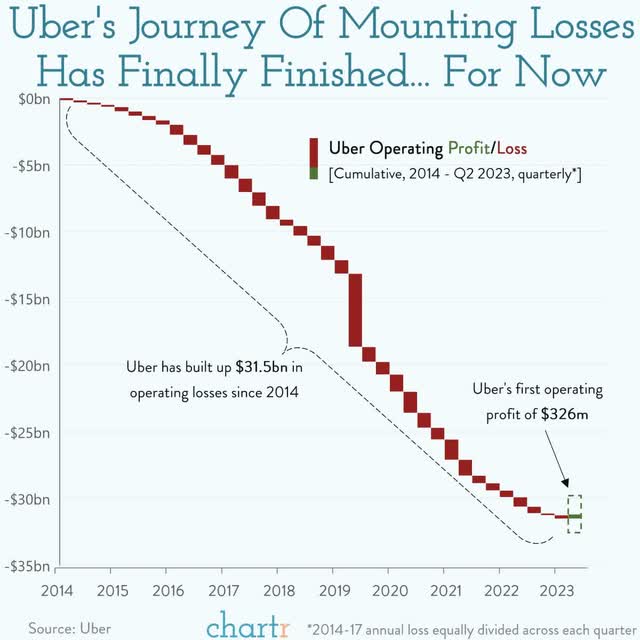

Uber Technologies, Inc., (NYSE:UBER) once primarily known as a ride-hailing platform, has evolved dramatically since its inception. Initially plagued with consistent unprofitability, the company built up losses of over $30 billion. But Uber recently celebrated a significant milestone: reporting its first-ever operating profit of $326 million. This remarkable turnaround has coincided with an 82% year-to-date surge in Uber’s stock, taking the company’s stock to just above $45 a share.

Chartr

Financial Overview

Uber’s present valuation stands at $91 billion, with $8.5 billion in cash, $7.5 billion in investments, and long-term debt of $9.3 billion, the enterprise value at approximately $84.3 billion.

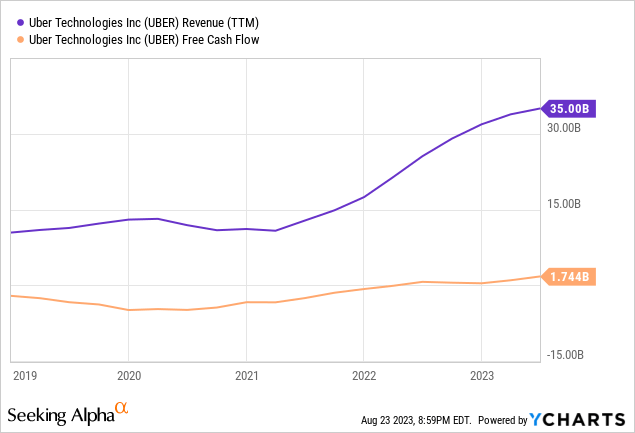

Gross Bookings saw an 18% YoY increase in Q2 at $34 billion. There was a 14% increase in total revenue coming in at $9.2 billion. That takes the trailing twelve month total to $35 billion. Net income for the quarter was $394 million but the trailing twelve month figure is still negative at -$400 million. Adjusted EBITDA more than doubled to reach $916 million and free cash flow climbed to $1.1 billion. Uber has now delivered over $1.7 billion of free cash flow in the past year.

Operational Segments and Revenue Streams

Uber’s diversification strategy is evident in its three primary segments:

1. Mobility ($17b or 49% of total revenue):

This segment incorporates ridesharing, carsharing, micro-mobility, and rentals. This segment has seen its revenue contribution decrease from 84% to 49% over recent years. This provides the business with some much needed diversification.

2. Delivery ($12b or 34% of total revenue):

This segment encompasses food and package delivery via Uber Eats and Postmates. There’s been a notable rise here, with revenue contribution jumping from 13% to 34%.

3. Freight Transport ($6b or 17% of total revenue):

This caters to shippers and carriers. While initially contributing a mere 3% of revenue, it has seen a surge to 17%.

