Introduction

Bristol-Myers Squibb (NYSE:BMY) is a global biopharmaceutical company, offering products for various diseases including oncology, cardiovascular, and immunology. Established in 1887 and headquartered in New York, its product range includes Eliquis, Opdivo, and Revlimid. It distributes to wholesalers, hospitals, and government agencies.

Recent developments: Bristol-Myers Squibb’s stock hit a 52-week low after disappointing Q2 results. Generic competition impacted earnings, with key drugs facing competition by 2028.

The following article discusses Bristol-Myers Squibb’s financial struggles due to upcoming patent expirations and competition. It highlights growth strategies and investor concerns.

Q2 2023 Earnings & Full-Year Outlook

In Bristol Myers Squibb’s latest earnings report, there was a 6% decline in Q2 revenues, settling at $11.2B. A significant factor behind this reduction was the dip in sales of Revlimid due to generic competition; U.S. sales plummeted by 42% and international sales fell by 38% year over year. Key revenue figures include Eliquis with $3.2B, Opdivo at $2.15B, and Revlimid pulling in $1.47B. The gross margin on a GAAP basis shrank to 74.4%. Marketing expenses increased by 7-8% to reach $1.9B, mainly because of costs linked to the launch of new products. The company spent slightly less on research and development, with expenditures dropping to $2.3B. However, there was an uptick in net earnings which amounted to $2.1B and a GAAP EPS of $0.99, a significant improvement from the previous year’s $1.4B and $0.66 EPS.

The company revised its financial outlook for 2023. The primary reason for this change is diminished sales of Revlimid, with lesser declines in Pomalyst sales. Revenue projections for Revlimid are now set at approximately $5.5 billion. While they had initially foreseen a roughly 2% rise in total revenues, the current estimate suggests a minor single-digit decline. Other modifications involve a marginal decrease in the gross margin percentage and a positive change in the anticipated tax rate. The updated forecast doesn’t factor in unexpected acquisitions, sales of assets, or other unknown variables. Even with these modifications, the firm remains committed to its 2020-2025 financial objectives, which includes achieving a minimum of a 40% non-GAAP operating margin.

Liquidity, Profitability, & Debt

Turning to Bristol-Myers Squibb’s balance sheet, the assets in terms of cash and cash equivalents stood at $8.4B, with marketable debt securities at $0.358B. Summing up these values, the total liquid assets amount to $8.758B. Over the past six months, Bristol-Myers Squibb has demonstrated profitability, adding a net of $4.335B. In terms of liquidity, the company is in a solid position with total current assets of $28.074B, easily covering their current liabilities which amount to $20.150B. Nonetheless, with long-term debt at $34.656B, it’s essential for the firm to manage its obligations effectively. Despite their profitability, the significant long-term debt may necessitate careful consideration of refinancing options or other financial strategies in the future. However, these observations are my own and may differ from other analyses.

Valuation, Growth, Momentum, & Dividends

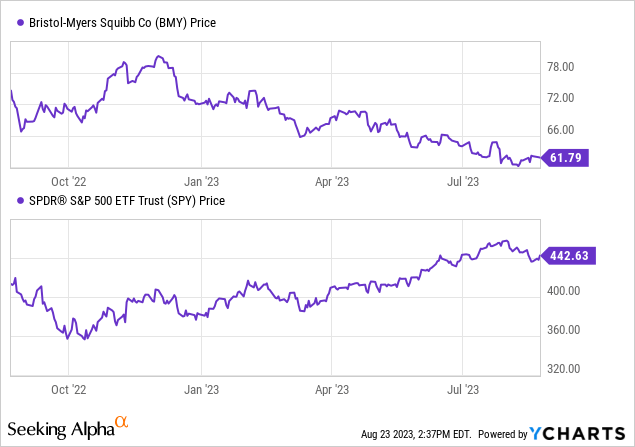

According to Seeking Alpha data: Bristol Myers Squibb’s capital structure reveals a significant amount of debt relative to its market capitalization, offset by a small cash position. The enterprise value stands at $159.77B. In terms of valuation, Bristol Myers Squibb’s forward P/E ratio indicates it is more attractively priced relative to future earnings than its historical earnings, and the valuation metrics such as EV/Sales and EV/EBITDA suggest a moderate valuation. The growth metrics show a decline in revenue YoY and an underwhelming future revenue growth, especially for 2025. This is corroborated by predominantly negative earnings revisions for the upcoming year. Stock momentum, when compared to the S&P 500, is negative over the past year, with the stock underperforming the broader market across all periods provided.

Bristol Myers Squibb offers a forward dividend yield of 3.69%, which is relatively attractive in the current market environment. The company has a track record of rewarding its shareholders, having grown its dividend at a 5-year CAGR of 7.19%. Furthermore, with a payout ratio of 29.57%, Bristol Myers Squibb retains a substantial portion of its earnings, suggesting potential for future dividend growth or other corporate investments. The company has consistently increased its dividend for the past 6 years, and its latest announced dividend stands at $0.57, paid on a quarterly basis.

