Thesis Summary

Last week, I wrote about the potential for a huge 1987-style Black Monday sell-off, which the now incredibly popular 0DTE options could ignite.

Since then, China has monopolized news headlines following the bankruptcy of Evergrande (OTC:EGRNF). Indeed, it looks like China is in big trouble.

Could this be yet another trillion-dollar black swan? Could China spark a global credit collapse? What can China do to stop this?

There’s no doubt that the Chinese government and the PBoC are in a hard spot, trying to re-ignite the economy and defend the yuan. With that said, I feel like China could be a good contrarian bet in the short term here.

Long-term investors might want to ask themselves. If China loses, who wins?

China Has Some Serious Problems

Once again, China is in the news, as the property giant Evergrande has filed for bankruptcy. This is probably not the first time you’ve heard of Evergrande, as fears of its collapse already surfaced back in 2021.

However, this time, it looks a lot worse for two main reasons. For one thing, the Chinese economy is in pretty bad shape, and we are already starting to see signs of contagion within China. Zhongzhi, a Chinese shadow bank worth $137 billion, is also preparing for restructuring.

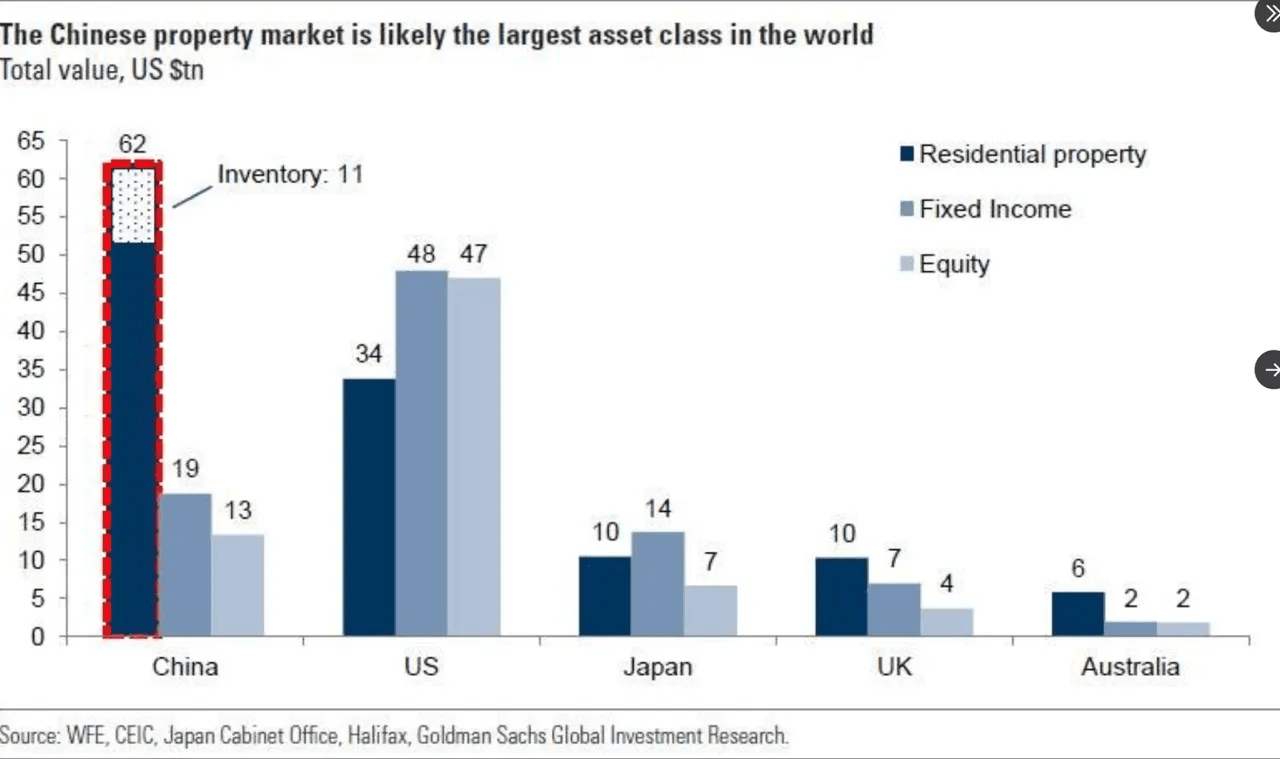

The shadow banking industry is worth over $3 trillion, and that’s nothing when we compare it to the size of China’s real estate market, which is arguably the largest asset class in the world:

Value of Chinese Property market (Goldman Sachs )

It would not be an understatement to say that this could be one of the largest credit events in history.

