“You American people worry too much about the China economy. Every time you think China is a problem, we get better, but when you have a high expectation for China, China is always a problem.” – Jack Ma

Watching with interest the Chinese financial “doomers” going onto overdrive recently, we reminded ourselves of the China doom and gloom reports of 2017. At the time we did exchange our thoughts with Kevin Muir from the excellent Macro Tourist blog:

“The PBoC does not want this devaluation to be a one way street where speculators easily earn profits. Keeping everyone honest by strengthening the Yuan right ahead of a devalue seems perfectly logical to me.

I believe the Chinese purposely tightened last year so that they could ease into this Autumn’s People’s Congress (China Downgrade – buy the news?). After writing that piece, a great macro writer by the name of Martin Tixier, who pens the terrific Macronomics blog, wrote me to say, China is conducting a “controlled demolition of their WMPs (wealth management products).” What an awesome line. And I couldn’t agree more. Their tightening was designed to take some steam out of the frothy areas of their economy.

But now they have tightened enough. They have slowed their economy. Withdrawn liquidity out the global financial system. They have accomplished what they set out to do.” – Kevin Muir, June 2017

So, given the “negative narrative” on Chinese woes, when it came to selecting our title analogy, we decided to go for “Fortune cookie”. A fortune cookie is a crisp and sugary cookie wafer with a piece of paper inside, a “fortune”, an aphorism, or a vague prophecy. The message inside may also include a Chinese phrase with translation and/or a list of lucky numbers used by some as lottery numbers. “Fortune cookies” are often served as a dessert in Chinese restaurants in the United States, Canada, Australia, and other countries, but they are not Chinese in origin. There are approximately 3 billion fortune cookies made each year globally, the majority of them consumed in the US. Authorities briefly investigated Wonton Food in 2005, after 110 Powerball lottery players won about $19 million after using the “lucky numbers” on the back of “fortunes cookies” messages. As such, it appears to us, that when it comes to making Chinese economic predictions, it is more a US centric marketing activity rather than a Chinese one but, we ramble again.

In this conversation we would like to look at the Chinese “doom” narrative. As well we want to continue to look at the US “trajectory” in continuation to our recent post relating to the “Latam playbook” and fiscal woes, which in our book explains the de-anchoring of the US long bonds and the continuation in the rise of yields.

-

Controlled demolition 2.0

In 2017 we used the “controlled demolition” analogy when it came to assessing what the Chinese authorities were trying to achieve relative to their shadow banking sector which was generating financial instability. As such they had to clamp down on the “Wealth Management Products”. It is a point we discussed at the time with Anthony Crudele in a podcast for those interested.

Again, this year we are hearing growing concern relative to the ailing Chinese economy in general and Chinese real estate in particular. To simplify our reasoning behind our analysis we would like to point out towards David P. Goldman assessment of the ongoing situation as he astutely demonstrated out in his Asia Times article entitled “The China contagion that never was”:

“The China property market shakeout is not contagious enough to herald a full-scale financial crisis

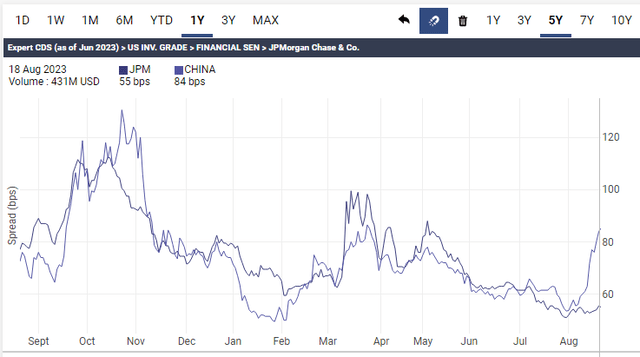

The price of hedging China risk on world markets hasn’t fluttered during the past couple of weeks, which means that investors with real money on the line and speculators looking for a score aren’t worried about China’s property market.

