The shares of sports betting company DraftKings (DKNG) were last seen 3.4% higher at $28.16, as part of the broader tech sector rally today. Today’s climb could be the beginning of a rebound, given the equity’s recent placement near a historically bullish trendline.

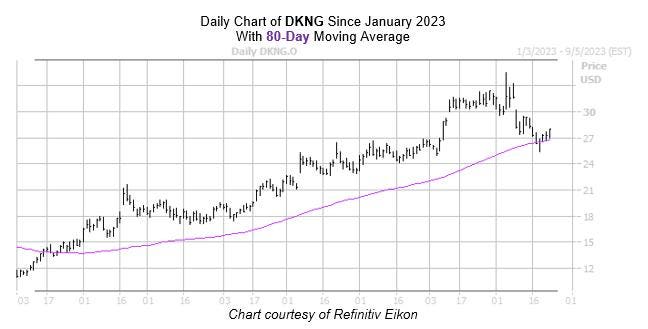

Specifically, DKNG in the last week pulled back to its 80-day moving average after spending a significant period of time above it. According to data from Schaeffer’s Senior Quantitative Analyst Rocky White, five similar signals occurred during the past three years, with DraftKings stock notching a 14.6% one-month gain 80% of the time. From its current perch, a similar move would put the equity back near its Aug. 4, year-to-date high of $34.49

The equity is underperforming even the SPDR S&P 500 ETF Trust’s (SPY) 3.4% monthly dip, with DKNG down 11.3% in August. Given this lackluster technical setup, it’s no surprise short-term options traders are more pessimistic than usual. However, an unwinding of this pessimism could bode well for DraftKings stock; its Schaeffer’s put/call open interest ratio (SOIR) of 1.06 stands higher than 88% of reading from the past year.

Now looks like a good time to weigh in on DKNG’s next move with options. Its Schaeffer’s Volatility Index (SVI) of 49% stands in the low 11th percentile of annual readings, implying options players are pricing in relatively low volatility expectations at the moment.

Read the full article here