Osisko Gold Royalties: Investors Should Be Thrilled

This article breaks down Osisko’s second quarter earnings and also discusses a recent positive news release discussing a maiden resource at Patriot Battery Metals’ (OTCQX:PMETF) Corvette project, and a subsequent investment in Patriot by Albemarle Corp. (ALB).

Key Highlights Of Q2 2023

Strong Gold Equivalent Production: Despite challenges faced by operating partners, impacted temporarily by wildfires in northern Ontario and Québec, Osisko says its production increased by 11% to 24,645 oz over the last year’s quarter. Meanwhile, the company is also on track to meet its 2023 production guidance.

Financial Performance: Operating cash flow rose to $47.4 million from $35 million, and net income was $17 million, or $.10 per basic share, consistent with last year’s earnings. Adjusted earnings were $32.6 million, $0.18 per basic share, up from $25.7 million, $0.14 per basic share in Q2 2022.

Acquisition of CSA Mine Stream: Osisko says it closed the $150 million acquisition of a silver and copper stream on the producing CSA mine in Australia. The company will purchase silver that’s equal to 100% of payable silver for the life of the mine and refined copper at rates specified in the transaction details.

Amendment to Gibraltar Silver Stream: Osisko increased its effective stream percentage on the Gibraltar silver stream by 12.5% to 87.5%, at a cost of $10.25 million, thereby boosting its future silver production.

Dividend Increase: The company declared a $.06 per share quarterly dividend, marking a 9% increase over the previous quarter, and its shares now yield 1.33%.

Summary: Q2 was another robust quarter for Osisko, marked by steady cash flow and earnings. The company was particularly active, acquiring new silver and copper streams on a top-tier asset in Australia, and increasing its silver stream on a producing mine in Canada. This further improves its jurisdiction risk profile, as most of its top assets are located in mining-friendly regions (such as Canada, Australia, and South America).

Following the quarter, Osisko announced the acquisition of copper and gold royalties at Hot Chili’s Costa Fuego project for $15 million, strengthening its development pipeline further (this link provides more details).

Patriot Battery Metals’ Resource Estimate On Corvette

Patriot Battery Metals

The recent announcement on Patriot’s maiden resource estimate at the Corvette lithium project is more great news for Osisko.

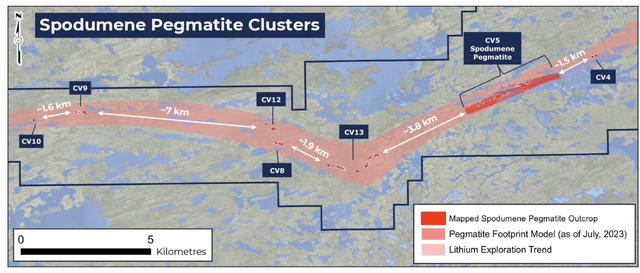

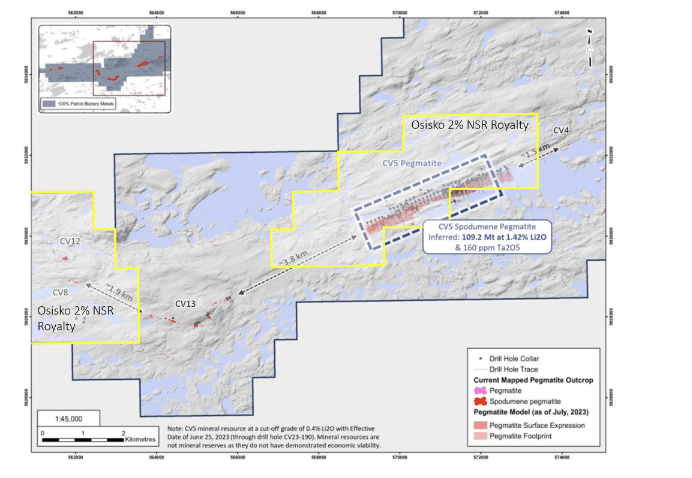

Here’s why: This MRE has established the CV5 Spodumene Pegmatite (within Corvette) as the largest lithium pegmatite mineral resource in the Americas, with 109.2 million tonnes at 1.42% Lithium Oxide and 160 parts per million Tantalum Pentoxide of Inferred Resources.

The total contained lithium carbonate equivalent is 3,835,000 tonnes, and according to Patriot, the geology of the project indicates “substantial potential for further growth.”

Osisko Gold Royalties

Osisko holds a sliding scale net smelter return (NSR) royalty of 1.5-3.5% on precious metals and 2.0% on all other products, including Lithium, at Corvette. Osisko estimates that 80-95% of the resource falls within its 2.0% Lithium NSR royalty area.

Why this is such good news: This significant royalty position in a major new resource represents millions in future royalty revenue potential for Osisko. While the project is still early stage and likely ~5 years away from production, its potential is exciting given the size of the deposit, the high prices of lithium, and the extremely bullish long-term set-up for lithium due to the likely rise in EV demand.

It’s way too early to come up with potential royalty revenue estimates, but certainly, one could surmise that this royalty would end up producing millions in annual royalty revenue based on the deposit’s size and scale, and high lithium prices.

Albemarle Provides More Good News

The potential of this asset was further underscored when Patriot secured a strategic equity investment of over C$100 million from Albemarle, a $20 billion chemical producer with a strong focus on lithium production.

By acquiring 4.9% of Patriot, Albemarle is not only providing financial backing but also validating the Corvette project’s potential. This investment will likely expedite exploration work at Corvette, and the partnership with such a significant player in the lithium market could even hint at the possibility of a future takeover if the exploration proves successful.

In summary, Osisko’s significant royalty position in an emerging lithium resource, coupled with a strategic investment from a major lithium producer, paints a highly bullish picture for this particular royalty, which I believe was not on any investor’s radar.

Osisko Gold Royalties: It’s A Winner

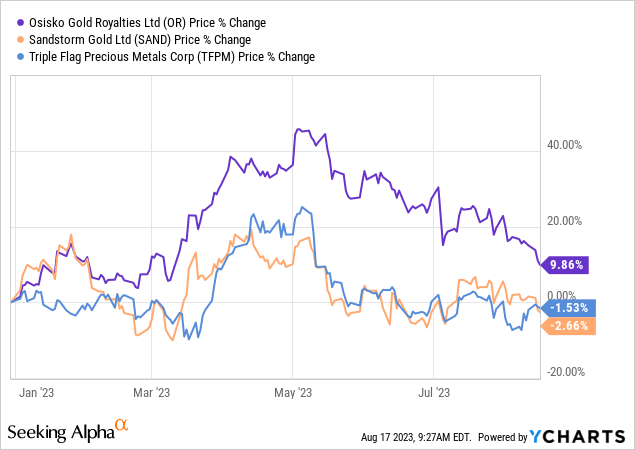

YCharts

Osisko Gold Royalties continues to outperform. While the stock is down by ~12% over the past month, this decline is attributed to the decline in gold prices rather than a company-specific factor. Shares are still up 9.8% year-to-date, crushing the performance of the VanEck gold miners index (GDX), as well as peers Sandstorm Gold (SAND) and Triple Flag Precious Metals (TFPM).

Osisko should be on every precious metals investor’s buy list here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here