I’m like a kid in the candy store in this market.

To explain why, let me back up and explain where I’m coming from.

My goal as a dividend growth investor is to generate the safest, largest, and fastest growing passive income stream possible. I’m neither a “value investor” nor a “growth investor,” although I like good values and growth as much as anybody else. Neither, really, am I a “dividend investor,” although every single stock and ETF I own pays a dividend.

I think of myself as an investor in high-quality businesses capable of generating ever-growing streams of cash flow. My fellow shareholders and I wish to take a portion of those cash profits as distributions/dividends each year.

With that regular influx of cash from my various ownership stakes in high-quality businesses, I continuously reinvest into whichever publicly traded businesses offer the most compelling value at the time.

Since I prefer to regularly receive a portion of cash profits from my investments in the form of dividends, I only seek out companies wherein the shareholders (via their representatives in the board of directors) have chosen to pay a dividend. At the same time, since I like quality businesses with competitive advantages, I don’t simply invest in whichever company offers the highest dividend yield.

- In short, I invest in quality businesses that pay dividends, and I seek to buy stakes (or shares) in those businesses at reasonable valuations.

I like to call my strategy “Quality At a Reasonable Price.”

In today’s market, there are lots of quality dividend payers at better-than-reasonable prices, especially in the realm of real estate investment trusts (“REITs”).

Higher interest rates have absolutely wreaked havoc on most REIT stock prices, and there have been several high-quality, low-leveraged REITs tossed out with the bathwater.

Below, I’ll highlight five of them that I’m buying today. But first, I want to discuss two quick points:

- The bigger the REIT, the better the performance has been

- REITs can still grow their bottom line profits even if interest expenses grow significantly faster than revenue over multiple years

Triumph Of The Big

Over the last five years and especially in the COVID era, bigger REITs have significantly outperformed small and mid-sized REITs.

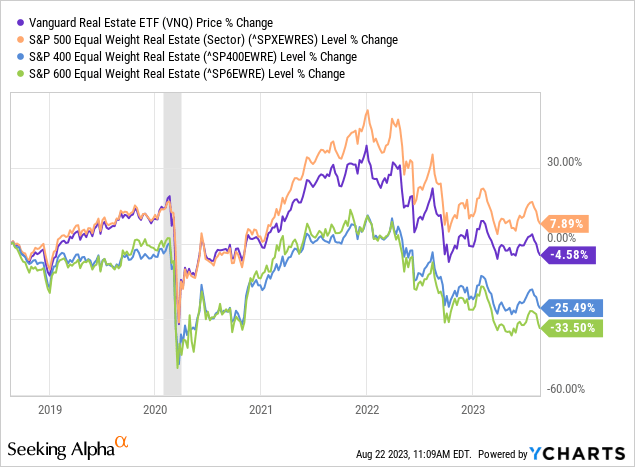

Take a look at the chart below. The purple line is the Vanguard Real Estate ETF (VNQ), which holds all US REITs but is heavily weighted toward large-cap names. The orange line is the equal-weight index of REITs in the S&P 500 (SPY), which represent the ~30 largest REITs on the market. The blue line is the equal weighting of REITs in the S&P 400 mid-cap (MDY) index, while the green line is the equal weighting of REITs in the S&P 600 small-cap (SPSM) index.

Generally speaking, the bigger the REIT, the better the performance over the last five years. The smaller the REIT, the worse the performance.

There are a few explanations for this.

- Larger market-cap REITs tend to be concentrated in a few high-growth, highly valued sectors like industrial, data centers, and cell towers, which have performed extraordinarily well in the COVID era. Meanwhile, small and mid-sized REITs tend to own other types of properties like office, retail, apartments, senior housing, hotels, hospitals, and self-storage that have had more mixed performance over the last several years.

- Bigger REITs tend to have higher valuations, higher credit ratings, and greater access to various forms of capital. Therefore, they tend to carry cheaper and less debt with longer maturities, which makes them less vulnerable to rising interest rates. In contrast, many smaller REITs have shorter maturity debt and more floating rate exposure, making them more vulnerable to rising interest rates.

