Market Commentary

Markets were positive in Q2 2023, with US stocks rising over 8% (as measured by the Russell 3000 Index), bringing YTD gains to roughly 16%. Continuing the YTD trend, large-cap stocks led in Q2, rising almost 9%, while mid-cap stocks rose nearly 5% and small-cap stocks rose just over 5% (as measured by the Russell indices). Also continuing from Q1, growth stocks outperformed their value counterparts across the cap spectrum. The Russell 1000 Value Index rose 4%, while its growth counterpart rose nearly 13%; the Russell Midcap Value Index advanced close to 4%, while the Russell Midcap Growth Index rose over 6%. The Russell 2000 Value Index added a little over 3%, and the Russell 2000 Growth Index rose just over 7%.

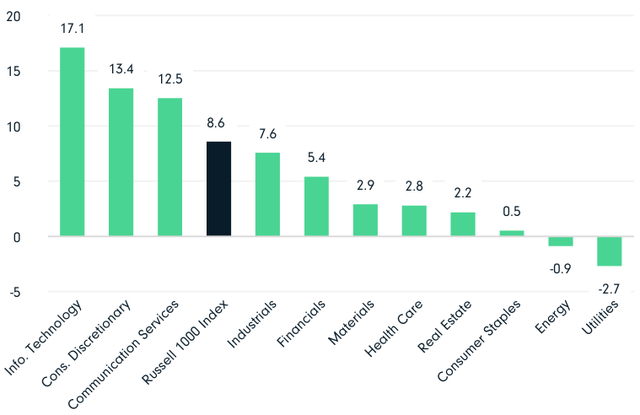

From a sector perspective, technology continued its strong YTD performance in Q2, rising north of 17%, while consumer discretionary (13%) and communication services (13%) were also nicely positive. Conversely, energy (-1%) and utilities (-3%) were in the red in Q2 as oil prices have defied expectations, they would rise given the ongoing Russia Ukraine war. Relatively moderate winter temperatures combined with increased production (and, therefore, increased supply), helped rein prices in — but consequently pressured returns in the relevant energy and utilities sectors.

2Q23 Russell 1000 Index Sector Returns (%)

Source: FactSet, as of 30 Jun 2023.

The macro picture has also been consistent in 2023, with inflation, central bank policy and ongoing geopolitical tensions dominating headlines. In early May, JP Morgan agreed to acquire most of First Republic Bank’s operations after the failed institution was seized by regulators. It marked the second-largest bank failure in US history (after Washington Mutual’s 2008 collapse) and is followed by Silicon Valley Bank and Signature Bank, both of which failed late in Q1 2023. While we remain vigilant in assessing the fundamental health of all our portfolio holdings, we believe the worst is behind us on this front for the time being.

Many point to the recent failures as signs monetary policy has gotten sufficiently (if not overly) tight — and investors consequently anticipated a slowdown or pause in rate hikes. Indeed, though the Federal Reserve did raise the benchmark rate 25 basis points (bps) in May to a range of 5.00% – 5.25%, it also tentatively hinted the current rate hike cycle (which has included 10 hikes in just over a year) was nearing its conclusion and didn’t raise rates in June.

Outside the US, global monetary policy is a more mixed bag. The UK faces ongoing stubborn inflation, seemingly decreasing the likelihood it is as close to the end of its hiking cycle as the US may be. Similarly, the European Central Bank likely has a way to go as inflation has proven sticky in major economies like Germany’s. In contrast, many emerging markets economies seem on the cusp of considering pausing rate hikes, if not beginning to cut. For example, Hungary trimmed rates (which remain high) during the quarter as it struggles to rein in inflation while not hampering too much economic activity. A notable exception is Turkey, which significantly raised rates (650 bps) following President Erdogan’s May re-election — presumably in a bid to convince markets the country will begin seriously addressing its economic challenges. Whether investors find the effort credible naturally remains to be seen.

Meanwhile, markets seem to continue climbing the proverbial wall of worry — likely aided by relatively resilient economic data and corporate earnings in the US (and, selectively, beyond). Inflation, though effectively a global concern, has yet to meaningfully dampen hiring in the US. Stocks have rallied — especially growth stocks, where prices have increased significantly — which could be reflective of the fact that markets have discounted an impending recession several times over the last couple years, each time getting a little more comfortable with the economy’s and corporate earnings’ resilience.

That said, we don’t believe now is the time to get complacent about the environment. As we saw in March this year when the banking crisis began, unexpected events could rattle markets periodically —and that is particularly the case given all the macroeconomic headwinds we currently see. Further, there is still a possibility we see a recession in the next three to nine months, given the 10-year/3-month yield curve remains inverted and has historically been a decent predictor of recession.

