There are many different experiences that every person should try at least once in their life. One of these, in my opinion, is to watch a film in an IMAX Corporation (NYSE:IMAX) theater. Unlike traditional theaters, IMAX offers a truly remarkable experience that utilizes technology to combine visual and audio content to make a memorable and immersive viewing adventure. In recent years, because of a recovery from the COVID-19 pandemic and thanks to continued expansion, the management team at the business has done very well to grow revenue and cash flows. The company still struggles to some extent when it comes to overall profitability. But because of how cheap shares are now looking on a forward basis and because of recent announcements aimed at creating additional shareholder value, I do believe that some attractive upside is bound to exist for the company.

Management is doing a great job

I know that I am oversimplifying matters considerably. But the easiest way to describe IMAX is as a theater with a massive, curved screen that creates a more immersive visual and audio experience than what traditional theaters offer. Using technology to paint the screen with the film that you are watching and by incorporating high quality surround sound, you get a truly memorable experience. After all, in an industry where the quality of what you see and the quality of what you hear makes up the vast majority of how you feel about that experience, getting that technological edge is incredibly important. And using that technology, management has set forward for it a path that should create significant value for the company’s investors in the long run. But before I touch on what kind of potential the company has from an operational perspective, perhaps we need to take a step back and talk about how far the business has come recently.

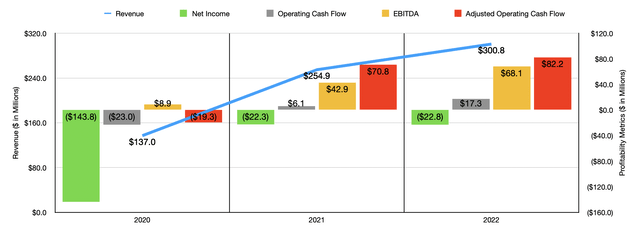

Author – SEC EDGAR Data

Over the past three years, the financial performance achieved by IMAX has been fantastic. Revenue has grown from $137 million in 2020 to $300.8 million in 2022. This growth in revenue was driven by a couple of different factors. Most notably, the company has benefited from higher revenue associated with what it calls its IMAX Technology Network. From 2021 to 2022, for instance, revenue associated with IMAX DMR jumped $24.2 million because of greater film attendance that the company saw. And, on this front, the company benefited from another $15.6 million increase involving joint revenue sharing arrangements for the same reason. Particularly helpful for the company was the $140.2 million in gross box office revenue that the company achieved because of the 2022 release of Avatar: The Way of Water. This was, according to management, the best grossing release for the company for that year. But it’s undeniable that a big part of the sales increase for the company also came from an increase in the number of systems that it has in operation. As of the end of 2022, the business had 1,716 such systems. That’s up from the 1,650 that the company reported back at the end of 2020.

This increase in sales brought with it improved profitability. Net income went from negative $143.8 million to negative $22.8 million over the same three-year window. Operating cash flow improved from negative $23 million to positive $17.3 million. On an adjusted basis, it went from negative $19.3 million to positive $82.2 million. Management has their own measure for adjusted EBITDA. But I don’t like that measure because it adds back share-based compensation. Even though that is a non-cash item, it is still a legitimate expense that the company would likely have to pay out in cash if it couldn’t issue stock. So adjusting for this, EBITDA for the company went from $8.9 million to $68.1 million.

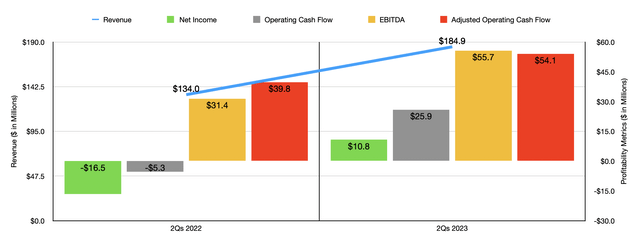

Author – SEC EDGAR Data

So far, the 2023 fiscal year is also looking up for the company. As you can see in the chart above, revenue in the first half of the year came in at $184.9 million. That’s 38% above the $134 million reported one year earlier. An increase in the number of systems in operation from 1,694 to 1,718 was instrumental in this, as was a continued recovery of the movie theater industry. Naturally, profitability metrics for the business also improved during this time. The company went from generating a net loss of $16.5 million to generating a profit of $10.8 million. And as you can see in the aforementioned chart, all of the other profitability metrics for the business followed a similar trajectory.

