Introduction

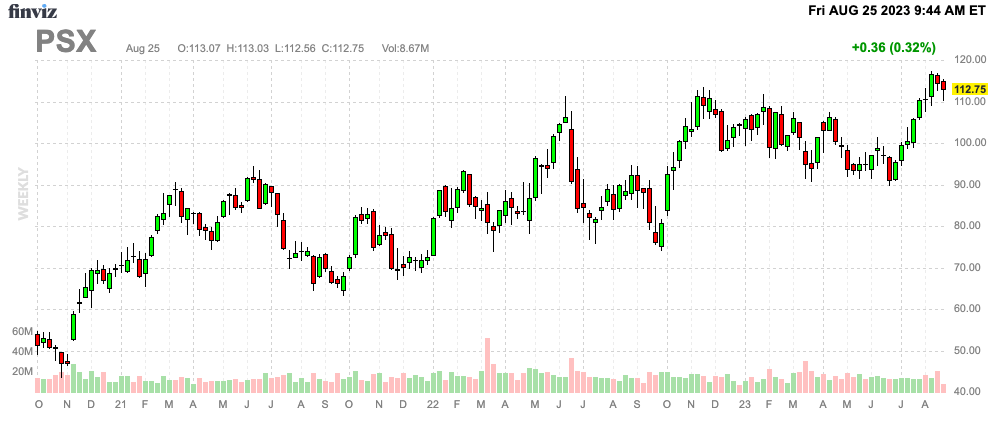

In May, I wrote an article titled Phillips 66: Harvesting Juicy Energy Dividends. Since then, the stock has risen by 23%, almost hitting my first $120 target in recent days.

FINVIZ

Hence, in this article, we’ll take a closer look at the attractiveness of Phillips 66 (NYSE:PSX) in light of the new risk/reward. After all, the yield has now come down to 3.7%, which isn’t that juicy anymore.

So, without further ado, let’s keep this intro short and get right to it!

A Well-Diversified Downstream Giant

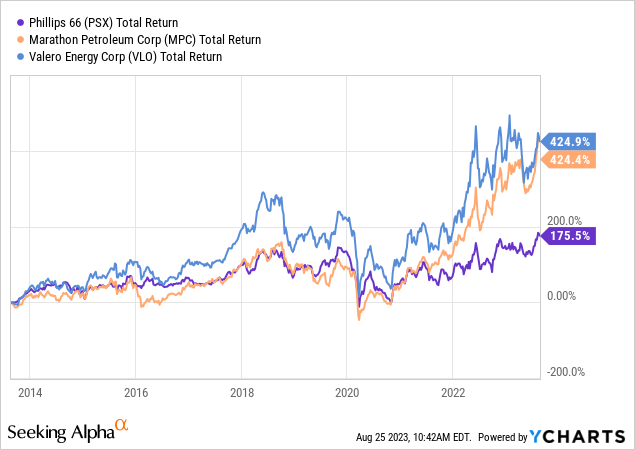

With a market cap of $50 billion, Houston-based Phillips 66 is one of America’s three major pure-play refinery stocks. Its main peers are Valero (VLO) and Marathon Petroleum (MPC). I’m saying pure-play because it also has competition from integrated oil and gas companies like Exxon Mobil (XOM), Chevron (CVX), and others.

One of the reasons why PSX has lagged behind its peers is its focus on other areas. As I wrote in my prior article, the company generated 66% of its full-year 2022 revenues in the Marketing & Specialties segment, followed by Refining (25%) and Midstream (9%).

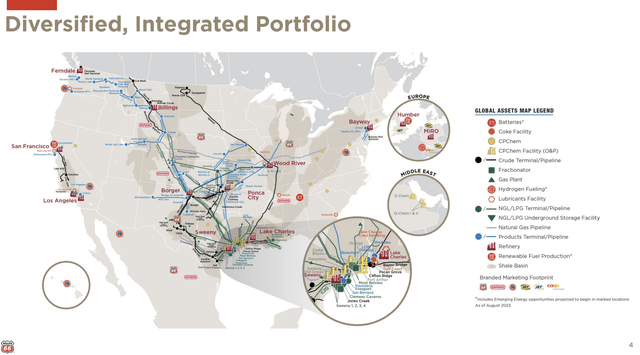

As a result, it has one of the most well-diversified portfolios among its peers – anywhere in the world. This includes major operations on the Gulf Coast and a pipeline network connecting other facilities to customers. On the Gulf Coast alone, it has the capacity to process more than 520 thousand barrels of crude per day.

