Broadcom’s (NASDAQ:AVGO) strategy of AI driving growth while it continues to buy expensive companies to generate growth may not be a promising idea given the state of the company’s balance sheet and the interest rate environment. We would avoid the stock and detail our thesis below.

Broadcom – The business

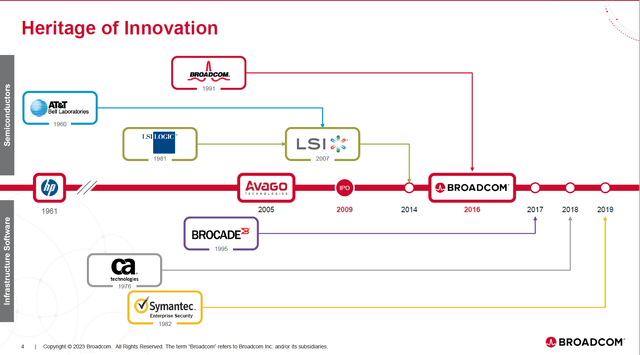

Broadcom sells semiconductor and infrastructure software solutions. The company today is a result of M&A over the years and boasts of over $30 billion in revenue and more than 17,000 patents.

Broadcom Corporate presentation

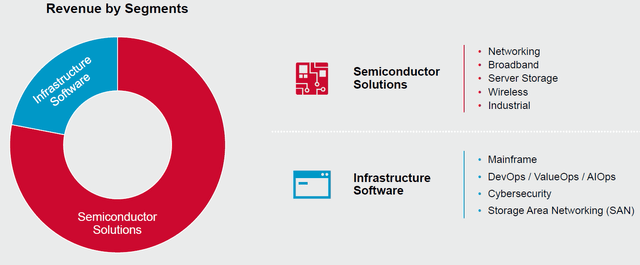

The semiconductor business accounts for almost 78% of the company’s revenue with the balance coming from the software division.

Broadcom Corporate presentation

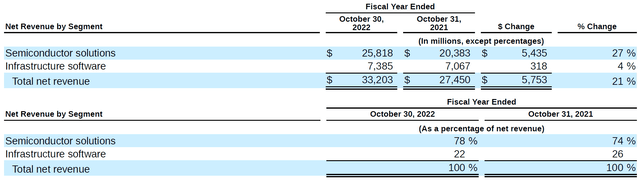

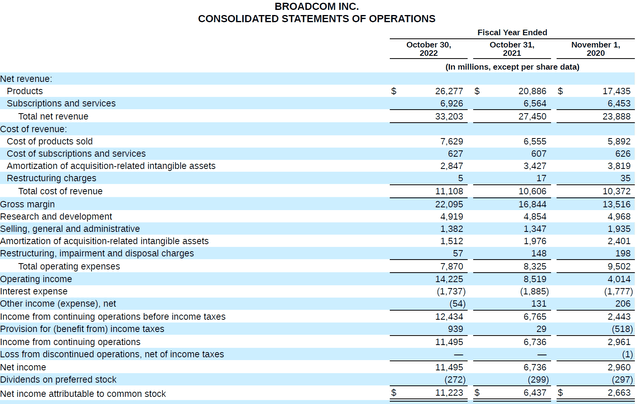

Broadcom 10K for fiscal 2022

The growth in the semiconductor business was driven by networking, server storage, broadband and wireless (for mobile devices). Software growth was led by mainframe solutions and fiber channel storage area networking (FC SAN) products.

Interestingly, the company disclosed that its gross margin strength was not driven by demand:

Gross margin was $22,095 million, or 67% of net revenue, for fiscal year 2022, compared to $16,844 million, or 61% of net revenue, for fiscal year 2021. The increase was primarily due to lower amortization of acquisition-related intangible assets, mainly from our 2016 acquisition of Broadcom Corporation and, to a lesser extent, favorable margin within our semiconductor solutions segment.

Source: Broadcom 10K for fiscal 2022.

