The investing environment has been very fluid both over the last several years, and over the most recent months as well. While Covid hit in 2020, prices began to rise significantly in early 2021. More recently, growth has begun to slow this year as the Fed has been forced to raise rates.

With economies slowing and inflation still high, even long-term investors have been forced to adapt to a consistently changing market environment over the last several years.

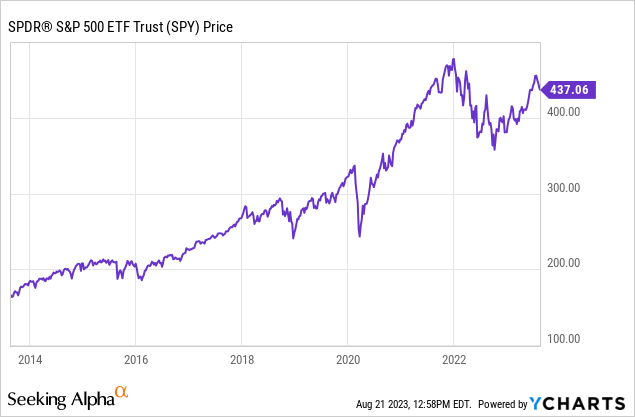

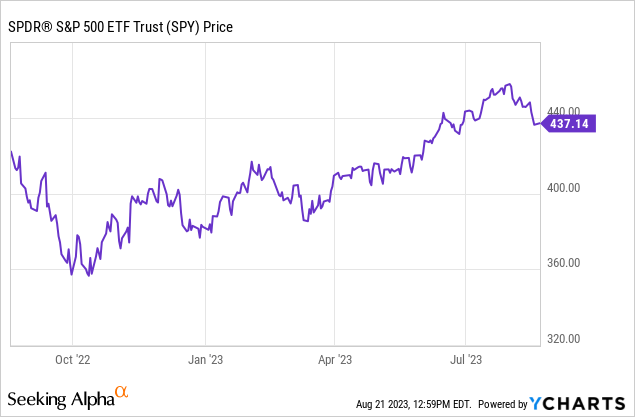

One of the most common investing strategies is to allocate capital to indexes such as the SPDR® S&P 500 ETF Trust (NYSEARCA:SPY). Targeting indexes has been a very successful strategy over the last several years, even though most of the broader indexes have offered only minimal total returns over the last year.

I wrote about the S&P 500 earlier this year. I rated the index a sell in February of this year, primarily because of inflation, forex, and valuation concerns. Today, I am changing my rating of this index to a hold. Inflation rates have come down in recent months, the economy appears likely to avoid a severe recession, the dollars have begun to weaken against the Euro and other major currencies, and valuation levels of this index have become more reasonable.

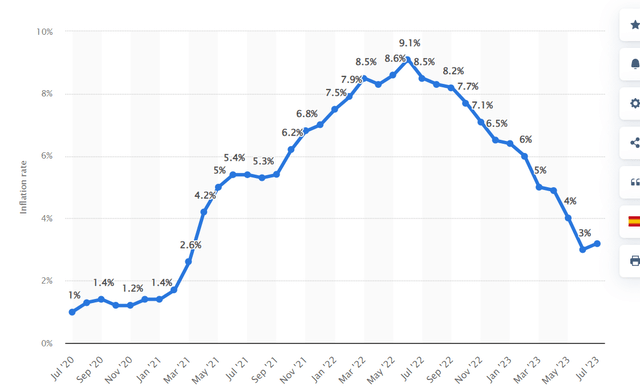

Inflation levels have moderated in recent months, and the Fed is likely close to the end of the current rate cycle. Even though the rate of price increases rose slightly in July to 3.2%, inflation levels had fallen for 12 straight months prior to July, and price rose just 2% in July.

A Chart of monthly inflation rates in the US economy (Statista)

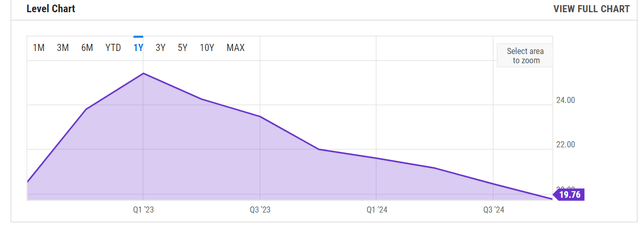

The earnings multiple of the S&P 500 has fallen significantly since the first quarter of this year as well.

A chart showing the forward PE of the S&P 500 (Statista)

The projected forward PE of the index is now 19.76. Earnings expectations for the S&P 500 have also risen for the full by 3.18% since the last quarter, and 14.16% over the previous year.

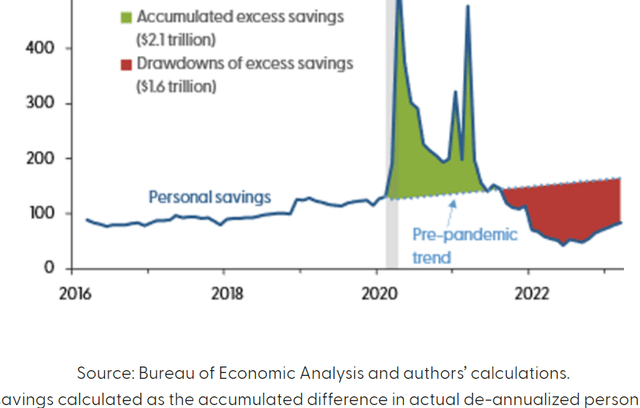

The economy also appears likely to be able to avoid a severe recession. Inflation rates are now just 1% higher than the Fed’s current 2% target, so the current rate cycle appears likely to be close to the end. The number of economists forecasting a recession has dropped over the last quarter from 70% to 58%, and a recent Philadelphia Fed survey of economists shows that most are predicting 1% growth this year. Most consumers still have saving from the pandemic that people can rely on, even with the recent drawdown most households have seen primarily become of inflation.

A chart showing personal savings levels of US consumers (Statista)

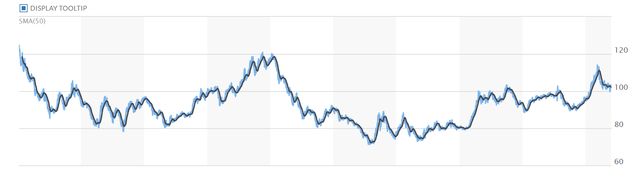

The dollar has also begun to weaken significantly against the dollar and other major currencies, and this move should continue as the Fed is likely close to the end of the current rate cycle, and the opening of Asia-Pacific economies should lead to an acceleration in growth outside of the US as well.

A chart of the US dollar against the Euro (Marketwatch)

About 37% of S&P 500 earnings come from outside of the United States, so a 10% rise in the dollar usually equates to a near 4% drop in earnings expectations. Europe is China’s biggest trade partner, so the opening up of the Asian-Pacific economies and the easing of the energy crisis in Europe should lead to EU growth rates stabilizing even if the Russia-Ukraine war continues.

This is why the S&P looks more reasonably valued at 19.76x expected forward earnings. Most large cap companies have very strong balance sheets, and management teams will likely focus on increasing the dividend if capital gains are more muted moving forward. The Fed is also likely to pause the current rate cycle soon, the economy should be able to avoid a significant recession, and the dollar’s strength against the Euro and other major currencies is likely to slow moving forward as well. While income investors may want to target specific companies or alternative index funds, most growth investors should find current valuation levels of the S&P 500 to be at reasonably levels for allocating new capital.

Read the full article here