It seems like it’s been years since we’ve had a true flush of IPOs hit the market, but in this chillier environment, Cava (NYSE:CAVA), a chain of fast-casual Mediterranean restaurants, has entered the fray.

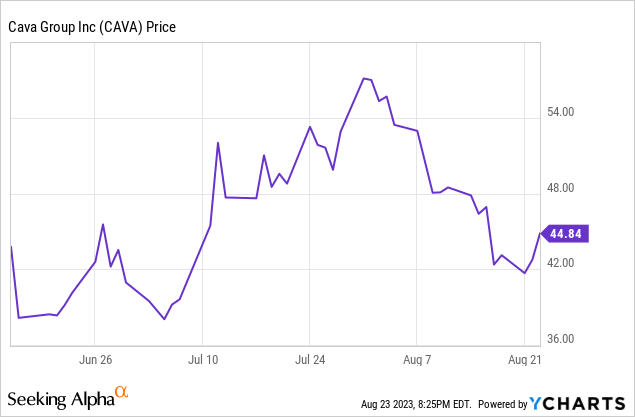

So far, the offering has been well received. After pricing its IPO at $22 per share in June, Cava has shot up more than 2x, indicating that the company may have left money on the table.

After poring through the prospectus and offering documents, while I am intrigued by the company, I am neutral and am on the sidelines to start.

For investors who are completely new to Cava: the company is effectively branding itself as the “Chipotle of Mediterranean food.” The company opened its first location in 2012 and has since grown to over 250 locations.

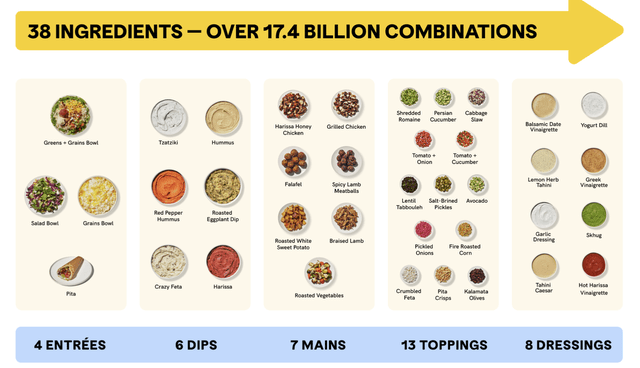

Cava menu (Cava prospectus)

In my view, there is a relatively balanced bag of positives and negatives to watch out for. On the bright side for Cava:

- The company is scaling rapidly. Unit economics for each new location are favorable, and the company’s only limitation seems to be capital (which fresh IPO funds can solve). With relatively low penetration in the U.S., Cava has plenty of room to expand.

- Aligns well with healthy food trends. Mediterranean foods, with its focus on grains and greens, is well-aligned to the healthy food trend and can continue to draw healthy attraction, particularly on the West Coast where Cava is relatively underpenetrated.

However, we should watch out for:

- Valuation. A lot of early investors are truly banking on Cava to take a Chipotle-like trajectory (for comparison – Chipotle is now worth just shy of $60 billion in market cap). There’s a fantastic Wall Street Journal IPO recap that details how Chipotle had roughly double the number of restaurants as Cava at the time of its IPO, despite being worth just over $1 billion in market cap at the time.

- Competition – will this food trend continue? The big question mark is if Mediterranean food is ripe for takeover by a major national chain – and if popularity for the cuisine can be sustained. Food trends often come and go as fads, and Cava’s heavy capital outlays to open a slew of new locations may not pan out as expected.

Overall, I’d recommend staying on the sidelines and exploring a buy position only if the stock dips from here.

Expansion potential

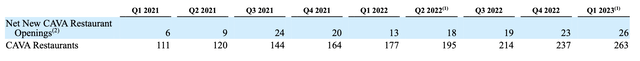

First – let’s look at Cava’s growth trajectory and its expansion potential. As of the first quarter of 2023, Cava has expanded to 263 locations. The company added 26 new restaurants in the past quarter alone.

Cava restaurant openings (Cava prospectus)

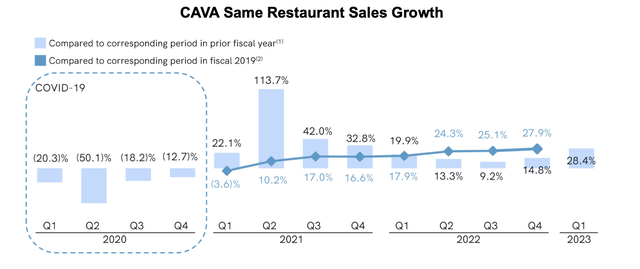

Same restaurant sales growth, which is a metric that tracks Cava’s revenue growth excluding the impact of new locations, is up 28% y/y as of the most recent quarter – indicating that popularity is continuing to grow. Q1 all-in revenue of $197 million, meanwhile, grew 76% y/y. And in Q2, the company’s first earnings release since going public, revenue continued to grow at a stunning 62% y/y pace.