However, we believe our philosophy and approach are well-suited to just such an environment — in which higher rates, higher inflation and, possibly higher volatility than we’ve seen over the last decade or so are likely — as value and cyclically oriented stocks are likely to become more attractive to investors as they are well positioned to produce abundant, consistent cash flows in the near and intermediate terms.

Performance Discussion

Our portfolio advanced in Q2 but underperformed the Russell 1000 Index. With the resurgence in growth and technology stocks, our underweight exposure to the tech sector was a headwind to our relative results. Our technology holdings collectively performed well but did not keep pace with those in the index. Additionally, our outsized exposure to the financials sector worked against us. On the plus side, we benefited from the lack of exposure to the utilities sector and from the relative strength of our holdings in the energy and consumer staples sectors.

Among our top contributors were insurance company American International Group (AIG), global online retailer Amazon (AMZN) and software and IT services provider Microsoft (MSFT).

AIG reported solid quarterly results for its fiscal Q1, consistent with our thesis that the company is now in the middle stages of a successful turnaround in its P&C insurance business that we believe still has meaningful runway for improvement. AIG also announced the expected sale of Validus Re (property catastrophe reinsurance) to RenaissanceRe, a transaction we view as mutually beneficial as it transfers the assets to an entity that can create the most value with the intellectual property and customer relationships. The sale is also consistent with AIG’s longer-term path of reducing underwriting volatility. The proceeds from the sale, along with an additional share sale of its ownership stake in CRBG (the holding company for its life and retirement business), will generate a nice cash flow for the company, which it intends to use to repurchase stock.

Amazon’s management team has been working to improve retail profitability, and Q1 results showed progress. In the case of Amazon’s web services (AWS), the market has shifted its focus from where growth will bottom in the near term to how AI can help accelerate the adoption of public cloud services in the future. We believe Amazon’s competitive advantages will continue to grow and that the business has the potential to grow faster than the overall economy in the coming years.

Microsoft reported strong quarterly results and provided more favorable than expected commentary on near-term Azure (cloud platform) revenue growth. Investors had become concerned that Azure’s revenue growth could come under increased pressure in a weakening economy, but the combination of quarterly results and commentary about Azure’s future growth trajectory calmed concerns.

Also among our leading contributors were media and technology company Alphabet (GOOG,GOOGL) and home builder NVR. Alphabet launched several new products to respond to competition from ChatGPT and Microsoft, which was a comprehensive response by the company to showcase that it is a leader in the artificial intelligence space.

Homebuilders have had a good start to 2023, and NVR has posted steady financial and operational performance year-to-date. The company’s core Mid-Atlantic markets have remained strong despite higher rates, and NVR’s financial model has leveraged that strength into solid earnings and some of the best operational performance among peers.

Our bottom contributors in Q2 included banking and financial services company Truist Financial (TFC) and health insurance company Humana (HUM). Truist, while not considered a “money center,” is a large, super-regional bank with an attractive Southeastern US footprint that has added value to the communities it serves via its extensive branch network and lending franchises. Truist also owns the fifth largest insurance brokerage in the US, which it recently sold a portion of for roughly $3 billion. Truist’s share price remained under pressure during the quarter as the market continued to be concerned with lower values of longer duration assets and increasing deposit costs. That said, we remain comfortable with our current position in Truist and believe a significant amount of pessimism is baked into its current share price.

Recently, Humana and one of its largest rivals discussed above-trend Medicare utilization, which is putting pressure on the medical loss ratios (MLRs) of managed care companies exposed to Medicare Advantage, of which Humana is among the most exposed. Humana and other managed care organizations (MCOs) may not have fully captured these trends in their pricing bids to the Centers for Medicare & Medicaid Services (CMS) for 2024, which were due in early June. We continue to like Humana’s position as a market leader and remain investors.

Also among our bottom contributors were biopharmaceutical company Pfizer (PFE), semiconductor manufacturer Texas Instruments (TXN) and copper-focused mining company Freeport-McMoRan (FCX). In recent months, Pfizer has been dealing with a decline in sales due to lower COVID vaccination levels. Additionally, in 2023, management has increased spend as the company invests in new product launches. Although we continue to see some long-term value in Pfizer, we sold our position in favor of a more attractive opportunity.

Texas Instruments’ end markets are facing some near-term headwinds where demand is concerned. We expect these trends to be transitory and continue to have a favorable view of the company’s long-term prospects and superior competitive positioning.