Phillips 66

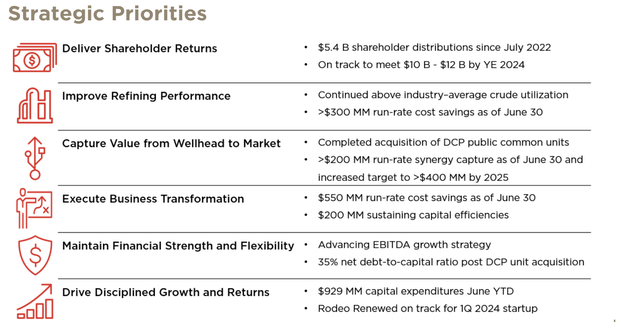

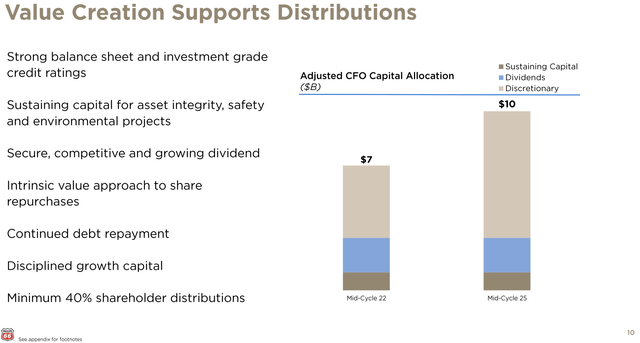

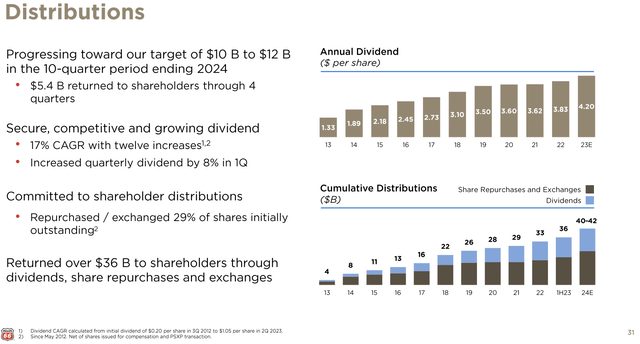

With regard to its strategic priorities (as seen in the overview below), over the past year, the company returned 14% of its market capitalization ($5.4 billion) to shareholders through dividends and share repurchases.

The company is on track to achieve the goal of returning $10 to $12 billion over the 10-quarter period from July 2022 to year-end 2024.

Phillips 66

The Refining segment contributed significantly to the cost savings that make this possible, with over $300 million of the $550 million run-rate savings attributable to Refining operations.

Furthermore, according to the company (emphasis added):

We’re executing our NGL wellhead to market strategy and capturing DCP integration synergies faster than expected. Our current synergy run rate is over $200 million. We’ve been successful in identifying additional opportunities to increase our target from $300 million to more than $400 million by 2025. In June, we completed the acquisition of DCP Midstream’s public common units for $3.8 billion, increasing our economic interest from 43% to 87%. We ended the quarter with a net debt-to-capital ratio of 35%. We expect leverage to be within our target range by year-end.

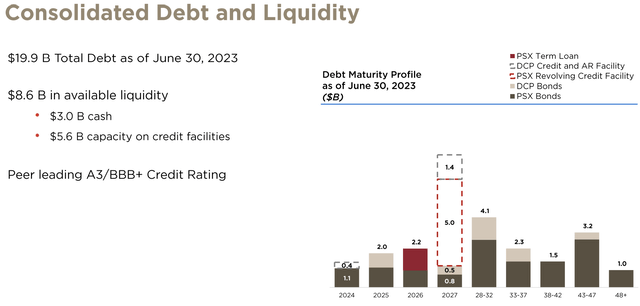

A closer look at its balance sheet shows that the company has $8.6 billion in available liquidity, $3.0 billion of this coming from cash. Its net debt ratio is close to 1.2x (EBITDA) and is expected to remain subdued. Hence, it has an A3/BBB+ credit rating.

Phillips 66

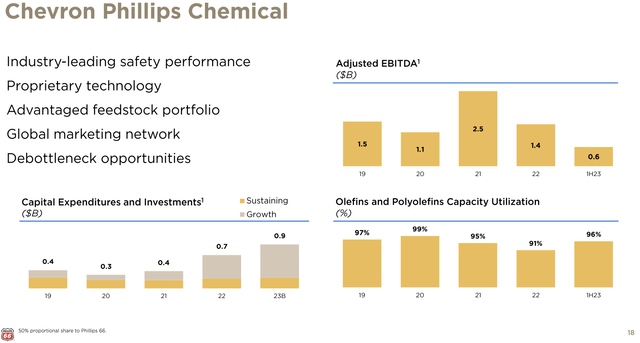

Furthermore, in addition to advancing the renewable fuels project at its San Francisco refinery to produce 50,000 barrels per day of renewable fuels, the company is seeing improvements in its Chemicals segment.

During its 2Q23 earnings call, the completion of the 1-hexene unit in Texas and the impending start of operations by the end of the third quarter were mentioned.

Additionally, the new propylene splitter at the Cedar Bayou facility is expected to begin operations in the fourth quarter.

Please note that the company’s chemical operations under CP Chemical are a joint venture between Phillips 66 and Chevron. As seen in the overview below, this segment is seeing a steep increase in CapEx to grow the segment more rapidly in the future – hopefully with economic tailwinds.

