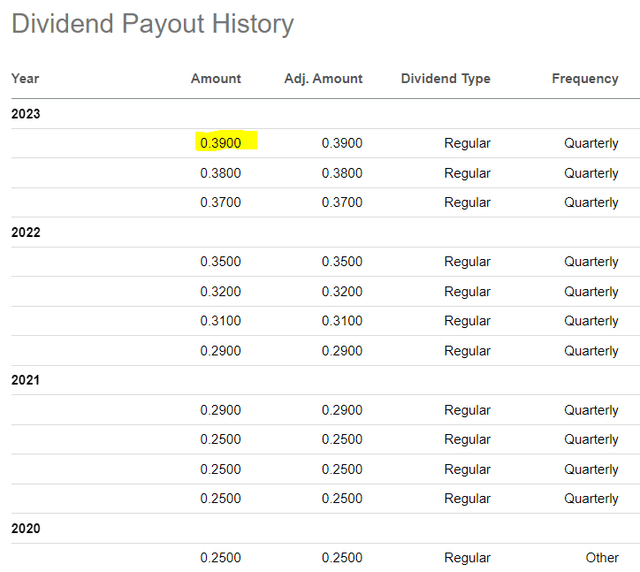

The backdrop is positive for MUSA shareholder distributions. We mentioned the company just hiked its dividend, an increase of 2.6% to a new quarterly rate of $0.39 per share.

MUSA stands out as something of an outlier in the market, increasing its dividend in each of the last six quarters since Q2 2022 following the initiation of a regular payout in late 2020.

While it’s unclear if the Board of Directors intends to keep this quarterly pattern going, we expect at least annual increases in line with the earnings trend.

source: company IR

The annualized rate of $1.56 represents a payout ratio of just 7% on the 2023 consensus EPS, which is a conservative level offering the company plenty of flexibility to not only fund organic growth opportunities but also consider share repurchases. Year to date, Murphy has bought back approximately $108 million worth of stock within a remaining $680 million authorization active through 2026.

We estimate MUSA offers a forward “shareholder yield” approaching 4% considering both the buyback and dividend.

source: company IR

MUSA Stock Price Forecast

There’s a lot to like about MUSA as a pure play on fuel marketing and convenience retail. This is in contrast to other large-scale gas station operators that also deal with broader downstream refining operations like Valero Energy (VLO) or PBF Energy (PBF).

The attraction here is that Murphy USA’s streamlined operation allows it to focus on its core strengths by avoiding the more capital-intensive logistical side of energy, while generally less exposed to commodity price volatility.

On the retail side, keep in mind that the same-store-sales merchandising gains this last quarter come during a period when the broader retail industry including giants like Walmart Inc (WMT) and Target Inc (TGT) are facing a challenging consumer spending environment. By this measure, we can say that convenience stores have been a strong point in the economy MUSA is capitalizing on.

With shares trading above $300, we believe the next leg higher will be defined by the market rewarding the stock with a quality premium. A scenario where economic conditions rebound through 2024, supported by easing inflation indicators and stabilized interest rates, should be positive for the operating environment.

The bullish case for MUSA is that the U.S. economy remains resilient while consumer spending strengthens, opening the door for the company to exceed current market earnings estimates over the next several quarters.

On the other hand, a scenario where macro conditions deteriorate further, defined by a sharp slowdown in consumer spending and even weaker fuel demand represents a risk to watch. Monitoring points here beyond economic indicators include the company’s contribution margin and progress in opening new store locations.

Seeking Alpha

Read the full article here