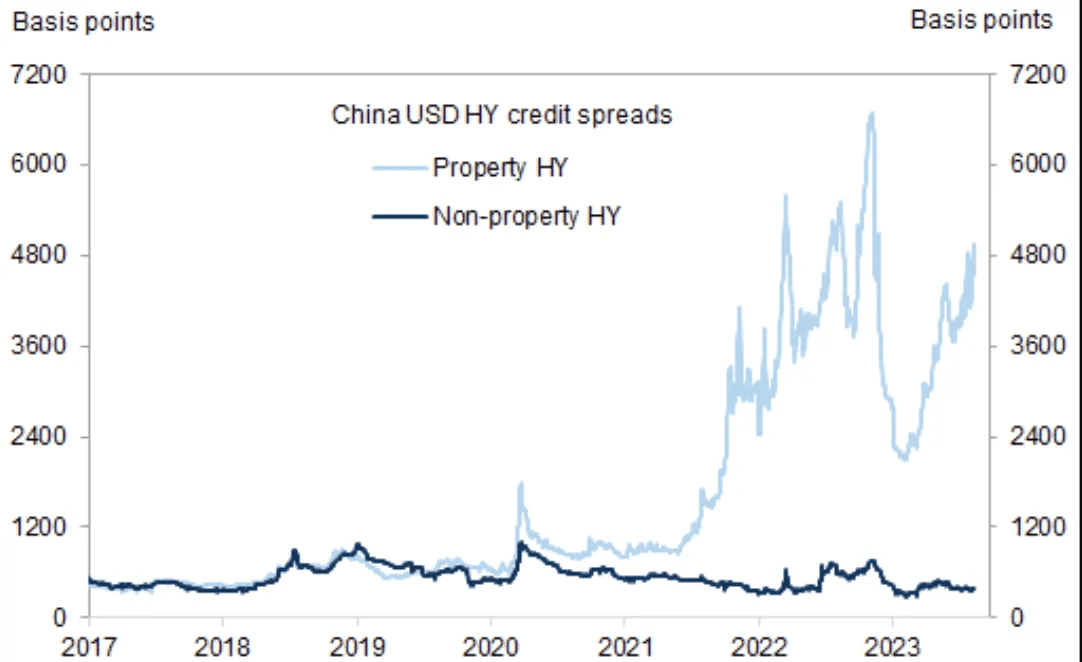

The pain in Chinese credit markets can also be clearly seen in the spread between property and non-property yields.

China credit spreads (X (Twitter))

And these developments come at a pretty bad time for the country. Youth unemployment is at record highs, exports are falling off a cliff, and the population is declining.

Can China Turn Things Around?

But surely, there’s something that China can do to fight this collapse? If this was the Federal Reserve, we would have probably already seen a swift and over-the-top response. But the PBoC is not the Fed, and it does not enjoy the benefits of dealing in the world’s reserve currency.

This is the second reason why this time collapse might be inevitable:

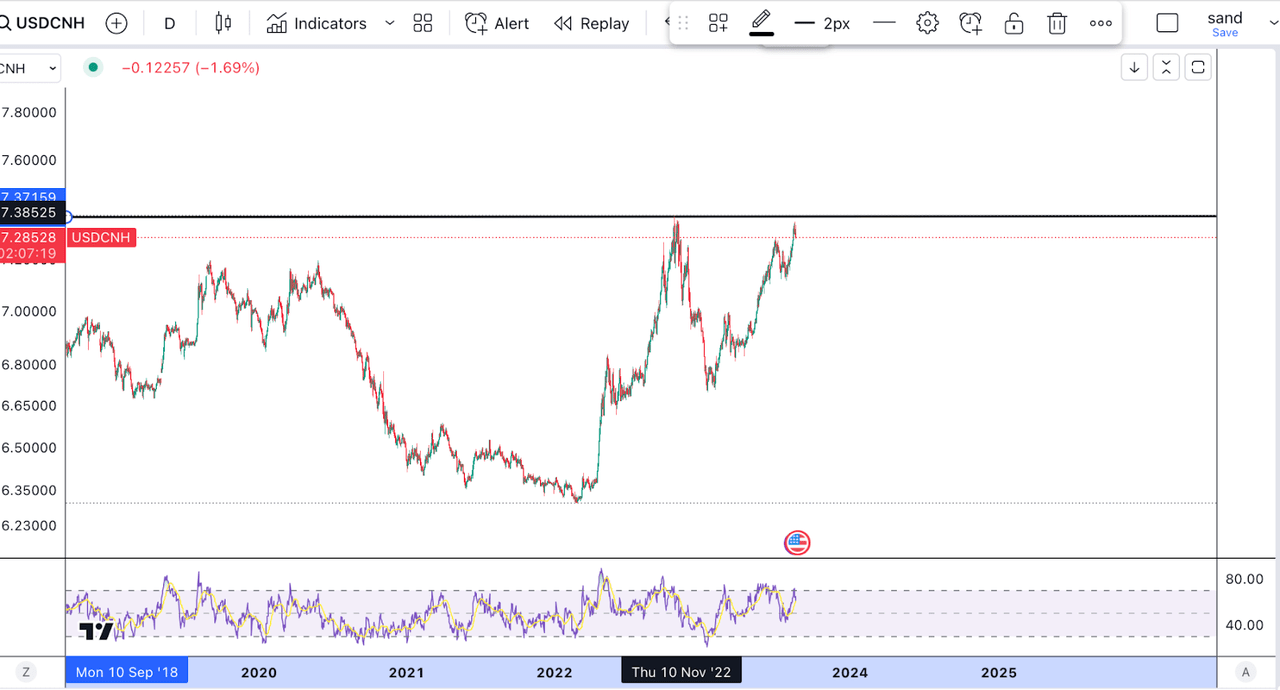

Yuan (TradingView)

The PBoC would probably like to stimulate the economy through aggressive monetary stimulus and rate cuts, but it probably also wants to defend the exchange rate at this point.

The USDCNH exchange is approaching its 2022 high. Over the last year, the yuan has been rapidly depreciating, and this is not something China wants to see as it tries to establish itself as a monetary alternative to the US dollar.

Furthermore, the country is also wearing off, pulling too hard on the fiscal and monetary levers, as doing so is precisely the reason why they face this housing (construction bubble today).

This can be at least partly attributed to the aggressive response that China carried out following the 08 financial crisis.

Back in 2008, Chinese leaders rolled out a four trillion yuan ($586 billion) fiscal package to minimize the impact of the global financial crisis. It was seen as a success and helped boost Beijing’s domestic and international political standing as well as China’s economic growth, which soared to more than 9% in the second half of 2009.

But the measures, which were focused on government-led infrastructure projects, also led to an unprecedented credit expansion and massive increase in local government debt, from which the economy is still struggling to recover. In 2012, Beijing said it wouldn’t be doing it again. The costs were just too high.

Source: CNN Business

China doesn’t want to resort to another huge round of stimulus, but it is slowly starting to signal that it is ready to support markets and the economy.