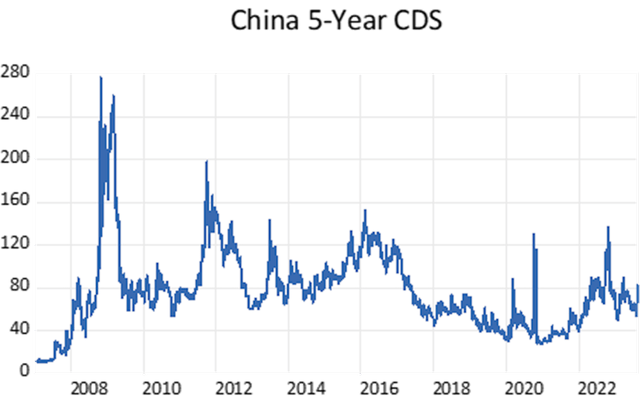

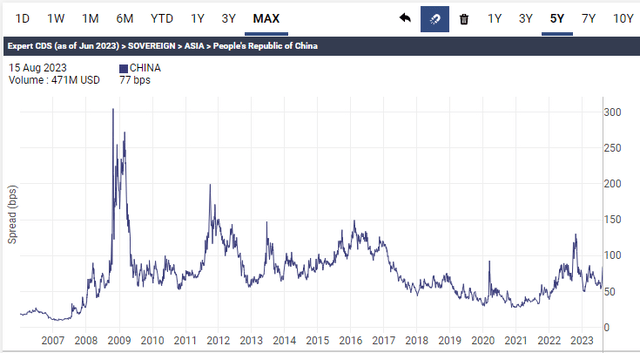

China CDS 5 year (David P. Goldman – Asia Times)

Credit default swaps are a form of bond insurance that makes creditors whole after a default. They are quoted in basis points (100ths of a percent) above the cost of interbank funding. The cost of default protection on China traded Aug. 18 at 80 basis points, on the lower side of its historic range.

Even in an extreme case, I showed in a companion article, China’s central government could cover the interest payments on defaulted local government debt with a bit over 1% of tax revenues. The shakeout in the property market and the financial vehicles that lend to it, including Local Government Financing Vehicles, isn’t a financial crisis as such; rather, Beijing is asserting central control over local governments that have coasted for years on rising land prices.

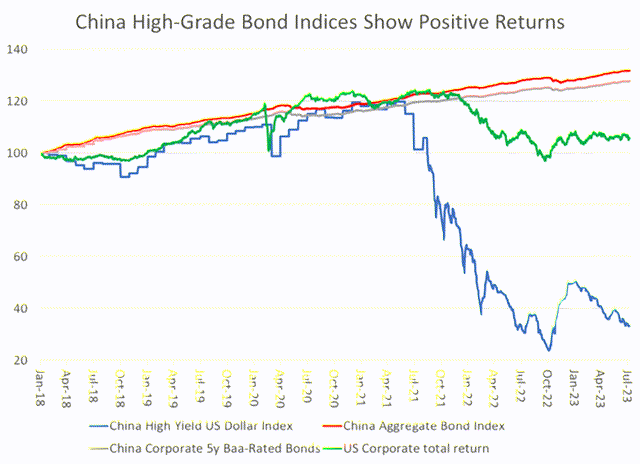

China High Grade bond indices (David P. Goldman – Asia Times)

The broad Chinese corporate bond market has ignored the property market fallout.

There’s a world of difference between the performance of property bonds, which make up most of Bloomberg’s China High Yield US Dollar Index, and the performance of investment-grade Chinese corporate bonds. The chart above shows that the high-yield dollar bond index has lost more than three-quarters of its value since the middle of 2021.

But the overall China bond index has registered positive returns throughout, and Bloomberg’s index of lower investment grade Chinese corporate bonds (rated Baa by Moody’s) has gained as well. The US corporate bond market has fallen in value because the Federal Reserve pushed up US interest rates. Bond prices move inversely to yields.

