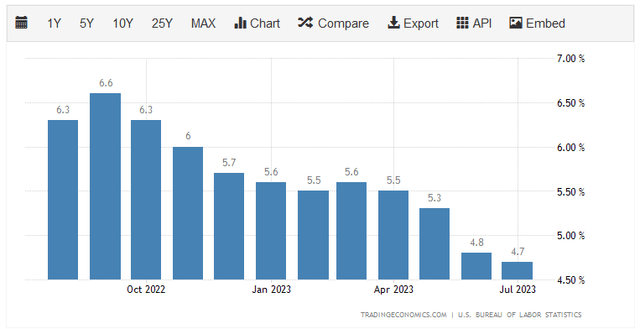

In my last article on the BlackRock Enhanced Capital and Income Fund (NYSE:CII), I discussed how the fund could be a good way to generate some additional income to offset the fact that inflation is pushing up the cost of living. The need for solutions to this problem has taken on a new level of importance recently, as inflation ticked up in July, with the consumer price index posting a 3.2% year-over-year increase compared to the 3.0% that it posted in June. The core consumer price index, which excludes volatile food and energy prices, did show some slight month-over-month improvement though:

Trading Economics

Overall, though, the thesis for why we need extra income remains intact. Fortunately, the BlackRock Enhanced Capital and Income Fund appears to still offer a solution to that problem despite the fact that the price has increased since we last discussed it on June 5, 2023:

Seeking Alpha

This price increase has not had a significant impact on the fund’s yield though, as the BlackRock Enhanced Capital and Income Fund yields a respectable 6.41% at the time of writing. This is admittedly not as good as some other closed-end funds yield, but it is well above the yield of the S&P 500 Index (SPY) or even the U.S. Utilities Index (IDU) as of the time of writing. As a few months have passed since we last discussed it, let us revisit the fund and discuss any changes to its portfolio or finances that may have come about in the interim.

About The Fund

According to the fund’s webpage, the BlackRock Enhanced Capital and Income Fund has the objective of providing its investors with a high level of current income and capital appreciation. The fact sheet discusses this in more detail:

Enhanced Capital and Income Fund, Inc. seeks to provide investors with a combination of current income and capital appreciation. The fund seeks to achieve its investment objective by investing primarily in a diversified portfolio of common stocks in an attempt to generate current income and by employing a strategy of writing (selling) call options on equities in an attempt to generate gains from option premiums.

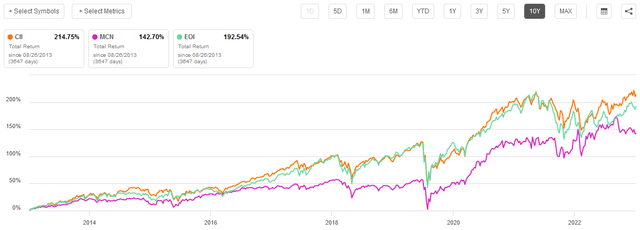

Thus, this is a covered call fund, much like the Madison Covered Call and Equity Strategy Fund (MCN) or the Eaton Vance Enhanced Equity Income Fund (EOI), all of which I have discussed over the past few months. The fund’s performance differs dramatically from these other funds, however. For example, the BlackRock Enhanced Capital and Income Fund outperforms both of these other funds on a total return basis over the past ten years:

Seeking Alpha

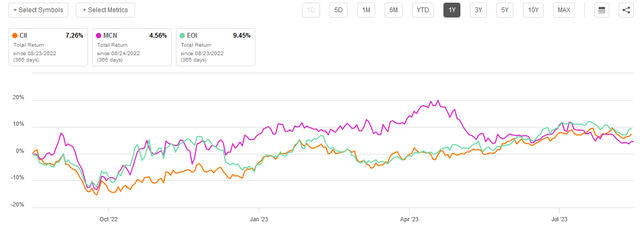

However, it has underperformed over shorter time periods. For example, over the one-year period, the Eaton Vance Fund outperforms the BlackRock fund, but both funds managed to beat the Madison Covered Call and Equity Strategy Fund:

