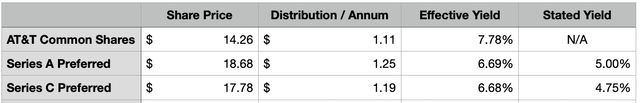

Those who follow my work closely understand that one of the companies I feel most strongly about, in a positive way, is telecommunications conglomerate AT&T (NYSE:T). As of this writing, it is the largest holding in my super concentrated portfolio, accounting for 18.6% of my assets. Clearly, I am bullish about the firm. While I do own the common shares of the company, one thing that is often overlooked is the fact that investors do have other ways that they can invest in the company. In addition to buying debt that the company has issued, there is also the opportunity to invest in the preferred shares of the business, such as the Series A Perpetual Preferred Stock (NYSE:T.PR.A) and the Series C Perpetual Preferred Stock (NYSE:T.PR.C). While I would definitely make the case that the preferred units do have attractive upside potential from here, if you are trying to decide whether to buy them or the common shares, my overall opinion is that the common is vastly superior.

Understanding the preferred units

For the purpose of this article, my emphasis is primarily on the Series A Perpetual Preferred stock and the Series C Perpetual Preferred stock of AT&T. For the sake of brevity, I will refer to them as Series A and Series C, respectively. Technically, each of these issuances of stock is worth $25,000 per unit. However, investors have the ability to purchase depositary shares that each represent 1/1,000th of an interest in the units. This translates to a $25 per unit liquidation value, which means that if they are ever bought back by the company or the company ever goes bankrupt, the holders of the units would be entitled to the full $25 for each share they have before the common shareholders get anything.

This seniority is one reason why investors sometimes gravitate toward preferred stock. I can definitely understand that. If your goal is safety above all else, preferred stock is rarely a bad idea to pick up over the common. But the downside to this is that the preferred units don’t really have any upside beyond the $25. And this is because holders of them are not entitled to the profits and cash flows that common shareholders get. It is also worth noting that another benefit to owning the preferred units is that holders get their distributions before common shareholders get a single red cent. So it is not an impossible scenario that the management team at AT&T could cut, perhaps even entirely, the common distribution and yet still pay out the preferred holders. For context, the Series A has a fixed distribution of 5% per annum, while the Series C has a distribution of 4.75% per annum.

The common makes a lot more sense

Unless your primary objective is safety above all else, I would argue that the common stock of AT&T is definitely superior to the preferred units. The entitlement to the upside of the company as it grows and as the distribution hopefully increases are a couple of reasons why. For instance, even if you assume that the common units of the conglomerate are fairly valued, in a hypothetical scenario where, over the next five years, cash flow increases by 30%, you should theoretically see a 30% increase in share prices. If over the next decade you see a doubling of cash flows, you should see the stock double as well. Meanwhile, the preferred units will only ever be able to move up to around $25, capping upside and resulting in only the distribution offering a return for shareholders.

It is important to note, however, that one positive to the preferred units is that they have, in most cases, less downside. Even in a volatile market, preferred units will almost always see less downside than the common stock would. As an example, we need only look at performance over the past year. For instance, over that window of time, shares of AT&T have dropped 21.4%. By comparison, the Series A have declined 14.5%, while the Series C have dropped 10.8%.

Author – SEC EDGAR Data

The good news for preferred holders is that there does seem to be some upside potential in the preferred stock at the moment. The Series A units, for instance, are trading at $18.68, while the Series C can be picked up for $17.78. This implies upside between what prices are today and the liquidation value of 33.8% and 40.6%, respectively. And by buying the units on the cheap, you have the ability to lock in a higher effective yield. For the Series A, that yield is 6.69%. And for the Series C, it’s only marginally lower at 6.68%. By comparison, however, the common stock currently is yielding 7.78%. So in addition to offering more upside from an appreciation perspective, it also offers higher payouts.

Those who disagree with my assessment of the picture would accurately point out that some risk exists regarding a distribution cut for the common units. Given that the company pays out only about $200 million to preferred shareholders each year, it is very unlikely that management would ever opt to stop paying distributions on the preferred units unless the company was on the verge of bankruptcy. However, the current distributions on common shares cost the business around $8 billion each year. That’s a lot of capital that could be trimmed off for other purposes like debt reduction.