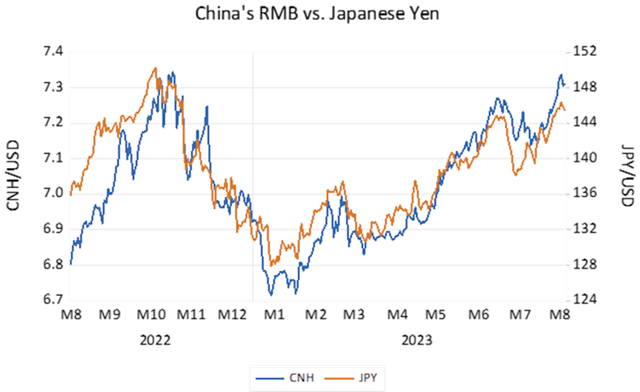

China RMB vs Yen (David P. Goldman – Asia Times)

China’s RMB (ticker CNH) is lower against the US dollar, but that’s due to higher US dollar interest rates, not RMB weakness. The Chinese currency has traded in lockstep with the Japanese yen for the past year.” – Source David P. Goldman, Asia Times, August 19, 2023

The rest of the article is obviously a must read. Some financial pundits want you to believe that the Chinese real estate sector woes are a “Lehman” moment, we do not buy “cheap” narratives and as well, we do not fall for central bankers “Jedi tricks” (Fed’s Barkin: “Recent moves in bond yields not a sign of inappropriate market tightening, likely a response to strong economic data”). Credit matters in our book and as concluded by David P. Goldman:

“The simple fact is that countries with enormous trade surpluses and very high savings rates don’t have financial crises. The Chinese government has the resources to cover the debt service of dodgy local government debt if it so chooses, and the banking system has vast resources to issue new loans. Whether Beijing will do so is a political, not a financial choice.” – David P Goldman, Asia Times, August 19, 2023

An entire generation of investors have now been used to “bailouts” being the instrument of “default” (pun intended). As pointed out by Frank Borman:

“Capitalism without bankruptcy is like Christianity without hell.”

As such if one can argue that the 5 years Sovereign CDS is a proxy for “credit risk” then indeed the latest “doom & gloom” in the financial sphere is not even warranted with China’s 5 years CDS trading at 84 bps:

China 5 year CDS (Macronomics – Datagrapple.com)

And to add some “interesting comparison” just for the fun of the argument, one could argue that JP Morgan Senior CDS at 55bps is trading too tight relative to China (84 bps) given the most recent S&P multiple US Banks downgrades on growing liquidity worries as well as Fitch downgrading the United States of America’s rating:

China 5 year CDS vs JP Morgan (Macronomics – Datagrapple.com)

One would opine that this is akin to a “logical fallacy”. Everyone is entitled to their opinion as the saying goes.

When David P. Goldman was asked about what would be a sign of contagion in regards to “contagion”, he answered:

“CDS above +125, for example. Or a big fall in RMB unrelated to other markets.” – David P. Goldman

As well we read with great interest Alexandre M. Andreoni’s take in our LinkedIn feed relative to Chinese woes:

“I’ve been reading a lot about China over the last few days, and I’ve been working on the Chinese file for several years now.

Let’s put things into context so that we can better understand and avoid the noise of the capital markets.

First, investors should understand that there is a group of financial companies under Zhongzhi, including licensed and unlicensed companies. The problems concerned unlicensed financial companies such as Hengtian Wealth Management. This is an independent case, which will have no impact on the financial system and will not entail any risk of contagion. Most of Zhongzhi’s companies are unlicensed and do not have many business relationships with traditional financial institutions, including banks and securities companies. Zhongrong Trust’s asset balance is less than $100BN, and no way this event could trigger China’s “Lehman moment”.

Second, Why is China’s story different from Japan’s? China has a long way to go before it experiences the same scenario as Japan in 1990. In the 1990s, Japan’s per capita residential area was 45 cm2, whereas China’s per capita residential area is currently 30 cm2. It will take at least 15 years for China’s real estate sector to develop and reach a balance between supply and demand. In 1990, Japan’s urbanization rate was 85%, while China’s is currently 65%.

Today, China is closer to Japan’s 1970 stage of development.

