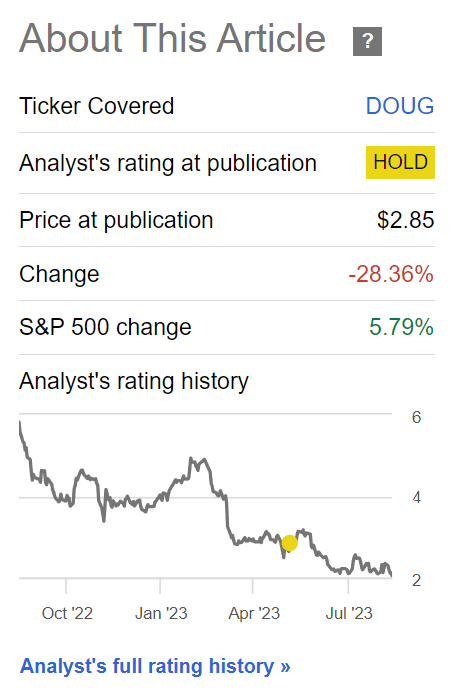

A few months ago, I reviewed the business operations of Douglas Elliman (NYSE:DOUG) and suggested investors should sit on the sidelines as real estate activity was still in a downswing. Since my article, shares of Douglas Elliman have collapsed by almost 30%, particularly as the company suspended its cash dividend and opted to pay a stock dividend instead (Figure 1).

Figure 1 – DOUG shares have underperformed (Seeking Alpha)

With the company recently reporting its Q2/2023 earnings, let us review DOUG’s operations to see if it is now ‘cheap’ enough to buy.

Brief Company Overview

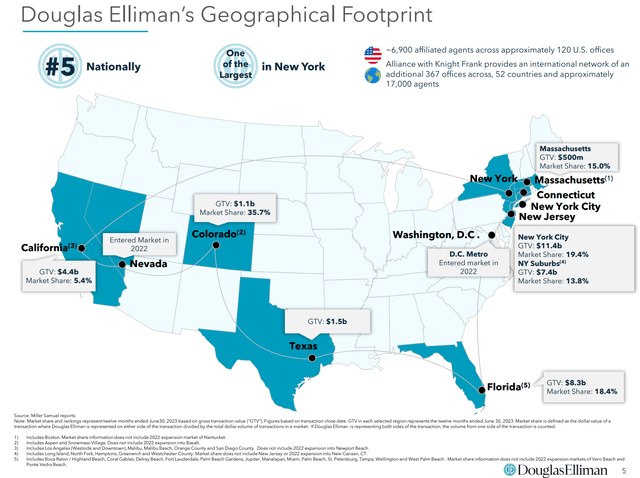

Douglas Elliman Inc. is a large, multi-state, real estate brokerage firm that primarily operates in New York (including the NY suburbs), Massachusetts, Florida, California, Texas and Colorado. DOUG has approximately 6,900 affiliated agents across 120 U.S. offices (Figure 2).

Figure 2 – DOUG overview (DOUG investor presentation)

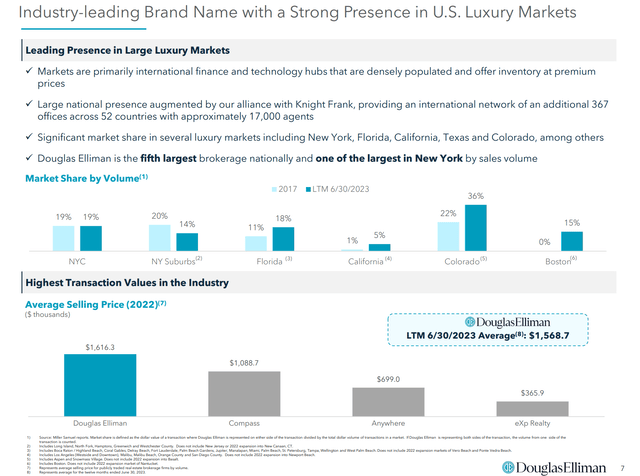

Douglas Elliman is known for its coverage of the U.S. luxury markets like the New York City, Colorado, and Boston (Figure 3). Its ~6,900 agents advised on $43 billion in transactions in 2022, or roughly $6 million per agent, generating ~$160,000 per agent in commission revenues.