Copper prices weakened slightly in Q2, providing a headwind to Freeport-McMoRan’s share price. Moreover, the company is negotiating an extension to its mining rights at the Grasberg mine in Indonesia beyond 2041. Concerns heightened that the Indonesian government was looking to purchase an incremental share in the mine and that Freeport shareholders may get a less-than-fair price for the portion sold. That said, we believe an extension of Freeport’s rights could unlock significant value for both the Indonesian government and Freeport’s shareholders; thus, we remain investors.

Portfolio Activity

With the sale proceeds from Pfizer, we established a position in HCA Healthcare, a company we know well from ownership in our large cap strategy. HCA is a best in-class operator of acute care hospitals and other health care facilities, including outpatient surgery centers. It has a strong market presence in highly attractive geographies with growing populations and low unemployment, such as Texas and Florida, which leads to a favorable payor mix. We are further attracted to its strong management team with a stellar track record of deploying capital, and the founding family continues to own almost a quarter of the business, which aligns with our ownership mentality.

Market Outlook

Despite equity markets’ positive returns in Q2 and 2023 to date, it has been among the narrowest markets in history, with just seven stocks — Meta Platforms, Apple, NVIDIA, Alphabet, Microsoft, Amazon and Tesla — contributing a large majority of the market’s return. These stocks collectively have increased 61% year to date, although the other 493 stocks in the S&P 500 increased a respectable 6%.

Market participants have seemingly moved past the recent failures of SVB Financial, First Republic and Signature Bank; however, the full effects of these failures have not yet been felt. For example, if banks pull back on lending to improve their capital positions, it could negatively impact economic growth. Balancing the potential economic impact of higher interest rates with still-elevated inflation levels continues to complicate the Fed’s monetary policy decision-making process.

Corporate earnings growth is expected to slow in 2023, weighed down partly by a decline in energy sector earnings due to commodities prices well below their mid-2022 peaks. However, the decline in this year’s earnings estimates seems to have bottomed.

Given the very aggressive monetary policy and much higher interest rates, we have been surprised many of the more speculative growth stocks have been leading the market thus far in 2023. Growth stocks more broadly have regained a vast majority of their 2022 underperformance versus value stocks, with the Russell 1000 Growth Index outperforming the Russell 1000 Value Index by 24 percentage points year to date.

Meanwhile, equity markets are trading at elevated valuations compared to history; however, this is somewhat misleading given the market’s narrowness. While the S&P 500 trades around 20x earnings per share (EPS), the median stock trades at a more reasonable ~17x EPS. So, while it may be difficult for equity markets to generate returns that match historical averages over the next five years, there are still attractive opportunities with the potential to generate above-average returns over that period.

Our primary focus is always on achieving value-added results for our existing clients, and we believe we can achieve better-than-market returns over the next five years through active portfolio management.

|

Period and Annualized Total Returns (%) |

Since Inception (26 Feb 2021) |

1Y |

YTD |

2Q23 |

Expense Ratio (%) |

|

Class I (MUTF:DHFIX) |

4.75 |

14.93 |

5.64 |

6.37 |

0.68 |

|

Russell 1000 Index |

6.93 |

19.36 |

16.68 |

8.58 |

— |

|

Russell 1000 Value Index |

6.48 |

11.54 |

5.12 |

4.07 |

— |

|

Click here for holdings as of 30 June 2023. Risk disclosure: Because the portfolio holds a limited number of securities, a decline in the value of these investments may affect overall performance to a greater degree than a less concentrated portfolio. The views expressed are those of Diamond Hill as of 30 June 2023 and are subject to change without notice. These opinions are not intended to be a forecast of future events, a guarantee of future results or investment advice. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. Investment returns and principal values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance quoted. For current to most recent month end performance, visit Diamond Hill. Performance assumes reinvestment of all distributions. Returns for periods less than one year are not annualized. Fund holdings subject to change without notice. Index data source: London Stock Exchange Group PLC. See Diamond Hill – Disclosures for a full copy of the disclaimer. Carefully consider the Fund’s investment objectives, risks and expenses. This and other important information are contained in the Fund’s prospectus and summary prospectus, which are available at Diamond Hill or calling 888.226.5595. Read carefully before investing. The Diamond Hill Funds are distributed by Foreside Financial Services, LLC (Member FINRA). Diamond Hill Capital Management, Inc., a registered investment adviser, serves as Investment Adviser to the Diamond Hill Funds and is paid a fee for its services. Not FDIC insured | No bank guarantee | May lose value |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here