Clock’s Ticking, But They’re Not Stopping

In their recent earnings call, Bristol-Myers Squibb’s management remains bullish on their growth prospects despite looming challenges. Key among their concerns is the upcoming patent expiration for some of their cornerstone drugs. While Eliquis enjoyed an extended lease on exclusivity due to a 2021 U.S. Court of Appeals decision that will maintain its patent protection until 2028, the clock is still ticking. Alongside Eliquis, the patent for Opdivo is also slated to expire in 2028, with other significant drugs like Pomalyst and Yervoy losing their protective shield by 2026. Management emphasizes their robust pipeline progress, citing the promising data for their LPA1 agonist in idiopathic pulmonary fibrosis and positive results for drugs such as Opdivo in Hodgkin lymphoma. They’ve also identified four growth pillars, including the evolution of their current product lineup, the introduction of six major assets, nurturing their early-stage pipeline, and potential external partnerships. However, the juxtaposition of this optimism against the backdrop of impending patent expirations has left investors wary, evidenced by the stock’s dip after the Q2 earnings.

The Evolution of Bristol-Myers: Preparing for a Post-Patent Era

Bristol-Myers Squibb is at a crossroads, facing both challenges and opportunities due to upcoming patent expirations and the rise of generic competitors. Here’s a glimpse into what the company might be up to, and what savvy investors should be looking for:

- Revamping the Drug Lineup: With patents on major drugs like Eliquis, Opdivo, Pomalyst, and Yervoy set to expire, Bristol Myers Squibb must get creative. Upping their investment in R&D for cutting-edge treatments and fast-tracking their launch is crucial. Investors should keep an ear out for news on breakthroughs or accelerated FDA nods that could plug revenue holes.

- Joining Forces and Smart Buys: As patent revenues wane, Bristol Myers Squibb might look at smart acquisitions or team-ups to beef up their product range. For example, the latest data on LPA1 agonist paints a promising picture in the fight against idiopathic pulmonary fibrosis. Keep an eye out for big merger news or partnerships, especially in areas where Bristol shines.

- Trimming the Fat: With marketing costs up and a hefty pile of long-term debt, Bristol Myers Squibb may need to tighten its belt. This could mean a sharper focus on operations, smarter marketing, and renegotiating supplier deals. They might also relook at their debt to ease future financial strains. Investors would do well to dig into their quarterly numbers to spot efficiency gains.

- Casting a Wider Net: With overseas sales dipping, Bristol Myers Squibb might push harder into booming markets like the Asia-Pacific, drawing on both its existing and new drug arsenal. Spreading out geographically can help cushion blows to domestic earnings.

- Guarding Their Turf: Bristol Myers Squibb could play defense with tactics like ‘patent thickets’ or secondary patents. This can fend off generic competitors for a while.

- Dipping into Generics: Once patents run out, Bristol Myers Squibb might dive into making their own generic versions. This way, they can keep a slice of the market pie while using their production and distribution strengths.

For those with stakes in Bristol Myers Squibb, it’s essential to juggle short-term gains with long-term vision. The company’s strong profitability signals and tempting dividend returns paint a rosy picture for shareholders. But, looming patent hurdles mean investors should watch Bristol Myers Squibb’s forward-thinking strategies and R&D leaps closely. In the quarters ahead, Bristol’s success will rest on its knack for reading market tides, innovating without pause, and pulling off growth plans without a hitch.

My Analysis & Recommendation

In conclusion, Bristol-Myers Squibb’s current position in the market presents a dichotomy. On one side, they showcase strong profitability and robust dividends, a testament to their historic standing in the pharmaceutical realm. Conversely, the impending patent expirations combined with the rise of generic competitors underscores a future potentially fraught with uncertainty.

For investors, the critical component to watch is the company’s adaptability. How will Bristol Myers Squibb navigate the waters of innovation while maintaining profitability? The company’s focus on expanding its drug lineup, potential mergers and partnerships, operational efficiency, geographical diversification, and strategies to ward off generic competition are the tell-tale signs of their future trajectory.

Although short-term gains suggest profitability, the emphasis should be on long-term strategies. Bristol Myers Squibb shareholders need to weigh the company’s clear advantages against potential risks on the horizon. Given the company’s historical resilience and present data, my investment advice is to “Hold”. In the near future, BMY stock might align with the broader market’s performance and offer a compelling dividend. Yet, expecting it to outperform the market might be optimistic. It’s crucial to monitor Bristol Myers Squibb’s efforts to enhance its growth trajectory in upcoming quarters. A marked shift from their expected growth path or a failure to address patent expirations could warrant a reconsideration of this stance.

Read the full article here