The company has been spending $5 billion for R&D and despite a $1.7-1.8 billion interest expense, been able to generate sustained net income and dividends.

Broadcom 10K for fiscal 2022

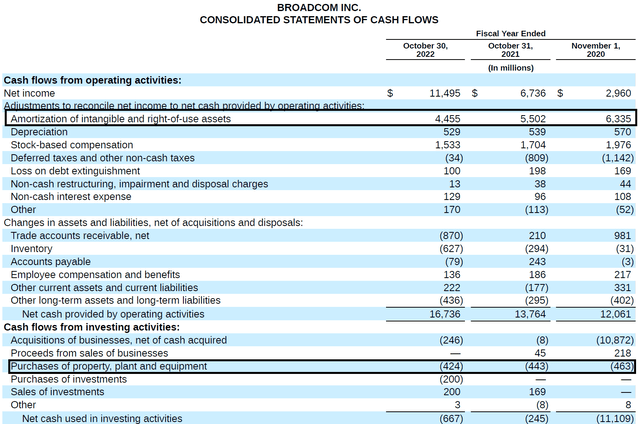

The strong net income, coupled with low capex has resulted in strong FCF.

Broadcom 10K for fiscal 2022

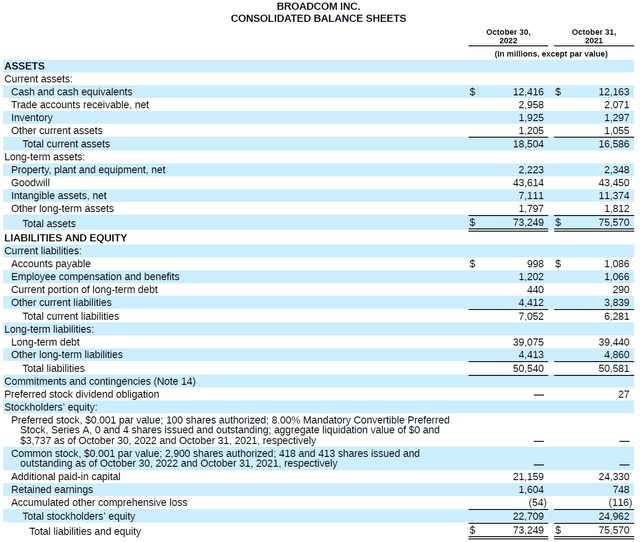

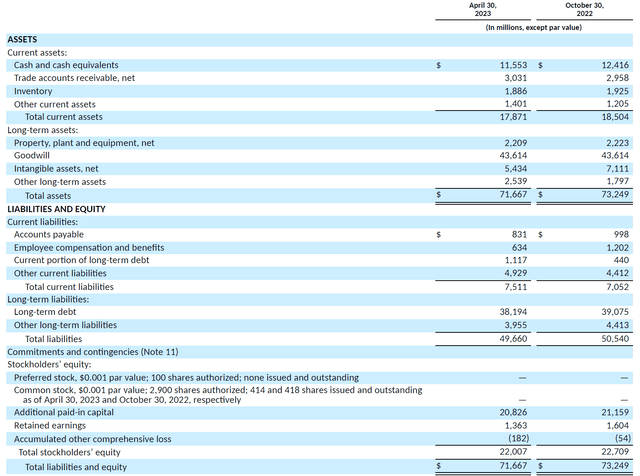

All of this translates into a $70 billion balance sheet.

Broadcom 10K for fiscal 2022

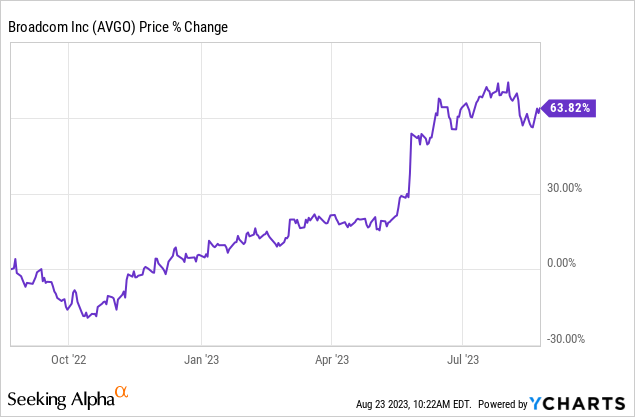

The stock has been seen as a beneficiary of the artificial intelligence (or AI) boom and is on a tear, with stellar 60% returns over the last 12 months.

