Looking for a high-yield tech vehicle? It may be time to investigate Digital Realty Trust, 5.85% Series K Cumulative Redeemable Preferred Stock (DLR.PR.K). These preferred shares are amply covered by earnings and cash flow from Digital Realty (NYSE:DLR).

Company Profile:

DLR is one of the world’s leading data center REITs with more than 300 centers in 24 countries, serving more than 5,000 customers on six continents. DLR serves large, well-known mega corps, as well as hundreds of lesser-known companies. When you consider how much video streaming, mobile data traffic, gaming, etc., is going on these days, it’s easy to see why DLR’s customers need more data center space.

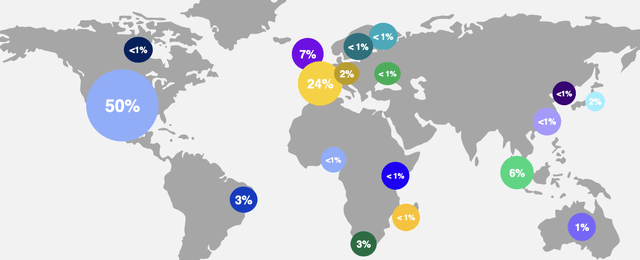

50% of DLR’s currency exposure is in the US, with 24% in Europe, 7% in the UK, 6% in Singapore, and the remaining 13% spread out between many other regions:

DLR site

JVs:

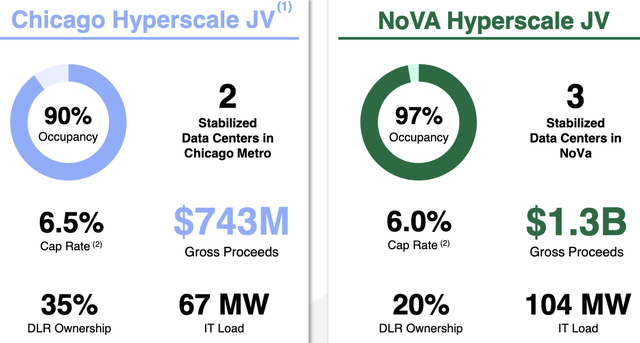

DLR has two large JVs in Chicago and northern Virginia, a tech hub.

The Chicago JV, of which DLR owns 35%, has two data centers with a 67 MW load, and $743M in annual revenues, with a 6.5% cap rate.

The NoVa JV has three data centers in northern Virginia, with $1.3B in annual revenues. DLR owns 20% of these facilities, which have 104 MW, and a 6% cap rate.

DLR site

Preferred Dividends:

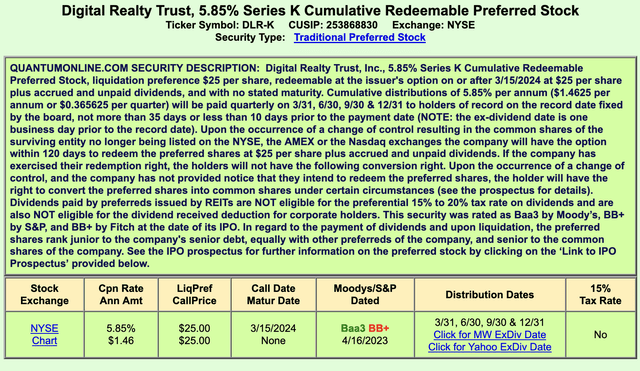

These are cumulative preferred shares, meaning that DLR must pay shareholders for any skipped dividends before they pay dividends on common shares. The dividends aren’t eligible for the 15%-20% tax rate, as DLR is a REIT.

qntmnln

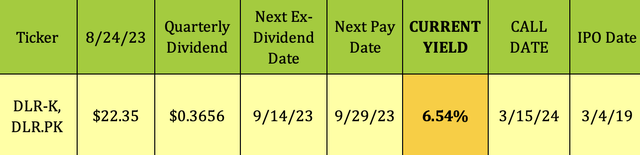

These shares IPOd in March 2019, with 8M shares at a call value of $25.00. At their 8/24/23 intraday price of $22.35, the DLR-K shares yield 6.54%. They go ex-dividend next on 9/14/23, with a 9/29/23 pay date.

