Introduction

Per my May article, BYD (OTCPK:BYDDY) is revolutionizing the battery electric vehicle (“BEV”) industry. The battery is about one-third of the cost of a BEV and BYD has made tremendous strides in this area. Nearly all BEVs have lithium batteries but the cathode chemistry varies. The nickel-cobalt chemistry has the highest energy density and it has been the lithium battery leader. However, lithium iron phosphate LiFePO4 (“LFP”) batteries have been improving and they now have a large amount of market share. My thesis is that BYD is changing the battery world given their success with LFP batteries.

The Numbers

Per the IEA, 95% of LFP batteries for light-duty vehicles (“LDVs”) in 2022 were for vehicles produced in China. BYD accounted for 50% of LFP demand in 2022 and Tesla (TSLA) accounted for 15% as Tesla started using LFP batteries in more of their vehicles:

Around 95% of the LFP batteries for electric LDVs went into vehicles produced in China, and BYD alone represents 50% of demand. Tesla accounted for 15%, and the share of LFP batteries used by Tesla increased from 20% in 2021 to 30% in 2022.

A December report from Adamas Intelligence says BYD and Tesla combined to make up 68% of LFP deployment for the first 9 months of 2022 (emphasis added):

Through the first nine months of 2022, Tesla and BYD were collectively responsible for a whopping 68% of all LFP deployed onto roads globally in newly sold passenger PHEVs and BEVs versus just 32% from the likes of SGMW, GAC, MG, Geely and others, combined. On the other side of the fence, the mass majority of automakers and passenger EV models sold globally continue to use nickel-rich cathode chemistries, like NCM 5-, 6-, 7-, 8- and 9-series, which if lumped together have a combined market share more than double that of LFP.

Regarding battery flow, BYD is the only company involved from the early material and component production part of the supply chain all the way to the car producing part per a FT article from Peter Campbell, Harry Dempsey and Christian Davies. I believe one of BYD’s advantages is that many of their competitors in Europe don’t think it is important to invest in batteries:

BEV Supply Chain (FT)

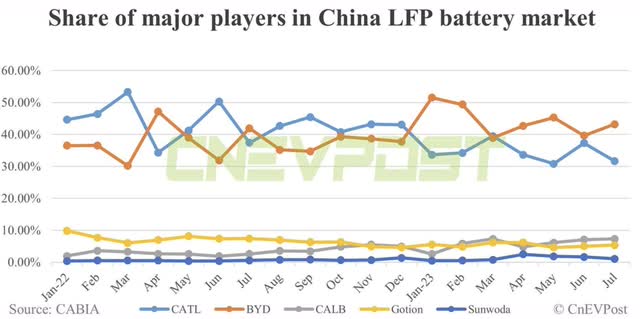

BYD and CATL are the dominant LFP producers in China and CnEVPost shows BYD has a larger share of the market for the first 7 months of 2023:

China LFP Market (CnEVPost)

LFP Vs Nickel

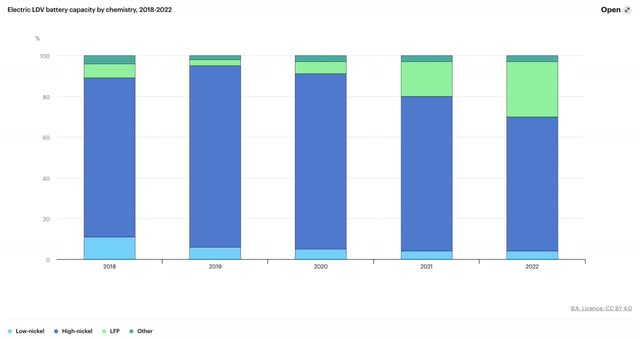

Per the IEA, LFP batteries made prodigious gains relative to nickel in 2022:

LFP Share (IEA)

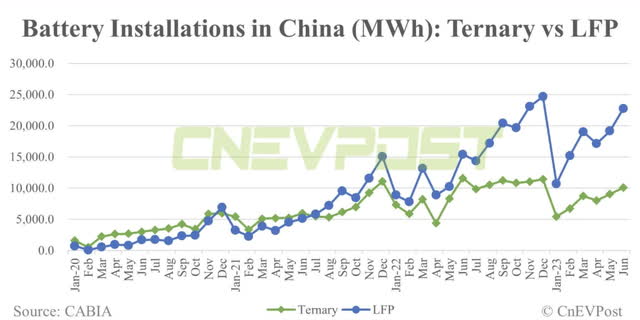

CnEVPost shows LFP has continued doing well in China in the first part of 2023 relative to nickel ternary battery installations:

Ternary vs LFP (CnEVPost)

It Isn’t Just BYD Betting On LFP

In July 2022, Ford partnered with CATL to produce LFP batteries. Ford (F) CEO Jim Farley explained the merits of LFP batteries and BYD’s dominant position at the Ford Motor Co at Morgan Stanley Sustainable Finance Summit in May (emphasis added):

BYD’s scale is way bigger than Tesla now. And they developed the LFP technology, which is a better battery, no fire risk basically, doesn’t use – and [uses] a little lithium, but it does not use cobalt or nickel and it has twice the charging cycle of iron – of lithium-ion battery. So the Chinese are going to be the powerhouse, I think, we think. To [beat them], you either have to have very distinct brands, which we think we do by leaner icons or you have to beat them on cost. But how do you beat them on cost if their scale is 5x yours. So I don’t know.