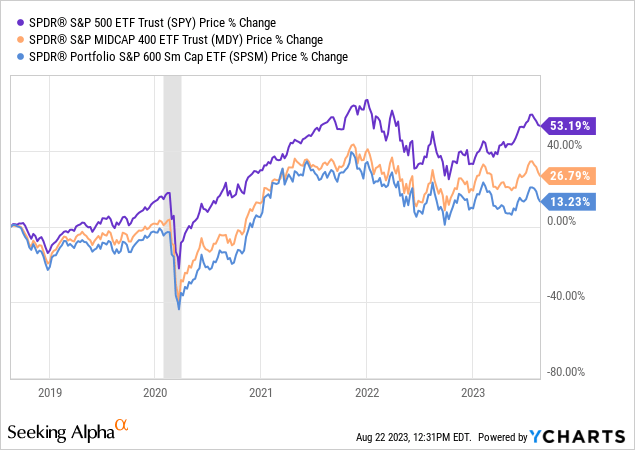

As you can see, these explanations are unique to the real estate sector. If you compare the various performances of SPY, MDY, and SPSM, which include all kinds of stocks, over the last five years, you’ll notice that the performance gap is there but isn’t as stark.

Does this mean small-cap REITs are a better value right now than large-cap REITs?

It depends on a lot of factors.

- When will interest rates come down from here and how far?

- Does the REIT have a strong or weak balance sheet?

- Is the REIT in an industry with secular tailwinds like industrial or secular headwinds like office?

- Has the REIT been hobbled in the last few years by expensive refinancing, asset sales, or a dividend cut?

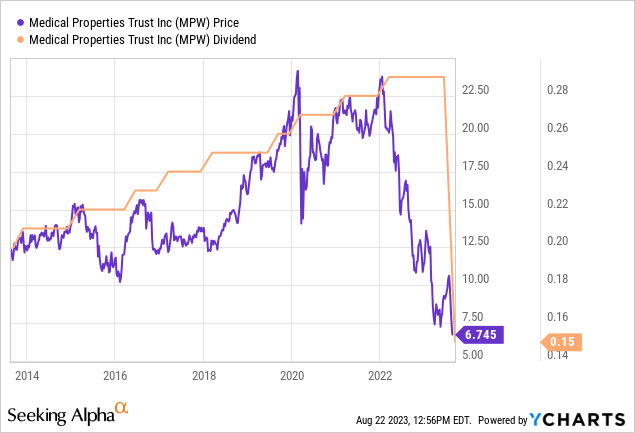

On that last point, consider the case of Medical Properties Trust (MPW). The REIT is doing all three: expensive refinancing, asset sales, and a dividend cut.

Bulls will say the dividend cut was a good thing. I disagree. It was necessary, but not good. It will free up some cash for deleveraging, but the hit to investor confidence that MPW just took is massive.

Historically, the record of companies that cut their dividends is not good, in part because they leave a bad taste in investors’ mouths. Many shareholders sell and never think about the company again, except to write the occasional critical comment on Seeking Alpha articles.

MPW was and is an income stock for most of its retail shareholder base. For many of these investors, cutting the dividend is a betrayal, no matter how you spin it.

As for me, I threw in the towel on MPW back in February and sold at a nearly 40% loss. Today, that would be about a 65% loss. The hospital labor shortage problem persists, and many high-margin services and surgeries formerly carried out in hospitals have moved to off-campus clinics and surgery centers. The troubles of MPW’s highly indebted, private equity-backed tenants aren’t going away anytime soon, and neither is MPW’s large debt load or low credit rating of BB.

In short, MPW is one of those smaller REITs that has massively underperformed, but I don’t think it’s primed for outperformance over large-cap REITs anytime soon.