Hidden Dividend Stocks Plus

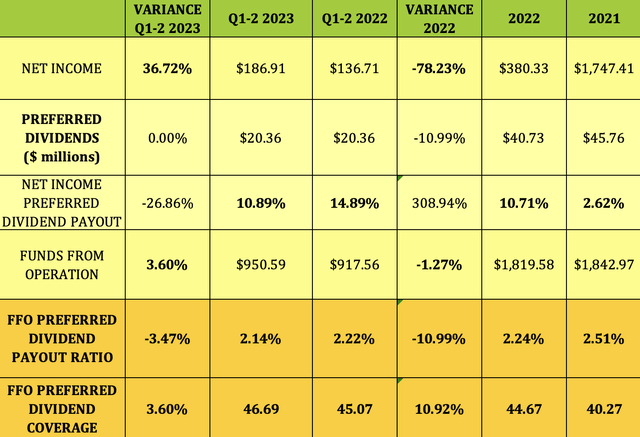

We looked at the dividend coverage two ways – using net income, which includes non-cash depreciation & amortization, and funds from operations, which doesn’t.

The net income/preferred dividend payout ratio was tiny in 2021, at 2.62%. Even though it increased 4X in 2022, 10.71% is a very conservative payout ratio. In Q1-2 ’23, this payout ratio improved 10.89%, vs. 12.89% a year ago.

On an FFO basis, the preferreds payout ratio has been very strong, running from 2.51%in 2021, to 2.24% in 2022, and 2.14% in Q1-2 ’23.

Flipping the numbers on that FFO payout ratio gives you an extremely robust coverage ratio of over 46X in Q1-2 ’23:

Hidden Dividend Stocks Plus

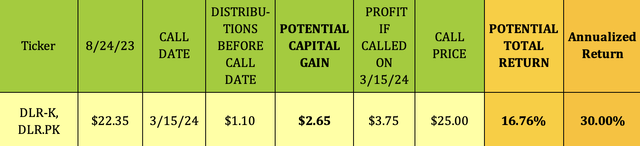

As DLR has been known to redeem some of its preferred series in the past, we took a look at the potential gain for the DLR-K shares if they get redeemed on their3/15/2024 call date.

There are three quarterly dividends left before the call date, totaling $1.10/share. Since these shares are 10.6% below their $25.00 call value, there’s also the potential for $2.65/share in capital gains. If they get redeemed on 3/15/2024 the total potential profit is $3.75/share, for a total return of 16.76% in a bit less than seven months, or 30% annualized:

Hidden Dividend Stocks Plus

Earnings:

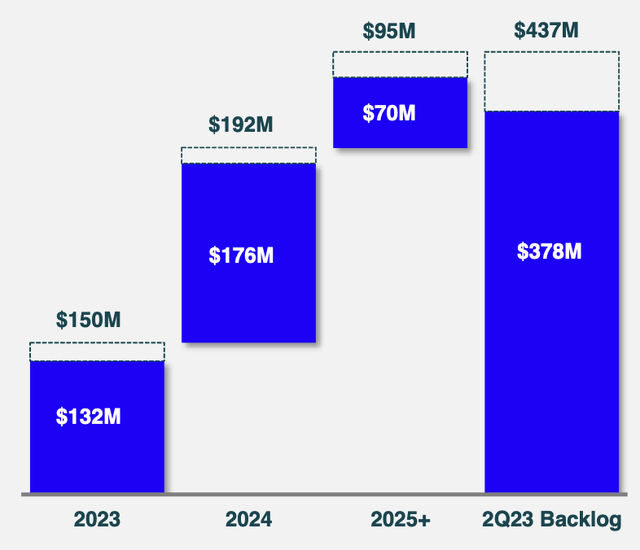

As of 6/30/23, DLR had a large backlog of $437M, comprised of $59M in its JVs and $378M in DLR properties. $150M of this amount is due to commence in 2023. The amounts shown in this chart represent GAAP annualized base rent from leases signed, but not yet commenced, based on the estimated future commencement date at the time of signing.

DLR site

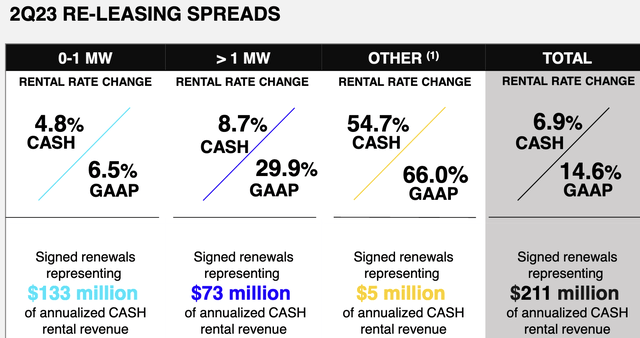

Lease renewals were strong again in Q2 ’23, with 0-1 MW renewals coming in at $133M, up 4.8% on a cash basis, and 1MW-plus renewals at $73M, up 8.7% on a cash basis. DLR’s total rental rates rose 6.9% on a cash basis and 14.6% on a GAAP basis in Q2 ’23:

