Earlier this year, a contagion spread throughout the banking sector. Practically every financial institution, particularly the community and regional banks, were negatively affected. Some even collapsed entirely. However, of the companies that did survive, the vast majority have experienced a sizable partial recovery. But one firm that has not moved all that much compared to the others is none other than United Bankshares (NASDAQ:UBSI). As of this writing, the stock is still down 22.6% compared to what it stood at on February 28th of this year. By comparison, at its lowest point, it was down 32.1%. You would expect a company that has staged such a modest recovery to have demonstrated weakness when it comes to its deposit picture. But the deposit situation is actually quite promising. The bigger problem, in my opinion, stems from the fact that the bank, while not exactly unhealthy, is trading at a multiple that is quite a bit higher than what other firms like it are currently going for. At the end of the day, the pricing of the bank has led me to rate it a ‘hold’ to reflect my view that, relative to other prospects, it’s upside from this point on will likely be more limited.

A generally promising picture

Just like most community or regional banks, United Bankshares engages in a wide variety of financial activities. Its work revolves around both commercial and consumer services, granting out mortgages, commercial real estate loans, various business loans, and more. The company originates and retains some of its loans. However, it also sells off many of its mortgages on the secondary market to other investors. The enterprise is also dedicated to providing various deposit related products. It also has other activities that it engages in as well. For instance, the bank provides digital banking solutions for its customers. It also is a member of a network of ATMs, plus it offers brokerage services and registered investment advisory services to certain clientele.

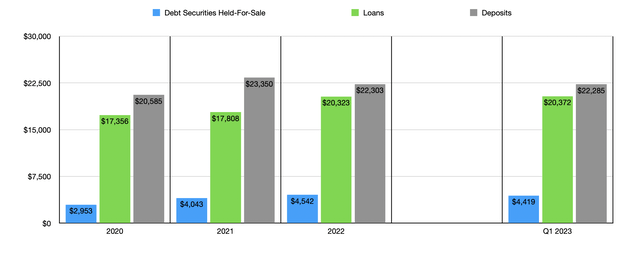

Author – SEC EDGAR Data

Over the three years leading up to the current fiscal year, the overall picture for United Bankshares was quite encouraging. Consider, for instance, the value of loans on its books. These increased from $17.36 billion in 2020 to $20.32 billion in 2022. Loans ticked up modestly to $20.37 billion during the first quarter of this year before climbing further to $20.51 billion by the end of the second quarter. This increase came even as the company saw a general incline in the value of securities that are available for sale that are not included in the broader loan portfolio. From 2020 to 2022, available for sale securities grew from $2.95 billion to $4.54 billion. We have seen a decline to $4.01 billion as of the end of the most recent quarter. But that’s a fairly small drop in the grand scheme of things.

It is important to look at the composition of loans. According to management, its largest concentration is to non-owner occupied commercial real estate. 31.6% of the company’s loan portfolio, by value and on a gross basis, fell under this category. It is important to note, for those who are worried about exposure to office space, that office properties comprised only 15% of this number, or approximately 4.7% of the company’s overall loan portfolio. That excludes any amount that it has classified as owner occupied. Next in line, we have residential real estate at 23.6%. This is followed up by 17% for commercial properties and 13.6% for construction and land development loans.

While the lone picture for the enterprise is important, what’s even more important is the deposit picture. The great thing for investors is that we have seen some improvement in the deposit situation as of late. After seeing deposits spike from $20.59 billion in 2020 to $23.35 billion in 2021, we saw a subsequent decline to $22.30 billion last year. This is not surprising when you consider that many banks have seen deposit outflows because of the search for yield from depositors in response to high interest rates.

Deposits fell slightly more to $22.28 billion by the end of the first quarter of this year before rebounding some to $22.37 billion by the end of the second quarter. The increase from the first quarter to the second quarter amounted to $85.2 million. Although small in the grand scheme of things, it’s encouraging to see an increase at all. It’s also valuable to know that, as of the end of the most recent quarter, only about 30% of the company’s deposits are classified as uninsured. This is usually the point that separates, for me at least, the more attractive companies from the less attractive ones. Anything above 30% makes me a bit worried. So it is right on the threshold.