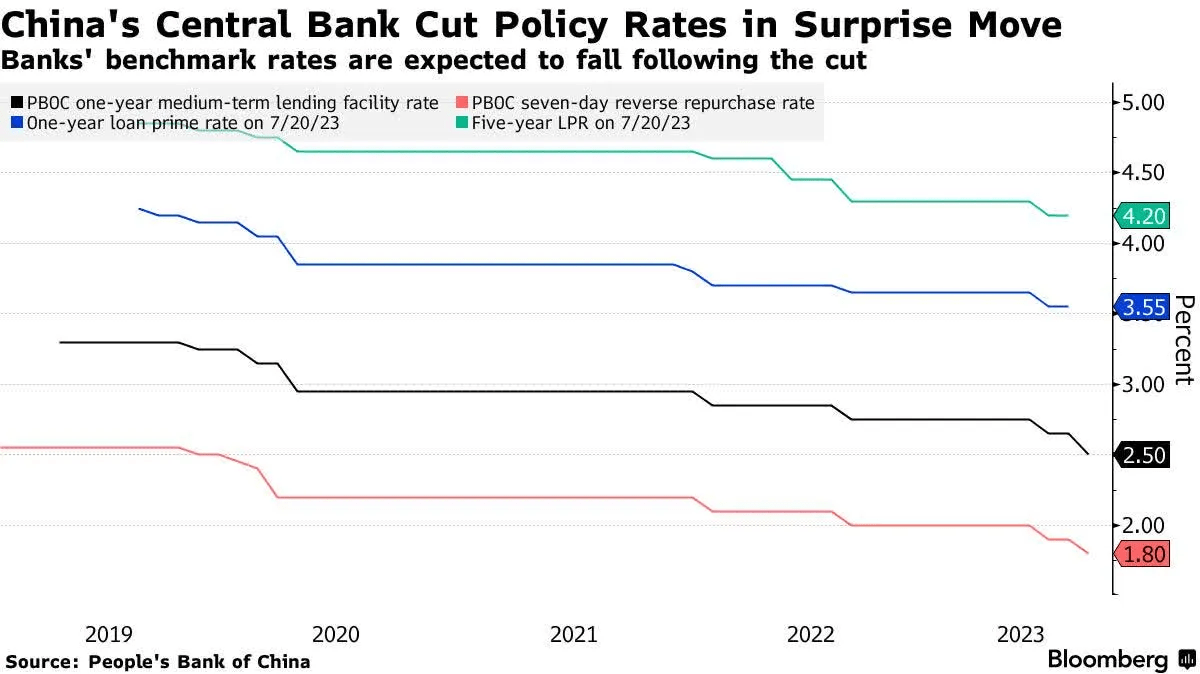

The PBoC surprised markets by cutting rates in its last meeting:

China Rate cuts (PBoC)

Beyond that, we can also expect the National Development and Reform Commission (NDRC) to support the economy in other ways:

The measures announced by the NDRC on Monday cover a wide range of industries, including automobile, real estate, electronic products, and services industry…

They include increasing consumer loans to encourage car purchases, building more EV charging facilities, building more affordable homes for young people, supporting the consumption of wearable devices and smart products, and encouraging local governments to hold food, music, and sports festivals to attract tourists.

Source: CNN Business

Interestingly, there’s also been some speculation that the Chines government could be directly buying ETFs.

China is limited on the monetary policy side, as it needs to defend its exchange rate. However, there are a couple of other options for the country here:

-

Release oil reserves to boost manufacturing

-

Increase foreign investment

China has been stockpiling oil reserves and could take a page out of the Biden book and begin to release some oil, especially now that prices have climbed.

In terms of foreign investment, this will be a difficult avenue to pursue since China’s actions over the past year, combined with poor market performance, have really spooked investors.

Could China Be The First Domino?

China could be the first domino in a long line of collapsing economies. Just like the US housing bubble created a global crisis, so could this.

But how can we know if there is a risk of this spreading to the US, and how exactly would this happen?

Of course, credit default swaps are one way to gauge how the market perceives China’s risk.

China CDS (wordlgovernmentbonds)

We can see these have been climbing in recent months.