How (Modestly Leveraged) REITs Grow Even With Rapidly Rising Interest Expenses

It’s all about the relative sizes of the numbers.

If a REIT enjoys an investment grade credit rating, modest debt, and no single years of massive debt maturities to be refinanced all at once, then interest costs should rise only at a steady but reasonable pace. But off of a low base of interest rates, the percentage growth will still look huge – 20% or 30% or 40% or more YoY growth in interest expenses.

How can a REIT growing its revenue at only about 5% per year continue to see bottom-line profit growth when its interest expenses are rising at, say, 25% per year?

Let’s do the math, assuming that our hypothetical REIT’s interest expenses are about 5% of revenue.

| Rental Revenue (Growing 5% Per Year) | Interest Expense (Growing 25% Per Year) | Revenue Growth Minus Interest Growth | |

| Year 1 | $10,000 | $500 | |

| Year 2 | $10,500 | $625 | $375 |

| Year 3 | $11,025 | $781 | $369 |

| Year 4 | $11,576 | $976 | $356 |

| Year 5 | $12,155 | $1,220 | $335 |

The far right column shows the difference between revenue growth and interest expense growth each year.

As you can see, because revenue is a much larger number than interest expense, it does not need to grow nearly as fast in order to produce a larger absolute amount of growth than the amount of growth in interest costs, even with interest expenses rising 5 times faster.

This is also how net operating income (“NOI”) works. Operating revenue can grow slower than operating expenses and still produce positive NOI growth, because the former is a much bigger absolute number than the latter.

That is how many modestly leveraged REITs can continue to grow their bottom-line cash profits even amid rapidly rising interest rates. All else being equal, even much slower revenue and EBITDA growth can more than offset high growth in interest costs.

With that said, allow me to pitch you five high-quality, larger market cap REITs that I’m buying today.

I discussed the unique qualities and competitive advantages of these five REITs in a recent article titled “If I Could Only Own 7 REITs, It Would Be These,” but I did not discuss valuations.

For a fuller discussion of the “what” and “why” of these REITs, see that previous article. For the “why buy now,” keep reading.

Agree Realty (ADC)

ADC is my largest holding. The net lease REIT is laser-focused on the nation’s largest and strongest retailers that are capable of not only growing but thriving in the age of e-commerce and omnichannel. Think of names like Walmart (WMT), Dollar General (DG), and Tractor Supply Company (TSCO), which happen to be its three largest tenants.

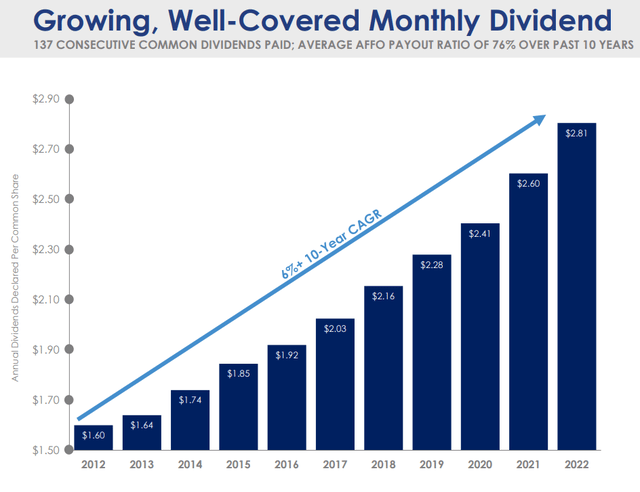

ADC August Presentation

In addition to high-quality tenants and real estate locations, ADC’s balance sheet exudes quality. Net debt to EBITDA is low at 4.5x, and only about 6% of ADC’s total debt matures before 2028, making the REIT highly insulated from rising interest rates.

