How many equity risk premiums are out there? Too many to address in a single blog post. The variety is at once a challenge and a tool. A challenge because depending on your modeling preference, forecasting how the stock market will fare relative to some proxy of the “risk-free” rate can be all over the map. That’s a problem, except when you consider that combining forecasts and using the median as a relatively robust guesstimate is a tool to make lemonade out of lemons.

This is a bit of a project, however, and so this post introduces what will be an ongoing and evolving effort to build a better equity risk premium forecast. In the weeks ahead, I’ll aggregate a variety of models and use the collective diversity to build a better forecast. That, at least, is the plan.

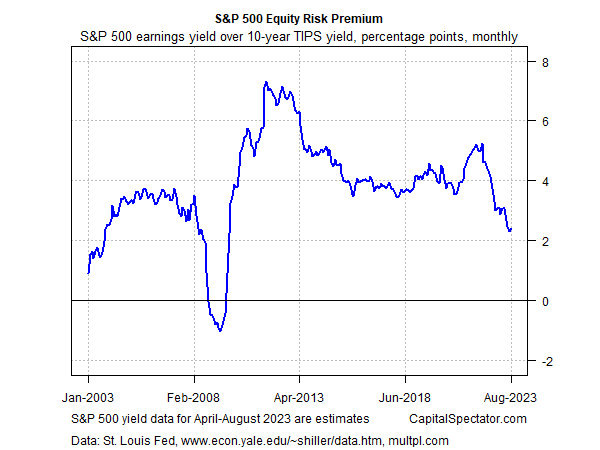

Let’s start with a basic setup: using the trailing S&P 500 earnings yield less the 10-year US inflation-protected Treasury yield. On this basis, the equity risk premium (ERP) has been fading lately and is currently around 2.4 percentage points.

That’s a roughly 50% haircut for the ERP vs. March 2022, when the Federal Reserve started raising interest rates. Is that a relevant date for why the ERP peaked in recent history? Oh, yeah. Higher interest rates represent stronger competition for stocks. If you can lock in a competitive and “safe” payout ratio in government bonds that’s close to, if not exceeds, the expected return for stocks, why assume the higher risk in equities?

Good question, and one that everyone’s asking these days after a year-and-a-half of rate hikes, that may or may not continue.

Another good question: What’s the best equity risk premium model? That’s a tough one, in part because every ERP model has its own set of pros and cons. The good news is that you can extract more signal and reduce the noise by combining forecasts from various models, a task that will be front and center in updates to this column in the weeks and months ahead.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here