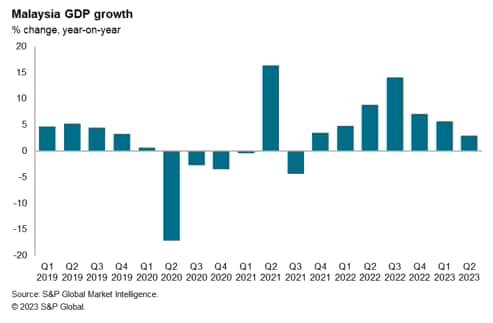

Malaysian economic growth moderated to a pace of 2.9% year-on-year (y/y) in the second quarter of 2023, compared to growth of 5.6% y/y in the first quarter of 2023.

However, when measured on a quarter-on-quarter (q/q) basis, the pace of growth improved to 1.5% q/q in the second quarter of 2023, compared to 0.9% q/q in the first quarter of 2023.

Merchandise exports have been weak during the first seven months of 2023, declining by 5.9% y/y. However, an important positive factor during the second half of 2023 and into 2024 is expected to be the continued gradual recovery of international tourism visits from Asia, the Middle East and Europe.

Malaysian economy moderates in Q2 2023

The pace of expansion of the Malaysian economy measured on a year-on-year basis has moderated due to a number of headwinds, including the impact of high base year effects and slowing merchandise export growth.

In the second quarter of 2022, Malaysian GDP growth had surged by 8.8% y/y and had risen by 4.1% q/q, which created high base year effects for the year-on-year growth rate for GDP in the second quarter of 2023.

However, measured on a quarter-on-quarter basis, the Malaysian economy grew by 1.5% q/q in the second quarter of 2023, improving significantly on the 0.9% q/q pace in the first quarter of 2023.

Growth momentum has been improving during the first half of 2023, marking a significant turnaround compared with contraction of 1.7% q/q in the fourth quarter of 2022.

The Malaysian services sector continued to show firm growth of 4.7% y/y in the second quarter of 2023, albeit moderating from the 7.3% y/y pace recorded in the first quarter of 2023.

The pace of expansion in the construction sector also remained strong, growing by 6.2% y/y in the second quarter of 2023, after growth of 7.4% y/y in the first quarter of 2023.

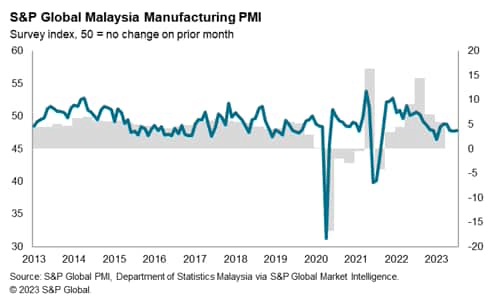

However, growth in the manufacturing sector has slowed, showing only a marginal increase of 0.1% y/y in the second quarter of 2023, after growth of 3.2% y/y in the first quarter of 2023.

The seasonally adjusted S&P Global Malaysia Manufacturing Purchasing Managers’ Index (PMI) posted 47.8 in July, up slightly from 47.7 in June, but still indicating weak operating conditions for the manufacturing sector.

The latest PMI reading is consistent with expansion in both manufacturing production and GDP, although there are signs that growth has dampened somewhat since the start of the year.

A key contributor to the sub-50.0 reading in July was a significant reduction in new order volumes. Demand has now moderated in each of the last 11 months, with the latest slowdown the most marked since January. A number of firms noted that client confidence remained subdued in both domestic and international markets.

During 2022, an important positive factor for the Malaysian manufacturing sector was the strength of manufacturing exports. Overall, Malaysian merchandise exports performed strongly during 2022, with exports rising by 25% y/y.

Exports of manufactured goods rose by 22% y/y during 2022, boosted by exports of electrical and electronic products, which rose by 30%. Rising world commodity prices also boosted commodities exports, with mining exports up by 68% y/y due to strong exports of oil and gas, while agricultural exports rose by 23%.

However, in 2023, the pace of export growth for goods has weakened, reflecting base year effects as well as the economic slowdown in key markets, notably the EU and mainland China.