Figure 3 – DOUG is known as a luxury real estate broker (DOUG investor presentation)

Q2/23 Results Better Than Expectations

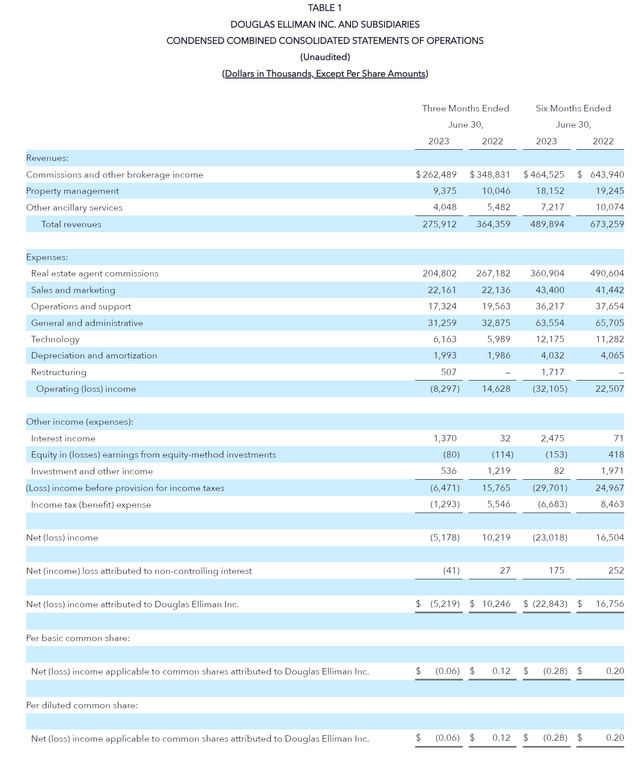

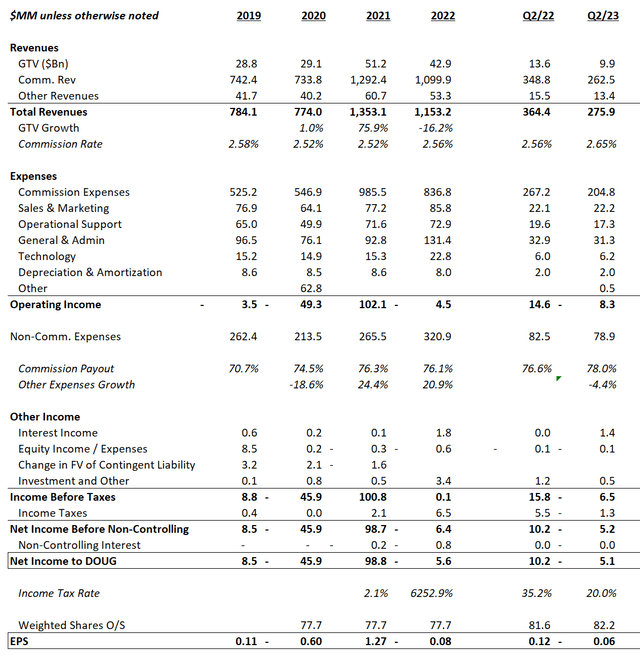

For the second quarter, Douglas Elliman reported financial results that were slightly better than expectations, with revenues of $276 million beating consensus estimates by $34 million and diluted EPS of -$0.06 beating by a penny (Figure 4).

Figure 4 – DOUG Q2/23 financial results (DOUG Q2/23 earnings press release)

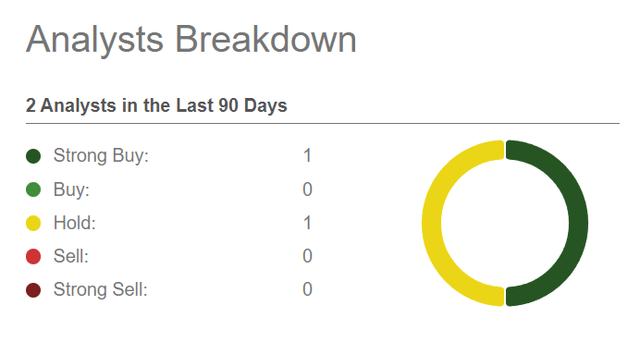

However, investors are cautioned against reading too much into the consensus estimates as there are only 2 Wall Street analysts covering DOUG (Figure 5).