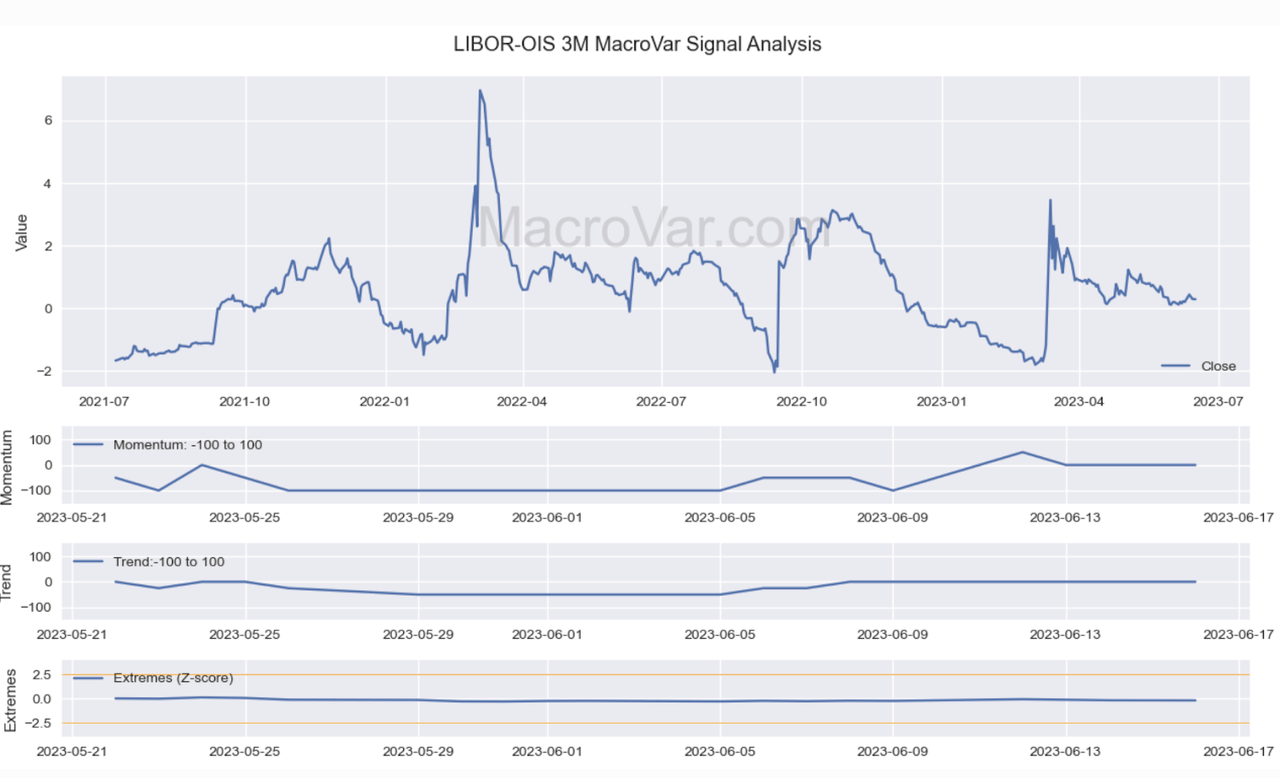

Another indicator we can use to gauge the level of distress in markets is the LIBOR-OIS spread.

LIBOR-OIS (MacroVar)

The Libor is the rate at which banks lend to each other, while the Overnight Index Swap rate is the one set by central banks. A big spread in these could be a tell of financial distress. This was the case, for example, in 2019 during the start of the covid pandemic, but we are not close to these levels yet.