Goods exports in the first seven months of 2023 fell by 5.9% year-on-year. In July 2023, the decline in goods exports was even more sharp, falling by 13.1% y/y.

This reflected a large decline in exports of petroleum products, which fell by 48.7% y/y, as well as a 34.4% y/y drop in exports of palm oil and palm oil-based products.

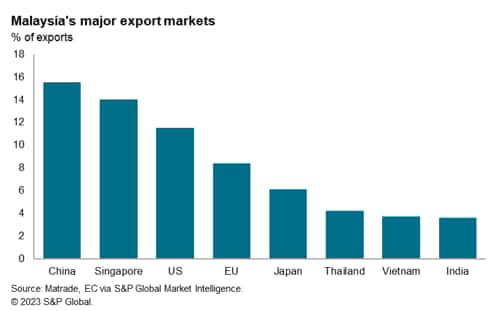

As mainland China is Malaysia’s largest export market, accounting for 15.5% of total exports, the weak momentum of the rebound in mainland China’s economy during the first half of 2023 has also been a significant headwind to Malaysia’s exports.

Malaysian merchandise exports to mainland China fell by 6.8% y/y in the first seven months of 2023. However, exports to mainland China for the month of July showed a rebound, rising by 6.1% y/y.

A positive factor for services exports is that international tourism has been strengthening, as tourist arrivals from major tourism markets in ASEAN, Middle East and Europe continue to recover, while Chinese tourist arrivals gradually improve.

Tourism Malaysia is targeting 16.1 million international visitor arrivals for 2023, a 60% increase compared with the estimated 10.1 million international visitor arrivals in 2022.

This compares with the pre-pandemic level of 26.1 million international visitor arrivals in 2019. In 2019, total domestic and international tourism was estimated to have accounted for around 16% of gross value added in Malaysia’s total GDP.

Inflation pressures have been gradually easing

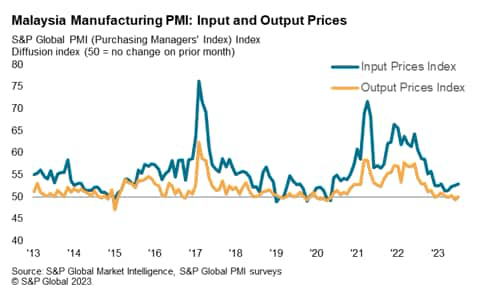

On the price front, average costs rose at a modest pace. Survey members mentioned that raw material prices continued to rise amid ringgit exchange rate weakness against the US dollar.

Firms meanwhile reported that prices charged for goods were broadly unchanged, although some panellists signalled that selling prices were reduced in order to stimulate demand.

CPI inflation pressures have been gradually moderating, easing to a pace of 2.4% in June compared with 2.8% y/y in May and compared with 4.5% y/y in September 2022.

During 2022, Malaysia’s central bank, Bank Negara Malaysia (BNM), had reduced the degree of monetary accommodation in a series of tightening steps. The most recent monetary policy tightening was on 3rd May 2023, when the Monetary Policy Committee decided to increase the Overnight Policy Rate (OPR) by 25 basis points to 3.0 percent.

The MPC expects that both headline and core inflation will moderate over the course of 2023, averaging between 2.8% to 3.8%. However, core inflation will remain at elevated levels amid firm demand conditions. Existing price controls and fuel subsidies will continue to partly contain the extent of upward pressures to inflation.

Moderating global electronics demand adds to headwinds

The electrical and electronics (E&E) sector has been an important driver of Malaysia’s manufacturing exports. Exports of E&E products, which accounted for 38% of merchandise exports, rose by 30% y/y in 2022.

This rapid growth was driven by robust global demand for semiconductors, reflecting technological trends such as 5G rollout, cloud computing, and the Internet of Things.

Exports of integrated circuits grew by 33% y/y in 2022, while exports of parts for integrated circuits rose by 120% y/y. The combined exports of integrated circuits and parts accounted for 58% of Malaysia’s total exports of E&E products in 2022.

The global electronics manufacturing industry has slowed since mid-2022 due to the weakening pace of economic growth in the US, EU and China. Malaysian exports of electrical and electronic products have shown some weakness in recent months, but showed a rebound in July, rising by 7.3% y/y.

