Palantir (NYSE:PLTR) is in the process of developing software platforms for governments and enterprises to integrate their data, decisions, and operations at scale. I believe that the majority of Palantir’s software solutions are non-standard platforms, making it challenging for them to leverage most of their technology from one project to another. While Palantir is working on standardizing their commercial solutions, I anticipate that this process will be time-consuming, and these non-standard software platforms may impede Palantir’s margin expansion.

In FY22, Palantir generated 56% of its total revenue from governments and 44% from the commercial segment. They have constructed four principal software platforms: Gotham, Foundry, Apollo, and the recently launched AIP.

Government Business: Customized Platform

Palantir’s Gotham platform has played a crucial role in enabling governments to extract insights from data, particularly for Western defense agencies such as the Central Intelligence Agency. For instance, their technology has been instrumental in combat scenarios and vaccine distribution efforts. Due to confidentiality agreements, Palantir cannot divulge extensive details about these successful projects. Palantir’s primary strength lies in its ability to aggregate, analyze, and deliver data analysis to authorized decision-makers. Consequently, Palantir is required to develop customized and non-standard software tailored to the unique needs of these government agencies. In essence, I think these software platforms are project-specific, making it challenging for Palantir to repurpose a significant portion of the code from one project to another.

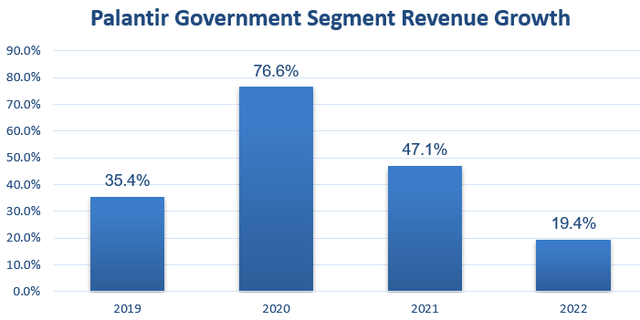

Palantir has experienced substantial growth in its government segment over the past few years, attributed in part to the volatile global political landscape and the COVID-19 pandemic outbreak.

Palantir 10Ks

I have strong confidence in Palantir’s technological superiority within Western government agencies, and I trust that they can secure more projects in the future. It’s evident that global political uncertainties have contributed to Palantir’s growth. However, it’s important for investors to recognize that the growth of the government segment is contingent upon government defense budgets, which can fluctuate from year to year. Furthermore, the allocation of defense budgets is also influenced by government elections.

I believe that Palantir cannot apply a standard platform to different projects, meaning there isn’t much synergy among multiple projects. While these non-standard projects may drive Palantir’s revenue growth, I don’t think they will significantly contribute to its operating margin expansion.

Commercial Business: Key for Margin Expansion

I believe that the key to Palantir’s future success lies in its commercial business. Palantir offers Foundry, Apollo, and the recently launched AIP for commercial institutions. Similar to their government offerings, Foundry has the capability to integrate and amalgamate the data, models, and processes of commercial institutions into an integrated platform for management decision-making. Apollo serves as a software management control center used for software development, monitoring, and remediation. Palantir AIP provides large language models for enterprises, which can be seamlessly implemented into existing platforms. Overall, I consider Foundry to be the most crucial platform for Palantir’s commercial customers.

In Q2 FY23, Palantir disclosed that their U.S. commercial business spans approximately 30 different industries, including pharmaceuticals, energy, consumer staples, utilities, healthcare, construction, automotive, and transportation infrastructure.

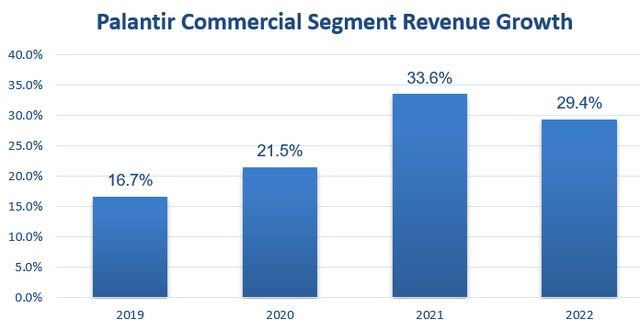

Palantir 10Ks

The question remains: can Palantir offer a standardized platform to these customers, or does each project require extensive customization?

