I wrote a bullish article about Canadian insurer Trisura (OTCPK:TRRSF) (TSX:TSU:CA) 2.5 years ago. At the time of writing, the stock price was about $30 adjusted for splits (all dollars are Canadian throughout the article). The stock reached the mid-forties three times since but currently is trading in the low-thirties.

What has happened? Is the stock attractive today? We will address these questions shortly but will start with a short review of the business.

Trisura’s Business Model

The company was spun off by Brookfield Corporation (BN) in 2017 as a tiny specialty property and casualty (“P&C”) insurer in Canada that specialized in three business lines: surety, corporate insurance (mostly directors’ and officers’ liability), and the so-called risk solutions that covered primarily extended warranty for various products. While small, Trisura was solidly profitable and growing.

The company, however, nourished aggressive growth plans in the US in a different line – fronting insurance – that it started implementing immediately upon the spin-off. At that time, its US office (located in Oklahoma) consisted of literally one person.

The fronting business seems rather simple in theory. A fronting insurer uses its license to write a policy that is immediately ceded in full or almost in full to third-party reinsurers (or some other form of alternative reinsurance capital) in exchange for a ceding (or “fronting”) fee which is typically 5-6% of the gross premium. All underwriting risks are being transferred this way and the fronting insurer keeps the fees. Provided the fronting insurer has secured the commitment of the willing and substantial reinsurance capital, the business may be quite lucrative. However, there are plenty of issues to be negotiated between the fronting insurer and reinsurers with most essential of them to be centered around the use of capital (collateral, how much, in what form), insurance lines, distribution, cash flow management, claims handling, counsel appointment, ratings, local regulatory issues including licensing on a state-to-state basis, and so on.

Once negotiated, these details, specific for each reinsurance contract, constitute a program that can be run smoothly for many years. This is not a new concept and several prominent insurers (such as Admiral Group (OTCPK:AMIGY) in the UK or Markel (MKL) in the US) have been successfully doing fronting business for years.

Trisura’s achievements in fronting insurance turned out truly astonishing. Over several years, its growth rate (measured by gross premium written, or “GPW”) reached triple digits. Additionally, the traditional Canadian segments consistently expanded by 20-30% annually, maintaining an exceptional combined ratio ranging from the seventies to the low eighties.

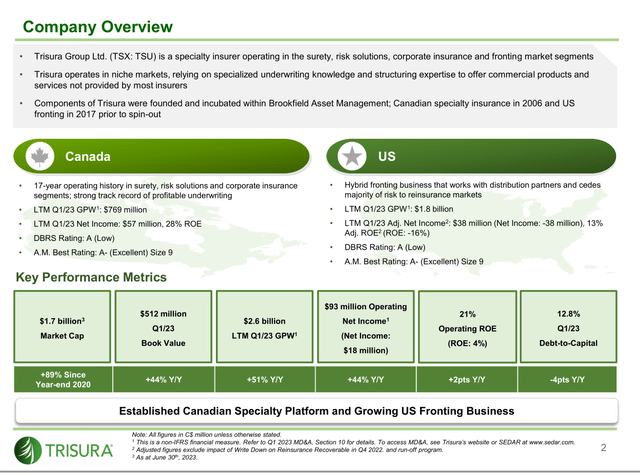

The slide below sums up Trisura’s snapshot after Q1 2023.

Company

The stock price mirrored this remarkable growth. Even today, after more than 6 years of retention (I made my investment immediately after the spin-off), my IRR stands at ~36%. This is especially noteworthy considering the stock’s lack of significant movement since 2021.

Over the past 1-2 years, Trisura achieved some integration of business lines between its Canadian and US segments. Specifically, the company ventured into the fronting business within Canada (reported within the Canadian segment as a separate line) and expanded into surety and corporate insurance within the US (reported within the Canadian segment as well).

Everything was going very well until the end of 2022.

Write-Down of Q4 2022

The issue that affected Trisura so badly was related to only one program out of about 70 that were running. In accounting terms, Trisura had to write down $82M of the reinsurance recoverable asset on its balance sheet. It was big considering that Trisura’s combined equity at the end of 2022, after the write-down, was $483M.

Let me first of all present the explanation of what happened from the Annual Report:

The write down in the fourth quarter was related to a disagreement over obligations under a quota share reinsurance contract. The program included captive participation and required catastrophe reinsurance making it unique in our portfolio. Higher catastrophe reinsurance costs had the effect of depleting collateral and contributed to the write down. This program had a multi-year history with Trisura, and a unique mix of factors drove the experience this year. The reinsurer does not participate on any other programs. We believe firmly that this is an isolated event, and remain confident in our ability to scale the platform in the long term. The program is now in accelerated run-off.

You may notice that the language is somewhat opaque which is probably due to the pending legal actions. Though we do not have a full and detailed disclosure, what happened is rather clear.

Upon issuing a policy, Trisura assumes a legal responsibility to indemnify losses, even if the policy is entirely ceded to another party. Nevertheless, in the event of a loss covered by the policy, the expectation is that the reimbursement will come from the reinsurer’s resources. The designated sum that the reinsurer is anticipated to provide is recorded as a reinsurance recoverable item on the balance sheet. Notably, this entry is backed by collateral (particularly for an unrated reinsurer) to prevent the reinsurer from eluding its contractual commitments.

Due to several distinctive factors specific to this program, the collateral in place was inadequate to offset these losses. As a result, Trisura had to write down the reinsurance recoverable and transition the program into a phase of managed decline (run-off).