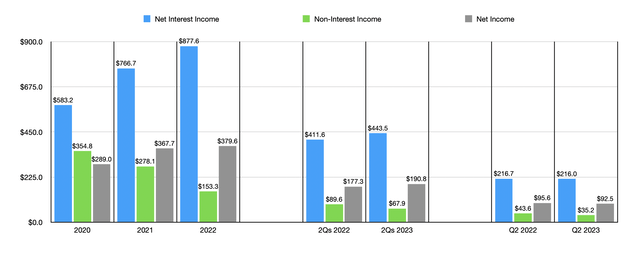

Over the past few years, management has done a great job growing the company’s net interest income. The growth in deposits and loans, combined with higher interest rates, allowed net interest income to expand from $583.2 million in 2020 to $877.6 million in 2022. Those who are bearish about the company would be correct to point out that non-interest income dropped over this window of time from $354.8 million to $153.3 million. But this can largely be chalked up to the fact that, over that window of time, income from mortgage banking activities plunged from $266.1 million to $42.7 million. Management attributed this decline to two primary factors. For starters, an increase in interest rates resulted in mortgage volume dropping for the company. And second, lower margins on loans were received in the secondary market.

Author – SEC EDGAR Data

If we exclude this downward trend, profitability for the company would have risen significantly. But it did still manage to rise nonetheless. Net income expanded from $289 million in 2020 to $379.6 million in 2022. As you can see in the chart above, the trends for net interest income, non-interest income, and net income, continued throughout the first half of the 2023 fiscal year. Though it is worth noting that we saw a general decline in all three of these categories when looking at the second quarter alone.

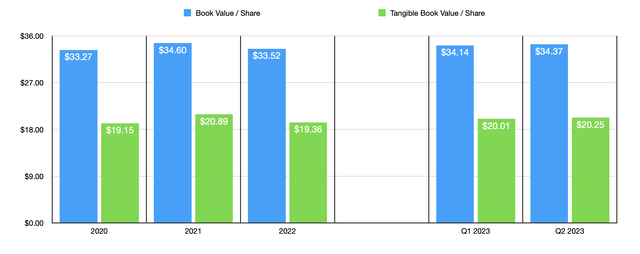

Over the years, the growing balance sheet and the strong profits of the company have pushed the book value per share of the business higher as well. This is true of both the general book value per share and the tangible book value per share as the chart below illustrates. The company is currently trading at a discount, with its stock at $31.57, relative to book value per share. But it is trading at a premium to tangible book value. That on its own is definitely not a deal breaker. However, using data from 2022, the bank is trading at a price to earnings multiple of 11.7. That is higher than what I am currently looking for in this space.

Author – SEC EDGAR Data

While the aforementioned price to earnings multiple might not be unacceptably high compared to the 10.5 price to earnings multiple of the industry as a whole (though it certainly means the stock isn’t cheap), there are firms trading well below where United Bankshares happens to be. In the table below, for instance, you can see five similar firms that I compared our prospect to that have multiples lower than 9.

| Company | Price / Earnings |

| United Bankshares | 11.7 |

| FS Bancorp (FSBW) | 7.9 |

| Preferred Bank (PFBC) | 6.9 |

| S&T Bancorp (STBA) | 8.0 |

| Columbia Banking System (COLB) | 5.4 |

| Independent Bank Group (IBTX) | 8.6 |

Takeaway

Based on all the data provided, I must say that I am encouraged by the overall sturdiness of United Bankshares. In the long run, I suspect the bank will be just fine. Having said that, shares do look a bit pricey relative to earnings. During these uncertain times and at a time when I can find competitors trading at multiples of between 6 and 9, I see no reason why I should allocate capital toward a bank that is relatively more expensive. Because of this, I have decided to keep the bank rated a ‘hold’ for now.

Read the full article here