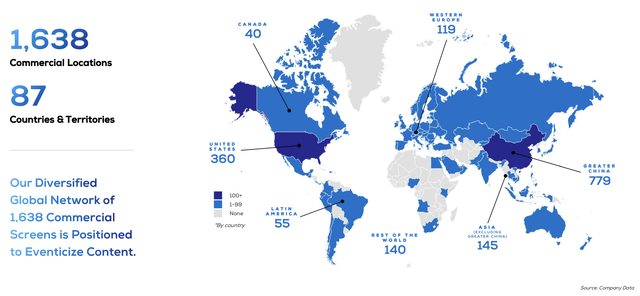

The past for the company is absolutely important. However, we also need to keep an eye on the future. I already mentioned how many systems the company has deployed. Of these, 1,638 operate in a commercial capacity. Furthermore, they are spread between 87 different countries and territories. Perhaps unsurprising is the fact that the largest exposure to the company is to the Greater China market. There, it has 779 systems in place, which dwarfs the 360 that it has here in the US. And this is where one of our first developments comes into play. As of the end of the 2022 fiscal year, IMAX owned 71.73% of IMAX China Holding. But that picture is now changing. In July of this year, for instance, management announced that they were acquiring the interest in the company that they don’t have for $124 million. For the first quarter of this year alone, this should result in about $5 million worth of EBITDA for the company. For the second quarter, the company added on to this another $2.9 million worth of EBITDA. To be conservative, I will assume, in my calculations, additional EBITDA associated with this operation to be around $10 million annually.

IMAX Corporation

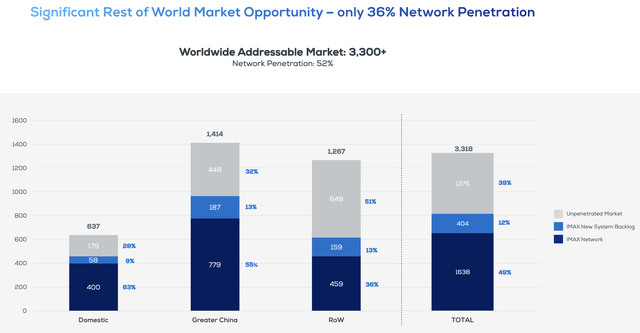

Even though the company has a tremendous market presence, it does seem to still have significant upside potential. Management believes, for instance, that there exists potential for over 3,300 systems worldwide. And the good thing for shareholders is that the company already has extensive backlog dedicated to reaching that point. As of the end of the most recent quarter, the company counted 404 systems in its backlog. This is up from the 361 that it had in backlog at the end of the 2022 fiscal year. To reach full market potential, this opens up the door for another 1,276 systems worldwide. Add on top of this upgrades to existing locations, such as the 92 upgrades that it has in backlog right now, and the potential for additional revenue in the long haul remains significant.

IMAX Corporation

While we are talking about various developments, it is worth mentioning a couple more. On July 24th, for instance, management announced a box office debut of $35 million associated with the 740 screens that aired the new film Oppenheimer. This makes the film the biggest share ever of a film’s global opening weekend box office, with 20% of total receipts at the global box office achieved at an IMAX location. And on August 2nd, management announced that the $176.2 million of gross box office revenue that the business achieved in the month of July made it the highest grossing month of July in the company’s history, surpassing the prior record of $124.1 million achieved in 2019. $86 million of that haul came from the aforementioned Oppenheimer film. And lastly, on July 25th, management announced that it struck a deal with Cineplex to expand the partnership between the two companies by adding an additional 5 new IMAX systems throughout Canada, as well as two upgrades. This occurred at the same time that Cineplex reaffirmed its commitment to the company with the renewal of agreement terms for 24 existing locations through the 2028 calendar year.

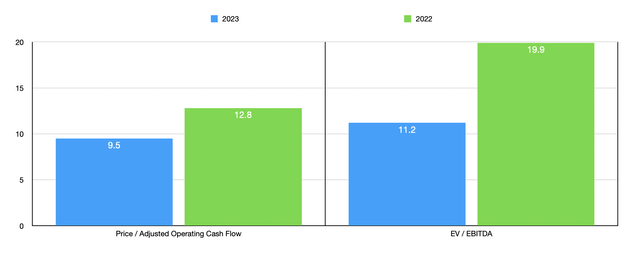

So we have a good understanding that growth for the company should exist moving forward. The next thing we need to ask ourselves is whether or not shares are worth that growth. As I mentioned already, I’m assuming about $10 million of EBITDA annually associated with its China purchase. I’m also assuming that management is having to pay about 6.85% per annum in interest on the debt that it is taking out for this deal. This assumes that the company finances the entirety of the purchase with debt as opposed to using some of the $95.3 million in cash that it has on hand. Adjusting for these figures and annualizing results seen so far this year would result in adjusted operating cash flow this year of $113.2 million and EBITDA of $120.8 million.

Author – SEC EDGAR Data

Using these figures, I was able to value the company as shown in the chart above. That same chart shows not only the pricing for the company on a forward basis, but also pricing using data from 2022. It adjusts for the China purchase as well. While it is true that the stock looks a bit pricey from an EV to EBITDA perspective using results from 2022, the stock does look attractively priced on a forward basis for 2023. Add on top of this future growth prospects, and I definitely like what I’m seeing.

Takeaway

The past few years have been great for shareholders of IMAX from a corporate growth perspective. Management continues to expand its footprint and the end result will be a larger and more profitable enterprise. Net income is finally starting to turn positive, but it would be nice to see that accelerate. Cash flows, meanwhile, are performing incredibly well and I expect that overall trend to continue. Given all of these factors, I cannot help but to rate the business a ‘buy’ to reflect my view that shares should outperform the broader market for the foreseeable future.

Read the full article here