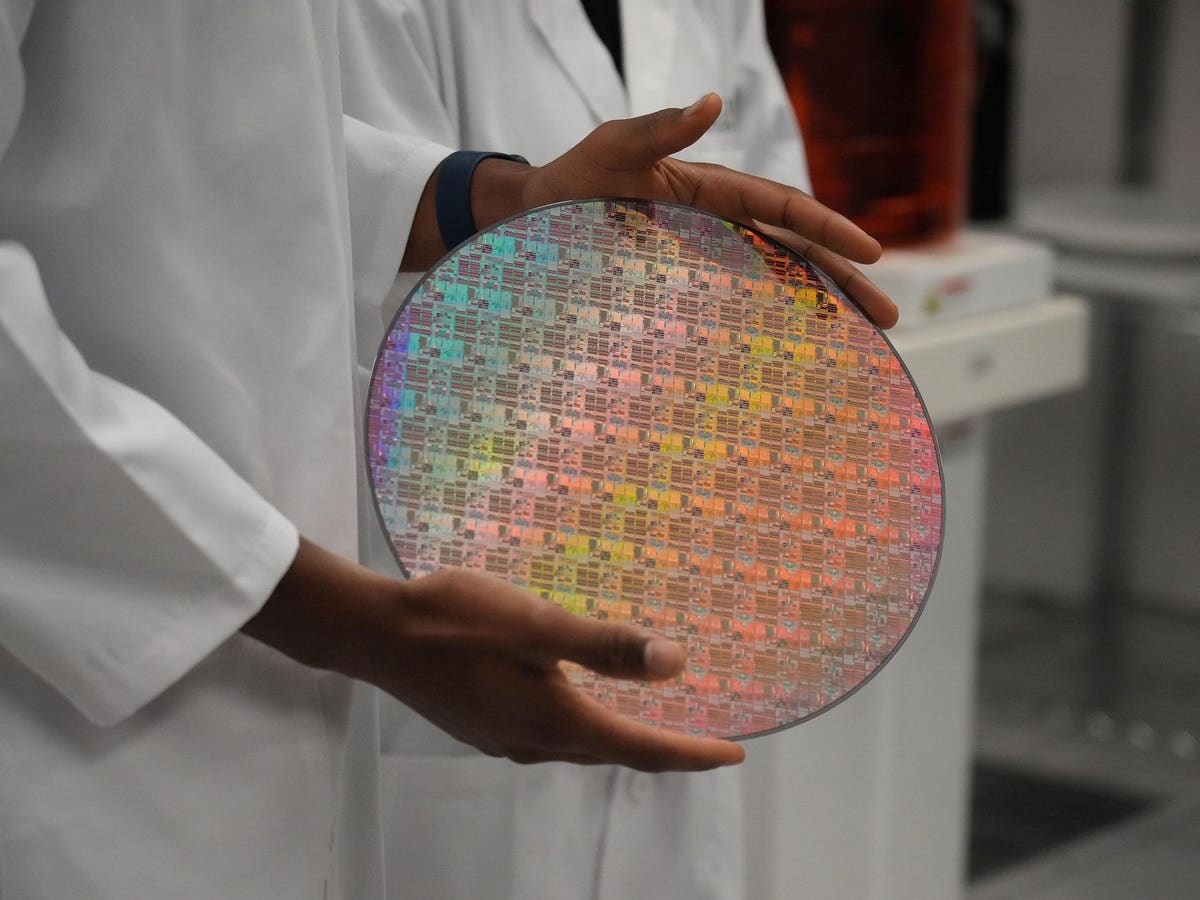

Applied Materials

AMAT

Interestingly, AMAT stock had a Sharpe Ratio of 0.7 since early 2017, higher than 0.6 for the S&P 500 Index over the same period. Still, it falls short of the Sharpe of 1.3 for the Trefis Reinforced Value portfolio. Sharpe is a measure of return per unit of risk, and high-performance portfolios can provide the best of both worlds.

Now, is Applied Materials stock a buy at current levels? There are some trends that could help Applied. Generative AI has captured the imagination of the technology industry, following the launch of the viral ChatGPT chatbot. This is likely to lead to a surge in demand for high-end graphics chips and high-bandwidth memory products to run compute-intensive generative AI algorithms. This could benefit Applied as well, given that customers could look to invest in more high-end chipmaking equipment. That said, Applied’s near-term performance could remain mixed with the company’s revenues and earnings projected to remain roughly flat over the next two years per consensus estimates. Moreover, at the current market price of about $148 per share, or about 19x projected 2023 earnings, Applied stock appears fully priced. We remain neutral on Applied Materials stock with a $148 price estimate. See our analysis of Applied Materials Valuation: Expensive Or Cheap for a closer look at what is driving our price estimate for the stock. See our analysis of Applied Materials Revenue for a closer look at the company’s key revenue streams.

Invest with Trefis Market Beating Portfolios

See all Trefis Price Estimates

Read the full article here