Over the past few years, I’ve observed that Palantir has taken steps towards transitioning from a highly customized and time-consuming deployment model to a somewhat more standardized approach. While they still have a long way to go, I believe this shift is the right strategy for Palantir. Highly customized software projects demand significant early investments and resources, and most of these cannot be leveraged in the future, making them less beneficial to the company’s margins.

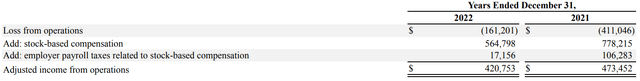

That being said, I think it might take decades for Palantir to fully achieve a standardized software platform. Consequently, this transition may impact their operating margin expansion in the near future. It’s worth noting that Palantir has reported a negative operating margin since its IPO, although the non-GAAP operating margin was 22.1% in FY22. Their adjusted operating income excludes stock options, which most companies also do. However, I view these stock options as genuine expenses, as they are part of the total compensation for their engineers.

Palantir FY22 Annual Reports

In summary, I believe Palantir is moving in the right direction by introducing more commercial solutions and working towards a more standardized platform, which has the potential to gradually improve their margins. However, it’s important to acknowledge that this margin expansion may be a lengthy process.

Considering both their government and commercial businesses, I anticipate that Palantir’s margin expansion will progress at a slow pace, and they may continue to report negative operating margins in the coming years. Ultimately, I estimate that Palantir may not reach margins similar to those of other pure software companies due to the project-based nature of their products.

Palantir and AI

Many investors are enthusiastic about Palantir and view it as an AI-focused company. I acknowledge that Palantir offers in-house technology to assist governments and commercial enterprises in aggregating data and performing data analytics. Furthermore, their AIP allows customers to deploy large language models using their own data. Nevertheless, I believe Palantir’s primary role is in facilitating enterprises and governments in implementing AI, and I don’t consider Palantir a pure AI company.

In my view, the way Palantir contributes to its customers is quite analogous to Accenture’s (ACN) business model. Accenture also heavily invests in the AI business, offering consulting and AI implementation services to its customers. However, I find it hard to classify Accenture as an AI company.

In other words, while AI and big data can certainly drive Palantir’s business growth and increase the demand for AI-related software platforms, Palantir operates primarily as a third-party service provider. For example, if an enterprise wishes to build a large language model for a specific aspect of their business, leveraging in-house datasets from various sources, they might develop these machine learning capabilities in-house or engage the services of Palantir or Accenture to assist them in building it.

Financials and Outlook

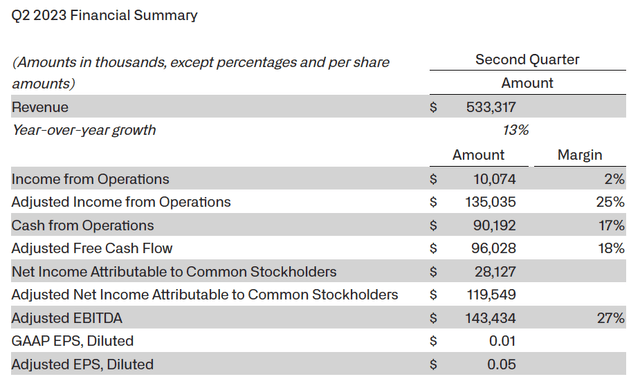

In Q2 FY23, their revenue grew 12.7% year-over-year and adjusted profits increased 25.2%. The adjusted free cash margin was 18% in Q2 FY23.

Palantir Q2 FY23 Earnings

They raised their revenue guidance to over $2.212 billion for the full year FY23 and increased adjusted operating income to $576 million. Overall, I believe it was a quite decent quarter for Palantir. Additionally, the board authorized a $1 billion stock repurchase for their Class A common stock.

On the balance sheet, they concluded the second quarter with $3.1 billion in cash and cash equivalents. Furthermore, they have access to $500 million in undrawn credit facilities. Consequently, I’d say Palantir possesses a robust balance sheet.

I anticipate that Palantir can achieve approximately 30% revenue growth in the coming years. This projection is based on their consistent investments in their commercial business and AI initiatives. Moreover, global political uncertainties could potentially fuel further growth for Palantir’s government solutions.

