Introduction

iTeos Therapeutics (NASDAQ:ITOS), a clinical-stage biopharmaceutical company, focuses on advancing immuno-oncology treatments for cancer patients. Building on their expertise in tumor immunology and immunosuppressive pathways, they’ve developed innovative therapies aimed at revitalizing the immune response against cancer. Their lead product, EOS-448 (or belrestotug), is an antagonist of TIGIT, with a recent collaboration with GlaxoSmithKline (GSK) to further its development. Another notable candidate, inupadenant, addresses tumor microenvironment immunosuppression.

Recent developments: Earlier this week, Roche (OTCQX:RHHBY) accidentally shared interim SKYSCRAPER-01 study data on its anti-TIGIT therapy, tiragolumab combined with Tecentriq. Preliminary results showed a 19% reduction in death risk and improved median overall survival, but the final analysis on overall survival remains pending.

The following article discusses iTeos Therapeutics’ financial position, collaborations, and its focus on TIGIT-targeted cancer therapies, with an investment recommendation as speculative “Buy.”

Q2 2023 Earnings

Looking at iTeo’s the most recent earnings report, the company’s cash and investment position stood at $677.5M as of June 30, 2023, down from $791.9M a year prior. However, it foresees the cash balance sustaining until 2026. R&D expenses rose to $29.2M for the quarter and $54.9M over six months, primarily driven by projects like belrestotug, inupadenant, and EOS-984. G&A expenses reached $13.4M for the quarter and $25.4M for the half-year, due to increased headcount and associated costs. A notable shift was seen in the net income/loss, with a loss of $34.3M for the quarter and $49.9M over six months, compared to a profit the previous year that was a result of GSK’s $625M upfront collaboration payment.

Liquidity & Cash Runway

Turning to iTeos Therapeutics’ balance sheet, the company had cash and cash equivalents of $216.2M, short-term investments of $383.0M, and long-term investments of $78.3M as of June 30, 2023. This sums up to a total of $677.5M in liquid assets. For the six months ended June 30, 2023, the company’s net cash used in operating activities was $56.1M. Dividing this by six months, the average monthly cash burn rate is $9.35M. Consequently, by dividing the total liquid assets of $677.5M by this monthly cash burn rate, the estimated cash runway for iTeos Therapeutics is about 72 months, or 6 years. However, these estimates are my own and may differ from other analyses. Furthermore, this does not take into account expected OpEx increases associated with advancing clinical drug to larger trials. With a significant amount of liquid assets and a manageable burn rate, iTeos appears to be in a strong liquidity position. Their total current liabilities stand at $30.0M, suggesting the company has ample coverage for its short-term obligations. While their cash position seems solid, it is crucial to monitor the company’s future burn rate and revenue streams to assess any potential need for additional financing.

Valuation, Growth, & Momentum

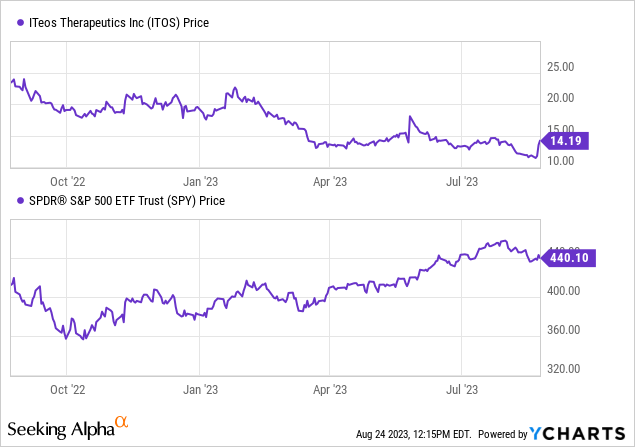

According to Seeking Alpha data: iTeos maintains a cash position that is significantly larger than its market capitalization and a small amount of debt. The enterprise value stands at -$110.72M, suggesting an unusual capital structure given the high cash reserves. In terms of valuation, standard metrics like P/E and EV/EBITDA are not meaningful as the company is pre-revenue. Growth outlook demonstrates increasingly negative EPS in the coming years, as the company is anticipated to have rising R&D expenses due to maturing clinical candidates. Momentum for the stock is negative over various periods, trailing the broader market (S&P 500) by a significant margin. Over the past year, the stock has declined by -42.33% while the S&P 500 has risen by 7.44%.