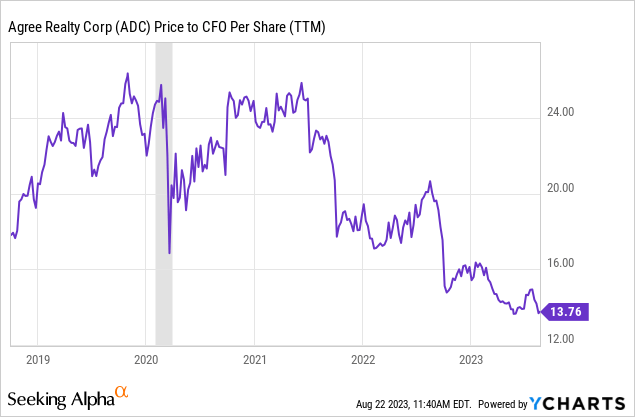

Today, ADC is trading at under 14x its operating cash flow, compared to its 5-year average of about 21x.

As for adjusted funds from operations (“AFFO”), ADC currently trades at an AFFO multiple a little over 15x, compared to its historical valuation of around 19-20x.

Meanwhile, compared to its 5-year average dividend yield of about 3.75%, ADC currently sports a yield of 4.7%.

If ADC continues its average dividend growth rate of about 6% going forward, then the yield plus growth alone should deliver 10%+ total returns for buyers at today’s price.

ADC August Presentation

But I foresee 25-30% stock price upside as well once interest rates normalized at a lower level.

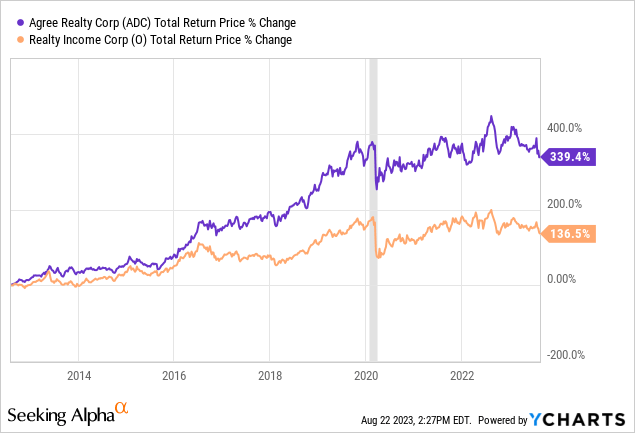

By the way, if you compare ADC to its immensely popular net lease peer, Realty Income (O), you’ll find that ADC is higher quality in virtually every way.

| ADC | O | |

| Investment Grade Tenancy | 68% | 40% |

| Net Debt To EBITDA | 4.5x | 5.3x |

| Debt Maturing Before 2028 | 6% | 47% |

| 5-Year Avg. Dividend Growth Rate | 7% | 4% |

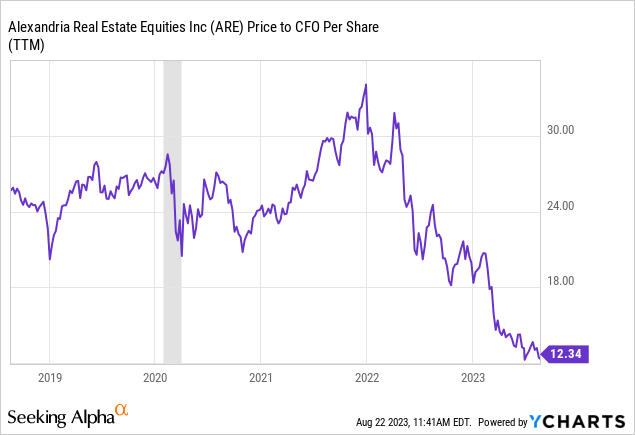

Alexandria Real Estate Equities (ARE)

ARE is the only pure-play REIT in the ownership and development of life science real estate — laboratory buildings used by biotech companies for research & development. Its buildings are among the most state-of-the-art and well-located, and its tenants are the biggest and most innovative in the world.

Moreover, ARE’s fortress balance sheet and BBB+ credit rating show no signs of stress. No debt matures until 2025. The weighted average maturity of debt is over 13 years.