Figure 5 – DOUG only has 2 Wall Street analysts covering it (Seeking Alpha)

Importantly, DOUG’s financial results for the second quarter were not particularly robust, with revenues declining by 24.3% YoY as gross transaction value (“GTV”) plunged by 27.2% to $9.9 billion.

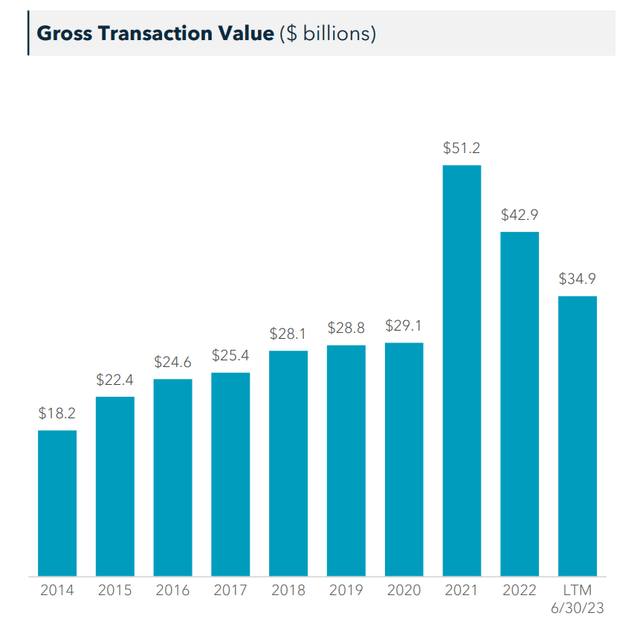

In fact, as I warned in my previous article, real estate transaction volumes are rapidly deflating after the ultra-low interest rates-fueled frenzy of 2021/2022, with trailing 12 month GTV declining to $34.9 billion (Figure 6).

Figure 6 – DOUG GTV declined to LTM $35 billion (DOUG investor presentation)

However, despite revenues declining YoY, DOUG’s cost structure remains elevated since its late 2021 IPO, leading to a steep $32.1 million operating loss in H1/2023.

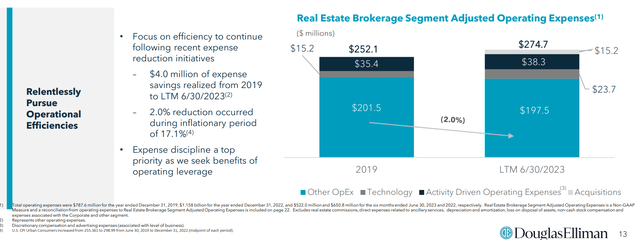

In fact, despite management’s claim of ‘relentlessly pursuing operational efficiencies’ (Figure 7), the truth is that non-commission expenses at the corporate level continues to run at a ~$80 million / quarter run-rate ($320 million / year), far above pre-IPO levels of $66 / quarter or $265 million / year (Figure 8).

Figure 7 – Management claims to be ‘relentlessly pursuing operational efficiencies’ (DOUG investor presentation) Figure 8 – However, actual results show G&A expenses have exploded (Author created with data from company reports)

The biggest jump in costs remain General & Admin expenses, which is running 30%+ higher than pre-IPO at over $30 million / quarter. I wrote about this issue in my initiation article and it remains unresolved.

DOUG Suspends Cash Dividends

In mid-June, Douglas Elliman suspended its $0.05 / quarter cash dividend, which had been underpinning the company’s valuation. In fact, when I wrote my cautious initiation article back in May, one of the biggest pushback from readers was that the stock was yielding 7% and yield-hungry investors did not want to ‘wait it out’.

The cash dividend suspension came as a surprise to myself and other investors, as my analysis of DOUG’s balance sheet suggested DOUG could easily continue paying the $4 million / quarter dividend with over $120 million in cash. This suggests management does not expect the company’s fortune to turnaround in the near-term, as a dividend cut is usually one of the last resorts.