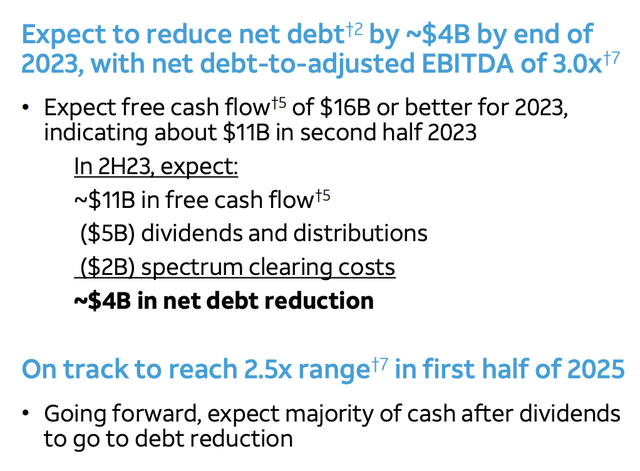

Personally, I believe that prognostications of a distribution cut for the company are, frankly, balderdash. There’s nothing in the fundamental data to suggest that this is even a remote possibility. Consider expectations for the current fiscal year. In the first half of the year, the management team at AT&T was successful in generating free cash flow of roughly $5.2 billion. Higher levels of capital expenditures that were front loaded to the first half of the year were responsible for keeping this number lower than it otherwise might have been. However, management is forecasting $11 billion in free cash flow for the second half of the year, bringing total free cash flow up to $16 billion. In fact, it might even come in higher than that.

AT&T

From this $11 billion, about $2 billion will be allocated toward spectrum clearing costs. Another $5 billion will be allocated toward dividends and distributions. This will still leave the company with $4 billion that it can allocate toward net debt reduction. Absent something extreme coming out of the woodwork, I cannot fathom a scenario where management would elect to slash the distribution when it clearly has an extra $4 billion that it can use to pay down debt to some extent.

This brings me to the other argument that I have seen the bears bring up. And this is that AT&T has ‘too much debt’. This is, quite frankly, an absurd notion. The amount of debt that is acceptable is relative to the overall cash flows of the company in question. Using the amount of debt currently outstanding, and assuming that the company should generate around $44 billion worth of EBITDA this year, we end up with a net leverage ratio of 3.04. If management comes through on reducing debt by another $4 billion before the year is out, this would bring net debt down to $129.8 billion. That translates to a net leverage ratio of 2.95. To put this in perspective, using the same methodology, the current net leverage ratio for rival Verizon Communications (VZ) is 3.10. Another competitor, T-Mobile (TMUS), is a bit lower, with a net leverage ratio of 2.54. However, the management team at AT&T claimed that they are on track to reach the 2.5 range by the first half of the 2025 fiscal year. Honestly, I wouldn’t be surprised if, once we get to that point, the distribution starts to increase.

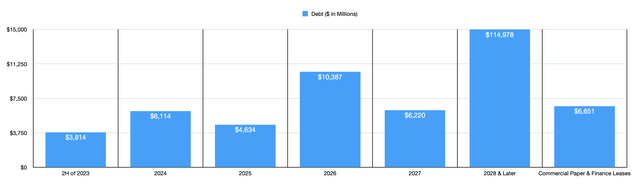

One argument that I have seen regarding the debt picture is that the company does have certain debts coming due. That’s true, but I would argue that those are the same debts that are going to be paid back. It is unlikely that management will have to refinance any upcoming debts. The argument is that, if the company is stuck refinancing debt, it may have to deal with higher interest rates because of the high interest rate environment and because of the amount of leverage the business currently has. But to me, this is a moot point. For the second half of the 2023 fiscal year, for instance, $3.81 billion worth of debt is coming due. Another $6.17 billion comes due next year.

Author – SEC EDGAR Data

Even if free cash flows flatline, which I don’t think will happen because I believe that they will increase from here, the company should be able to cover around $7 billion to $8 billion worth of debt reduction each year. So in addition to covering what is coming due in 2023 and 2024, it can easily cover the $4.63 billion that comes due in 2025. 2026 is a bit of a difficult year because $10.39 billion comes due. But with the small amount that the company has to pay off in 2025, it should have more than enough excess cash flows to meet its obligations. This continues in following years, such as 2027 when the amount of debt that comes due should be $6.22 billion. It is important to note that I am excluding from all of these figures the credit facilities that the company has. I don’t think that there will be an issue with rolling those over and any interest rate increase experienced from those should not be terribly significant in size.

Takeaway

If your goal is to get solid returns with a tremendous amount of safety, opting for preferred units can make sense. But if you prefer an investment that has a bit more risk with significantly more upside, I would argue that the common units in this case are the most logical. Claims that the company might have to cut the common distributions make no sense when you think about the picture objectively. Debt is not significant relative to the cash flows the company generates. And that debt is decreasing. On top of this, the common units currently have a higher yield than the preferred ones do and you can capture greater upside as shareholders benefit from the companies continued growth and cash flow generation. Given all of these factors, I still believe that AT&T is a ‘strong buy’ candidate at this time, though I definitely would admit that the preferred units are both ‘strong buy’ candidates as well, even if they might not be as appealing as the common shares.

Read the full article here