Seeking Alpha

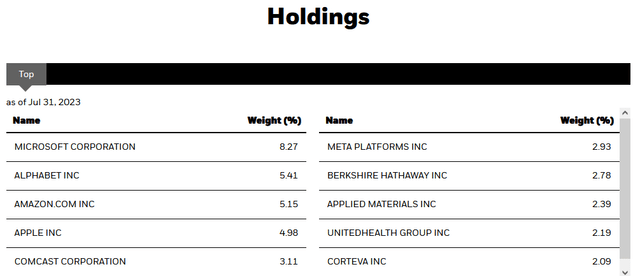

This is partly due to the differing strategies of all of these funds. In particular, the portfolios of all of them are quite different. For example, the Madison Covered Call and Equity Strategy fund tends to be somewhat more opportunistic and invests more heavily in small companies or struggling ones. I discussed this in my article on that fund. However, most of the market strength year-to-date has been driven by only a very small handful of technology companies. Other than these companies, the market has been relatively flat. Those are the companies that are heavily weighted in the BlackRock Enhanced Capital and Income Fund. We can see that here:

BlackRock

The largest positions in the fund look quite similar to the last time that we discussed it. In fact, the only changes of note here are that Sanofi (SNY) was removed and replaced with Applied Materials (AMAT). The fact that there have been few changes would seem to suggest that the fund has a very low annual turnover. The most recent data point is from December 31, 2022, but it says that the fund has a 32.00% annual turnover. That is pretty low for an equity closed-end fund, although not nearly as low as most index funds possess. This does suggest that the fund limits its trading activity, however, which is nice as this helps to keep expenses down.

As regular readers on the topic of closed-end funds are no doubt well aware, I do not usually like to see any single position in a fund account for more than 5% of the fund’s assets. I have explained why in multiple previous articles. To quote myself:

I generally do not like to see any single position in a fund account for more than 5% of the fund’s assets. That is because this is approximately the level at which an asset begins to expose the portfolio to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk that any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification, but if that asset accounts for too much of the fund’s portfolio, then it will not be completely diversified away. Thus, the concern is that some event may occur that causes the price of a given asset to decline when the market does not, and if that asset accounts for too much of the portfolio, then it could end up dragging the entire fund down with it.

As we can see above, there are three assets in this fund that currently account for more than 5% of its total assets. These are Microsoft (MSFT), Alphabet (GOOG), and Amazon (AMZN). All three of these are among the seven companies that were responsible for much of the market’s returns year-to-date. As these are all rather long-duration stocks and their performance this year has been much stronger than the rest of the market, there could be reason to believe that they will decline much more than the rest of the market during any correction. We could see a correction in the near future, as there are some whispers that the Federal Reserve will eliminate all hopes of an interest rate cut during Chairman Powell’s speech from Jackson Hole tomorrow. As such, we could see that event drive down the price of this fund somewhat.

With that said, the covered call strategy that is used by this fund usually outperforms during either flat or bear markets. This is due to the upfront call premiums that the fund receives from the sale of the call options. These upfront call premiums help to offset losses due to falling stock prices. However, investors should still be aware of the risks here and ensure that they are willing to take them on before purchasing shares of the BlackRock Enhanced Capital and Income Fund.

