Magnite’s (NASDAQ:MGNI) second quarter results came in soft relative to expectations, and were particularly disappointing in light of what appears to be a general reacceleration in digital advertising. While Magnite’s revenue growth was in line with the previous quarter, CTV growth was soft and non-cash expenses continue to weigh on margins. Magnite’s second quarter results were also negatively impacted by the MediaMath bankruptcy. Longer term, there remains a large opportunity for SSPs, but industry dynamics still appear unfavorable.

Market

While the digital advertising market showed signs of stabilization, in the second quarter of 2023, SSPs still appear to be facing a tough operating environment. Many advertisers remain cautious due to economic conditions, with brand advertising particularly impacted. Ad budgets have been pressured in the auto, technology and media and entertainment verticals. TV upfronts (excluding sports and live events) were also weaker than anticipated, further demonstrating ad market weakness.

Magnite saw softness in its managed service beginning in June, which the company attributed to the macro environment. Larger CTV players are taking share from smaller publishers and shifting towards programmatic advertising. This includes Disney, Roku, Warner Brothers, Discovery, and Vizio who are moving more inventory toward programmatic transactions and away from traditional direct sold executions. While Magnite believes this is a positive in the long run, it is negatively impacting financials at the moment. This is because Magnite is providing services with a lower take rate. Despite near term headwinds, Magnite believes that it is taking market share. In Q2, ad spend on Magnite’s platform grew at a far higher rate than its revenue and the industry forecast.

PubMatic (PUBM) has suggested that supply growth is outpacing ad spend growth, which is placing downward pressure on ad pricing. In terms of the monthly progression through the second quarter, PubMatic’s April revenues were flat and May revenues increased YoY. June revenues declined driven by softness in both online video and display CPMs. This is not homogeneous though, with the impact varying across ad verticals and by region, format and channel. Given the progression of CPMs over the last 12 months, PubMatic expects video CPMs to be roughly 20% lower YoY in the third quarter and display CPMs to be down 10%.

Magnite

Magnite introduced two new products in the second quarter, ClearLine and Access. ClearLine is a self-service direct video buying solution for agencies that supports its SPO efforts. Magnite believes this product will help to unlock linear budgets and efficiently shift them to programmatic CTV. Agencies using ClearLine now include Camelot, GroupM, MiQ, GD&M, Horizon Media and Omnicom Media Group. Publishers using ClearLine include A&E Networks, AMC Networks, DirecTV advertising, DISH media, Disney advertising, Fox Digital, Nine, Warner Brothers Discovery, LG and Vizio.

Magnite Access is a suite of omnichannel audience data and identity products that make it easier for media owners and advertising partners to maximize the value of their data assets. This includes a DMP, a data storefront and a secure solution enabling sellers and buyers to match datasets. Parts of Access are already available, while others are still in testing and are expected to be released later this year.

Magnite also recently announced an integration with FreeWheel which enables FreeWheel’s ad server clients to work with Magnite for their programmatic needs. This integration is expected to allow clients to maximize yields across sales channels, as well as unify their view of ad creatives, frequency capping, and other data. FreeWheel is a Comcast company which provides ad platforms for publishers, advertisers, and media buyers.

Financial Analysis

CTV contribution ex-TAC increased 8% YoY in the second quarter and DV+ contribution ex-TAC increased 10%. CTV constituted 42% of contribution ex-TAC in Q2, with 39% from mobile and 19% from desktop. DV+ contribution ex-TAC grew 10% YoY in the second quarter, despite industry-wide weakness in CPMs. Magnite’s international business is currently performing much stronger than its US business, with over twice the growth rate in the second quarter. Unsurprisingly, travel ad spend has been an area of relative strength, while technology and media and entertainment have been relatively weak.

Second quarter revenue was negatively impacted by managed service business deals being canceled or shifting out of the quarter, as well as a surge in publisher-sold programmatic deals. Magnite’s managed service business operates at the highest take rate, meaning the decline has had an outsized impact on revenue. Larger CTV players with direct sales teams and quality data prefer to try and sell direct. While Magnite believes that programmatic AVOD will ultimately be a tailwind, this is one of the big questions for SSPs.

Magnite expects contribution ex-TAC to increase by roughly 2% YoY in the third quarter. CTV contribution ex-TAC is expected to decline roughly 9% YoY in the third quarter and DV+ contribution ex-TAC is expected to increase roughly 10% YoY. For the full year 2023, Magnite’s contribution ex-TAC growth rate is expected to be in the mid to high-single-digits.