We now dig into some of the more popular themes.

AI: The Broadcom Story

When asked about Broadcom’s beginnings into AI, Hock Tan, the CEO of Broadcom had stated:

There wasn’t any vision here

So this division that does ASICs was approached many years ago by one hyperscaler to get — to try to develop an AI engine, a very dedicated AI engine focus on the models of that particular hyperscale, very dedicated, very team optimized where we are, took a lot of work, took some level of investment but it’s — our IP really relates to our ability to manifest in silicon, what is a very complicated AI training chip and inference chip.

And that’s how we got into it. It’s true being able to having the technology and the skills to create silicon, not an architectural definition play that says — or vision that says, hey, AI is the place to be in. We don’t do computing typically. We’re not — and it’s not an area not to say we can’t do it. It’s not an area where we want to come in and compete against players who have been focused on doing it much longer and will probably out invest us in those space.

Source: Broadcom Bank of America 2023 Global Technology Conference Transcript from Seeking Alpha.

So, Broadcom moved into AI due to a client’s requirements. The company sees AI as the current flavor and the thing that’s driving business and not necessarily with the same-colored lens the world wants to see with AI:

And — but for years, high-performance computing which is another way of calling AI, by the way, used to be called HPC high-perform computing and we all call it AI, then we call it something — machine learning and now it’s back to AI, generative AI, whatever it is, the scale is growing.

Then last year, generative AI showed up with Open AI and ChatGPT, where they talk about taking huge database, large language models, LLM, as we call it now and load it all into this massive computer — computing machine to be able to literally create analytics out of a huge database, especially in training. And you need to do it with lots — you hear about lots and lots of AI engines which have to work in a synchronized manner.

Source: Broadcom Bank of America 2023 Global Technology Conference Transcript from Seeking Alpha.

To Broadcom, AI is another area to make money. How much or how sustainable will the trend be is something Hock Tan seems unwilling to call out.

I don’t think enterprises are really jumping in and investing in AI in a big — in the way the hyperscalers are doing.

…But will it go up at the scale we’re seeing today? Can’t tell, I don’t know.

…I don’t have any vision in my mind that I should be 50% hardware, 50% software. We are really a technology company. And we look at areas in technology, to invest in to buy first, invest in, develop, even grow where we can be very successful.

Source: Broadcom Bank of America 2023 Global Technology Conference Transcript from Seeking Alpha.

What however is clear is that Broadcom is making hay while the sun shines, with its networking products.

And speaking of AI networks, Broadcom’s next generation Ethernet switching portfolio consisting of Tomahawk 5 and Jericho3-AI offers the industry’s highest performance fabric for large-scale AI clusters by optimizing the demanding and costly AI resources. These switches based on an open distributed disaggregated architecture will support 32,000 GPU clusters running at 800 gigabit per second bandwidth.

In Q3, we expect networking revenue to maintain its growth year-on-year of around 20%.

Source: Broadcom Q2 2023 Earnings Call Transcript from Seeking Alpha.

It is worth highlighting it that Broadcom continues to expect a revenue of $800 million from Ethernet switches deployed in AI in 2023 versus $200 million in 2022. Furthermore, generative AI is expected to drive Broadcom’s compute offload business at hyperscalers from $2 billion in 2022 to $3 billion in 2023.

Seen in a different light, generative AI revenues were 15% of Broadcom’s revenues and are expected to go to 25% by the end of 2024. In effect, the entire $3-4 billion of growth will only exclusively come from AI. While the traditional business may also show growth, the possibility of cannibalization should not be ruled out.