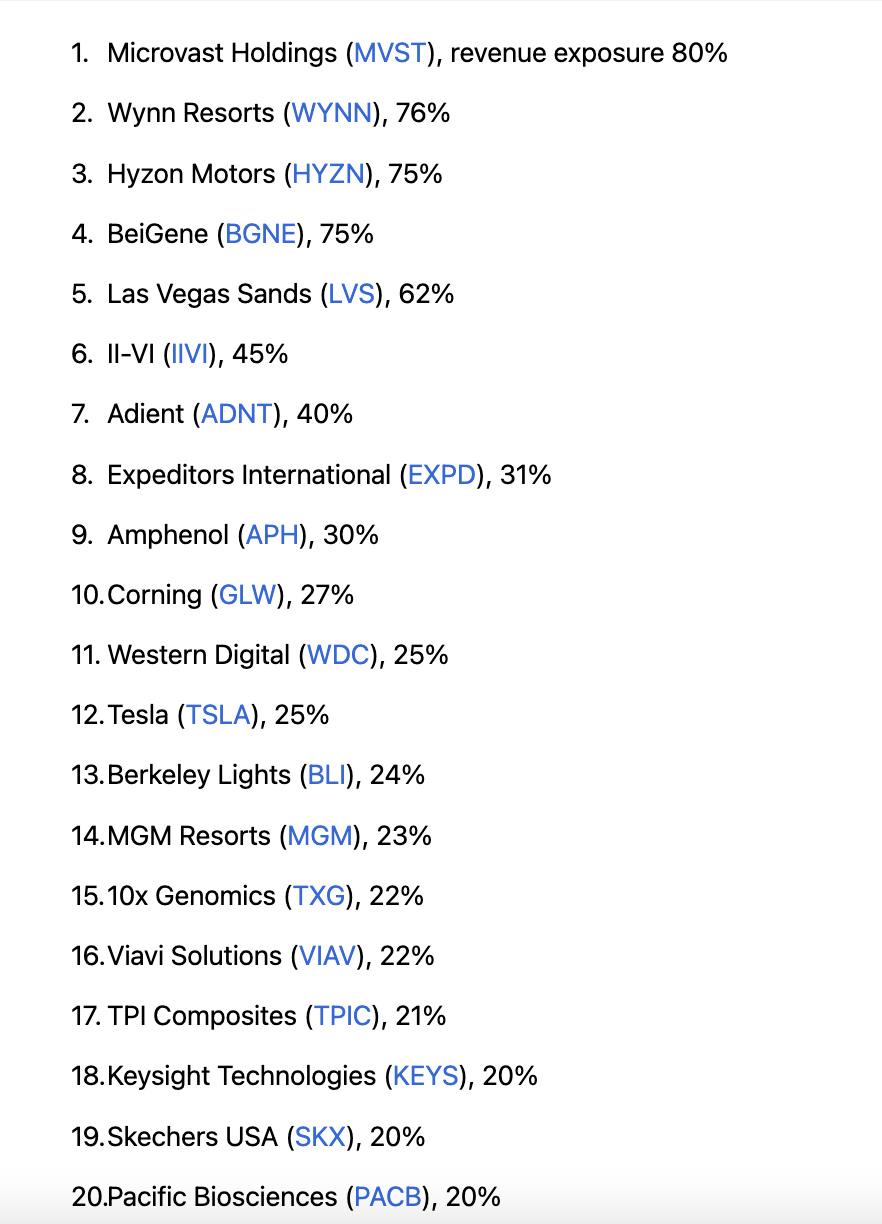

And of course, in a more direct sense, China’s weakness will have a direct impact on the US, as there are many companies that depend on the country as a revenue source:

Top 20 stocks with china exposure (Seeking Alpha)

The list above excludes semiconductors. That list is actually topped by NVIDIA Corporation (NVDA), which has seen a massive rally this year and is set to report earnings on Wednesday.

All in all, due to the size of the real estate market in China, and the connectedness between both economies, it’s hard to see a situation where China falls and the US escapes unscathed.

How To Profit From This

The bottom line here is that something big is going on, and there’s a chance to profit. I see two main strategies to do this. One more risky and short term, and one less risky and long term.

In the short term, I believe that a further dip in Chinese stocks could be bought up. Fundamentally, the Chinese government has already voiced the fact that it will be looking to support the market moving forward, and there’s even the speculation that they are already buying. If so, this is a classic instance of front-running the central banks.

