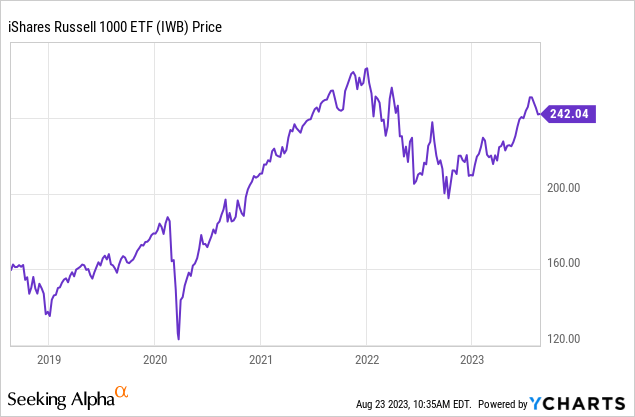

The iShares Russell 1000 ETF (NYSEARCA:IWB) is a tech-focused slice of the US stock market with plenty of large-cap exposure. Ultimately, these stocks are all high multiple and their valuations are being driven by cash flows forecast way into the distance. That means a lot of sensitivity to the interest and inflation rate situation, with the IWB stocks also being some of those that drive the overall US market. On balance, we think that the last leg of inflation will be tough to deal with, and that the current market levels ignore the fact that the economy is not in a solved and sustainable shape. Nonetheless, there are still some shoes to drop that can help reach more sustainable inflation levels before the interest rates reach levels that can tank the economy. Still, purely on an earnings yield and a benchmark rate basis, IWB looks on the stretched side.

IWB Breakdown

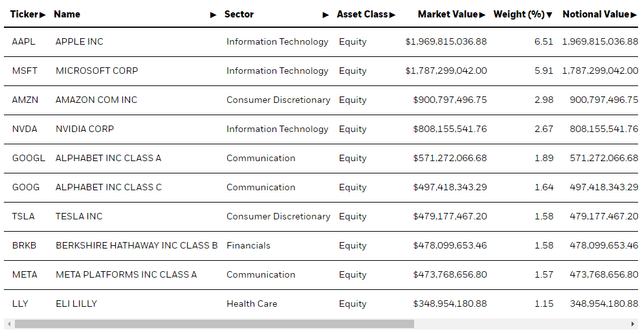

The technology skew is immediately visible in the top holdings.

Top Holdings (iShares.com)

There’s quite a lot of AI-related exposure here, including providers of cloud computing power, Nvidia (NVDA) with GPUs and Microsoft (MSFT) with ChatGPT. Firstly, there is reason for skepticism around the AI-boom. A lot of the demand will be upfronted as firms experiment, and there will be disillusionment in the scope of the applications of generative AI. Moreover, it may be tough to monetise AI, specifically the very publicised LLMs, since it depends so much on copyrighted material, where major lobbies and companies such as news organisations and media companies will begin to fight tooth and nail to enforce copyrights for materials that AI would have to be trained on. While the applications in some spheres are clear and revolutionary even for the current version of LLMs and other generative AI, there is likely excessive hype considering where equity markets in the US are, where benchmark rates are today and where bond markets expect benchmark rates to be, even in the long-term. Risk free rate expectations have risen considerably for the long-term lately.

Although it should be said that AI-based earnings and cloud-related earnings are still on the uptrend, we have some worries about how sustainable a portion of these earnings are in the horizons that these companies are valued over given their multiples. Nvidia is not worried though, considering its doing some buybacks, although both the buyback programme and NVDA’s allocation in IWB isn’t that big. It helps that all the world’s AI training is still being done on GPUs.

The matter of long-term rates are important, since so much of the valuations of these companies lie in horizon values of forecast models. High-tech and high multiple companies in general with a lot of growth expectations depend a lot, in terms of fair value, on the long-term costs of capital. Factors like deglobalisation are completely undeniable and have a very real and probably foreseeable insurmountable impact on the direction of long-term cost of capital expectations. Deglobalisation is an important secular trend that will not stop over the next five years at least, and it will cost us a lot.

Bottom Line

Short-term rates are likely to approaching a peak at some point this year. Whether this will entail a lot more rate hikes and more expectation revisions to the long-term rates is not totally clear. The mitigating factors against further rate hikes is going to be rents, which are currently the main problem for US inflation figures which have very conservative calculation assumptions that inflate the impact of rents on the figures. The supply/demand relationship in housing is actually pretty favourable, even though higher rate environments are usually going to affect property buyers and property prices at the margin where mortgages are variable rate, and for new buyers who are more likely to end-up on variable rate mortgages as banks deal with duration gap. Rents are likely to fall as a consequence of the hits to disposable income which are going to require some residences to be vacated as they become unaffordable.

Unfortunately, WFH is being pushed back on by corporates, where WFH would have been the revolution to drive some real and benign deflation in the economy. Moreover, the last leg of inflation is still a 1% gap or more, not being helped anymore by easily overcome base effects. It will be tough to stamp out.

It all comes down to what you can get at zero risk in long-term fixed income securities and where valuations are in tech. We worry about short and long-term interest rates. Deglobalisation is a much more real factor than AI for the evolving economic story in our opinion.

Read the full article here