Overall, we think AI is possibly the next logical leg of growth for Broadcom and not necessarily as transformational for the fundamental contours of the business as the market would like to think.

We next look at the company’s balance sheet.

A balance sheet dominated by goodwill

Broadcom’s total assets of $72 billion have a little over 60% or $43 billion of goodwill.

Broadcom 10Q for Q2 2023

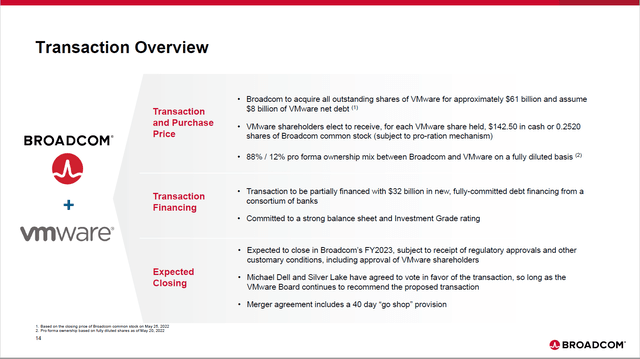

Now consider the proposed VMware (VMW) transaction.

Broadcom Presentation on the VMware acquisition

Broadcom had proposed acquiring VMware for $61 billion with $32 billion coming from new debt and the rest though issuance of equity.

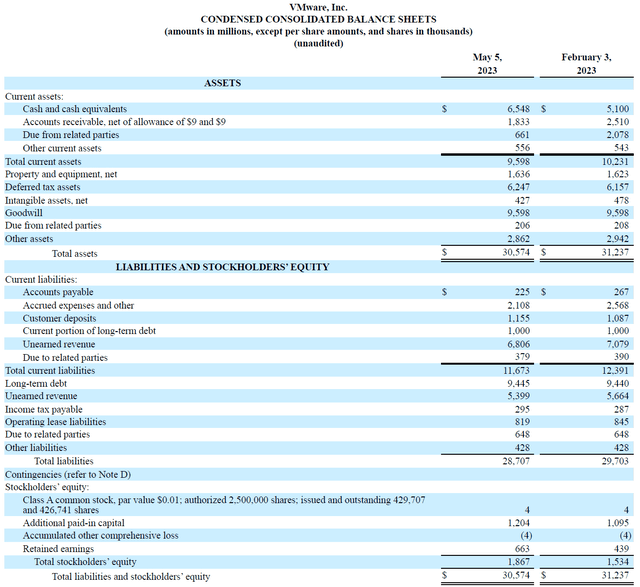

VMware’s latest reported balance sheet is as follows:

VMware 10Q

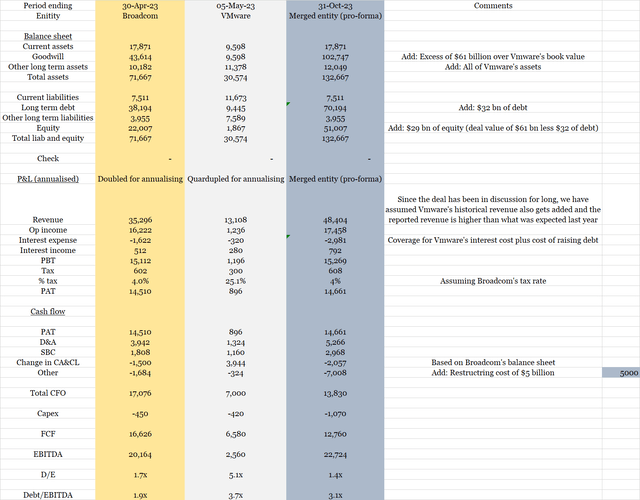

VMware’s net worth was $1.9 billion, implying Broadcom would add $59.1 billion of goodwill to its balance sheet. In addition, to finance the deal, Broadcom would add $32 billion in debt and $29 billion in equity (there might be certain adjustments, but the broad pro forma picture should be as below):