Third, Zhongzhi and Country Garden

Zhongzhi: Zhongrong’s real estate products are mainly purchased by UHNWI in China for their targeted return of 6-7% with a high leverage ratio. It is obvious that today this product suffers from a liquidity problem due to the lack of sufficient risk management.

Country Garden: The main reason for the delay in debt payment is closely linked to the company’s operating capabilities and aggressive expansion. The company operates mainly in China’s third- and fourth-tier cities, where downward pressure on housing prices is greatest. By contrast, a real estate company like Longfor Properties, whose activities are concentrated mainly in first-tier cities, is not affected by the crisis due to its prudent management of operations and risks.

Fourth, let’s not forget that China’s long-term economic development is based on the private economy. Private companies contribute 60% of Chinese government tax revenues, 60% of GDP and 70% of innovation, provide 80% of employment and account for 90% of the number of registered companies.

To conclude, the rhetoric of political speeches over the past few months concerning the immobility and lack of urgency of officials no longer seems to be a concern and has evolved into a new dimension where the constructive and proactive environment signals an outright reset in response to investor sentiment and capital markets that were somewhat appraised after the Politburo meeting of July.”- Alexandre M. Andreoni

Again “bailouts” are “political decisions”. China has sufficient means to tackle these ongoing issues which we clearly identified in 2017 and some were already addressed at the time. What matters to China is “stability”. China doesn’t want destabilizing rampant speculation and yes, some “speculators” will pay the price in true “capitalist” fashion like they did in 2017 with the previous clamp down on “Wealth Management Products” (WMPs).

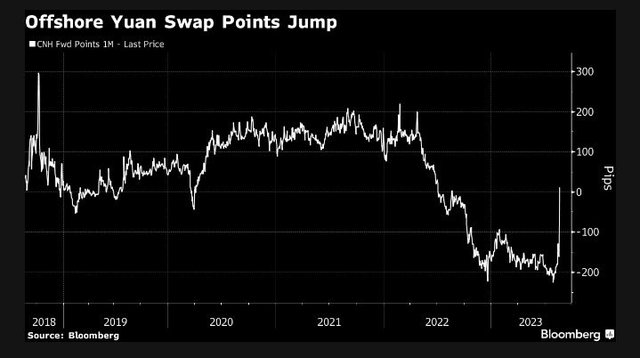

Also note that China has closed the “speculative” gap between CNY and CNH. The yuan’s onshore exchange rate ticker is CNY. Foreign businesses trading within mainland China can accept CNY as payment, but when they want to use yuan offshore, they need to exchange CNY to CNH. CNH is renminbi traded offshore from mainland China:

Offshore Yuan swap points (Bloomberg – Twitter)

More importantly Yen has fallen relative to CNY (offshore yuan):

Yen vs Offshore Yuan (Bloomberg – Twitter)

There has been has been a significant weakening of the Japanese yen in synch with the rise in US Treasury 10 year yields:

USTs 10 year yield vs USD/JPY 6 months chart (Macronomics – TradingView)

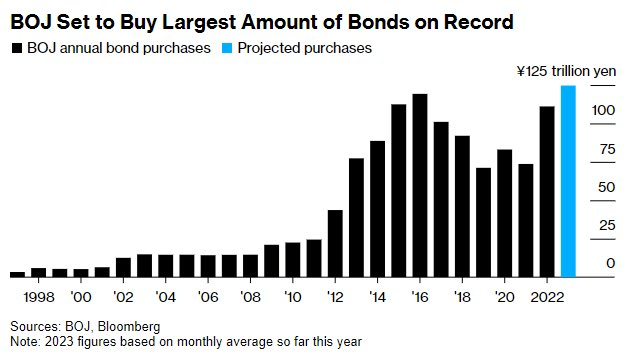

The weakening of the Japanese yield is the consequence of significant amount of bonds purchase by the Bank of Japan. As we pointed out in our March conversation “The Cheshire Cat”, Japan already owned 56% of the Japanese government bond market and given their willingness in boosting their defense spending and that Japanese are reluctant to accept tax hikes, the easiest way of course is therefore to issue more bonds and for the Bank of Japan to buy more of it:

Bank of Japan bond buying (Bloomberg – Twitter)

As such, China is in effect trying to “offset” Japanese yen weakness and closing the gap via offshore yuan (CNY) and prevent speculation. Many pundits are pointing towards “deflation” in China. In any case China 10 year yields 2.554%, its lowest level since April 2020.