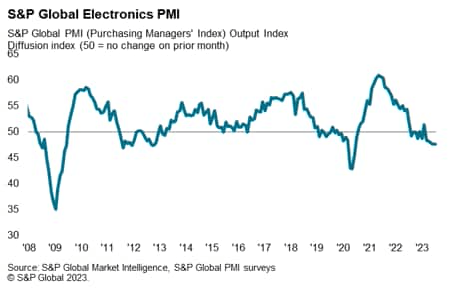

However, recent S&P Global survey data continues to indicate that the global electronics manufacturing industry is facing headwinds from weak economic conditions in key markets.

The headline seasonally adjusted S&P Global Electronics PMI was at 47.6 in July, continuing to show contractionary conditions across the global electronics manufacturing sector as key consumer markets for electronics, notably mainland China and the EU, remained weak.

Economic outlook

The Malaysian economy rebounded strongly during 2022, with economic growth momentum boosted by the easing of COVID-19 restrictive measures as well as buoyant exports of electrical and electronic products, palm oil products as well as oil and gas exports.

In 2022, higher world oil and gas prices as a result of the Russia-Ukraine war boosted Malaysian energy exports and contributed to higher fiscal revenues. Malaysia also benefited from higher average palm oil prices, due to disruptions to world edible oil markets, including Ukrainian exports of sunflower oil.

During 2023, growth momentum has moderated when measured on a year-on-year basis, due to base year effects and the slowdown of merchandise exports.

However, the reopening of international borders across the Asia-Pacific region, notably in mainland China, will help the continued gradual recovery of the international tourism industry, which was an important part of the Malaysian economy prior to the pandemic.

This will help to mitigate the impact of slower growth for merchandise exports. Domestic demand has remained resilient during the first half of 2023, helped by the improvement in labour market conditions. Easing of restrictions on entry of migrant labour are also gradually helping to support industry sectors that are reliant on foreign workers.

There are a number of downside risks to the near-term growth outlook, particularly due to the weak economic conditions in the EU and the weak pace of recovery in mainland China.

Malaysia’s export sector is vulnerable to the risk of protracted weak economic growth momentum in 2024 in the US and EU, which together account for around one-fifth of total exports, as well as downside risks to the pace of mainland China’s recovery.

Despite the slowdown in global electronics orders in the first half of 2023, the medium-term economic prospects for Malaysia’s electronics industry are favourable.

The outlook for electronics demand is underpinned by major technological developments, including 5G rollout over the next five years, which will drive demand for 5G mobile phones.

Demand for industrial electronics is also expected to grow rapidly over the medium term, helped by Industry 4.0, as industrial automation and the Internet of Things boosts rapidly growth in demand for industrial electronics.

Malaysia’s competitiveness as a global electronics hub has been highlighted by the decision of a number of electronics multinationals to invest in large-scale new projects.

Intel (INTC) is investing USD 7 billion in a new semiconductors packaging plant in Penang, which is estimated to be completed by 2024 and create thousands of new jobs in Malaysia.

Infineon Technologies (OTCQX:IFNNY) is constructing a new state-of-the-art wafer fab module in Kulim, with around Ringgit 8 billion of investment. The new module, which is expected to be completed in 2024, will add significant manufacturing capacity in power semiconductors.

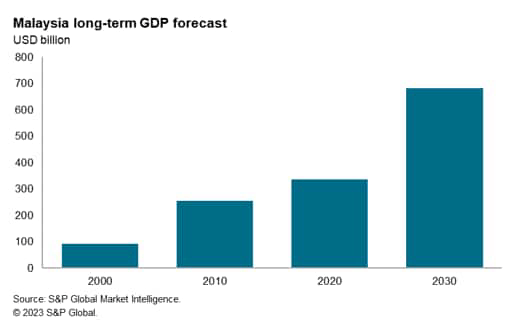

Overall, the medium to long-term growth outlook for Malaysia remains favourable, with total nominal GDP measured in USD terms forecast to rise from around USD 400 billion in 2022 to USD 680 billion by 2030 and USD 780 billion by 2032.

Meanwhile per capita GDP is projected to rise from USD 12,000 in 2022 to USD 18,600 by 2030, which will help to drive the growth of the domestic consumer market.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here