As DOUG has shown, it is always risky investing in a money-losing company purely based on the assumption that the company will continue paying its dividend.

Homeowners Handcuffed By Mortgage Rates

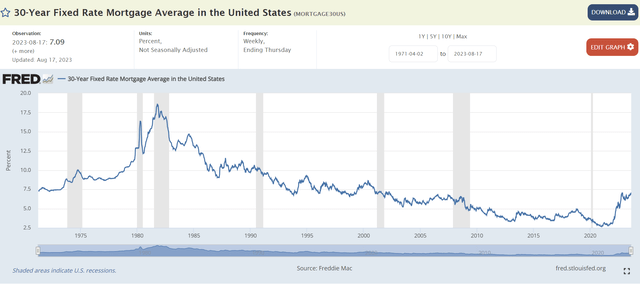

Operationally, I continue to hold a dim view for the real estate brokerage business, as a surge in interest rates mean that mortgage rates are now approaching the highest levels since the early 2000s (Figure 9).

Figure 9 – Mortgage rates are the highest since early 2000s (St. Louis Fed)

Many homeowners are trapped by the ‘golden handcuffs’ of ultra-low mortgage rates that they have secured in the past few years, limiting their desire and ability to move and engage in real estate transactions.

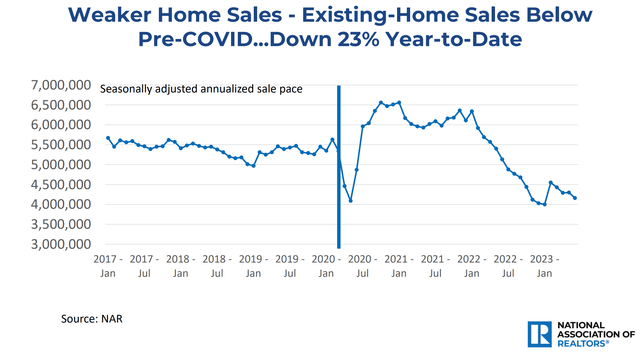

This has kept existing home sales at a ~4 million unit pace, more than a million lower than pre-COVID levels (Figure 10).

Figure 10 – Existing home sales are 1 million units lower than pre-COVID (NAR)

Unless interest rates and mortgage rates decline in the coming months, 2023 and perhaps 2024 will be lean years for real estate brokers like DOUG.

Forecast & Valuation

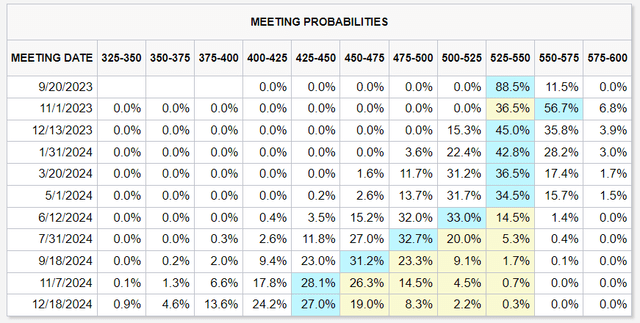

Looking forward, consensus appears to have pushed out the timing of interest rate cuts from the Federal Reserve to mid-2024, as hot economic growth figures give the Fed cover to maintain its ‘higher for longer’ monetary policies (Figure 11).

Figure 11 – Consensus have pushed out rate cuts to mid-2024 (CME)