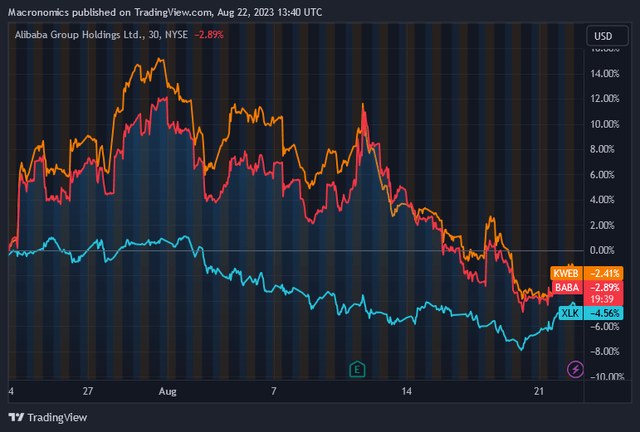

But returning to “Fortune cookies”, as per our Jack Ma’s opening quote we like to be contrarian. We discussed in our previous conversation the attractiveness of Alibaba ($BABA) and since our last conversation, sure, the stock’s performance has been erased but, we continue to think it has attractive valuation metrics (ETF XLK vs ETF KWEB vs $BABA, one month chart):

ETF XLK vs ETF KWEB vs $BABA, one month chart (Macronomics – TradingView)

As a reminder our friend Geoffrey has realized an augmented media presentation relating to GraphCall – Navigation valuation for those who wants to investigate more thoroughly this “value” proposal (should you want to subscribe to this service, you can use our discount code MNDOCUTALK).

While China’s “doom & gloom” is still the clickbait du jour it’s been a big month for tech earnings in China. On August 16, JD.com reported that net revenues for the quarter ended June 30 jumped 7.6 percent to $39.7 billion (287.9 billion RMB). Last week, rival Alibaba similarly beat Wall Street estimates as revenue surged 14 percent year on year to $32.3 billion (234.16 billion RMB) in the same period. After several years of tech crackdowns and Covid-19 restrictions, China’s e-commerce giants are making a comeback and there are even new IPOs taking place:

“SF Express, China’s largest express delivery company, has filed for a Hong Kong second listing that could raise as much as $3 billion.” – Bloomberg.

Of course China’s slowdown is real but we would argue that a lot of European countries would take a 5% projected GDP growth any day. Let’s move on to the continuation of US woes fiscal wise given that the de-anchoring of the US long end is a worrying trend in our opinion.

-

US Fiscal policy is out of control

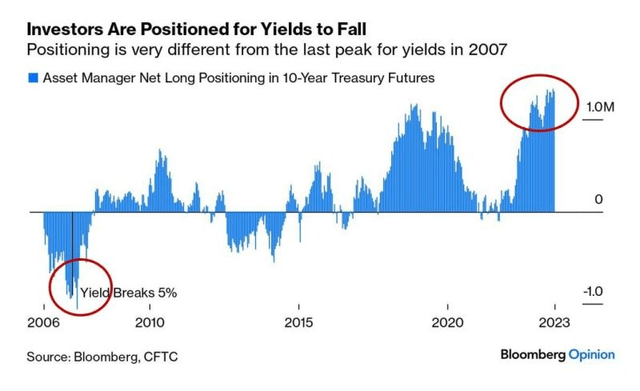

Whereas in “risk-off” episodes investors where racing towards the safety of US treasuries, the US long end has continued rising and it seems that many investors are positioned the wrong way we think:

Investors US bond positioning (Bloomberg – Twitter)

The Fed can control the short end of the yield curve but, not really the long end. The long bonds are de-anchored. Why is so? Because as we discussed in our previous conversations, the US needs to put its fiscal house in order.

