Medtronic stock (NYSE: MDT) gained 2% in a week, faring slightly better than the broader S&P500 index, up 0.5%. Medtronic

MDT

Interestingly, MDT stock had a Sharpe Ratio of 0.1 since early 2017, lower than 0.6 for the S&P 500 Index over the same period. It compares with the Sharpe of 1.3 for the Trefis Reinforced Value portfolio. Sharpe is a measure of return per unit of risk, and high-performance portfolios can provide the best of both worlds.

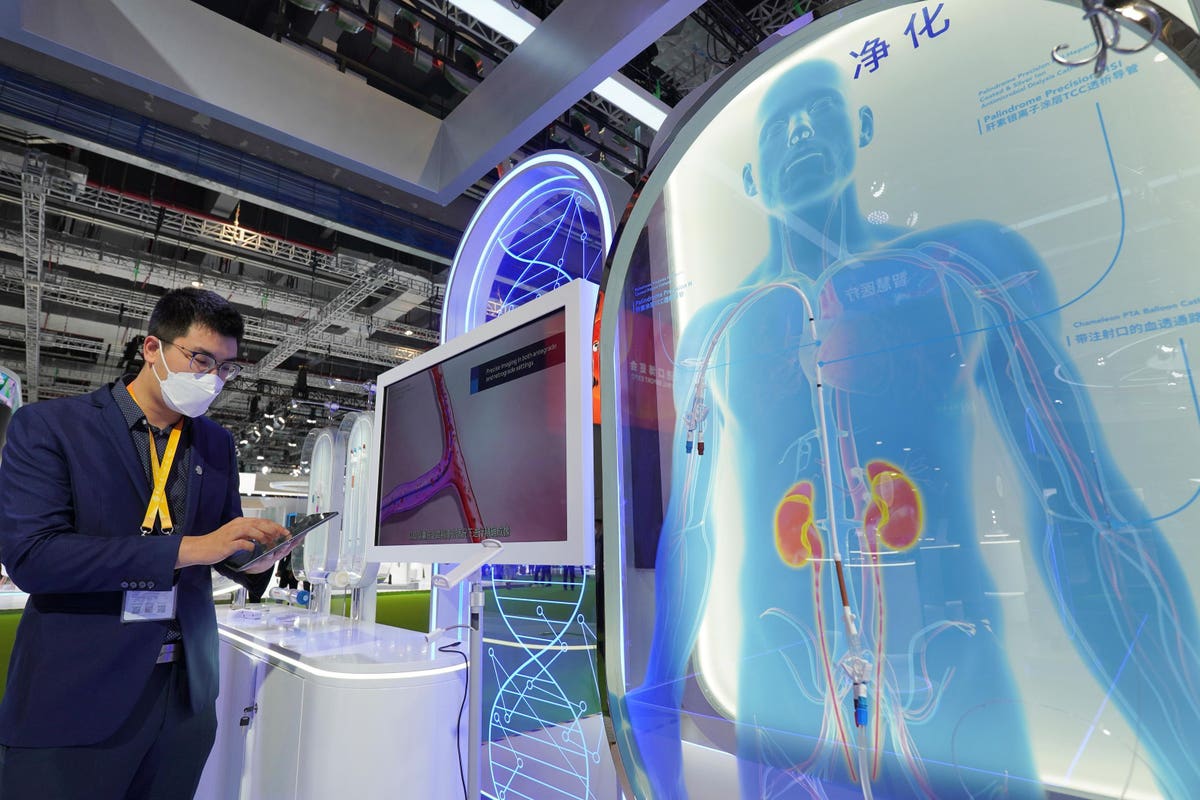

Medtronic’s revenues were up 4.5% to $7.7 billion in fiscal Q1’24. The Cardiovascular and Medical Surgical revenue grew 5.5%, Neuroscience was up 4.9%, and Diabetes sales were up 6.8%. The Diabetes segment benefited from the increased adoption of its MiniMed 680G insulin system in the international markets. 780G was also launched in the U.S. along with Micra AV2 and Micra VR2 leadless pacemakers.

The company’s adjusted operating margin improved by 90 bps to 24.8%, partly due to lower R&D expenses. The earnings of $1.20 on a per-share and adjusted basis were up 6% from $1.13 in the prior-year quarter and compares with the consensus estimate of $1.11. The rise in earnings can be attributed to higher sales and improved operating margins.

Not only did Medtronic exceed the street expectations in Q1, but it also raised its full-year outlook. It now expects its fiscal 2024 sales to rise 4.5% (organic) vs. its earlier estimate of 4.0% to 4.5% growth. It also raised its earnings outlook to be in the range of $5.08 to $5.16 on a per-share and adjusted basis, compared to its prior range of $5.00 to $5.10.

We have updated our model to reflect the latest quarterly performance and expect the company to post sales of $32.3 billion in fiscal 2024, reflecting 3% y-o-y growth. We believe that Medtronic will benefit from the launch of its new products, primarily MiniMed 780G in the U.S. The company’s focus on cost-cutting and an improved supply chain situation will bolster its operating margin growth. Looking at the stock price, we estimate Medtronic’s Valuation to be $97 per share, about 15% above the current market price of $84. At its current levels, MDT stock is trading at 16x its expected forward earnings of $5.09 on a per share and adjusted basis for full-fiscal 2024, compared to the last four-year average of 20x, implying ample room for growth.

While MDT stock looks like it can see higher levels, it is helpful to see how Medtronic’s Peers fare on metrics that matter. You will find other valuable comparisons for companies across industries at Peer Comparisons.

Invest with Trefis Market Beating Portfolios

See all Trefis Price Estimates

Read the full article here