The program is expected to be completely off Trisura’s books by the end of Q4 2023. Meanwhile, it introduces certain volatility in Trisura’s results and the company presents its results on both an IFRS basis and an operating basis ignoring run-off and capital gains.

Following this incident, the company disclosed financial results for two consecutive quarters and conducted a meticulous review of its financial records. The management seems assured that this particular failure was an exceptional occurrence and is unlikely to happen again. Still, the stock price experienced a decline of nearly 25% when Trisura revealed the write-down in early 2023 and has not rebounded since.

Please note that this failure does not compromise Trisura’s business model. Markel has run a very similar fronting operation for many years without a single glitch.

The Latest Results

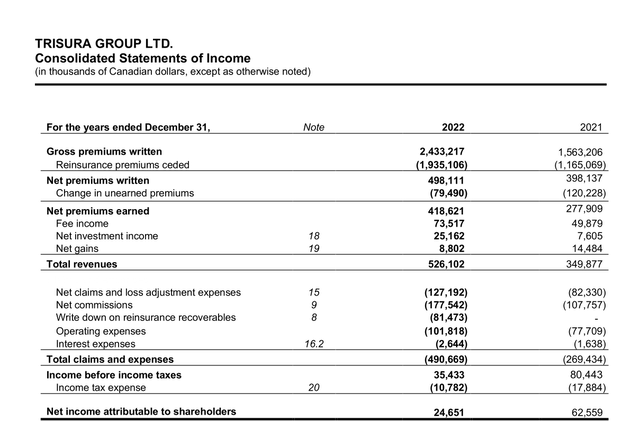

I will start by presenting the latest full-year income statement which allows readers to judge the rate of growth and the current scale of operations.

Company

The sharp drop in net income was due to the write-down that we have discussed. But please pay attention to the growth in insurance revenues and net investment income as well.

IFRS required insurers to implement a new accounting standard (IFRS 17 and 9) effective Jan 1, 2023, with a transition date of Jan 1, 2022. This has created a somewhat confusing situation: We have Trisura’s 2022 full-year results according to the old accounting standard presented above, and the Q1 and Q2 results for both 2022 and 2023 according to the new standard. To discuss the 2023 half-year performance, I will use the new standard.

In Canada, insurance revenues grew at 32% with a combined ratio of 82% YTD. This is despite increased expenses related to expanding its surety business to the US (as a reminder: US Surety is reported within the Canadian segment). In the US, the insurance revenue grew by 59% YTD.

On an operating basis, the company earned $1.13 per diluted share YTD evenly split between two quarters. If we double it to estimate the full-year EPS, Trisura is currently trading at a P/E of 32/2.26~14.

This valuation appears to be low for a quick grower. Nevertheless, individuals contemplating an investment should weigh whether the Q4 2022 write-down was an isolated incident or indicative of systematic oversight. The former scenario seems more probable, given that it stood as the sole misstep during the company’s 24 quarters of reporting. Moreover, after the occurrence, the company took multiple measures to strengthen its business processes.

In my opinion, investors will require a couple of additional quarters to forget what happened in Q4 2022. Only after that and provided the growth and profitability remain intact, the stock may revisit the high forties.

There are several reasons to be optimistic about the growth. First, the company has plenty of capital to support writing policies. Several days ago, Trisura issued additional shares to raise $53M. Its leverage is low and the company can issue more debt to further increase its capital base.

Secondly, this quarter, Trisura is expected to make a small acquisition in the US that should bolster its surety business. Trisura also just started hiring staff to offer corporate insurance in the US.

Thirdly, there is still plenty of growth left within its US fronting business. Currently, there exists a high demand for Excess and Surplus lines that are bread and butter for Trisura’s fronting business. But admitted lines started contributing as well – 10% in the last quarter. For admitted lines, Trisura has licenses in 49 states and is working to get it in the last one.

Until recently, the company’s investment portfolio was rather small but it is more than a billion including cash now. Its optimization combined with higher interest rates should provide additional income.

Conclusion

Being still small is the main risk for Trisura. A single mistake can trickle down to the bottom line. However, its current valuations are sufficiently low to mitigate this risk for investors.

Being small can be advantageous as well. The company can continue its rapid growth. No doubt the management is confident in this growth – otherwise the recent equity issuance would not be required. In my opinion, it is a very bullish sign as the management is aligned with outside investors. For CEO David Clare, the ratio of his share ownership to salary is about 14 and is pretty high for several other executives.

Trisura can also become a target for a deep-pocketed acquirer. For 2023, GPW will likely be close to $3.5B vs. ~$1.5B of the market cap. These figures can be attractive for an insurer that can replace reinsurance capital, at least partially, with its own.

One potential acquirer is Brookfield. Differently from other alternative asset managers, its insurance arm Brookfield Reinsurance (BNRE) is interested in P&C assets in addition to annuities. Brookfield (including affiliations) has intimate knowledge of Trisura’s business and representation on the Board. Brookfield’s affiliations were holding stakes in Trisura recently and, perhaps, are still holding though I was not able to verify it through the company’s recent filings.

Of note, Argo Group (ARGO), a P&C insurer that Brookfield Reinsurance is scheduled to acquire this year, recently announced a partnership with Trisura. Certainly, it might be just a pure coincidence.

I intend to keep my Trisura shares hoping for further appreciation in 2024.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here