Distribution Analysis

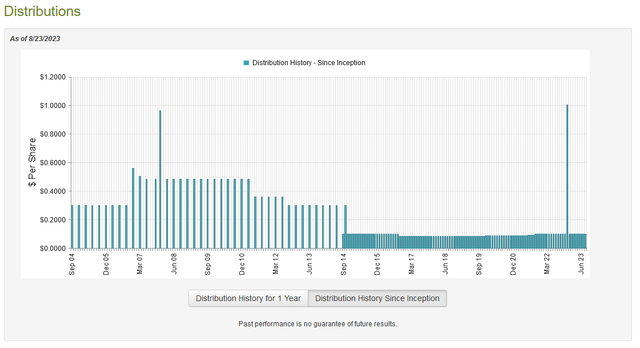

As mentioned earlier in this article, the primary objective of the BlackRock Enhanced Capital and Income Fund is to provide a high level of current income and capital appreciation to its investors. In order to achieve that objective, the fund purchases various stocks and then writes call options against them. The goal is to receive the call premium from the option sale and then have the option expire worthless. In that scenario, the option premium is essentially a synthetic dividend. The yield from doing this can be very high though, depending on the length of the option and the strike price relative to the price of the underlying stock. The fund collects these premiums, as well as any dividends paid by the stocks in the portfolio, and pays them out to its investors, net of any expenses. As such, we can assume that the BlackRock Enhanced Capital and Income Fund will boast a very high yield. This is indeed the case as the fund pays a monthly distribution of $0.0995 ($1.194 per share annually), which gives it a 6.41% yield at the current price. That is nowhere near as good as the yield on some other closed-end funds using a similar strategy, but it is still well above the 5% yield offered by money market funds today. The fund has been reasonably consistent with respect to its distribution over the years, as can be seen here:

CEF Connect

As we can see, the fund has generally been increasing its distribution since the middle of the last decade, although it has not been perfect in this respect. The fact that it did not have to cut in response to the tightening monetary environment in 2022 speaks well for the quality of its portfolio and strategy, since some of Eaton Vance’s option-income funds did have to cut during the same year. As is always the case though, we want to ensure that the fund can actually afford the distributions that it pays out. After all, we do not want to be the victims of a distribution cut, since that would both reduce our incomes and almost certainly cause the fund’s share price to decline.

Unfortunately, we do not have an especially recent document that we can consult for the purposes of our analysis. The fund’s most recent financial report corresponds to the full-year period that ended on December 31, 2023. As such, it will not include any information about the fund’s performance year-to-date. As several of the largest positions in the fund’s portfolio have delivered very strong performance in the stock market so far this year, it is disappointing that we have no insight into the fund’s ability to capitalize on the situation. With that said, this report will still give us a great deal of information about how well the fund handled the difficult market conditions that were present over the course of 2022, and sometimes a fund’s ability to handle difficult times is more insightful than its ability to make a profit when a stock is going up.

During the full-year period, the BlackRock Enhanced Capital and Income Fund received $10,532,392 in dividends and surprisingly no interest from the assets in its portfolio. Once we net out the money that the fund had to pay in foreign withholding taxes, we get a total investment income of $10,392,441 during the period. It paid its expenses out of this amount, which left it with $2,696,846 available for shareholders. That was obviously nowhere close to enough to cover the fund’s distributions, which totaled $92,693,757 over the year. At first glance, this is almost certainly going to be concerning, as the fund did not get anywhere close to covering its distributions out of net investment income.

However, the fund does have other methods through which it can obtain the money that it needs to cover its payouts. For example, it does receive option premiums from the covered call strategy. These are not included in the net investment income, but they obviously do represent money coming into the fund. The fund also might have capital gains that can be paid out. Fortunately, it had a great deal of success generating capital gains during the period. The BlackRock Enhanced Capital & Income Fund reported net realized gains of $100,213,617 but this was offset by $211,028,139 net unrealized losses. Overall, the fund’s net assets declined by $200,811,433 after accounting for all inflows and outflows. That was certainly disappointing, and it does imply that the fund failed to cover its distributions overall. However, the net realized gains plus the net investment income were sufficient to cover the distributions that were paid out with some money left over. Thus, the fund does appear just fine for this period, however, the depleted asset base could make it more difficult for it to earn the returns that are necessary to maintain the payout going forward. We will want to keep an eye on this and look closely at the fund’s semi-annual report when it is finally released. That should be within a few weeks.

Valuation

As of August 23, 2023 (the most recent date for which data is currently available), the BlackRock Enhanced Capital and Income Fund has a net asset value of $19.10 per share but the shares currently trade for $18.56 each. That gives the shares a 2.83% discount on net asset value at the current price. This is relatively in line with the 2.45% discount that the shares have had on average over the past month. Overall, it is a reasonable price to pay for the fund.

Conclusion

In conclusion, the BlackRock Enhanced Capital and Income Fund continues to be a reasonably reliable place to park money and earn a positive level of real income. However, there are some risks relating to the fund’s substantial weighting to a few of the mega-cap technology stocks heading up to Jackson Hole and the possible dashing of the market’s hopes for a rate cut. However, the covered call strategy does provide a bit of protection against market declines and the fund appears reasonably well-equipped to handle near-term market volatility.

Read the full article here