Cava same-store sales growth (Cava prospectus)

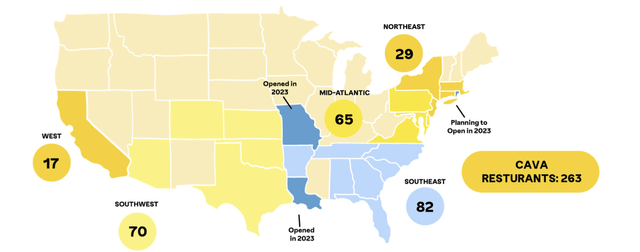

From a geographic perspective, Cava has mainly established a presence on the East Coast where it was founded. Meanwhile, there is plenty of uncharted territory in the Midwest and West Coast, as shown in the map below:

Cava geographic coverage (Cava prospectus)

New opening economics

Needless to say, adding territory and locations is critical to Cava’s growth path going forward.

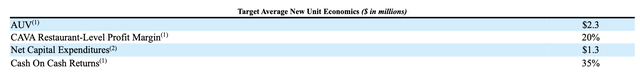

The company disclosed that the typical restaurant takes $1.3 million in capex outlays to open. In turn, the company targets a restaurant in its second full year of operations to generate $2.3 million in annual revenue, at a 20% margin (versus $2.5 million in average AUV for a suburban Cava location, and $2.8 million for an urban one).

Cava unit economics (Cava prospectus)

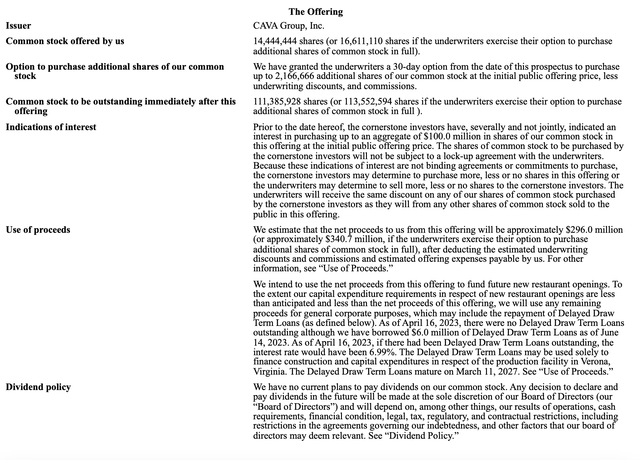

In terms of ability to finance expansion: Cava’s IPO brought in $296 million of net proceeds, per the company’s final registration filing, which the company plans to use predominantly for new restaurant openings.

Cava IPO metrics (Cava prospectus)

This comes at good timing, as Cava had only $22 million on its balance sheet prior to its IPO. Not counting the working capital needed to operate a restaurant, and using $1.3 million as the average capex outlay for a new location, the IPO gives Cava funds to open more than 200 new locations, nearly doubling its size. Going forward, the company can certainly pick up its pace of opening 20-25 locations per quarter. The operational risk here is if Cava tries to move too quickly: in the rush to grow quickly to use up the IPO proceeds while the company has momentum, it may be less selective in new restaurant openings and chain-level performance could suffer as a result.

Profitability

Some good news here: Cava’s profitability is improving both at a company level and restaurant level.

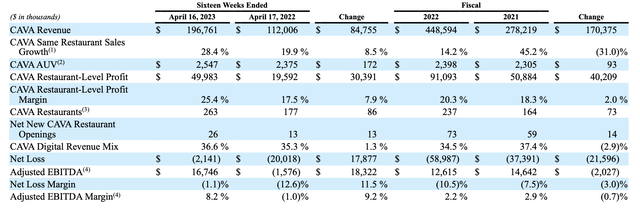

Cava key financials (Cava prospectus)

As shown in the table above, the company hit a positive 8.2% adjusted EBITDA margin in the trailing sixteen weeks prior to IPO, representing a 920bps improvement from the year-ago period. And restaurant-level profit, which is a measure that strips out corporate operating expenses, rose roughly 2.5x y/y to $50.0 million, representing a 25.4% margin – 790bps better than the year-ago period.

This does indicate that Cava is scaling well and has good unit economics. As a reminder, the company targets a 20% restaurant-level margin by Year 2 of operations, which the overall company is exceeding for all of its locations. The one asterisk with using this pro forma metric is that Cava does have discretion over how to allocate expenses, so parking more spend into its corporate umbrella may help the company’s restaurant-level margins look healthier.

Key takeaways

All in all, I don’t see enough immediate appeal in Cava to buy the stock so early on into its life as a public company. The next year will be a big test for Cava as the company bets big on national expansion using its IPO funds. If the favorable unit economics we’ve seen on the first 263 locations plays out well into the next 200, Cava will be in good shape – but this execution is far from certain. Keep watching CAVA stock, but exercise caution.

Read the full article here