Key Risks

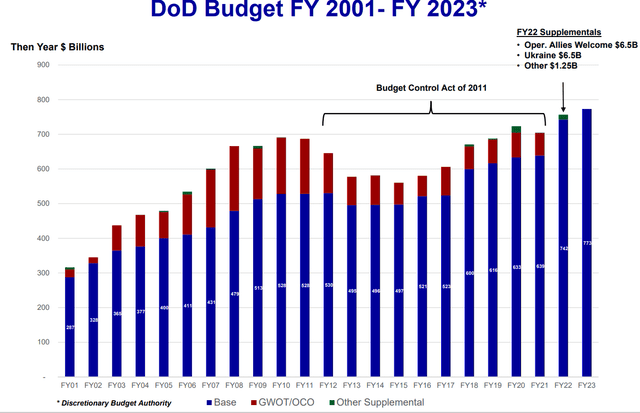

Government Defense Budget: According to the U.S Department of Defense 2023 budget, the requested defense budget for 2023 stands at $813.3 billion, representing a 2.2% increase from the 2022 level. It’s important to note that while Palantir’s government business is primarily tied to the software portion of the budget, its revenue growth could be influenced by the overall spending pattern.

As illustrated in the chart below, the DoD budget has historically experienced fluctuations, with most of these fluctuations being attributed to political parties or global political uncertainties, particularly concerning Russia and China.

The U.S Department of Defense

High Stock Based Compensation: Palantir currently allocates nearly 30% of their sales to stock-based compensations. It’s worth noting that they have been actively managing stock-based compensations in recent years, significantly improving the situation.

For comparison, in previous fiscal years, they allocated 42% of revenue to stock-based compensation in FY18, 32% in FY19, a staggering 116% in FY20, and 50% in FY21. This resulted in a dramatic increase in their shares outstanding over the past few years, with a 7.3% increase in the last fiscal year alone.

Palantir excludes stock-based compensation when calculating adjusted gross margin and adjusted operating margin. In Q2 FY23, they anticipate that stock-based compensation will continue to trend upward through the latter part of the year. Additionally, they are in the process of linking future employee equity compensation to the success of AIP. As a result, I believe it’s unlikely that their stock-based compensation will decrease in the near future.

DCF Valuation

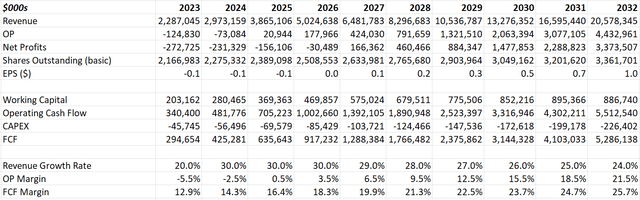

In my assessment, Palantir has the potential to achieve rapid revenue growth over the next decade. However, I don’t expect them to reach the same operating margin levels as other software companies. While most software companies can deliver operating margins of 30% to 40%, I estimate that Palantir will expand its margin to 21.5% by FY32 in my discounted cash flow model.

In my model, I assume that their revenue will grow by 20% in FY23 and around 30% for several years thereafter. Based on these assumptions, I project that Palantir could become a $20 billion revenue company by FY32.

Palantir DCF Model – Author’s Calculation

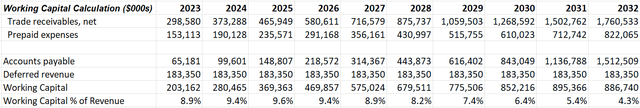

With these assumptions, the free cash flow margin is forecasted to reach 25.7% in FY32, and their working capital as percentage of revenue will be improved to 4.3% in FY32.

Palantir DCF Model – Author’s Calculation

I am using 10% of WACC, 4% of terminal growth rate and 20% of tax rate, and the enterprise value is estimated to be $27 billion in my model. Palantir has zero debt, so adding back the cash, the fair value is $13.5 per share as per my estimates.

Conclusions

I have a strong belief in Palantir’s growth trajectory over the next decade. However, I am less confident in their margin expansion story, as I believe it will take a considerable amount of time for them to standardize their commercial platforms. Additionally, their high stock-based compensation could persist for an extended period. Taking into account the valuation, I am assigning a “Hold” rating for Palantir.

Read the full article here