And yet, ARE has sold off hard over the last year. Its price to operating cash flow of 12.3x is roughly half its historical average of about 25x.

And its AFFO multiple of 15.5x is far lower than its 5-year average multiple of 25.5x.

Meanwhile, ARE’s 12-year dividend growth streak continues onward, and its payout ratio is only about 2/3rds of AFFO.

Even if growth slows from here, and even if ARE doesn’t ever attain its historically average valuation again (which I find unlikely), there’s still a huge margin of safety built in to the current price.

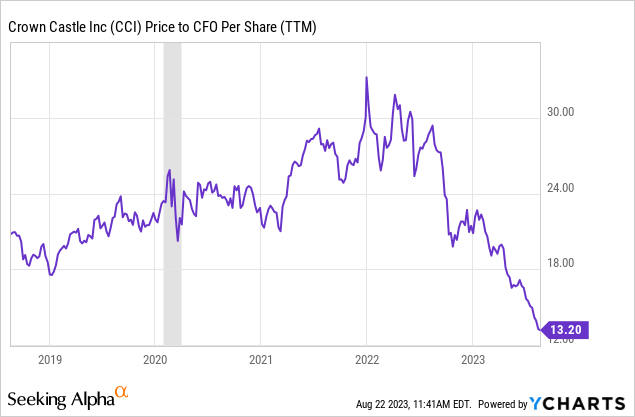

Crown Castle (CCI)

CCI is the leading US-focused telecommunications infrastructure REIT. It owns ~40,000 cell towers, over 120,000 small cells, and ~80,000 route miles of fiber. It is taking a hit to growth over the next few years from lease cancellations due to the merger between T-Mobile (TMUS) and Sprint, but the market seems to fear that CCI will never be able to revive growth again thereafter.

Ask yourself these questions:

- Will the huge growth in mobile data usage and 5G applications really not need any more infrastructure investment from the wireless carriers? (Of course it will.)

- Is it likely that we will see more consolidation among telecom providers? (No, it’s already an oligopoly.)

- Am I willing to wait until 2026 before I see AFFO and dividend growth pick up for CCI again?

CCI has become dirt cheap with a massive margin of safety.

Its AFFO multiple of about 14x is well below its 5-year average of 23x, and its 6.3% dividend yield almost twice as high as its average of 3.4%.

I’m in CCI for the long haul and believe it will return to mid- to high-single-digit growth after 2025.

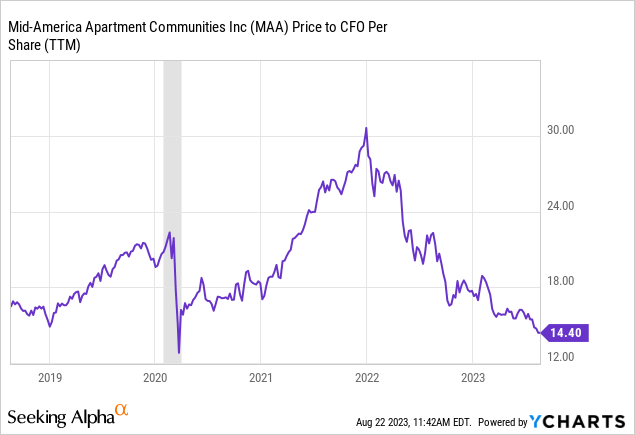

Mid-America Apartment Communities (MAA)

MAA is the leader in Sunbelt apartments. Many of these Sunbelt markets are seeing big waves of new supply hit the market right now, but I think MAA’s apartments are mostly insulated. Why?

- Location: The new supply is mostly popping up in suburban areas further away from population centers and highways, while MAA’s locations are closer to urban areas and more convenient.

- Price: Developers are trying to get top-dollar rents for their newly built properties, with asking rents typically 10-20% higher than MAA’s existing apartments.

- Renter Profile: The type of renter attracted to the brand new, Class A apartment building is often not the same as the renter living in an existing community.

