Nanobiotix (NASDAQ:NBTX) is a clinical stage French company developing cancer treatments that use proprietary nanotechnology. Lead asset NBTXR3 is a radioenhancer, a “suspension of metabolically inert nano-sized particles for intratumoral injection,” being evaluated both as a single agent activated by radiotherapy alone, and as a combination product with other anti-cancer therapies including chemotherapy and immune checkpoint inhibitors.

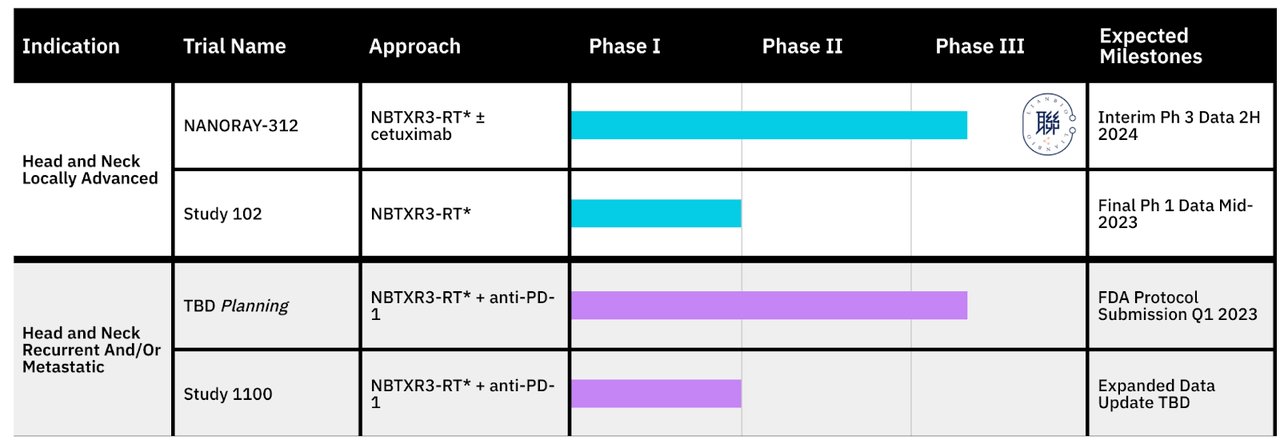

Here’s the pipeline:

NBTX PIPELINE (NBTX WEBSITE)

As you can see, NBTXR3 is the only asset, but it is like a platform of sorts. It is being used in various combinations. In non-metastatic HNC, it is used in combination with cetuximab in a phase 3 trial (which will have interim phase 3 data in 2H 2023), and it is also used in the same indication as a single agent in a phase 1 trial (final data mid-2023). NBTXR3 is also used in combination with an anti-PD-1 agent in recurrent and/or metastatic HNSCC, which had an FDA protocol submission in Q1; and there’s one more phase 1 trial. There is also a completed trial in various solid tumors, and an ongoing study by MD Anderson Cancer Center.

NBTX had a licensing deal with LianBio in certain territories including China. In July, the company signed a major deal with Janssen, whereby it is giving JNJ global licensing, co-development, and commercialization rights, under the following payment terms:

Nanobiotix will receive near term cash and operational support valued up to $60 million. This includes an upfront cash licensing fee of $30 million, and in-kind regulatory and development support for study NANORAY-312 valued at up to $30 million that Janssen may provide at its sole discretion. Nanobiotix will maintain operational control of NANORAY-312 and all other currently ongoing studies, along with NBTXR3 manufacture, clinical supply, and initial commercial supply. Janssen will be fully responsible for an initial Phase 2 study evaluating NBTXR3 for patients with stage three lung cancer and will have the right to assume control of studies currently led by Nanobiotix.

Nanobiotix is eligible for success-based payments of up to $1.8 billion, in the aggregate, relating to potential development, regulatory, and sales milestones. Moreover, the agreement includes a framework for additional success-based potential development and regulatory milestone payments of up to $650 million, in the aggregate, for five new indications that may be developed by Janssen at its sole discretion; and of up to $220 million, in the aggregate, per indication that may be developed by Nanobiotix in alignment with Janssen.

Following commercialization, Nanobiotix will also receive tiered double-digit royalties on net sales of NBTXR3.

Thus, what this means is that NBTX is effectively sharing NBTXR3 for $30mn in upfront payment and a huge promise valued at over $2bn. They are giving it to a big pharma arm known for its R&D prowess. The deal tells me that JNJ thinks RBTXR3 is worth a lot of money if it can fulfill its promise. I think this is a good deal. The company has an “extraordinary” shareholder meeting on Sept 1 to discuss equity shares they will issue to JNJ for another $30mn in equity stake JNJ will assume as part of the deal.

In a phase 1b trial in rectal cancer, RBTXR3 showed positive data, as follows:

-

70% of patients showed objective tumor response after CCRT. Around 90% of patients underwent total mesorectal excision (surgery); and 17.6% achieved pathological complete response (pCR).

-

50% of patients receiving surgery had good tumor regression (tumor regression grade 0 or 1).

This data was presented at ASCO-GI in 2021, although the rectal indication is no longer being pursued.

In the same ASCO meet, NBTX also presented data from the combo trial of RBTXR3+chemo+anti-PD1 in various solid tumors, which showed:

-

Tumor regression was observed in 76.9% (10/13) of evaluable patients, regardless of prior anti-PD-1 exposure.

-

The study reported tumor regression in 80% (4/5) of anti-PD-1 naïve patients and 60% (3/5) had investigator-assessed objective response, including one complete response.

In HNSCC, NBTXR3 is running a phase 1 trial which yielded very strong data, with 63% complete response among 41 evaluable patients. HNSCC is a major market where key medicines have over a billion dollars in sales, and where, despite limitations, 74% of patients receive radiation therapy. The solid data in this still-ongoing phase 1 led to the phase 3 NANORAY-312 studies, as monotherapy and in combination, in local and metastatic HNSCC.

Financials

NBTX has a market cap of $315mn. The company did not release earnings this quarter because of the JNJ deal. In the May quarter, it said it had a cash balance of €41.4 million as of the December quarter. R&D spend was €32.6 million for the twelve-month period ended December 31, 2022, while G&A expenses were €17.9 million for the same period. This fund, the company said, would fund it till the third quarter, which is now. Thus, we can see how the JNJ deal is a lifeline for them, and why they did not release earnings yet, because they wanted to update their earnings figures with the updated deal data. If all else was well, the earnings update, which I suppose they will release sometime in September or in the next quarter, will give the stock a boost.

Risks

All is, however, not well, given the low volume of trading in the US. At such low volatility, even good news may not have much impact on the stock price, although, to be sure, the stock has spiked 5x since May on low volume.

The low cash was, of course, a problem, but that is roundly mitigated by the JNJ deal.

Bottomline

Barring that volume problem, NBTX looks like an attractive stock. These RT therapies, if they can penetrate the tumor and get adequately titillated by X-Rays, usually produce good tumor killing response as well as a residual immune response that can then be enhanced by the immune checkpoint inhibitor, producing a comprehensive killing effect. I will continue watching NBTX with interest.

Read the full article here