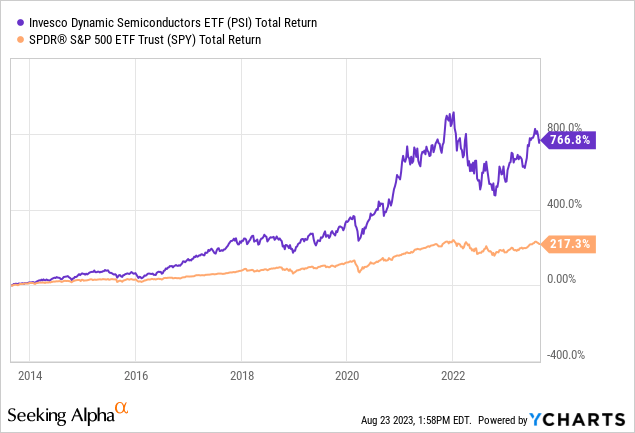

Invesco Dynamic Semiconductors ETF (NYSEARCA:PSI) is a sector-focused fund that invests in about 30 stocks. The fund has had an outstanding performance in its history and easily beat S&P 500 index (SPY) by a pretty wide margin in both price appreciation and total returns.

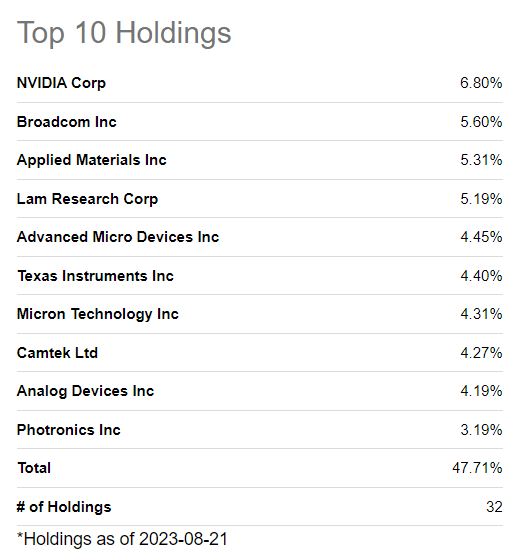

When we look at the fund’s top holdings, we see a lot of familiar names like Nvidia (NVDA), AMD (AMD) and Texas Instruments (TXN) but what is more surprising is that the fund is not invested in a lot of big names in the industry such as ASML (ASML), Samsung (OTCPK:SSNLF), Taiwan Semiconductor Manufacturing (TSM), Qualcomm (QCOM) which also happen to be some of the cheapest chip stocks (I also looked beyond the top 10 holdings just to be sure). The great majority of the fund’s holdings are “fabless” companies, meaning they don’t have their own manufacturing capacity and mostly outsource this to other companies such as TSM and Samsung.

PSI Top 10 Holdings (Invesco)

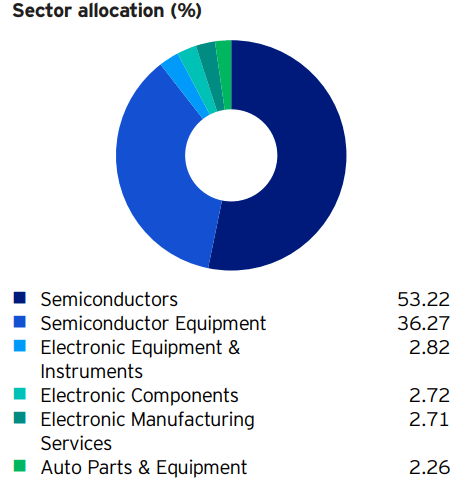

As a matter of fact, only about 3% of the fund’s assets are allocated in “Electronic Manufacturing Services” which further supports this notion that the fund is mostly involved in companies that are considered fabless. This could be because most of fund’s holdings are growth stocks and not many manufacturers are in growth mode but then again TSM has been posting some solid growth in recent years since it’s the company that produces chips for companies like Nvidia, AMD and Apple.

PSI Sector Allocation (Invesco)

The fund seems to have a good mix of large cap and small cap stocks. For example one of the fund’s biggest holdings is Photronics (PLAB) and another one is Camtek (CAMT), both of which are small cap stocks with their market cap around $2 billion. These two stocks have a weight of 3% and 4% in the fund respectively which is only slightly less than Nvidia’s weight of 7%, Broadcom’s (AVGO) 6% and Applied Materials’ (AMAT) 5% which are the fund’s top 3 holdings. It’s clear that the fund is not weighted by market cap or share price.

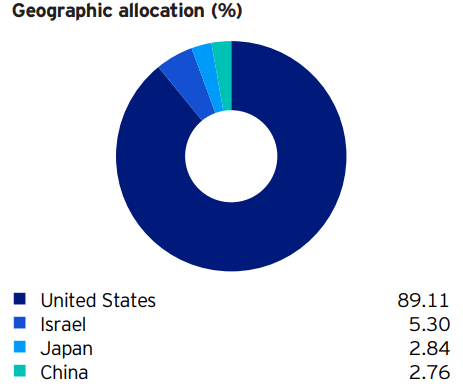

Geographically speaking, close to 90% of the fund’s assets are allocated in American stocks. We also see a small allocation in Israel but it’s mostly Mobileye (MBLY) and a couple other small allocations. Again, I am surprised to see no allocations in Taiwan or South Korea, two of the biggest chip producers in the world, mostly because of its low overall allocation to manufacturing.