Company filings, Seeking Alpha, Author’s Analysis

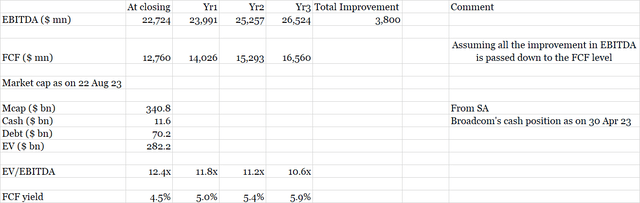

Evidently, due to the markedly different profitability profiles of the two companies, this deal is unlikely to create any value in year 1. However, Broadcom has expressed confidence of eking out efficiencies from VMware.

we are targeting to increase VMware’s stand-alone EBITDA of approximately $4.7 billion to approximately $8.5 billion in pro forma run rate EBITDA within 3 years of closing.

Source: Broadcom Q2 2022 Results and VMware Acquisition (Transcript) from Seeking Alpha.

If the $3.8 billion of improvement does come through and all of it flows down to the free cash flow, the FCF yield still is below the risk-free 12-month and even 2-year treasuries!

Source: Company filings, Seeking Alpha, Author’s Analysis

As we had published earlier as well, the Broadcom deal was not a good one for VMware and the financial metrics show that it isn’t good for Broadcom as well.

- VMware Can Have More Than Broadcom.

- Broadcom’s Aspirations Could Be Met At A Lower Cost.

Broadcom is asking investors to finance a deal that dilutes them by 9-10% so that the company can load up more debt to essentially take the goodwill on the balance sheet to over a $100 billion. The benefit: growth in FCF, but the FCF yields remain below what the US risk-free treasury return!

How does this make any economic rationale?

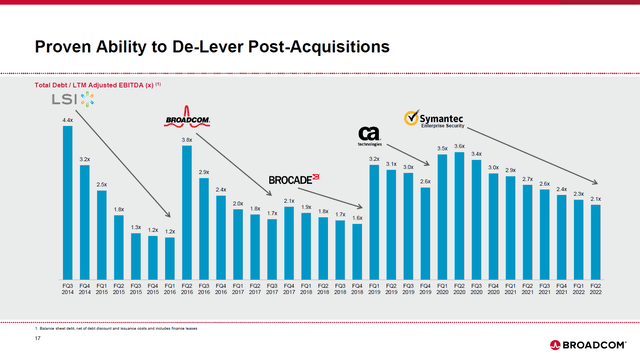

Broadcom carries a BBB- rating and in the current environment, may cause a downward revision. Although Broadcom claims that it has been able to de-lever rapidly post its earlier acquisitions, all of those were done in an environment of benign interest rates.

Broadcom Presentation on the VMware acquisition

Let us remember that the Fed started raising rates from March 2022 and monetary policy transmission works with a lag.

Risks to our thesis

- Interest rate cut: Much of Broadcom’s play around VMware is on the cost of money and if the rates slide faster than expectations, Broadcom will get a long runway to execute on the merger synergies and hence grow with VMware. Furthermore, a weak interest rate environment will give a further push to the AI demand, fueling Broadcom’s business and stock price.

- Divestment of non-core assets: If Broadcom were to start hiving-off divisions with lower profitability, we could start liking its balance sheet and even the attempted merger with VMware.

Outlook

We think AI is a tide that is lifting many boats and Broadcom is reaping the benefits of AI. However, considering AI to be a transformation pivot for the company that can allow Broadcom to execute in its historical private equity style may be too much of an expectation.

The second half of the year is expected to be relatively modest from a growth standpoint. Coupled with the fact that some of Broadcom’s divisions may be less profitable than others, there may be merit for the company to consider how much leverage can it carry in an environment where money is more expensive than it has been in the last couple of decades.

Read the full article here