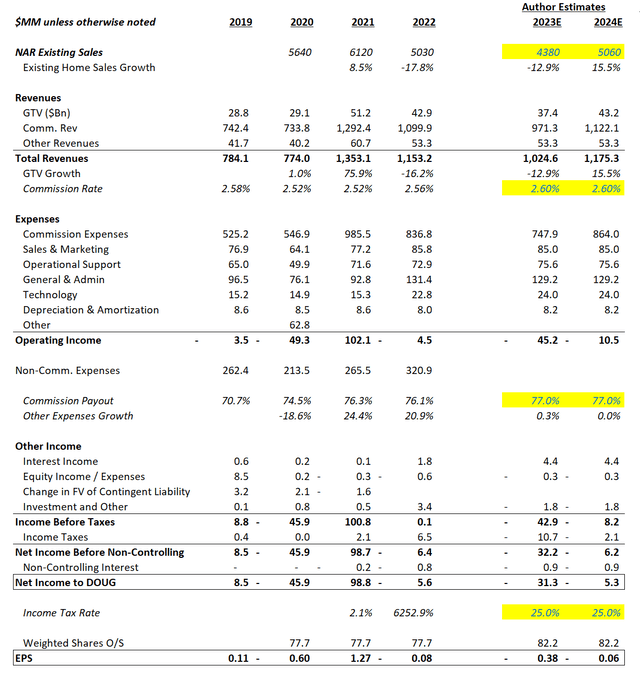

With the National Association of Realtors (“NAR”) recently downgrading its 2023 existing home sales estimates to 4.38 million units (from 4.6 million previously) and 2024 estimate to 5.06 million units (from 5.3 million previously), I am likewise downgrading my forecasts for DOUG (Figure 12).

Figure 12 – DOUG forecast model (Author created)

I now expect DOUG to advise on only $37 billion in transactions in 2023 (vs. $39 billion previously and $24 billion YTD) and $43 billion in 2024. I have also made adjustments to the commission payout rate to be consistent with DOUG’s 2023 YTD rate of 77%, which leads to a deterioration in operating income to a loss of $45 million in 2023 (vs. $26 million operating loss in my prior article) and an operating loss of $11 million in 2024 (vs. $11 million operating profit previously).

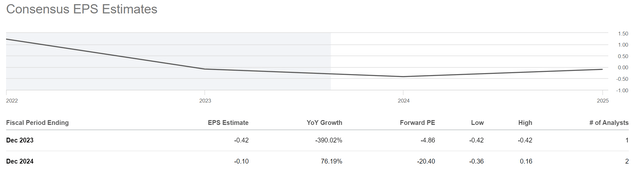

Consensus expects DOUG to lose $0.42 in 2023 and $0.10 in 2024, generally consistent with my estimates above (Figure 13).

Figure 13 – Consensus EPS estimates for DOUG (Seeking Alpha)

Valuation-wise, with the suspension of the cash dividend, there is not much else to work with, since DOUG is expected to generate losses for the next 2 years.

Is Douglas Elliman A Potential M&A Target?

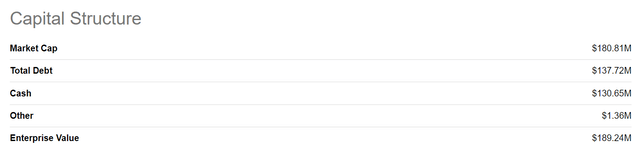

The best that can said is that DOUG’s enterprise value of $189 million is currently very discounted, equivalent to $1.6 million per office or $27,000 / agent (Figure 14).

Figure 14 – DOUG enterprise value (Seeking Alpha)

This may appeal to another real estate brokerage firm that can acquire the Douglas Elliman brand and use it as their luxury offering.

Recall, the biggest issue for DOUG has been the step-up in cost structure since the IPO. If another firm were to acquire/privatize DOUG, they may be able to strip out the $14 million / quarter in General & Admin costs that were added per quarter since the IPO and return the business to profitability. Berkshire Hathaway HomeServices, the nation’s number 2 real estate brokerage network, comes to mind as a potential acquirer.

For example, if an acquirer can bring 2024 G&A expenses down from my estimate of $129 million to 2021’s $93 million, then my $11 million 2024 operating loss estimate will turn into a $25 million operating profit. A potential acquirer can afford to pay a 30% premium to DOUG’s share price ($235 million market cap) and acquire the business for ~10x operating profits post-synergies. The key is whether they can wring $35-40 million in synergies out of DOUG’s bloated G&A.

Conclusion

As an operating company, I believe Douglas Elliman will continue to struggle as real estate activity remains depressed due to high mortgage rates. I now expect DOUG to report operating losses in both 2023 and 2024, as interest rates are expected to stay higher for longer.

However, for those with a contrarian view, DOUG’s valuation of $189 million enterprise value may start to look interesting, especially as an M&A target. An efficient acquiror can potentially pay a large 30% premium to DOUG’s current share price and still make the math work post-synergies.

I rate DOUG a hold for now, pending a recovery in real estate activity.

Read the full article here