PSI Geo Allocation (Invesco)

This is one of those funds you would buy if you are feeling really bullish about its industry overall. The semiconductor industry is highly cyclical but this cyclicality has been mostly masked by new developments in the field of technology such as the rise of AI and self-driving vehicles. Historically the performance of semiconductor industry has been very highly correlated with economic cycles where revenues and profits jump sharply during booming times and drop as sharply during slowdowns but we are also seeing some secular trends in the technology field that might reduce such effects.

Companies like Samsung and TSM are building new factories and infrastructure to be able to manufacture chips at much higher volumes in anticipation that there will be more usage of technology in the future with the rise of AI and smart devices. This could keep driving the demand for chips higher for decades to come regardless of economy cycles.

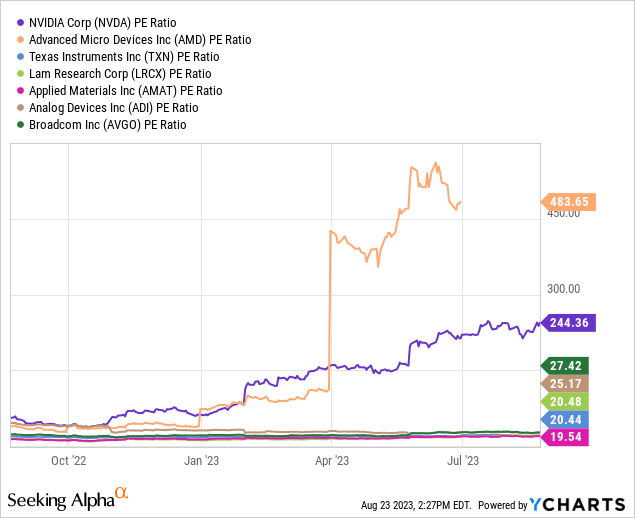

Then there is the issue of valuations. Many chip stocks already rose so much in recent years in anticipation of this. The stock market is a forward discounting mechanism where long term trends get discounted many years ahead. It is no secret that the world is moving towards more smart devices, higher usage of AI and automation and there will be more need for advanced chips so the stock market already started bidding up chip stocks to elevated valuations which some people might even consider crazy.

As a matter of fact, most of those valuations are driven by a few companies like Nvidia and AMD which trade at P/E values in triple digits. If you exclude these companies, the rest of the industry seems to trade at more reasonable valuations. For example, Applied Materials trades at a P/E of 19, Texas Instruments trades at a multiple of 20, same as Lam Research. Analog Devices and Broadcom have higher valuations in mid 20s but nothing I would consider crazy.

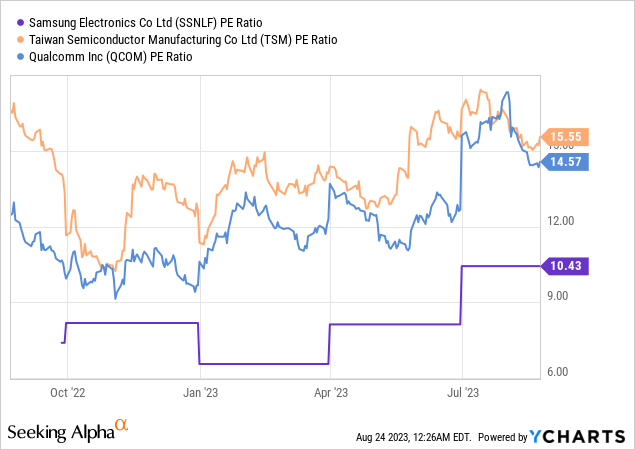

Interestingly enough, some of the cheapest stocks in the industry are not represented in this ETF such as TSM and Qualcomm with their P/Es in mid-10s. I could understand excluding TSM and Samsung if the fund doesn’t want to focus on manufacturing stocks but I find it odd that they excluded Qualcomm.

In the future, the world will need not only more chips but more powerful and more sophisticated ones. There will be also a huge need for chips that can do more for less. What I mean is chips that can produce more output by using less energy. Today many GPUs and CPUs are notorious for using tons of energy and many times the cost of running these processors can be as much as buying them. If chip companies can come up with more energy efficient chip designs they can charge a premium because users will save a lot on energy costs. We don’t know who the winners will be in the future since this is a highly dynamic industry with so many moving parts. This is why it’s easier to invest in a highly diversified fund than try to pick winners. While this fund is not as diversified as I’d like it to be, it comes close and its past performance speaks volumes on its behalf.

By the way the fund’s name is about to change from Invesco Dynamic Semiconductors ETF to Invesco Semiconductors ETF in the coming days but there won’t be any changes in the fund’s philosophy, strategy, management, holdings or allocations. It’s really only a name change so don’t be surprised or alarmed if you are holding this fund and the name suddenly changes on your brokerage statement.

In conclusion I think this is a good fund with stellar historical results. I am a bit bothered that it doesn’t include some of the cheaper chip stocks such as TSM and QCOM but then again we know how some cheap stocks are cheap for a good reason and how cheap stocks have a bad habit of staying cheap for a long time. If you are bullish on the semiconductor industry overall, this fund offers a good exposure to the industry. While some of the fund’s holdings seem to have “crazy” valuations in triple digit P/Es, the majority of the holdings still have reasonable valuations.

Read the full article here