On a side note on US woes we highly recommend listening to Bill Isaac, former FDIC chair’s interview relative to the title of our bullet point and US fiscal woes. In the video Bill Isaac recounts his handling of large bank failures in the 1970s and 1980s, including the collapse of Continental Illinois, which was the largest FDIC takeover until Washington Mutual in 2008. Back in March in our conversation “Reverse polarity” we indicated that the banking woes were akin to the Savings & Loan crisis. As such, in similar fashion to the period experienced by Bill Isaac you will see more bank failures and consolidation of the US banking sector and of course more inflationary pressures down the line.

Returning to the long-end of the curve, the US fiscal trajectory is unsustainable because of Quasi Fiscal Deficit in the US. (For more on QFD issues we highly recommend watching Geoffrey Fouvry quick take on Graph Financials, part 1 and part 2).

But when it comes to US woes in particular and the “Latam” playbook in general, we recommended you in our previous conversation to read both John H Welch research paper from the Federal Reserve Bank of Dallas entitled “Hyperinflation, and internal debt repudiation in Argentina and Brazil” published in 1991 as well as Charles W. Calomiris paper from the Federal Reserve Bank of Saint Louis entitled “Fiscal Dominance and the Return of Zero-Interest Bank Reserve Requirements”.

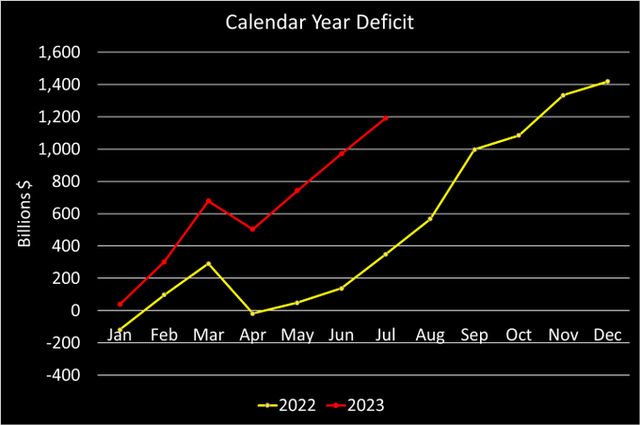

What is our great concern when it comes to the “long end” of the US yield curve is falling “foreign” demand. On the 10th of August, the Fed bought almost 40% of the $23 billion 30 year bond issued at a yield of 4.189% at a time where the Federal deficit in just 7 months has hit $1.2 trillion, up 242% over 2022:

US Calendar fiscal deficit (@ThHappyHawaiian – Twitter)

As commented by our friend Geoffrey, the “bond vigilantes” are in control of the long-end and do not care about inflation numbers but care about the fiscal position of the United States. So either the US Congress comes up with a real fiscal plan or they will have to monetize much more and in effect go for full fiscal dominance à la Argentina:

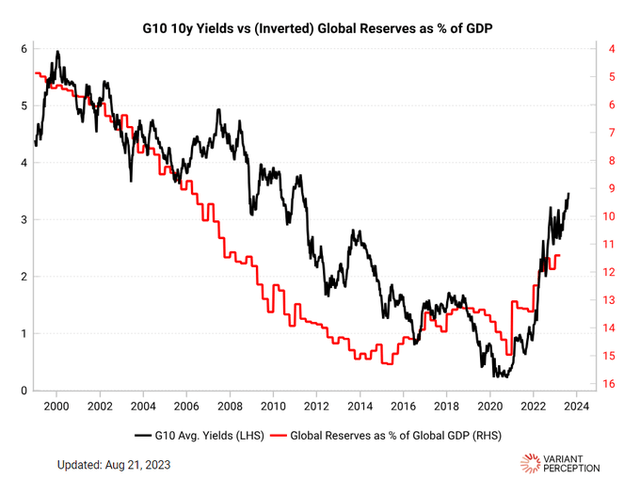

G10 10y Yields vs Global Reserves as percentage of GDP (Variant Perception – Twitter)