Competition has long been more intense in the Sunbelt than in more supply-constrained coastal markets, but that’s why MAA relies on good old fashioned real estate fundamentals. Eventually, this wave of supply will end, but above-average demand growth in the Sunbelt is expected to persist.

Oh, and with net debt to EBITDA at an ultra-low level of 3.3x, MAA has incredible capacity to acquire or develop properties when opportunities become available.

Meanwhile, MAA is now cheaper than it was even for most of 2020, during the COVID-19 lockdowns.

Its current AFFO multiple of 17x may not sound that low, but its 5-year average is 21.5x. That’s 25% upside to the historical average. I’m confident that I’ll see that upside in the next few years.

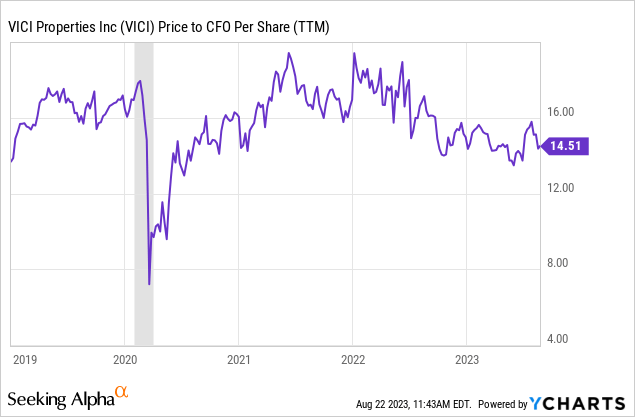

VICI Properties (VICI)

When it comes to the Landlord of Las Vegas, the word that comes to mind is “resilient.” I can’t think of a more perfect storm for Las Vegas and casinos/experiential real estate more broadly than a pandemic that causes strict lockdowns and social distancing. And yet, because of the resilience of VICI’s tenants, the REIT collected 100% of contractual rent through the pandemic.

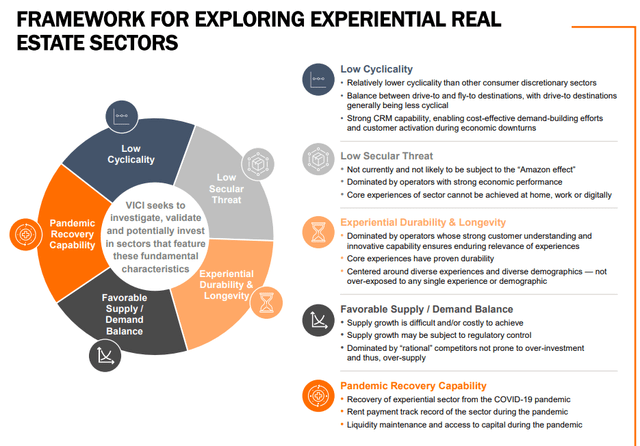

Now one of the largest REITs in the world after its acquisition of MGM Growth Properties, VICI is expanding into other forms of experiential real estate with top-tier tenant-operators. The key differentiator for VICI’s investment philosophy, I think, is selectivity.

VICI May Presentation

The REIT is expanding partnerships with best-in-class destination resort operators like Great Wolf Lodge and Canyon Ranch. But what gives me confidence in management is the quality tilt of their investment philosophy.

VICI may not be as heavily discounted as some other REITs, but it still has about 10% upside to its average price to operating cash flow.

The dividend yield of 5.2% is slightly above its historical average of about 5.0%, and I think investors can expect mid-single-digit growth for the foreseeable future.

Bottom Line

I know these aren’t the highest yielding REITs out there. But I would argue that they are among the highest quality REITs. And they are trading at reasonable or better-than-reasonable valuations. This equates to a healthy margin of safety for long-term investors.

For QARP (Quality At a Reasonable Price) dividend growth investors like me, REITs are arguably the best place in the market to look for deals right now.

Read the full article here