DLR site

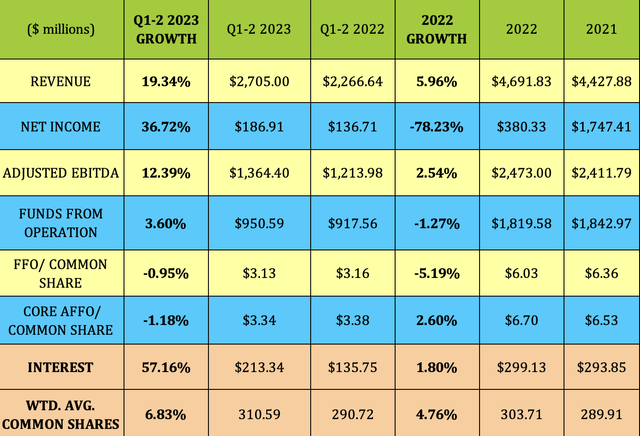

In 2022, the main contributor to a 78% net income decline was a $1.2B decline in sales on investments, and a $215M increase in utilities costs. Revenue rose ~6%, with EBITDA up 2.5% and FFO/share down 5%, as the share count rose 4.8%.

Q1-2 ’23 has seen strong topline growth of 19%, while net income was up ~37%, and EBITDA grew 12%. FFO growth was mild, at 3.6%, while FFO/share was down 1%, with the share count rising 6.8%. Interest expense rose by $77M, up 57%.

Hidden Dividend Stocks Plus

2023 Guidance:

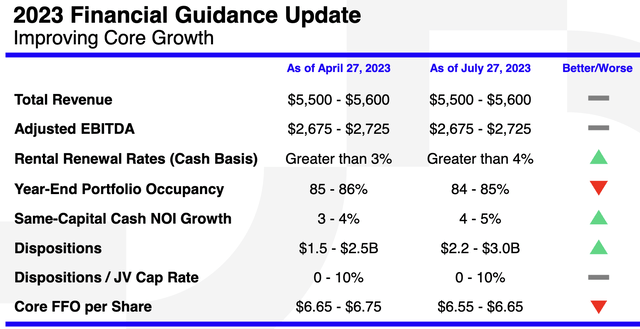

Management reiterated its prior revenue and EBITDA growth estimates on the Q2 ’23 release, while raising forecasts for rental renewal rate, cash NOI growth, and asset dispositions. They decreased year-end occupancy rates by 100 basis points, and Core FFO/share by $.10/share.

DLR site

Profitability & Leverage:

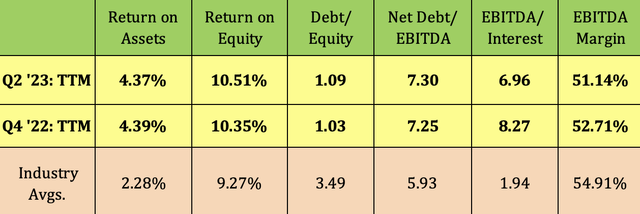

DLR’s ROA and ROE have been stable over the past two quarters, and remained higher than the Specialty REIT industry averages. However, take those averages with a grain of salt as the specialty REIT sub-industry is a mixed bag, with many different types of companies within it.

Debt leverage rose slightly in Q1-2 ’23, while EBITDA/interest coverage fell; as did EBITDA margin:

Hidden Dividend Stocks Plus

Debt and Liquidity:

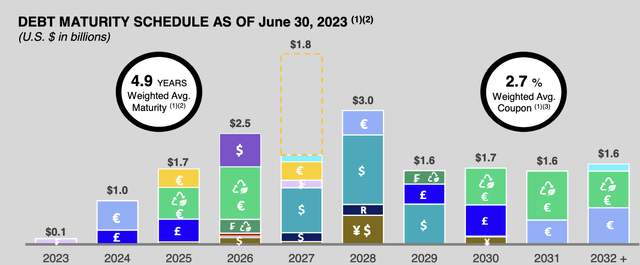

DLR’s debt is in several different currencies, including the US dollar, the Euro, the British Pound, and the Singapore Dollar being its largest exposures. It has ~5% of its debt coming due in 2024, and ~9% in 2025, with weighted maturity of 4.9 years, and an average coupon rate of 2.7%.

DLR site

Parting Thoughts:

While other analysts have pointed out DLR’s lack of growth over the past few years, and the possibility of a common share dividend cut, DLR has such a huge preferred dividend coverage cushion that we rate the DLR-K shares a Buy. There’s also the possibility of an attractive capital gain if these shares get redeemed next year.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Read the full article here