“From 2000-2015, long-term FX reserve buildup boosted demand for USTs, pushing yields lower. That trend started reversing in the mid-2010s and is accelerating post-Covid. While not a day-to-day timing device, this is an unambiguous structural headwind to USTs” – Variant Perception – Twitter

If you want a concerning chart, much more concerning than a Chinese one, we think this one is more appropriate:

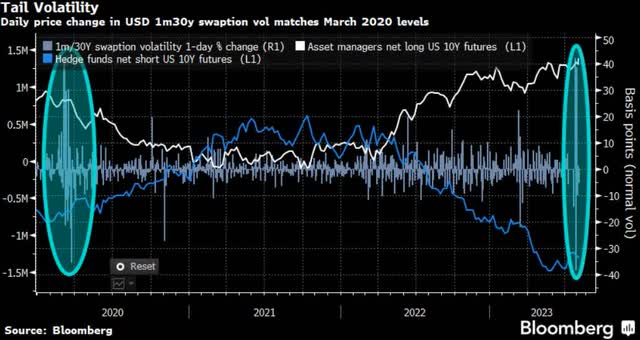

Tail volatility (Bloomberg – Twitter)

There are growing liquidity issues in the US Treasury Markets.

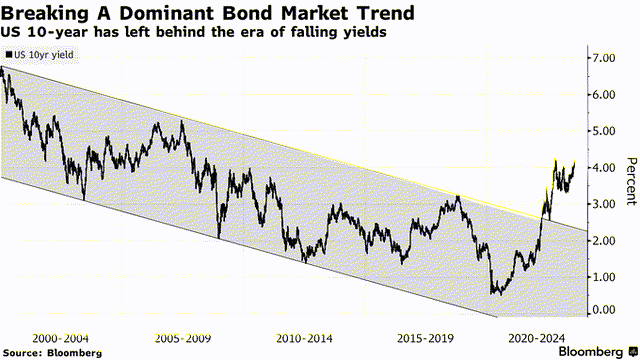

As such no wonder the US 10 year has broken out of its range:

US 10 year yield breaking range (Bloomberg – Twitter)

When it comes to “Fortune cookies” it seems that China is having a different read on its economy and has more concerns on the US fiscal situation given it has cut its US Treasury Notes holdings to a 14 year low:

China’s holdings of US Treasuries (Christophe Barraud Twitter)

As well as we pointed out in our previous musing, Bondzilla is “Made in Japan”. With the Bank of Japan tweak of the Yield Curve Control (YCC), Japanese long-term yields have risen (due to tighter monetary policy). Yet another large foreign holder of US Treasuries, becoming less interested in US bonds and asking for a premium.

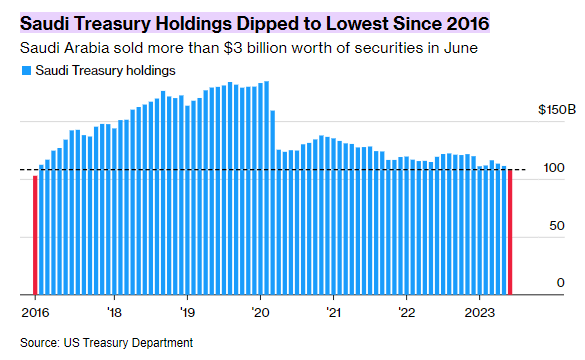

The US dollar recycling machine from oil to US Treasuries seems to have lost its appeal at the long end of the curve given also Saudi Arabia has cut on its holdings to the lowest level in 6 years:

Saudi Arabia holdings of US Treasuries (Bloomberg – Twitter)

Maybe Jack Ma is right and the US Fortune cookie is wrong?

With Geoffrey’s help, we endeavor to touch more on various subjects through GRAPHFINANCIALS

“There is no instance of a nation benefitting from prolonged warfare.” – Sun Tzu

Read the full article here