For H1 2023, Mobility and Delivery revenues observed a growth of 52% and 18% respectively. However, the Freight segment was a disappointment with a 27% revenue dip. This was attributed to a macro slowdown in freight rates and shipping demand. In the scheme of things, the slowdown in freight doesn’t deter from what was an impressive quarter from Uber.

Geographical Revenue Breakdown

- United States and Canada: 58%

- Latin America: 6%

- Europe, Middle East, and Africa: 24%

- Asia Pacific: 12%

Uber’s potential for global expansion remains substantial, especially considering their strategic investments in companies like Didi and Grab.

Operating Expenses

It’s been a long road but Uber’s gross margin of 39% just about covers its operating expenses:

- Operations & Support: $2.5b (7.2% of revenue)

- Sales & Marketing: $4.8b (13.6% of revenue)

- R&D: $3.1b (8.8% of revenue)

- General & Administrative: $3.1b (8.8% of revenue)

- Depreciation & Amortization: $865m (2.5% of revenue)

Strategic Partnerships and Challenges

Uber’s network effect and progress can be seen through a number of partnerships it’s made in recent months. While the company’s strategic partnership with Domino’s Pizza may not be a gamechanger in terms of revenue growth the collaboration emphasizes the value that restaurants derive from Uber’s expansive network. This is a partnership that exclusively offers Domino’s pizza on Uber Eats.

Reuters

Labor Risk

Perhaps the biggest risk right now for Uber is its relationship with drivers. Notably, its ability to keep drivers happy while also keeping profit margins intact. It’s a fine balance that is made worse by the current low unemployment environment. Even so, Uber at this point looks to have done enough to wade off competition from the likes of Lyft (LYFT).

On the technological front, Uber’s collaboration with Google’s Waymo for autonomous driving is another development that is worth keeping an eye on. Will Uber achieve the same dominance for autonomous driving or will customers gravitate towards native apps from the AV companies themselves (Google/GM/Tesla etc.)?

The Road Ahead

Uber’s potential growth in the coming years remains significant. Latin America and the Asia Pacific regions contribute less than 20% of revenue, indicating expansion possibilities in those markets. Meanwhile, in Uber’s prime markets, less than 10% of the population engages with Uber weekly. Uber’s three markets; mobility, delivery and freight simply provide so many options for future growth. On top of that, Uber has investments in startups and it has growth bets such as advertising Uber for Health and Uber for business.

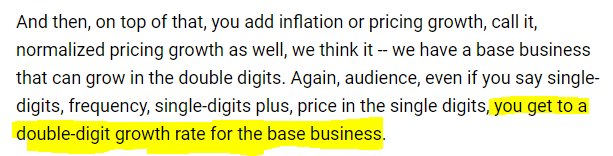

Dara Khosrowshahi has proven to be a competent and pragmatic CEO. He believes the base Uber business is poised for double-digit growth. ‘Growth bets’ on top of that can provide an even larger boost.

Q2 earnings transcript

Back Of Envelope Valuation

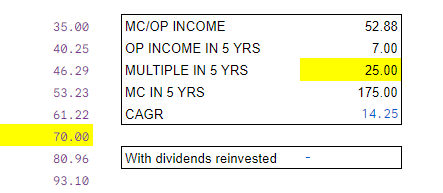

So let’s assume a scenario where Uber can sustain a 15% annual growth rate in keeping with the CEO’s comments over the next five years and then achieve an operating margin of 10%. In that scenario Uber would generate $70 billion in revenue and $7 billion of operating income in five years’ time. Apply a 25 times multiple to that figure gets the valuation to $175 billion and that works out to an investment return of 14.25% a year.

Authors workings

That may be a slightly aggressive forecast for a company that is only just turning profitable but it points to the rewards on offer for a company of such scale. And one thing investors overlook when discussing Uber is the company’s ability to tap into vast swathes of data. Every trip, every delivery can be analyzed and it is this data that allows the company to further fine tune its offering and usurp its competition.

Conclusion

Uber’s transformation from a simple ride-hailing platform to a diversified global enterprise is an impressive journey that has overcome many hurdles and setbacks. Its financial and operational growth continue to offer an intriguing prospect for investors. While risks remain, the company’s strategic moves and commitment to innovation position it well for the future.

Read the full article here