Phillips 66

The company is also actively engaged in joint ventures with Qatar Energy to establish significant petrochemical facilities in the U.S. Gulf Coast and Qatar.

PSX Dividends & Buybacks

Phillips 66 currently pays a $1.05 dividend per share per quarter. This translates to a yield of 3.7%.

This dividend is protected by a 21% net income payout ratio, a healthy balance sheet, and a boatload of free cash flow.

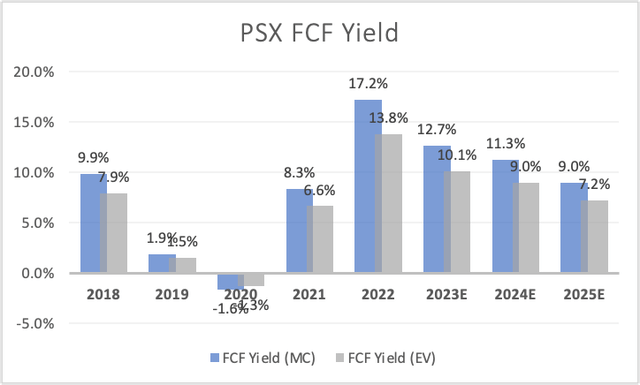

The company is expected to maintain a free cash flow yield of over 9% through 2025 – despite an expected moderation in free cash flow. Even including net debt (FCF/EV), that ratio remains elevated.

Leo Nelissen (Based on analyst estimates)

The chart below confirms this, as dividend payments are just a very small part of operating cash flow. The biggest part is spending on growth.

Even sustaining CapEx is very low, which means once growth spending declines, free cash flow is likely to accelerate.

Phillips 66

Additionally, the company has a history of buybacks. Since the spin-off from ConocoPhillips (COP), the company has spent more on buybacks than dividends, buying back close to 30% of its shares.

Phillips 66

The five-year dividend CAGR was 6.6%. The most recent hike was 8.2% on February 8, 2023.

Recent Events & Valuation

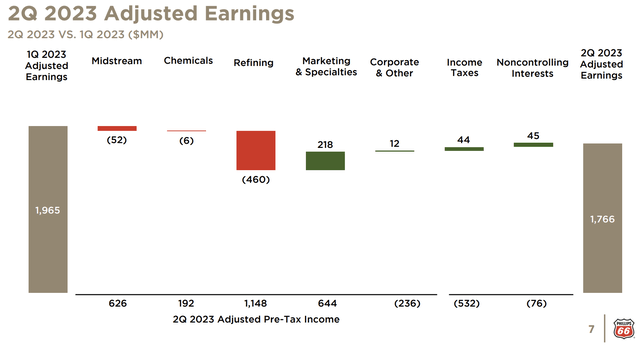

Adjusted earnings decreased by $199 million during the second quarter, primarily due to lower results in Refining and Midstream.

Phillips 66

While Refining’s adjusted pretax income decreased by $460 million, Midstream’s adjusted pretax income was down $52 million due to declining commodity prices in the NGL business.

Chemicals’ adjusted pretax income decreased by $6 million.

Marketing and Specialties, however, experienced a $218 million increase in adjusted second-quarter pretax income due to higher global marketing margins.

Going forward, in Chemicals, a mid-90s global O&P utilization rate is expected in the third quarter.

For Refining, a mid-90s worldwide crude utilization rate is expected, along with projected turnaround expenses of $110 to $130 million.

Corporate and Other costs for the third quarter are estimated to be between $280 million and $300 million.

During its earnings call, the company also mentioned that the full-year capital spend is expected to exceed the $2 billion budget due to additional spending on projects like Rodeo Renewed and the recent acquisition of West Coast marketing assets.

While margin normalization is somewhat hurting refining income and slower economic growth should keep a lid on organic growth in chemicals, the company remains in a good spot.

The company is trading at 8.9x 2024E free cash flow. Using the 10x multiple I applied in the past gives us a 13% upside.

The current consensus price target is $127. That’s 12% above the current price, in line with my target.

However, I wouldn’t jump into PSX at these prices. While I will apply a Buy rating, the recent stock price jump has lowered the dividend yield to 3.7%. That’s not a lot, given the cyclical risks that come with it – despite consistent dividend growth.

If I didn’t own Valero already, I would be looking to buy PSX for close to $100 per share.

Given the weakness in economic growth, I do not rule out reaching that target.

Takeaway

Phillips 66, with its diversified downstream portfolio and strategic priorities, stands as a significant player in the industry.

The company’s well-managed balance sheet, commitment to shareholder returns, and ongoing projects underscore its resilience.

However, the recent price surge prompts caution, as the cyclical nature of the energy sector calls for prudent evaluation of the risk/reward.

While my Buy rating is maintained, the current dividend yield may not satisfy income-focused investors.

Should the market offer an opportunity to buy shares around $100, the cyclical risks might be better cushioned.

As economic uncertainties persist, the journey to that mark could well be worth the wait.

Read the full article here