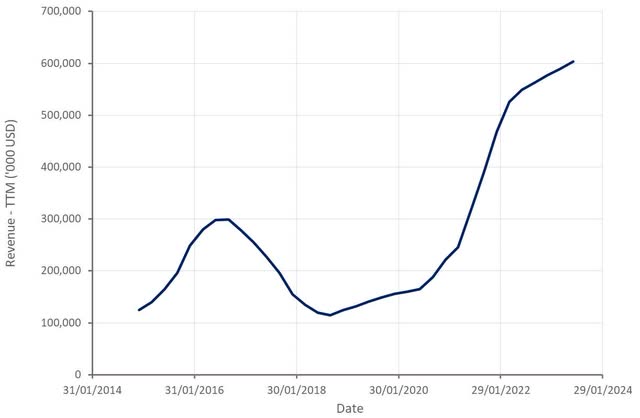

Figure 1: Magnite Revenue (source: Created by author using data from Magnite)

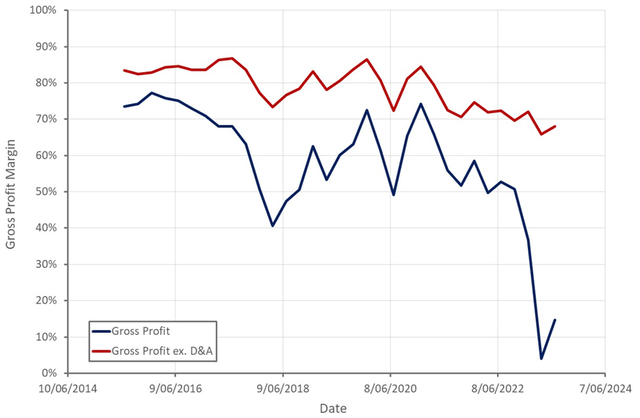

Magnite’s profit margins are still depressed, largely due to non-cash accelerated amortization resulting from its platform consolidation. Excluding this impact, gross profit margins appear to be drifting lower but are still relatively high. This is not surprising given current pricing pressures in the market.

Second quarter results were also negatively impacted by a 4.5 million USD bad debt expense that was recognized as a result of the MediaMath bankruptcy. Higher operating expenses were also the result of higher platform expenses, payroll expenses, return to office, and travel and event-related costs.

Figure 2: Magnite Gross Profit Margins (source: Created by author using data from Magnite)

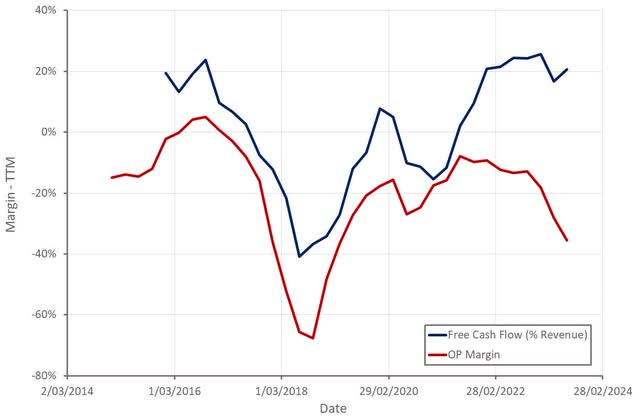

Magnite’s free cash flows are probably a better indicator of the company’s earnings power at the moment given elevated non-cash expenses. Magnite’s margins should begin to improve as these non-cash expenses normalize, but the company’s margins are likely to remain under pressure while ad inventory growth continues to outpace demand growth.

Figure 3: Magnite Operating Profit Margins and Free Cash Flow (source: Created by author using data from Magnite)

Valuation

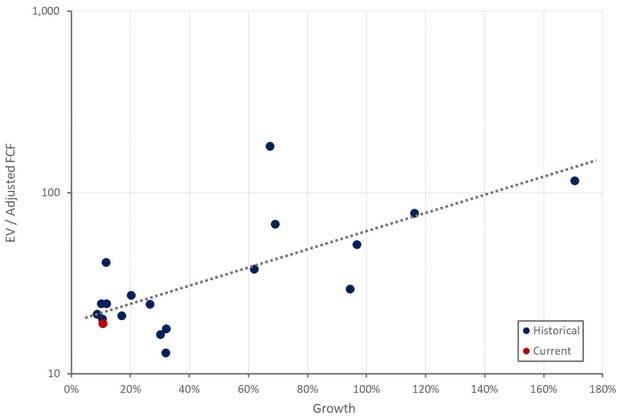

Magnite’s valuation now looks reasonable given the company’s ability to generate free cash flow and growth in the face of tough market conditions. The supply side of the adtech market has a history of disappointing investors though, with SSPs struggling to establish strong competitive positions. Magnite believes that the SSP side of the adtech market will eventually consolidate in a similar manner to DSPs. Market consolidation, supply path optimization, CTV and a greater premium on data all have the potential to improve the economics of SSPs. Despite this potential, SSPs face the risk of disintermediation, CTV customer concentration and a lack of differentiation.

Figure 4: Magnite Relative Valuation (source: Created by author using data from Yahoo Finance and Magnite)

Read the full article here