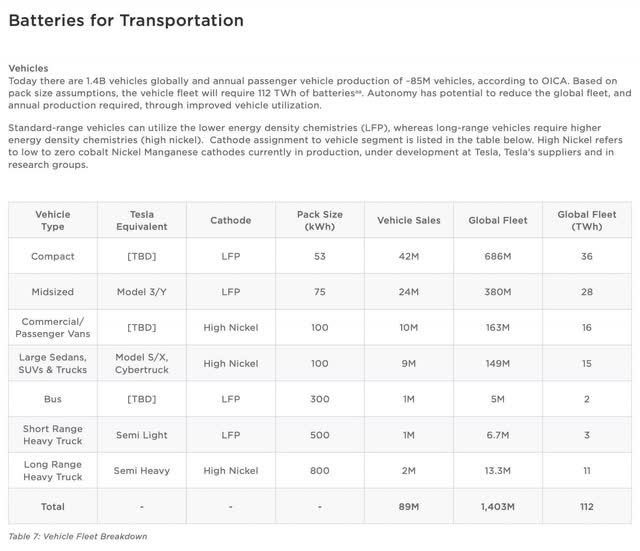

Tesla’s Master Plan part 3 from April shows 686 million compact BEVs and 380 million midsized BEVs using LFP cathodes in the future:

LFP’s Future (Tesla Master Plan part 3)

Per an August article from Reuters, BYD Chairman Wang Chuanfu called for Chinese automakers to band together and go global. This thought process is part of the plan to expand BYD’s battery share on a worldwide scale. Soon we will see more headlines about more carmakers betting on LFP batteries on a global scale.

Closing Thoughts

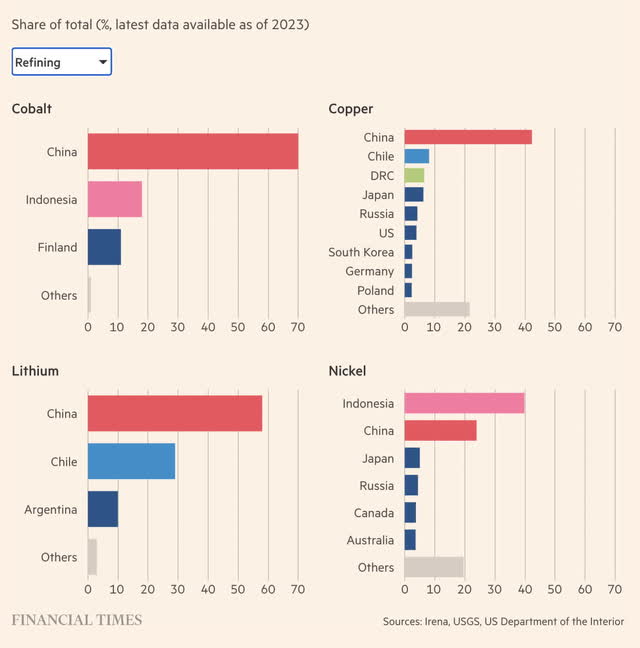

A February MIT Technology Review article by Zeyi Yang talks about the fact that China’s refinery capacity is dominant; obviously this benefits companies like BYD and CATL:

China has also had one key advantage in battery manufacturing: it controls a lot of the necessary materials. While the country doesn’t necessarily have the most natural resources for battery materials, it has the majority of the refinery capacity in the world when it comes to critical components like cobalt, nickel sulfate, lithium hydroxide, and graphite. García-Herrero sees China’s control of the chemical materials as “the ultimate control of the sector, which China has clearly pursued for years well before others even figured that this was something important.”

An August article from the Financial Times illustrates China’s above refinery capacity advantage graphically and no country other than Chile comes close to China with respect to refining lithium. Again, this is one of the reasons why BYD and CATL have grown to become the biggest LFP battery producers in the world:

Lithium Refining (FT)

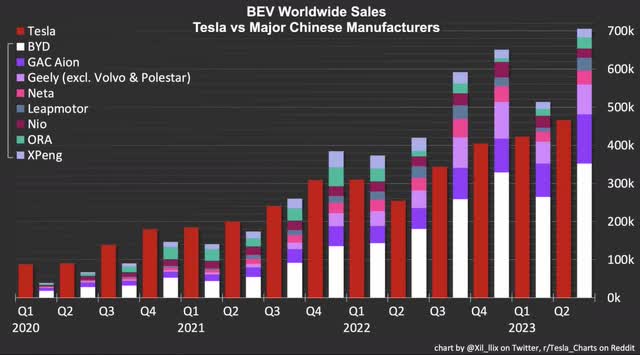

Again, BEV manufacturers in China use a larger percentage of LFP batteries than BEV manufacturers in the US and Europe. @Xil_llix shows the tremendous growth of Chinese-made BEVs from the last few years. I expect BEVs built in China with LFP batteries to continue increasing in volume in the quarters ahead:

BEVs From China and Tesla (@Xil_llix)

My valuation thoughts haven’t changed substantially since my May article; I still view the stock as a hold. This is because investments are being made in income statement lines such that net earnings are small relative to the market cap. Gross profit can be a better proxy at this stage but arguments can be made that the stock is expensive on a gross profit basis as well. Another valuation challenge is the geopolitical risk with China.

Forward-looking investors should continue to watch LFP installations in China in the quarters ahead. A July CarNewsChina.com article talks about BYD’s battery manufacturer, Fudi, saying their LFP batteries are scheduled to power FAW Group vehicles starting in September. Another CarNewsChina.com article from August says the Kia EV5 will use a BYD LFP battery.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here