Advancements in Modulating TIGIT for Enhanced Immune Response

TIGIT functions similarly to a dimmer switch for our immune cells, notably T cells and NK cells. When this “dimmer” is heightened, it weakens the body’s natural defense against tumors. This muted response makes it harder for the immune system to recognize and fight cancers. Interestingly, some cancer cells amplify signals that intensify TIGIT’s dampening effect, cleverly eluding detection.

Roche’s tiragolumab and iTeos Therapeutics’ EOS-448 are drugs developed to target and modulate TIGIT. Their aim is to lower this “dimmer switch,” thereby strengthening the immune system’s response to cancer. Roche accidentally disclosed data indicating that patients given tiragolumab alongside another drug, Tecentriq, experienced a 19% reduction in death risk compared to those only treated with Tecentriq. This combination treatment increased the median overall survival rate to 22.9 months, in contrast to 16.7 months with only Tecentriq.

Roche’s data reveal underscored the potential of all TIGIT-targeting therapies, resulting in a surge of over 15% in iTeos’ stock value. The investor excitement suggests a growing belief in the transformative potential of TIGIT-focused therapies in cancer treatment.

iTeos, partnering with GSK, is also delving into the TIGIT domain with their drug candidate belrestotug (EOS-448). This pioneering anti-TIGIT monoclonal antibody is currently in multiple clinical trials, being tested in combination with agents like dostarlimab to treat various cancers. These include advanced non-small cell lung cancer, advanced head and neck squamous cell carcinoma, and certain advanced solid tumors. Furthermore, a Phase 1/2 trial is examining belrestotug as a standalone treatment and in combination with Bristol-Myers Squibb’s (BMY) iberdomide for multiple myeloma. The results of these studies are eagerly awaited in 2024.

My Analysis & Recommendation

Reflecting upon the intricate landscape of iTeos Therapeutics and the broader immuno-oncology industry, several elements warrant close attention, particularly for potential investors.

Firstly, the company’s negative enterprise value presents a unique opportunity, painting a financial picture where the firm’s cash and investment holdings surpass its combined equity and debt value. This rare situation, in the absence of obvious red flags, is indicative of the market’s potential undervaluation of the company or a bearish sentiment around its prospects. Given this, there exists an opening for value investors looking to capitalize on companies with sound financial footing, especially in a volatile industry like biopharma.

Secondly, iTeos’ collaboration with pharmaceutical giant GSK is a noteworthy validation of the company’s strategic direction and its leading candidate EOS-448. Partnerships with industry behemoths like GSK usually entail rigorous due diligence, further substantiating the potential of iTeos’ investigational treatments. Given the increasing enthusiasm surrounding TIGIT as a therapeutic target—evidenced by Roche’s accidental revelation and the subsequent upward surge in iTeos’ stock—it becomes apparent that the domain is garnering significant interest.

Lastly, with a six-year cash runway, iTeos is poised to conduct its research and trials without the immediate pressure of raising capital. Such a long runway provides the company with the financial stability to bring EOS-448 to completion, especially with upcoming results awaited in 2024.

Weighing the aforementioned rationales, and considering the current positioning of the company in an industry on the cusp of transformational breakthroughs, my investment recommendation for iTeos Therapeutics is a speculative “Buy”. Investors are advised to proceed with caution and consistently monitor the company’s clinical advancements, particularly surrounding the TIGIT domain, as these will be instrumental in determining the company’s long-term viability.

Risks to Thesis

When the facts change, I change my mind.

While I recommend a speculative “Buy” for iTeos Therapeutics, several risks might contradict this recommendation:

- Clinical Trials Uncertainty: Clinical studies are inherently risky. Promising early-phase results don’t always translate to successful Phase 3 trials or regulatory approvals. Importantly, Roche’s anti-TIGIT may fail to meet its primary endpoint (overall survival), prompting downward pressure on other biotechs, like iTeos, developing anti-TIGIT therapies.

- Competition: While Roche’s data is promising for TIGIT-focused therapies, it also means increased competition. If Roche’s drug gets to the market first or shows better efficacy, it could overshadow iTeos’ product. Other companies also developing anti-TIGITs.

- Cash Burn: The 6-year cash runway is a projection based on current spending. If unexpected costs arise or trials need to be expanded, the runway might shorten considerably.

- Stock Performance: The recent downward trend in iTeos’ stock indicates market skepticism. If this negative sentiment continues, it might impact the company’s ability to raise funds in the future.

- Reliance on Partnerships: While the GSK collaboration is a vote of confidence, it also means iTeos might be somewhat dependent on GSK’s decisions regarding the EOS-448 development.

Read the full article here