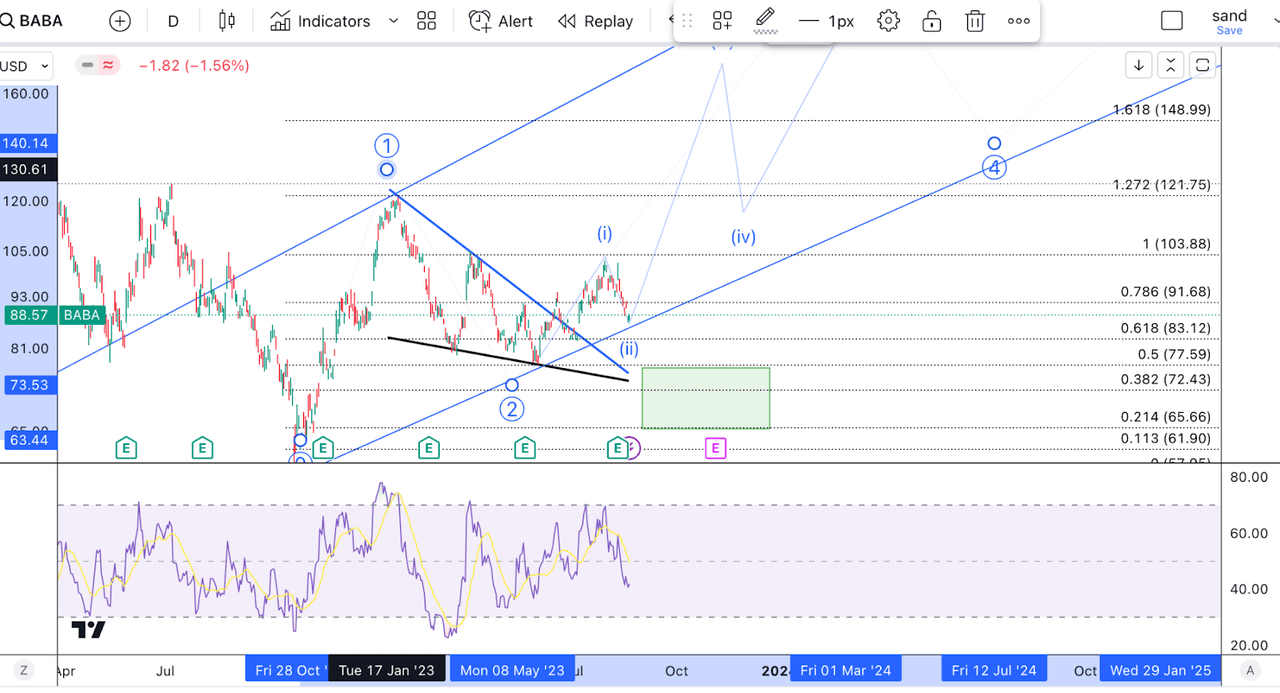

On top of that, from a technical perspective, Chinese stocks have suffered a lot, and we are now resting on important support. I like to use Alibaba (BABA) as a proxy for China.

BABA TA (Author’s work)

This stock put in a bottom back in October and has since been trading in an upward channel. We are currently just above the support offered by this channel. BABA is also trading just around the 61.8% retracement of its last rally, what I have labelled here as a wave (i). This is an ideal spot for a turnaround.

With that said, if we break below support, it opens up the door to forming lower lows and heading back toward $73, which is itself the 61.8% retracement of the larger circle wave 1. At this point, I would definitely be considering going long.

Now, though China could offer us short-term trade here, I would have to agree with the idea that long-term things don’t look good for its economy. So, we have to ask ourselves; if China loses, who wins?

In this regard, we are already seeing a shift towards India, something which fellow SA contributor Lyn Alden has already pointed out.

India is set to overtake China as the world’s most populous country, and still has a very low (but rising) per-capita GDP. As a large emerging market, it has one of the highest GDP growth rates in the world, and is set to become one of the world’s largest economies by the 2030s.

Source: Lynalden.com

So for those looking to benefit from China’s decline long term, emerging markets like India, perhaps, Indonesia, or in my opinion, even Brazil, could be a good place to set your sights long-term

Takeaway

China could be a ticking time bomb. The PBoC is caught between a rock and a hard place, by which I mean defending the exchange rate or supporting the economy. With that said, a further sell-off from here could be a good dip buying opportunity, as the Chinese central bank and government could be actively supporting their equities. Long term, the move away from China seems unstoppable, and while China loses, some of its neighbouring countries will benefit.

Read the full article here